In a particularly fruitful week for many participants in the stock market, the stocks of Google parent Alphabet (NASDAQ: GOOGL) have joined the new all-time high (ATH) club, and they continue to race on the wings of positive developments and optimistic expectations.

As it happens, GOOGL shares have started to pick up the pace in recent days, amid multiple Wall Street analysts upgrading their price targets and reports that Alphabet was developing a product for creating and conversing with customizable chatbots modeled after user-made celebrities.

Wall Street’s bullish Alphabet price targets

In this context, a group of 38 Wall Street analysts has offered their 12-month price targets for Alphabet shares in the last three months, rating them as a ‘strong buy,’ with 33 votes arguing for a ‘buy,’ five recommending a ‘hold,’ and with no sell calls, as per data on June 28.

In terms of specific price targets, the analyst consensus places the average price of GOOGL at $198.92, which would represent an increase of 7.36% from its current price, the lowest target standing at $168 (-9.33%) and the highest at $225 (+21.43%).

Among the analysts offering their Alphabet stock price predictions are those working at Jefferies, including Brent Thill, who raised his firm’s price target on Google stocks to $215 from $200 while retaining the ‘buy’ score after surveying over 1,500 consumers and office workers on artificial intelligence (AI).

At the same time, Commerzbank has boosted its target price to $220, holding onto its ‘strong buy’ rating and focusing in a recent analyst note on Alphabet’s dynamic development and stable growth potential due to its continuous introduction of new AI-driven applications.

Meanwhile, GOOGL shares have received a ‘hold’ score with a target of $180 from Bernstein, whereas a Goldman Sachs (NYSE: GS) report noted that “negative perception about long-term search positioning and operating results on margins/efficiencies have become less pronounced due to strong Q1 operating results.” Per the report:

“Company events have demonstrated commitment to innovation while also delivering on operating efficiencies. Rising capital investments remain a topic for forward estimate revisions, but cloud segment and wide-ranging platform/product innovation should continue to demonstrate potential for sustained industry leadership.”

Google stock price analysis

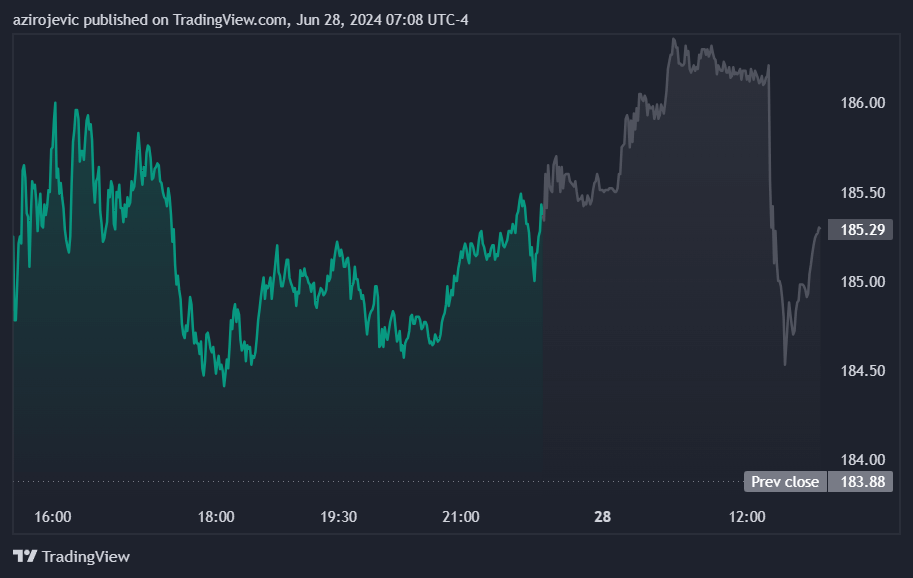

At the moment, the price of Google shares stands at $185.29 in pre-market, suggesting a very slight 0.08% decline while gaining 4.75% in the last week and advancing 6.28% across the month, adding up to the increase of 33.82% this year, as per the most recent chart data retrieved on June 28.

Indeed, GOOGL shares have been among the better-performing participants in their industry, as well as outperforming 94% of all assets in the stock market, demonstrating a consistent pattern of rising prices, and are currently trading above the 5, 20, 50, 100, and 200 simple moving averages (SMA).

To conclude, both analysts and technical analysis (TA) indicators agree on predicting a bright future for GOOGL shares, but it is always wise to stay on guard, do one’s own research and Google price tracking, and understand all the involved risks, as trends can change unexpectedly.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.