Alphabet (GOOGL) stock is down today on news of a probe from the Consumer Financial Protection Bureau (CFPB). The government agency is moving to place Google under formal federal supervision. While this still has not been finalized, The Washington Post reports that the CFPB has been discussing this with Google for months, and could lead to Google being subjected to more monitoring and regulatory oversight if the bureau moves forward with its plans.

What’s Happening with Alphabet Stock Today?

With news of the probe in full focus, Alphabet stock has spent most of today trending downward. In fact, it finished down 1.84% for the day. GOOGL is also down 2% for the week after five days of volatile trading, primarily due to market conditions. But does today’s performance mean that Alphabet stock is in trouble if the supervision plan persists?

Google is no stranger to regulatory probes. Big Tech companies, in general, often have to deal with regulatory agencies looking into their operations. Unless these investigations discover significant improprieties, it is rare that they push down share prices for any length of time.

The decision to place Google under formal federal supervision implies that the CFPB believes an investigation is warranted. However, as the Post notes, “the exact scope of the CFPB’s concerns with Google’s financial products is not clear,” meaning that more details will likely be revealed in the coming weeks. Until more information is known, it will be hard to assess the impact it could have on GOOGL stock.

Wall Street Remains Bullish on GOOGL Stock

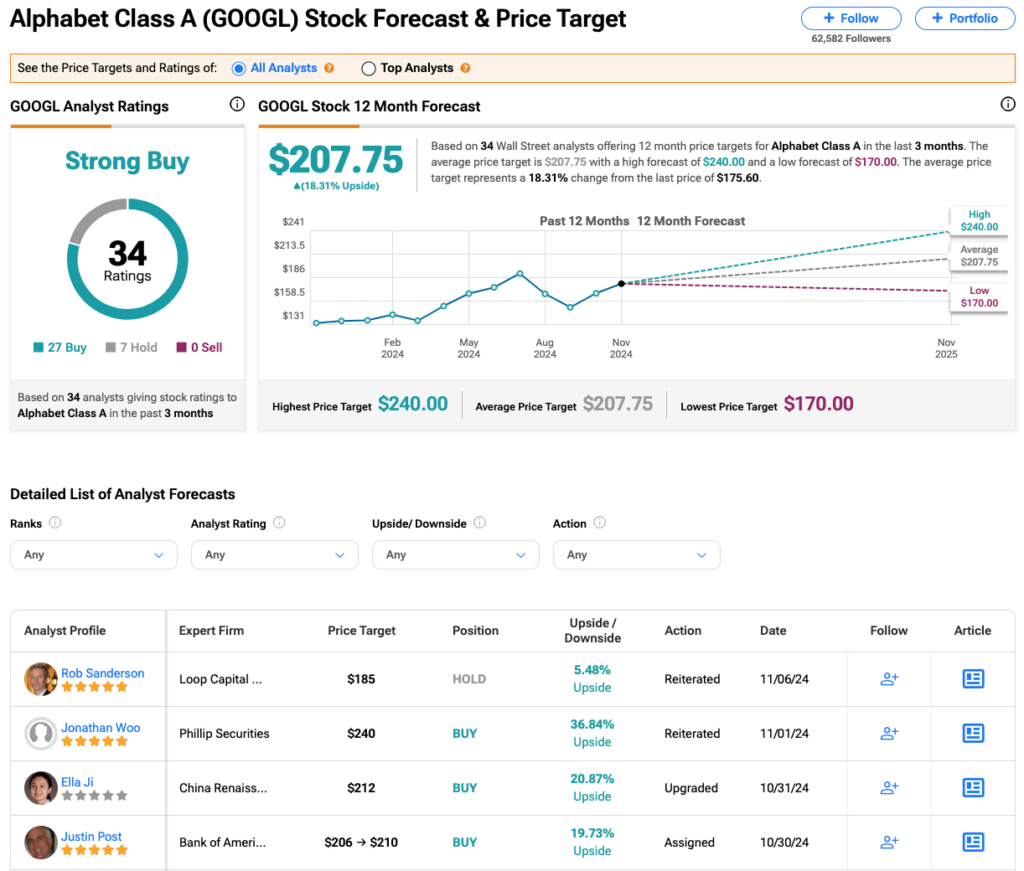

So far, Wall Street doesn’t seem overly concerned with the CFPB update. Analysts have a Strong Buy consensus rating on GOOGL stock based on 27 Buys and seven Holds assigned in the past three months, as indicated by the graphic below. After a 32% rally in its share price over the past year, the average GOOGL price target of $207.75 per share implies 18% upside potential.