gorodenkoff/iStock via Getty Images

Back in November, we published an article on Alphabet (NASDAQ:GOOG, NASDAQ:GOOGL) titled: “Google, Likely The Main Beneficiary Of OpenAI Tumult”.

The article talked at length about the Sam Altman firing controversy at OpenAI which we thought was a positive for GOOG, and we also touched on our thought process around Alphabet’s long-term strengths in the AI arena.

In our view, GOOG was (and remains) in a good position with its Gemini product, despite missteps, and we don’t think that ChatGPT, over the long haul, presents an existential threat to GOOG’s main search business.

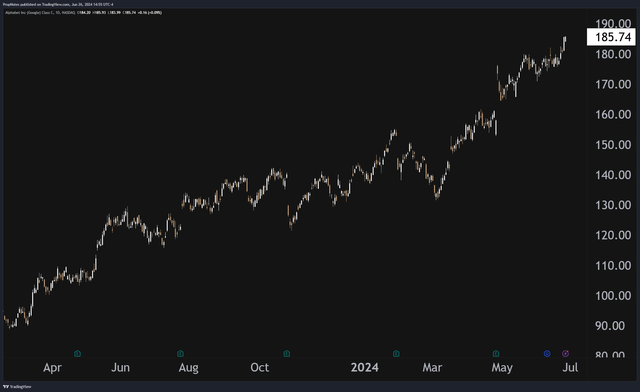

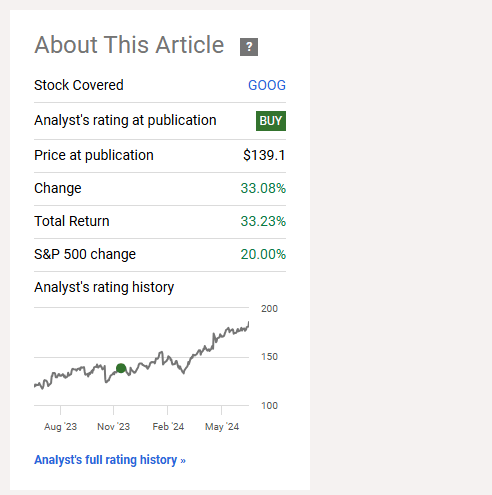

Since our bullish rating, the stock has returned more than 33%, beating the market significantly over that stretch:

Seeking Alpha

As things sit, the company continues to chug forward, growing revenues and profit to new heights. And, while GOOG’s search segment continues to make up the lions’ share of top and bottom-line results, YouTube and Cloud are growing more quickly and contributing more meaningfully to net income than ever before.

Today, we thought it would be a good time to dive into those businesses a bit more and explain why they have the potential to drive GOOG shares much higher into the second half of this decade.

Sound good? Let’s dive in.

Alphabet’s Financials

As always, let’s start by taking a look at GOOG’s financials.

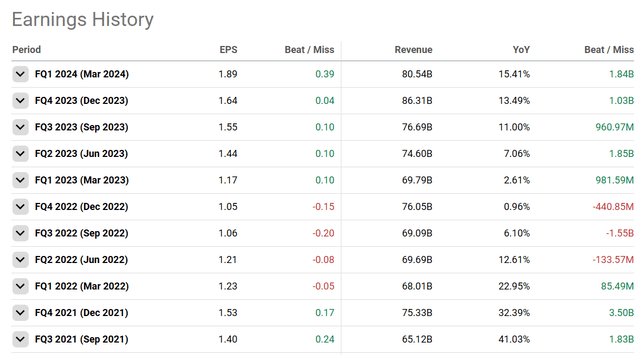

Alphabet released its most recent Q1 earnings report in late April, and the results were strong across the board:

On the bottom line, EPS came in at $1.89 per share, which was well above estimates, and top line revenue also came in at more than 80 billion, which was a beat of nearly $2 billion. This continues GOOG’s streak of topping analyst estimates, but this beat, especially on EPS, was, in percentage terms, much larger than anything else the company has put up recently.

Also of note was a re-acceleration in top line revenue growth, which grew 15% YoY. This marks a huge shift from where things were in late 2022 when EPS results were missing estimates, and top line growth YoY was under 1%.

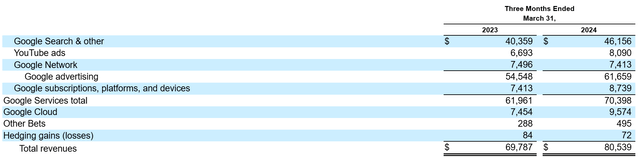

Zooming in a bit, Google’s three main businesses continued to grow, as Search, YouTube, and Cloud all saw gains on a YoY basis:

We like to break down Alphabet’s businesses a bit differently than the company does itself, in order to get a better view of how each core property / segment is doing on its own. This is a bit tricky as GOOG doesn’t break out some numbers, but we’re going to estimate where things are based on commentary in the 10Q.

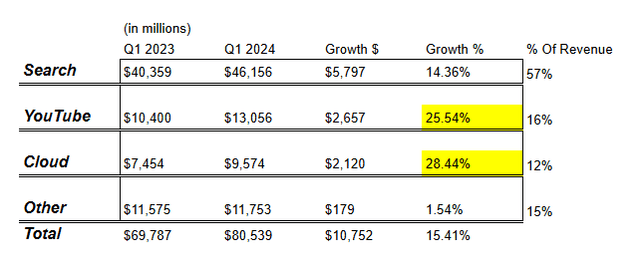

As of Q1, GOOG’s segment breakdown looked something like this, as our best guess:

This frame is far more useful because it focuses on the three core lines of business and how they are performing.

For reference, the YouTube figures we got by taking half of the subscription revenue in 2023, then adding on 90% of the growth in subscription revenue YoY through 2024, largely based on this quote:

Google subscriptions, platforms, and devices revenues increased $1.3 billion from the three months ended March 31, 2023 to the three months ended March 31, 2024, primarily driven by an increase in subscription revenues, largely from growth in the number of paid subscribers for YouTube services.

You can debate the exact percentages, but the thrust is the same; YouTube and Cloud are GOOG’s primary growth drivers for the time being.

This is exciting because in total, these two segments are worth 28% of GOOG’s revenue, but their nominal top line growth increases are worth $4.8 billion in aggregate, nearly the same size as Search’s contribution.

These segments are punching above their weight, something we expect will continue into the future.

On the YouTube front, it’s clear that YouTube has been the real winner of the streaming wars.

The segment’s total TTM revenues of (in our estimation) roughly ~$46 billion top even streaming giant Netflix’s (NFLX) overall annual sales, and with a rough operating margin of 38% (inherited from Google services profitability figures, although it could be higher due to lower TAC), the video streaming platform is also far and away more profitable:

With almost zero additional incremental cost of serving the new YouTube Premium offering, we expect that as more subscribers join the paid tier, that almost all of that new revenue will drop to the bottom line. This should substantially enhance the overall Google Services margin mix. At the rate that YouTube is growing, this could begin having a material impact on EPS sooner rather than later.

We also estimate that YouTube’s total revenue could reach $25 billion per quarter by 2027, if even a very small fraction of global users upgrade to the paid offering in that time.

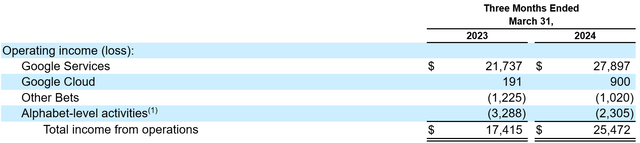

On the Cloud front, things are even more bullish. Not only is revenue growing the most quickly out of any segment, but the group only recently turned the profitability corner, which means that up until this point, not much of Cloud’s utility to GOOG has shown up on the bottom line.

Operating income grew from $200 million to $900 million over the last year alone, and management are incredibly bullish on this market opportunity moving forward:

At Google Cloud Next, more than 300 customers and partners spoke about their generative AI successes with Google Cloud, including global brands like Bayer, Cintas, Mercedes-Benz, Walmart, and many more. Our differentiation in Cloud begins with our AI Hypercomputer, which provides efficient and cost-effective infrastructure to train and serve models. Today, more than 60% of funded Gen AI startups and nearly 90% of Gen AI unicorns are Google Cloud customers. We offer an industry-leading portfolio of NVIDIA GPUs along with our TPUs. This includes TPU v5p, which is now generally available, and NVIDIA’s latest generation of Blackwell GPUs.

AWS and Azure have proven to be profit drivers for Amazon (AMZN) and Microsoft (MSFT) respectively, and we see no reason that GOOG’s offering couldn’t also reach 30% OM’s by 2027-2028 as things mature.

If things continue apace, this means that Cloud could be contributing close to $5 billion in operating income per quarter by that date.

All in all, despite GOOG’s size, there are substantial growth opportunities in two of the company’s three main lines of business.

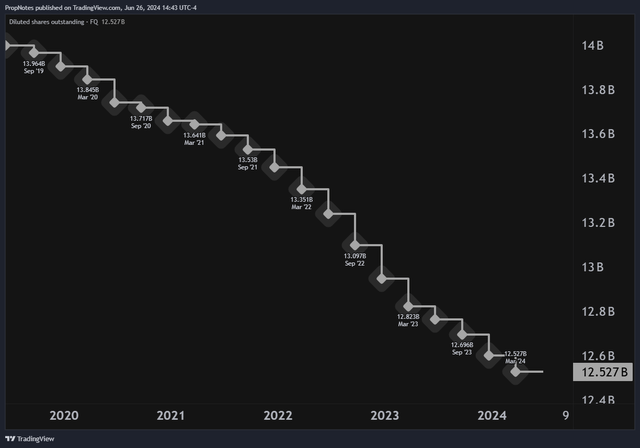

Combined with a share count that is dropping precipitously as the company redirects profits to shareholders, and we see EPS sustaining high teens / low twenties YoY growth rates for the foreseeable future.

Alphabet’s Valuation

But what is the company worth?

All of this doesn’t mean much if shares in GOOG are prohibitively expensive to purchase right now in the open market.

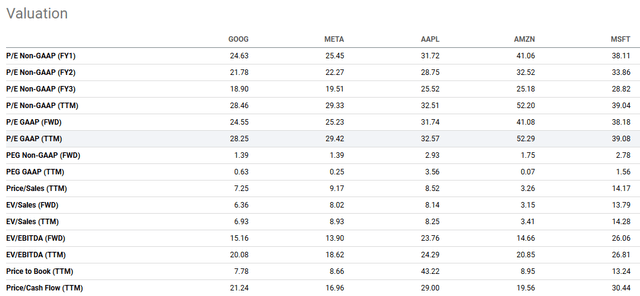

On this front, we have some good news – GOOG is trading at a slight premium at the moment, but the cost is not such that it would prevent an entry into the stock.

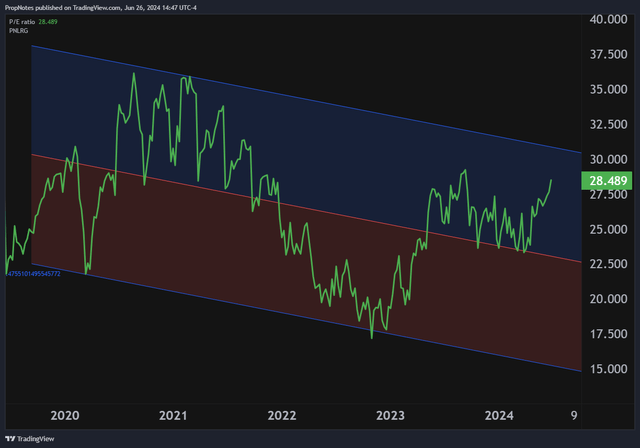

On the top line, GOOG is trading at 7.8x sales, and on the bottom line, the company is trading at 28x net income:

As you can see, these multiples are well within the 5-year standard deviation bands, although they are also above the ‘midpoint’ linear regression line.

Versus itself, historically, GOOG shares are at a small premium, but they’re not ‘red hot’, despite what the current ‘AI bubble’ narrative would have you believe.

More broadly, GOOG appears to be the cheapest of the ‘big tech’ stocks on both the top and bottom line, save the Amazon sales multiple (that’s largely a result of the company’s lower margin business model):

All in all, in our view, GOOG is trading for a fair price. Given the ~20% potential EPS growth that the company should be able to sustain for the next 4+ years, the potential for organic gains here is substantial.

Risks

Buying GOOG isn’t without risks, and here are a few of those key risks laid out:

- Multiple Risk

- Search Under Threat

- Overbought

Let’s start with the multiple.

As we just examined above, GOOG’s valuation is at a slight premium as of late. The company is not scraping all time high earnings multiples or anything like that, but it is trading at nearly 30x earnings, which might be a bit high given the company’s EPS growth prospects.

Also, if you look at the current ‘bubble’ narrative which claims that big tech is overvalued like it was in the dot-com bubble, then you can see that there’s room for substantial downside in shares should things get worse. GOOG’s lowest profit multiple over the last 5 years was around 17x, which poses 30%-40% downside in an extremely adverse scenario. It’s something to be aware of, especially if inflation picks back up and sends interest rates higher.

In addition to the multiple, many see GOOG’s main search business as ‘under threat’ from new LLM competitors like ChatGPT. The argument goes that people will begin to use Chatbots instead of search over time, which would lead to revenue losses that could cascade.

We don’t see this happening for a number of reasons that are beyond the scope of this article but suffice it to say that many see Search encroachment from OpenAI is a threat to GOOG.

Finally, the stock is simply quite strong, which isn’t the best news from a technical standpoint:

This trend strength could be seen by some as a good thing, not a bad thing, but in our view, it’s been almost 18 months since GOOG shares saw any real pullback. Buying in now, even with the reasonable multiple, may come with more risk as a result of the stock being potentially a bit overheated. This isn’t a long-term threat, but it’s something to consider from a tactical POV.

Summary

Overall, we’re quite bullish on GOOG over the long term as a result of significant tailwinds from GOOG’s YouTube and Cloud segments. Plus, with a reasonable-looking valuation, we think you could do a lot worse right now than to buy into this big tech behemoth.

Thus, we re-iterate our ‘Buy’ rating.

Cheers!