Alphabet’s (GOOGL) Q4 earnings are just around the corner. Google’s parent company, Alphabet, is set to announce its highly anticipated quarterly results after the bell on Tuesday, 4 February.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks’ Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts’ recommendations with Your Smart Portfolio

The stock is trading at all-time highs above $200 per share, and GOOGL’s management is desperate to maintain the bullish momentum. While the big tech giant will face some tough comps, especially in its advertising business, I’m bullish on its shares ahead of its results. I expect another strong performance from Google Cloud and not many surprises in AI infrastructure spending to keep costs in check.

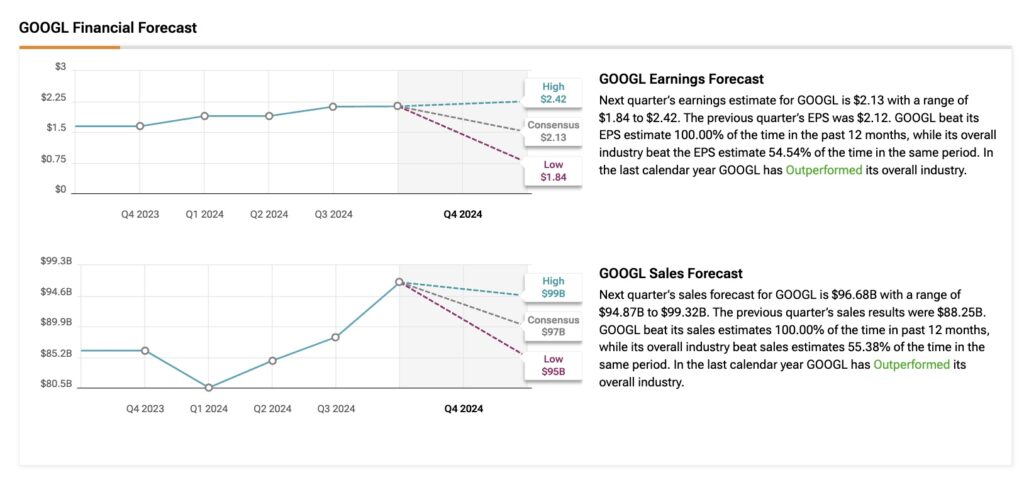

If Alphabet beats estimates again, it will mark the company’s eighth consecutive quarter of exceeding EPS expectations, following a four-quarter streak of misses in 2022 and 2023 when its investment thesis was put to the test amid stagnant growth pre-AI.

What to Look for in Alphabet’s Q4 Earnings

Much of my optimism supporting Alphabet rests on the combination of leadership in two secular growth trends: digital advertising and cloud. Both have grown rapidly, showing very high profitability in markets with no sign of reaching saturation.

Any signs of these trends continuing in Q4 for Alphabet should be enough to push the stock higher. To beat Wall Street estimates, Alphabet must report EPS above $2.13 and revenues above $96.67 billion, i.e., annual growth of 29.8% and 12%, respectively. Considering the strong growth rates in both the top and bottom lines in recent quarters, the more modest growth numbers compared to other quarters may reflect Alphabet experiencing higher comps in Q4.

For 2024, analysts estimate that Alphabet will end up with EPS of $7.99, which would mark a solid 37.7% annual growth, plus revenues of around $350 billion, up 13.8%. However, the trend for FY2025 shows a slowdown in bottom-line growth, with analysts projecting just 12.6% growth compared to 2024.

The Key Topics for GOOGL Earnings Day

Although Alphabet generates the majority of its revenues (around 75%) from advertising, and therefore growth in Search is key for GOOGL’s positive outlook, I believe the main topic of conversation on earnings day will be its rapidly growing cloud business, which has been expanding faster than its major peers.

In Q3, the most recent quarter, Google Cloud’s revenue jumped 34.5% year-over-year to $11.3 billion, marking the impressive feat of being the seventh consecutive quarter of growth. While Alphabet’s cloud segment still has a lot of work to do in matching the profitability of its peers like AWS and Azure, margins improved significantly to 17.4%, up from 11% in Q2.

Much like the other hyperscalers, Amazon (AMZN) and Microsoft (MSFT), the margin expansion for Google Cloud reflects its drive to deliver high-quality cloud AI services, particularly in Alphabet’s case, blended with products like Google Cloud Platform (GCP) and Google Workspace. As a result, Alphabet has already spent $38.2 billion in CapEx during 2024, marking a 44% increase in investment compared to the same period last year.

That said, the trend is for ongoing CapEx growth, with management hinting in Q3 that it plans to invest at the same level for Q4 (approximately $13 billion). Nevertheless, for FY2025, management said that expenditures will not increase at the same percentage rate as in 2023 and 2024, but there will still be an additional increase.

As seen with Microsoft during the current earnings season, a scenario of high spending on AI infrastructure coupled with a slowdown in cloud growth and margins (likely temporary) was not well received by the markets, even though AI demand is still robust. However, since Google Cloud is still consolidating growth and margins close to those of the top two hyperscalers, I anticipate steady results in this regard for Q4.

Potential Risks Behind a Strong GOOGL Outlook

Although the bullish outlook on Alphabet looks strong heading into Q4, a rise in share price isn’t guaranteed, even if the company beats expectations across the board.

Since Alphabet typically doesn’t guide margins and revenues—only CapEx—this could be the metric the market focuses on the most. However, perhaps the main point of attention will be the performance of Google Search and YouTube. Over the last five quarters, the segment has shown double-digit increases, most recently jumping 12% year-over-year in Q3 2024. This strong performance helped offset shortfalls in YouTube revenues, which grew 12% in the same period, down from 13% in Q2.

In a previous earnings call, Alphabet CEO Sundar Pichai said that advertising revenue would slow down compared to the strong comps of mid-2023, mainly due to the surge in advertising from APAC-based retailers last year. Therefore, should growth figures in Search and YouTube come in much lower than 12%, this could be a warning sign for a less bullish post-Q4 reaction.

Is Alphabet (GOOGL) a Buy, Hold, or Sell?

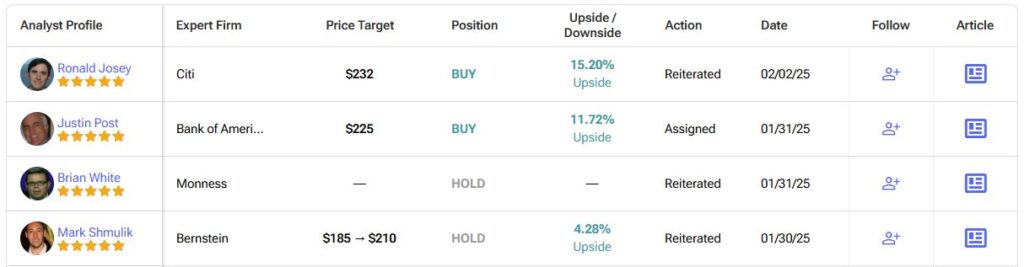

At TipRanks, the Wall Street consensus for GOOGL is a Moderate Buy, with 21 out of 29 analysts rating the stock as a Buy and the remaining eight rating it a Hold. Notably, not a single analyst rates GOOGL as a Sell. The average price target is $219 per share, suggesting a ~9% upside from its current price.

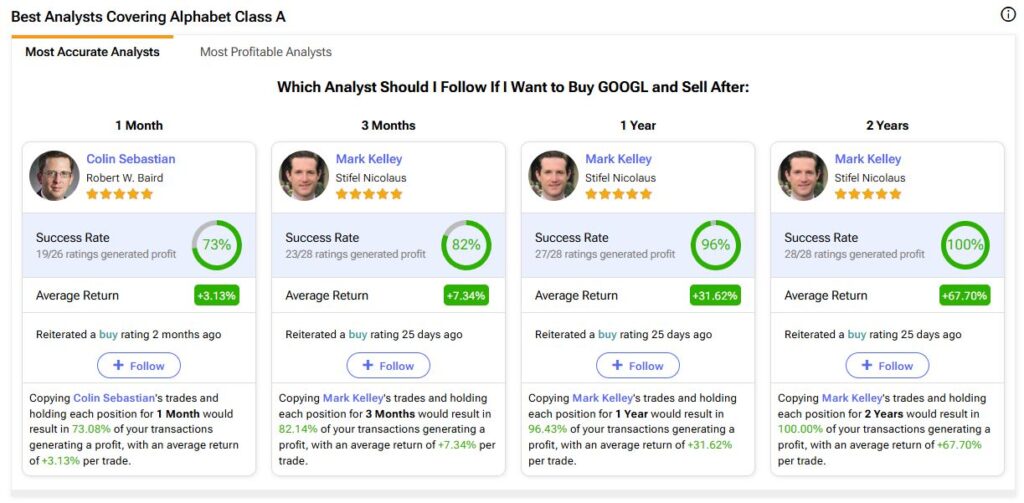

A special mention goes to the top-performing analyst on GOOGL over the past year, Mark Kelley from Stifel Nicolaus. Kelley has achieved an impressive 82% success rate over 3 months, a 96% rate over 1 year, and a 100% success rate over 2 years. Over the past 12 months, he has achieved a 31.6% average return on GOOGL stock. The analyst currently holds a Buy recommendation on GOOGL and reiterated his Buy rating last month.

Alphabet Set to Extend Prolific Earnings Streak Tomorrow

The expectation for Alphabet’s Q4 earnings is continued double-digit growth in its key segments, focusing on Google Cloud, particularly its margin growth, which could offset any headwinds in its advertising business due to tough comps.

I’m reiterating my Buy rating on Alphabet ahead of its earnings, recognizing that Q4 could be an essential piece of the puzzle in its long-term growth story. However, the short-term upside may be limited since the stock is at all-time highs and more susceptible to profit-taking should GOOGL even marginally disappoint.