Illustration: Intelligencer

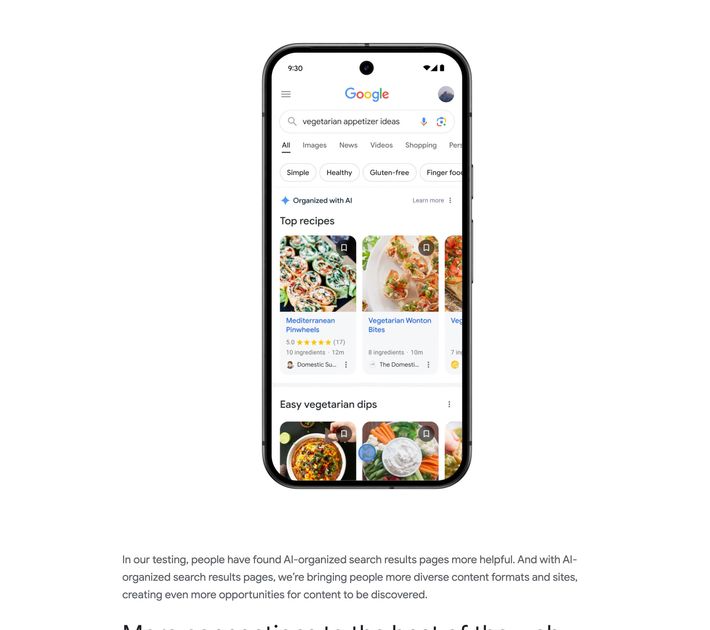

This month, Google dropped a few hints about how its most important and lucrative product, Search, will be changing in the coming months. Earlier this year, the company rolled out AI Overviews — generated summary blurbs that are frequently passable and not infrequently completely erroneous — to many of its customers. “This week, we’re rolling out search results pages organized with AI in the U.S.,” the company said in a blog post. The test would be limited to “recipes and meal inspiration” for now, but searchers will “now see a full-page experience, with relevant results organized just for [them].” This, Google suggested, would be an exciting improvement. “You can easily explore content and perspectives from across the web including articles, videos, forums and more — all in one place,” the company said. Not only that, but the company is testing a new design for AI Overviews that “adds prominent links to supporting webpages directly within the text.” Oh, and one more thing about the AI Overviews: Google has been “carefully testing ads” for “relevant queries.”

It doesn’t take much extrapolation to imagine AI Overviews, which are currently contained in a box above the standard and ever-more-cluttered search page, expanding from summaries to more comprehensive digests of information, with more citations, more things to tap and click, and space for sponsorship. Google’s most visible, high-stakes AI deployment is a set of tools that will automatically find and “organize” content from the web, present it in summary with prominent links, and have big chunky ads for products, not just links. Sound familiar? Google’s vision for the future of AI is… Google, again.

The prevailing narrative around Google’s current situation is that, despite its leadership in AI research, it was caught flat-footed by the arrival of apps like ChatGPT. It’s been hampered in its attempts to respond by institutional caution and clumsy moderation choices, but also by fear that revamping Search, a great product gradually undermined by an even greater business model, might threaten its underlying ad business. There simply isn’t as much room for ads, and not as much tapping or clicking, in a world where search engines start answering questions. There’s a lot of truth in this story, but it depends on an understanding of what Google has become and how people use it that’s slightly out of date.

Google is, substantially, still a platform for finding content on the web supported by ads from brands and websites. It’s also, by default, a major e-commerce platform, or at least a site through which we start to find things to buy. This has changed how the service looks and feels as well as the entire web around it. It should also change how we think about Google’s competition. Sure, it should be worried about OpenAI. But it might be more worried about… Amazon?

I don’t mean to understate the extent to which the arrival of ChatGPT and other AI services has rattled Google: It has. When Google and Microsoft showed off their first AI search demos in early 2023, they highlighted the ability to “chat” with your search engine, which would then produce, in conversational format or a clean, simple digest, links and summaries from the web. These were compelling previews of an entirely new interface. Arguably the most enticing thing about them was that they were stripped-down, simple, and did what they were asked.

That’s not quite what they ended up shipping, of course. AI Overviews, in the beginning, leaned hard into summary, attempting to synthesize full answers while minimizing outside content. They also appeared as one more widget among many, another extra box with an unclear relationship to the rest of the results page, sometimes existing in conflict with other information presented just a few inches away. Google’s previews of its “AI-organized” results pages now look an awful lot like Google Search result pages, with a bunch of grids and modules and lists remixed but ultimately sort of piled together. Google, despite suggestions that it might change everything, is rapidly circling back around to where it started:

Illustration: Google Marketing

Meanwhile, ChatGPT, which is by far the largest new competitor for Google Search, with a claimed 200 million weekly users, is formidable but strange. It’s a generative chatbot, meaning it can be prompted to do all sorts of things, but for certain search queries (or prompts) it produces a streamlined version of a familiar Google experience: Instead of providing you with a quick shortcut to a Wikipedia article, ChatGPT quickly generates something sort of like a Wikipedia article, in many cases drawn from Wikipedia articles. OpenAI is currently testing out a tool called SearchGPT, which is an explicit Google competitor: A slightly busier interface with AI summaries, link lists, and conversational features.

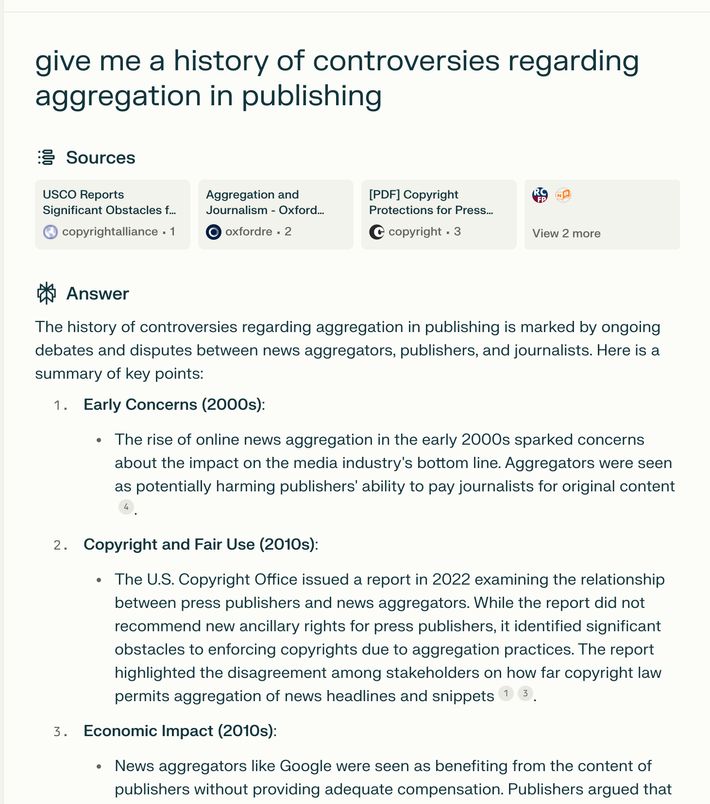

Illustration: Screencap

Perplexity, a smaller new AI search engine, looks a lot like a version of Google unburdened by the need to make money with ads (though it’s starting down that path) or the sorts of ethical and reputational concerns that might give a company like Google pause. It’s pretty effective in that it provides solid answers to queries with lots of sources in a relatively checkable and transparent way. Part of what makes it work, however, is that it sneaks around paywalls and “summarizes” sources by sometimes repeating them at length. It’s a solid user experience with occasionally wild flaws — a recent search for measurements on a coat resulted in Perplexity inventing an air conditioner and describing its size — and with features that are probably riskier to deploy for a litigation target like Google than for a mid-sized startup.

Still, competition from these companies isn’t yet doing much to erode Google’s actual search market share, and the companies competing in this space are pretty clearly converging on a similar and familiar point: the AI firms are trending toward cluttered, ad-ready results pages while Google is adding AI to its cluttered, ad-ready results pages. Google is right to anticipate that this could present a challenge in the long term as habits erode or antitrust actions pry them out of lucrative and useful partnerships with companies like Apple, but these are long-term problems that Google, as a wildly profitable incumbent, is fairly well equipped to deal with. While the Justice Department has hinted that remedies ranging from killing search default deals to breaking up the company are on the table, they’re unlikely to take effect for years. For now, companies like OpenAI and Perplexity are burning piles of cash, with unclear plans for monetizing search traffic. Google isn’t chasing AI companies into chatbot oblivion, in other words — AI companies are approaching Google on its own turf.

That AI companies might not be quite the imminent threat to search that Google initially imagined would be a relief for the company if it didn’t have deeper, older problems. While Google’s market share for search remains at or above 90 percent, where it’s been for years, eMarketer and Wall Street Journal report a much more shocking number:

Google’s share of the U.S. search ad market is expected to drop below 50% next year for the first time in over a decade, according to the research firm eMarketer. Amazon is expected to have 22.3% of the market this year, with 17.6% growth, compared with Google’s 50.5% share and its 7.6% growth.

Google’s biggest competitor in search ads isn’t a search engine, really, but Amazon — a dominant player (and accused monopolist) in a slightly different sector. This is a less intuitive but more significant story than the rise of AI search, at least for now. Amazon’s search product is only narrowly competitive with Google’s from a user perspective — Amazon isn’t stealing too many users away from Google overall — and it’s similarly been degraded by one of Amazon’s secondary business models, which is to get sellers and brands to pay for ads to reach Amazon search users, in theory helping them discover the right products to buy but in practice obstructing routine shopping with endless pitches for junk.

Amazon’s search is a janky, frustrating thing to use, with limited options for sorting and finding products and clutter everywhere. But it’s perfectly positioned to skim advertising dollars away from the underlying business that makes Google’s search dominance so lucrative. Everyone uses both, and Google ends up sending lots of customers to Amazon anyway. Why shouldn’t advertisers choose to spend their money on the site where people actually buy things?

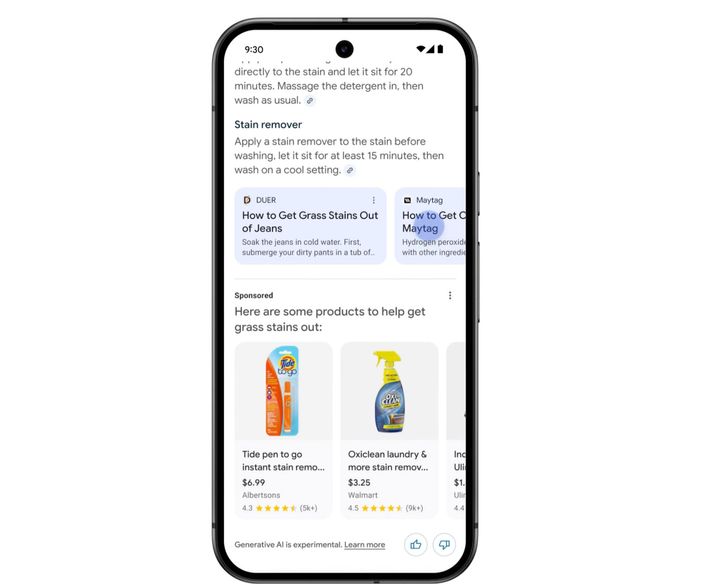

Google has been aware of this erosion for a while now and has pushed hard into product recommendation content and modules of its own, with mixed results. You can see clear evidence in its new AI features, where the first ads are not for links or sites, but for specific products to buy. Google’s AI search rebirth might end up being fairly heavy on commerce:

Illustration: Google Marketing

Do people need advanced AI to figure out where to buy Tide, or to be reminded to buy it in the first place? Probably not. Even more worrying for Google, though, is that they might not need Search either. People need less assistance, not more, to buy things online.