JHVEPhoto/iStock Editorial via Getty Images

Please note all $ figures in $CAD, not $USD, unless otherwise stated

Introduction

Since the last time I reviewed WSP Global Inc. (TSX:WSP:CA) six months ago, WSP has reported Q4’23 and Q1’23 results, so I thought it would be a good time to come back to my original investment thesis and see if shares are still a buy today. At the time, I viewed WSP Global as a high-quality Canadian company with potential to grow both organically and via M&A. With a track record of steady growth, the company was trading at an affordable valuation and had a growing backlog to support further revenue growth. In this article, I’ll provide a quick background on the company, discuss the latest results, provide my updated outlook on the company, and my thoughts on the company’s current valuation.

Company

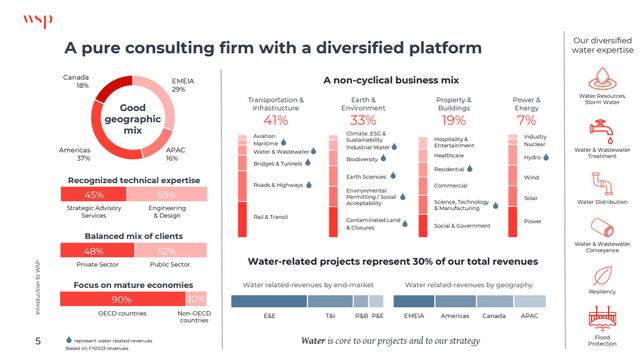

WSP Global is an engineering and consulting company with operations around the world. Despite being a Canadian company, it has a strong international presence with about 37% of its mix coming from Americas, 29% from EMEA, 18% from Canada, and 16% from APAC. The company services private sector as well as government clients in an effort to help them tackle some of the most complex engineering, infrastructure, and building projects. This includes everything from building new railways, highways, and large-scale construction projects. With its scale and size, WSP benefits from secular tailwinds, growing above GDP growth rates and has competitive advantages as a recognized leader in engineering consulting projects.

Background

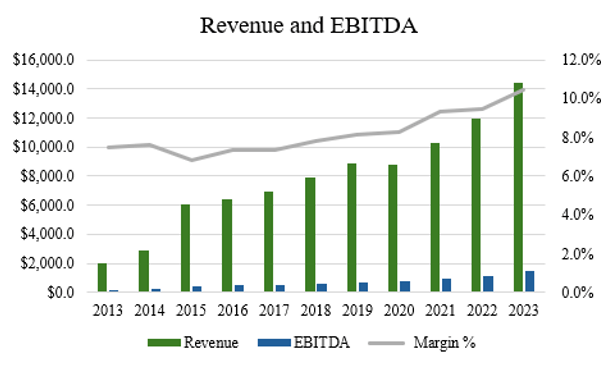

WSP Global has had a strong record of growing both its top line and bottom line. Over the last decade, the company has grown revenues and EBITDA at 21.8% and 25.9%, respectively. In the last five years, the company has grown revenues and EBITDA at 12.8% and 19.4%, respectively (source: S&P Capital IQ). While the five-year CAGRs are lower than the ten-year CAGRs, indicating that the company’s growth rate has decelerated, EBITDA growth is higher than revenue growth, indicating margin expansion over time.

Author, based on data from S&P Capital IQ

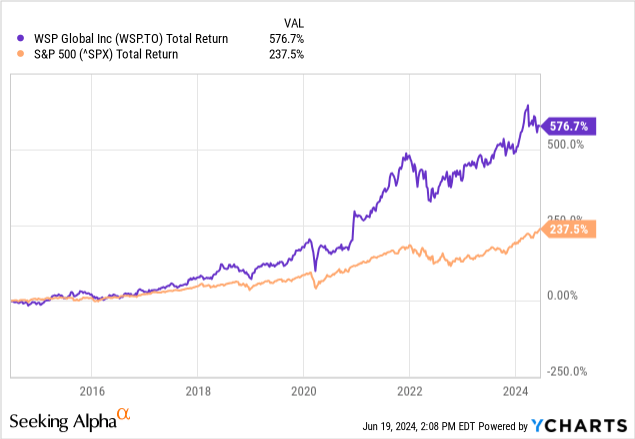

We see this show up in the share price performance too. Even though the share count has more than doubled in the last decade, WSP Global’s shares have put up consistently strong returns. In the last decade, stock has delivered a total return of 577% compared to the TSX’s return of just 238%. On a compounded annual return basis, this equates to an enviable CAGR of 21.1%.

Recent Results

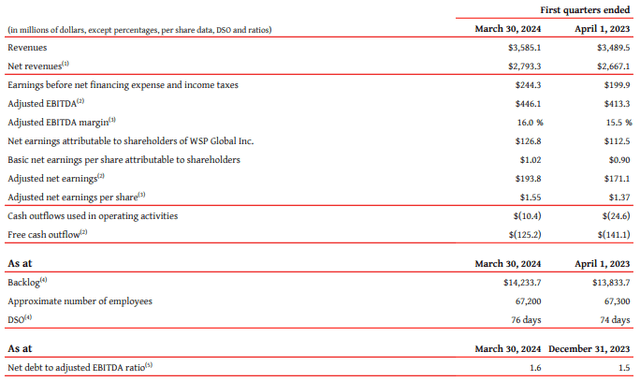

In the latest Q1 Results, WSP reported net revenue organic growth of 4.6%, with net revenues growing 4.7% to $3.585 billion. On adjusted EBITDA, the company’s margin profile climbed 50 bps to 16.0% compared to 15.5% the year prior.

Compared to what analysts were expecting, the quarter came in slightly above expectations. Revenue beat by $41 million and GAAP EPS came in ahead of expectations by 1 cent to $1.01 per share.

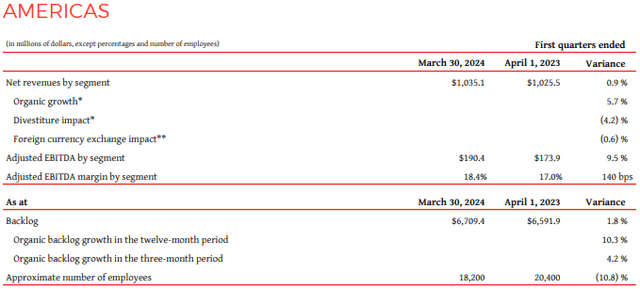

Across all geographies, revenues were higher. The notable standouts were Canada, up 8.3% (6.9% of which was attributable to organic growth) and EMEIA, up 7.2% (3.9% organic growth). In the Americas segment, revenues were up only 0.9%. However, this was mostly due to a divestiture impact with the sale of LBS in August 2023. This had an impact on the segment of about 4.2%. Organic growth was strong in the Americas, highlighted by 5.7% growth, mostly driven by growth in transportation and infrastructure, as well as the property and building markets sectors.

The last time I reviewed WSP Global (which was after Q3’23 results), I noted that the backlog was about 50% higher than Q2’23 and 30% higher since the start of 2023. When looking at the backlog today, WSP Global has $14.23 billion in backlog, which equates to about 11.8 months of revenue. Compared to last year’s backlog of $13.83 billion, the backlog growth has slowed, but is nevertheless very strong and offers good visibility into the coming quarters, particularly in the Americas, where the company is seeing double-digit backlog growth.

In terms of major project wins, WSP won one of the largest programs in terms of its scale, revenue, length and complexity in the energy space, the Great Grid Upgrade, which is building 50 gigawatts of electricity transmission infrastructure and network capacity by 2030. It’s one of seven companies that’s been assigned as a provider of WSP has been appointed as one of seven industry partners tasked with providing over £9 billion worth of design and construction for national grids over 12 years.

In the U.S., the company signed a $100 million contract for a 15-mile light rail extension project in Los Angeles County. Finally, in Australia, WSP is supporting the Queensland Train Manufacturing Program, which will deliver 65 new six-car passenger trains in time for the Brisbane 2032 Olympics.

Clearly, WSP continues to execute by winning new contracts and steadily growing its revenue. With Q1 in the bag, the company is maintaining guidance set out at the end of 2023, which includes a target for between $11.2 billion and $11.7 billion in net revenue. The company expects adjusted EBITDA to be in the range of $2.05 billion to $2.13 billion. At the midpoint, this implies an adjusted EBITDA margin of 18.25%.

On the earnings call, management was notably upbeat about the market fundamentals across the geographies it serves and is confident in its ability to achieve around 65bps of y/y margin expansion in 2024. All of the company’s Canadian, U.S., and U.K. operations have now been migrated onto the company’s new ERP platform (70% of WSP’s adjusted EBITDA) and it’s likely WSP can complete the remaining 30% sometime in the 1H of 2025 in my estimation.

From a balance sheet perspective, WSP ended the year with cash of $342 million, available room on its syndicated credit facility $1.31 billion, and $163 million in operating credit facilities for total liquidity of $1.81 billion. On debt, WSP has a Net Debt to EBITDA ratio of 1.6x, which is 0.1x higher than last year. According to Bloomberg, the company’s bonds yield between 4.49% and 4.65%, so the company has low leverage and a low cost of debt and is rated BBB (investment grade) by DBRS. With a Debt/EV of 13%, the company maintains only a small portion of debt within the capital structure.

In terms of my outlook for WSP, I expect revenue to continue to grow in the high-single digits with steady EBITDA growth. Historically, WSP has been active in M&A, acquiring and integrating several companies to invest capital at high rates of return to compound value for shareholders. In 2023, WSP acquired a few companies, which totaled $354.3 million. Compared to 2021 and 2022 when WSP spent $1.244 billion and $2.554 billion in M&A, I foresee activity picking up again once valuations become more attractive because WSP already has the balance sheet in place to make it happen.

Key acquisitions so far in 2024 were Communica (a leading indigenous and stakeholder engagement and consulting firm), Proxion (one of Finland’s largest rail consultancies), 1A Ingenieros (a Spanish consulting firm in transmission and distribution), and AFK (the environment and infrastructure business of John Wood Group). With only $286mm deployed in M&A during the last four quarters, cash deployed on acquisitions should increase. On the earnings call, management said that they are “confident that the remainder of the year should bear fruit” with respect to M&A.

Valuation

Based on the 12 sell-side analysts who cover WSP Global’s stock, there are 11 ‘buy’ ratings and 1 ‘hold’ rating. The average price target is $240.50. From the current price to the average price target one year out, this implies approximately 15.2% upside, not including the dividend yield of 0.7%. With a total return potential of 15.9% over the next year, analysts are pretty bullish on WSP Global’s near-term outlook.

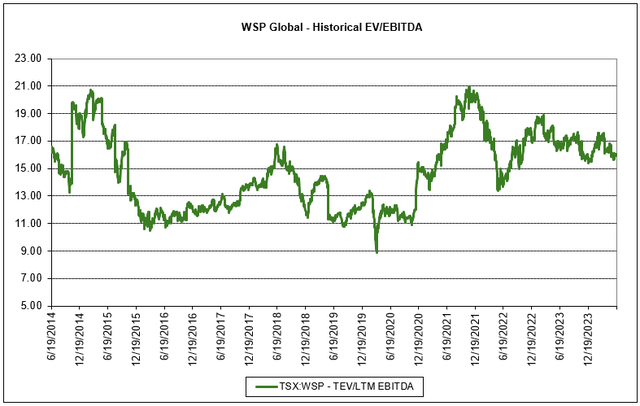

From a historical valuation perspective, WSP Global has traded between 8.9x and 20.9x EV/EBITDA. At its current multiple of 16.0x (on an LTM basis), WSP Global trades slightly above the historical ten-year average multiple of 14.7x. With full year 2024 EBITDA of $2.09 billion expected from the street, the company trades at 14.0x 2024 EBITDA (source: S&P Capital IQ). So, despite the recent run-up since my last article, WSP doesn’t appear to be expensive.

Author, based on data from S&P Capital IQ

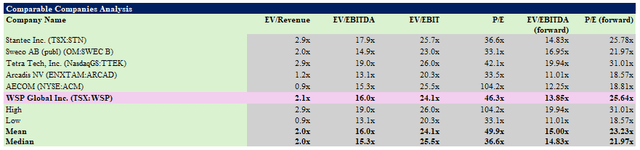

When looking at the relative valuation, WSP trades at a 1-turn premium on a forward EBITDA basis. I’m choosing to use EBITDA and the forward multiples here to account for differences in leverage among engineering peers and to allow for some normalization in the multiples, as 2024 had been a weaker year for some.

Overall, I think WSP’s premium is justified. Compared to a company like Stantec (STN:CA), which is slower growing and solely in the engineering and architecture business, WSP has a footprint in higher margin and faster growing businesses like design, services, and consulting. I also believe that with a strong track record for M&A, WSP has proven itself to be a better allocator of capital over time, returning significant value to shareholders over time.

Author, based on data from S&P Capital IQ

Risks

There are risks to any investment, and WSP is no different. However, in WSP’s case, most of the risk is likely to do with the macroeconomic environment. As a company involved in the cyclical construction industry, WSP could be exposed during a downturn. That said, having many large customers including governments reduces this risk, along with significant backlog in place.

As for company-specific risks, there are two I would note. Firstly, with engineers being in short supply, particularly in developed countries, managing labor will be key. On labor, management noted on the earnings call that the labor situation is better than it was a few years ago and that the fee per employee that the company is generating continues to grow. Secondly, as WSP grows in size, it will become harder for small acquisitions to move the needle, so there’s always a risk that management overpays for an acquisition or does deals that don’t have a good fit. Overall, management has typically been very disciplined with respect to deal size, price paid, and most importantly, deal fit. Given the track record of the management team, there’s little to worry about, but it’s something to monitor long-term.

Conclusion

In summary, I continue to believe many of the positive things about WSP Global, while shares are 9% higher since the original article, the valuation is, in fact, the same at 16.0x EV/EBITDA. For a company that can likely grow its top line at high-single digit growth rates, I think WSP’s valuation is very fair. While capital deployed on M&A has been notably lower compared to previous years, I expect WSP will continue to find attractive uses for capital and continue to create value for long-term shareholders. So with strong industry tailwinds, I continue to rate shares as a ‘buy’ today.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.