lamyai

According to the Q1 2024 Infrastructure Quarterly report from CBRE, 2024 is turning out to be an unusual year for investors in infrastructure.

The macro outlook in 2024 is more supportive of listed infrastructure due to slower global growth, above-trend inflation and interest rate stabilization, which have historically catalyzed listed infrastructure performance. Infrastructure fundraising faced two key roadblocks last year. Buyers and sellers were met with uncertainty around the trajectory and impact of higher interest rates on asset values and discount rate assumptions. In addition, the denominator effect was at play as steady infrastructure valuations began to overweight private market allocations in institutional investor portfolios following 2022 public stock declines.

Looking to 2024, we see the macro environment as more supportive of the asset class. Structurally higher inflation generates revenue growth for a variety of infrastructure assets; robust policy support improves project economics; and moderating interest rates narrow the gap between buyer and seller expectations. As the impacts of tight monetary policy spread across economies, we believe the defensive, yielding nature of infrastructure assets are attractively exposed to the secular mega-trends of the energy transition and digitalization. We expect to see the continuation of infrastructure debt and higher yielding strategies generating interest within fundraising vehicles as rates remain high, the energy transition to keep driving project finance, and AI development to spur innovation within the evolving digital infrastructure sector.

Amongst all the recent discussion about infrastructure spending in the US and globally, one investment that stands out is the Cohen & Steers Infrastructure Fund (NYSE:UTF). While UTF offers investors a steady and predictable monthly dividend that amounts to an 8% annual yield at the current price, I feel that there are better choices available, especially for income investors such as myself.

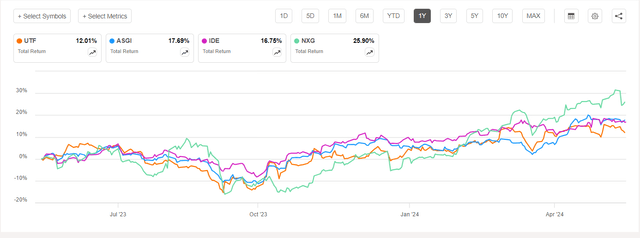

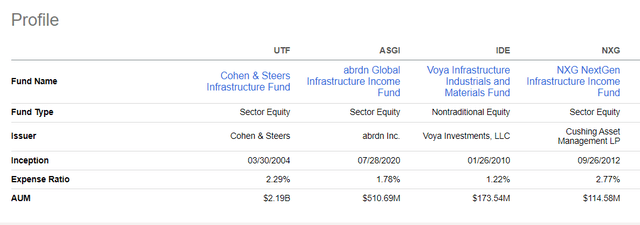

As a recent retiree looking for a steady income stream to support my passive income stream in my Income Compounder portfolio, the returns from UTF in the past year do not justify an investment in this CEF when there are others that invest in similar assets that offer much higher yields and total returns over the past six months to a year. For example, IDE, ASGI (which I recently reviewed), and NXG all offer much higher distribution yields and have delivered stronger total returns over the past year. Furthermore, all 3 of those peer funds offer significantly higher yields and each has increased the distribution substantially in the past year.

Seeking Alpha

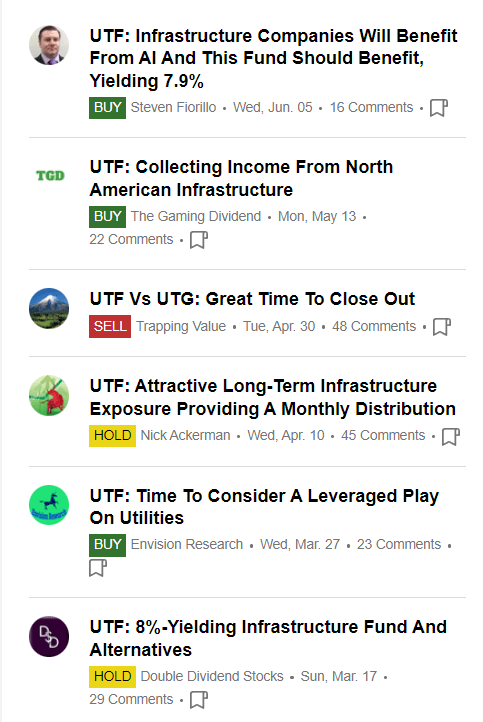

While UTF gets mostly Buy or Hold ratings from other analysts on SA, this fund gets a Sell rating from me currently. The reason is due to interest rates remaining higher for longer, which in turn is likely to negatively impact investor sentiment in UTF. This is especially the case when there are other options in CEFs that invest in infrastructure assets that delivered much higher total returns in the past year and have recently increased their distributions, which are already much higher yielding than UTF.

Seeking Alpha

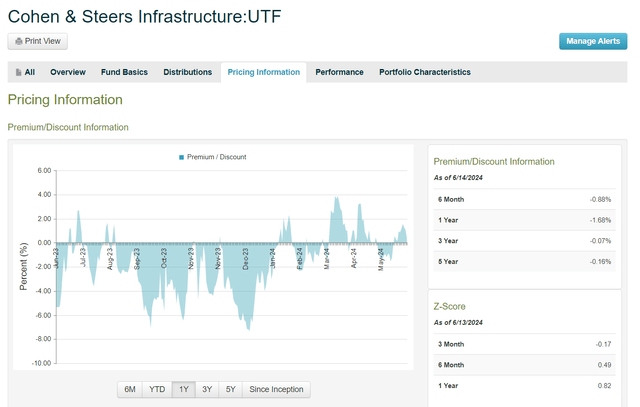

More conservative investors may prefer the lower yield and relative price stability that UTF offers, with its share price trading closer to par than other peer funds that tend to trade at a wide discount. For example, for most of last year UTF traded at just a slight discount to NAV while in 2024 it has mostly traded at a slight premium as shown in this pricing chart from CEFconnect.

CEFconnect

While UTF is much older and much larger than the 3 peer funds that I am comparing it to, it has more of a history to review and many investors like to choose new investments based on past performance. However, past performance is no guarantee of future results and I like to judge funds based on what is likely to happen in the near future when deciding when to buy or sell.

Seeking Alpha

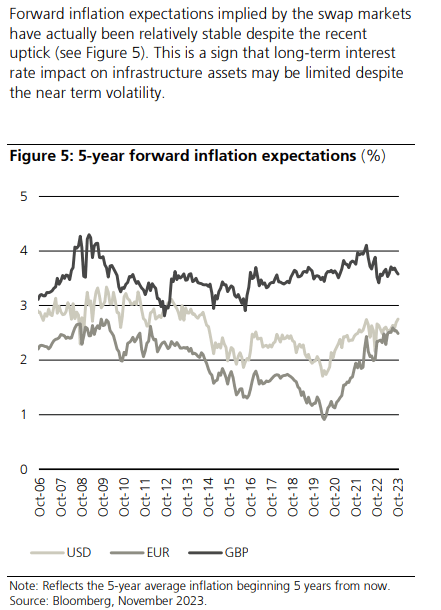

According to this 2024 Outlook report from UBS, the impact of interest rates on infrastructure assets based on 5-year inflation expectations is expected to be muted.

Since infrastructure assets tend to be highly levered, investment performance can be sensitive to interest rates if the asset does not have strong cost passthrough.

UBS

We are at a sort of inflection point in my view with respect to infrastructure assets and the future looks bright for those funds that make investments in holdings that will deliver stable income and see rising capital appreciation over the next 5 years. The UBS report further outlines some of the tailwinds that will drive this upward trend in the long-term investment theme in infrastructure:

The infrastructure sector continues to benefit from secular tailwinds such as the 4 Ds – decarbonization, digitalization, deglobalization, and demographic change. As we move beyond the inflation and interest rate shock in 2022-23, market expectations will reset, and we are cautiously optimistic that deal activity will pick up, especially since the long term investment themes remain intact.

UTF Overview

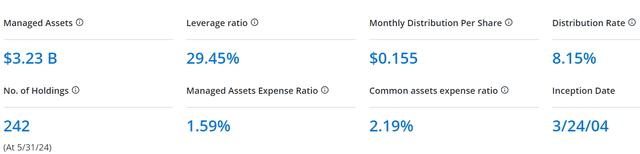

According to the fund website, UTF has more than $3.2B in managed assets with 242 holdings as of 5/21/24. It employs leverage of just about 30% and yields just over 8%.

UTF website

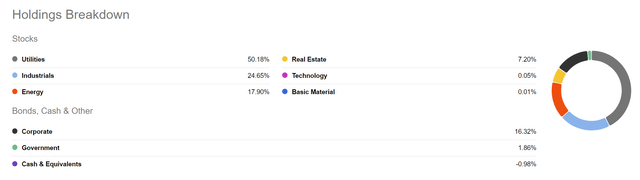

The top 10 holdings as of 3/31/24 make up about 30% of the total portfolio and it appears that about 22 holdings were sold between 3/31 and 5/31 (264 compared to 242).

Seeking Alpha

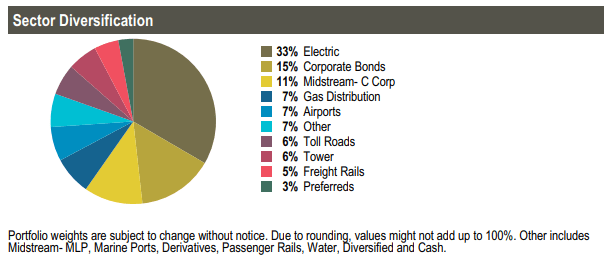

The fund’s emphasis is primarily on Utilities with about a third of the fund invested in electric utilities.

UTF fact sheet

With interest rates staying higher for longer and now just one possible rate cut expected later this year, if any, electric utilities are likely to continue to underperform. Utilities tend to be adversely affected by higher interest rates.

Utilities have benefited from cheap financing rates in recent years, but a significant rise in interest rates would change that. Some utility companies can offset their increased borrowing costs by passing them on to customers, but being able to raise their rates enough to cover the extra cost of financing is not a given. If companies are unable to pass on the extra costs to their customers, these costs are at least partially borne by their equity investors and bondholders, thus making the companies less attractive to new investors.

UTF Dividend History

One positive aspect to UTF is the steady dividend history with its managed distribution policy, as explained in the latest Annual Report:

The Fund, acting in accordance with an exemptive order received from the U.S. Securities and Exchange Commission (SEC) and with approval of its Board of Directors (the Board), adopted a managed distribution policy under which the Fund intends to include long-term capital gains, where applicable, as part of the regular monthly cash distributions to its shareholders (the Plan). The Plan gives the Fund greater flexibility to realize long-term capital gains and to distribute those gains on a regular monthly basis.

For more than 6 years now (since January 2018) the fund has paid a monthly dividend of $0.1550 as shown in the Dividend History tab on SA. Even throughout the Covid-19 crash in 2020, the steady dividend was paid each month with no cuts or interruptions.

Seeking Alpha

For income investors who are looking for a conservative fund that will not be at risk of losing substantial capital while paying a steady dividend, UTF may be worth considering. However, I believe that UTF will soon begin to trade at a discount to NAV once again as the ongoing impacts of higher interest rates take their toll on fund performance.

Higher Interest Rates Impact Fund Leverage and Performance

Because UTF uses leverage and that leverage is funded by mostly floating rate debt, the impact of higher interest rates for longer will eat into the net income generated from the fund holdings and may lead to NAV destruction as well. To offset this negative impact, UTF employs interest rate swaps as explained in the Annual Report management summary:

In connection with its use of leverage, the Fund pays interest on its borrowings based on a floating rate under the terms of its credit agreement. To reduce the impact that an increase in interest rates could have on the performance of the Fund with respect to these borrowings, the Fund used interest rate swaps to exchange a portion of the floating rate for a fixed rate. The Fund’s use of swaps contributed to the Fund’s total return for the 12-month period ended December 31, 2023.

The downside to leverage risk is explained in detail in the Annual Report:

Utilization of leverage is a speculative investment technique and involves certain risks to Common Stockholders. These include the possibility of higher volatility of the NAV of and distributions on the common shares and potentially more volatility in the market value of the common shares. So long as the Fund is able to realize a higher net return on its investment portfolio than the then-current cost of any leverage together with other related expenses, the effect of the leverage will be to cause Common Stockholders to realize higher current net investment income than if the Fund were not so leveraged. On the other hand, to the extent that the then-current cost of any leverage, together with other related expenses, approaches the net return on the Fund’s investment portfolio, the benefit of leverage to Common Stockholders will be reduced, and if the then-current cost of any leverage were to exceed the net return on the Fund’s portfolio, the Fund’s leveraged capital structure would result in a lower rate of return to Common Stockholders than if the Fund were not so leveraged. Any decline in the NAV of the Fund’s investments will be borne entirely by Common Stockholders. Therefore, if the market value of the Fund’s portfolio declines, the leverage will result in a greater decrease in NAV to Common Stockholders than if the Fund were not leveraged. Such greater NAV decrease will also tend to cause a greater decline in the market price for the common shares. To the extent that the Fund is required or elects to redeem any Preferred Shares or prepay any Borrowings or Reverse Repurchase Agreements, the Fund may need to liquidate investments to fund such redemptions or prepayments. Liquidation at times of adverse economic conditions may result in capital loss and reduce returns to Common Stockholders.

With more than half of its holdings in Utilities, that sector is likely to have the greatest impact on near-term (next 6 months to a year) performance of UTF.

Seeking Alpha

Although Utilities are one of the leading sectors thus far in 2024, I believe that performance will be muted in the second half of the year as the reality that rates will remain elevated for longer sink in and impacts investor appetite. Other infrastructure assets that are more industrial and energy-related appear to have better near-term potential and the “peer” funds that I mentioned in the beginning of this article tend to focus more on those types of infrastructure assets such as pipelines, gas processing facilities, etc.

Better Choices than UTF in Infrastructure Funds

Although UTF had strong performance in low to zero interest rate environments, the fund’s performance has suffered in the past two years as interest rates soared higher. Other funds that invest in infrastructure assets have fared much better and offer investors the potential for high current income along with potential capital appreciation as the discounts to NAV close.

In addition to ASGI, which I reviewed in detail back in March, NXG, and IDE also offer high yield income with recently raised distributions. Another fund that I recently reviewed that invests in “real assets” which includes some infrastructure assets is JRI. That fund also just increased the distribution substantially and now offers a 14% yield while still trading at a discount to NAV. You can read more about that fund in this article: Get Real Assets At A Big Discount And Collect 14% Yield.

Even though UTF has been a good performing fund in the past with a steady, managed distribution that offers a reliable 8% yield it is a bad time to buy in my opinion, with the continuing interest rate risk and leverage risk that I outlined above. I believe that your investing dollars would be better spent on one of the other funds that hold infrastructure assets and have recently raised their distributions such as ASGI, IDE, NXG, or JRI.