Plume Creative/DigitalVision via Getty Images

It’s a radically new world of communication -, one that no longer confines the market to just old media. Everyone is creating content, and everyone wants to watch the content that everyone else is creating. The Vanguard Communication Services Index Fund ETF Shares (NYSEARCA:VOX) is designed to give investors exposure to the fast-growing new communications services sector.

Launched in 2004, VOX measures the return of the MSCI US Investable Market Communication Services 25/50 Index, a broad-based benchmark reflecting the performance of thousands of companies supplying telephone, data transmission and cellular or wireless communications services, including those distributing content through a wide range of electronic outlets. Offering exposure to a portfolio of 119 underlying securities spanning more than $4 billion in assets under management, VOX brings a broad approach to tracking this dynamic sector in a passive manner.

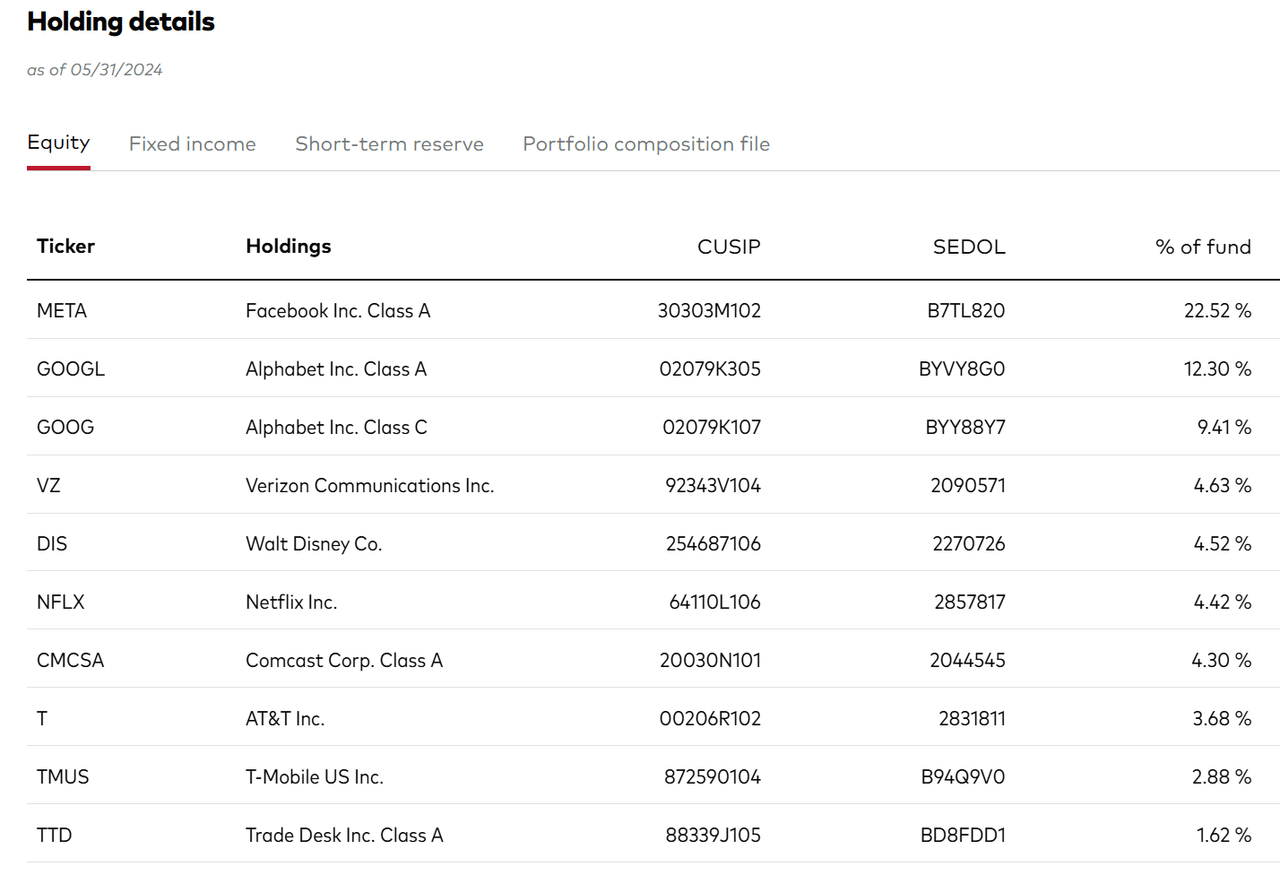

A Look At The Holdings

A cluster of communication giants, virtually redefining the industry, reside at the heart of the fund. This is clearly top-heavy, with Meta and Alphabet making up nearly 45% of the fund. On the one hand, I get it given the sheer size of these companies, but on the other hand? That’s some serious concentration risk for a “diversified” fund.

The exposure to Verizon, Disney, and Netflix shows that the fund is also focused on more traditional content distributors as well.

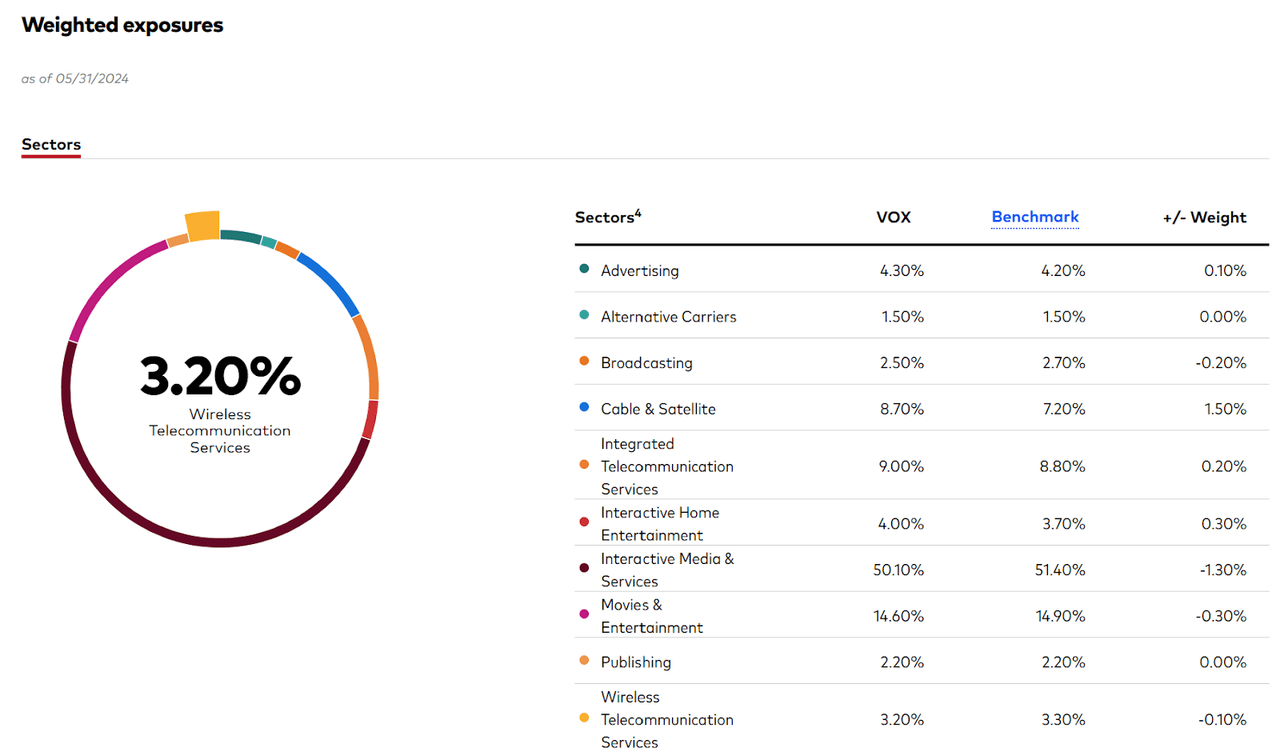

Sector Composition and Weightings

VOX’s sector weightings reveal the detailed complexity that underpins the communications services sector. The fund is broadly diversified across the different sub-sectors that drive communications of the future.

Interactive Media Services makes up the largest allocations and covers the firms at the center of digital communication. That is, firms that drive both the social aspect and the information flow with platforms such as Facebook and X, along with search engines like Google and the online advertising giants.

Movies & Entertainment are the second largest sub-sector and includes traditional media conglomerates and streaming pioneers alike that are redefining content. Following that is Integrated Telecommunication Services, which covers the infrastructure of communication service providers, including fixed-line or wireless services. Cable & Satellite covers companies that are engaged in the distribution of cable, satellite and broadband services. This includes the delivery of data and entertainment.

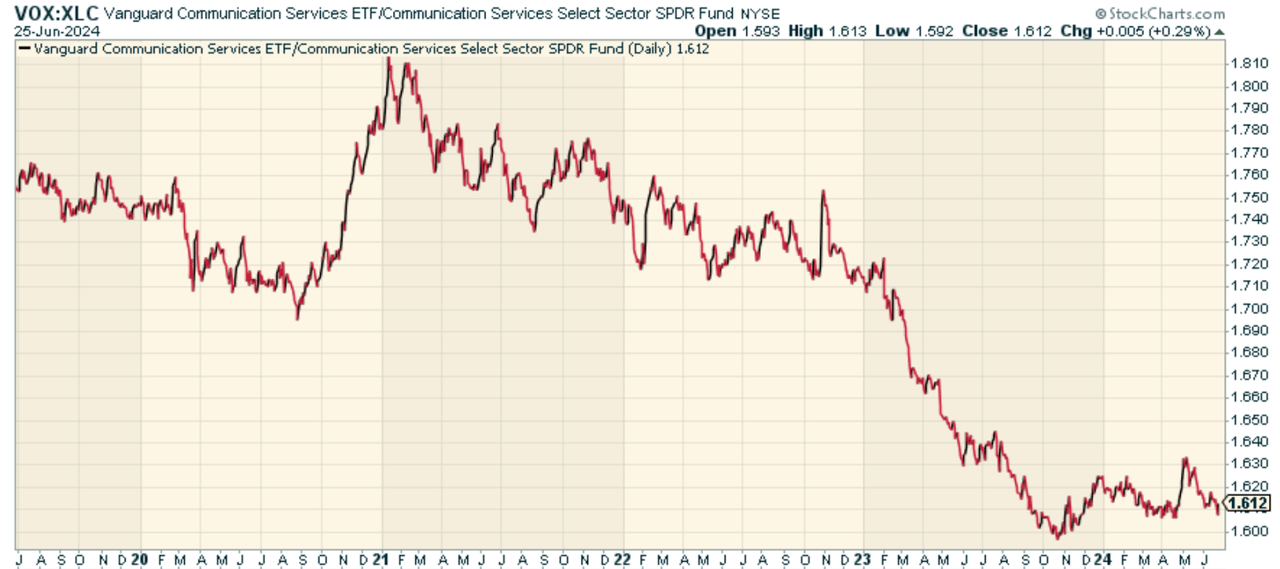

Peer Comparison

One good comp is the Communication Services Select Sector SPDR Fund (XLC). This fund concentrates on the performance of communication services stocks that are a subset of the S&P 500 Index. Similarly, Meta and Alphabet make up nearly the same weighting here as VOX. When we look at the price ratio of VOX to XLC, we find that VOX has underperformed. It’s not immediately clear why, so I’m not sure anything can be gleaned from this as to which fund is better over the other.

Pros and Cons

With that in mind, investing in VOX or any other sector-specific ETF requires you to make a careful assessment of strengths and weaknesses. On the positive side, the communication services sector is seeing robust growth through technological innovation, changing consumer behavior, and demand for seamless connectivity and digital experiences. Firms like Meta (META), Alphabet (GOOG), and Netflix (NFLX) (all VOX holdings) are reshaping business models to push these disruptive trends even further with innovations.

The downsides to plowing money into VOX is the sheer concentration of the fund’s portfolio, which relies on Meta and Alphabet. These companies dominate their respective industries, and that strength is a big reason for their inclusion. But it also means that when the market is rocky or challenges arrive at their companies, the volatility will be magnified in VOX.

Furthermore, the communication services sector is highly susceptible to technological obsolescence and oversight from regulators, which could disrupt VOX’s underlying companies’ day-to-day operations and profitability. Such considerations include the massive intrusion into consumers’ devices and personal privacy that tech monopolies have facilitated, not to mention antitrust investigations against these titans of industry and the irreversible shifts in the competitive landscape that will affect consumer behavior for decades or more.

Conclusion

The Vanguard Communication Services Index Fund ETF Shares lets investors get exposure to new media innovators and old-school phone and cable companies. Though the fund does have high concentration, there is not much investors can do about it if they want a market-cap weighted approach. Overall, I like the sector, I just would prefer a more equal-weighted approach for accessing it.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.