PM Images

Written by Nick Ackerman, co-produced by Stanford Chemist

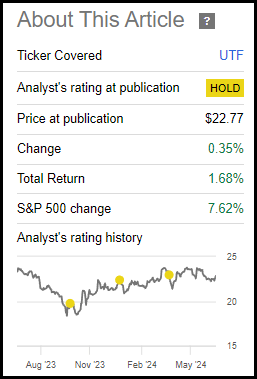

The utility sector had been under pressure due to a higher rate environment. That was on both ends, with the Fed increasing short-term target rates and risk-free rates increasing as well. With things stabilizing and the expectation that rate cuts are next rather than further increases, this is a space that continues to look quite attractive moving forward.

Cohen & Steers Infrastructure Fund (NYSE:UTF) and Reaves Utility Income (UTG) are two closed-end funds that invest with exposure not only to utilities but also to the broader infrastructure space. That includes real estate investment trusts that are relevant for digital infrastructure, such as tower REITs and data centers. That was another area that was under pressure during a higher rate environment that could see potentially better performance going forward.

Neither of these funds is a screaming bargain in terms of trading at large discounts to their net asset values. However, over the long term, they have tended to be two of the more reliable funds in terms of delivering decent results and a steady distribution. That’s helped to ensure that these funds generally trade near their NAV per share for extended periods of time.

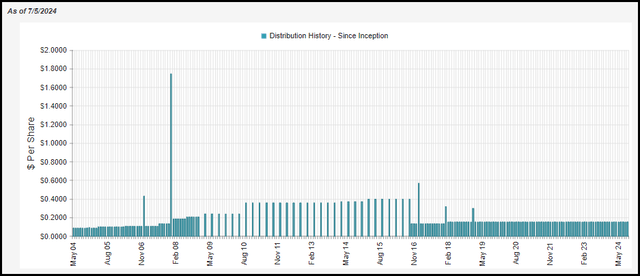

UTF cut its distribution during the Global Financial Crisis, but UTG has managed never to have to cut its distribution. With NAV distribution rates that aren’t overly unrealistic currently, I believe that the distributions still look quite sustainable. So, with that, I believe that both could still be worth considering for dollar-cost averaging for income investors who have a long-term view and can wait for rate cuts to benefit this space.

Cohen & Steers Infrastructure Fund

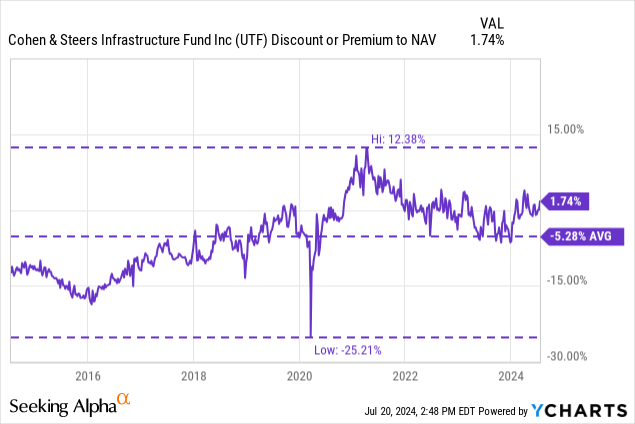

- 1-Year Z-score: 1.34

- Discount/Premium: 1.74%

- Distribution Yield: 8.14%

- Expense Ratio: 1.39%

- Leverage: 30.15%

- Managed Assets: $3.15 billion

- Structure: Perpetual

UTF’s objective is

“total return, with an emphasis on income through investment in securities issued by infrastructure companies.” They define infrastructure companies as those that; “typically provide the physical framework that society requires to function on a daily basis and are defined as utilities, pipelines, toll roads,

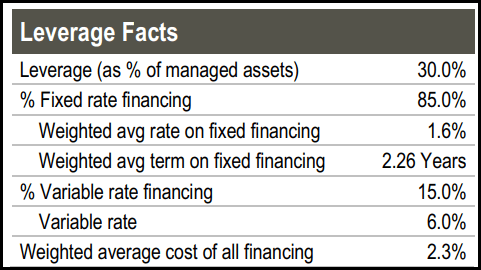

The fund utilizes leverage based on SOFR plus a spread, and that has seen its costs rise substantially due to the higher rate environment. Fortunately for investors, they had largely hedged their borrowings with interest rate swaps that last for another couple of years. When these hedges run out, they will be facing higher borrowing costs, but given the Fed’s own projections, rates should be lower when that happens.

UTF Leverage Stats (Cohen & Steers)

Since our last update, the fund has seen its premium shift to actually trading right at its NAV per share. This is an exceptionally rare occurrence, as most closed-end funds trade at discounts/premiums regularly. I suspect that won’t last long. That said, that helped to keep the overall total returns a bit more suppressed than they otherwise would be.

UTF Performance Since Prior Update (Seeking Alpha)

However, that also means it looks a bit better value today than it was earlier this year. That’s also reflected in the fund’s 1-year z-score going from 2.16 down to 1.34. That indicates that the fund is still trading on the higher end relative to its shorter-term average but is not nearly as expensive. Over the long term, this fund did have an extended period of time where the discount was quite wide. In fact, the average discount of this fund is still over -5%.

That could have been ‘punishment’ from investors for the fund having to cut its payout during the GFC. They did this by going from a monthly distribution to a quarterly distribution instead. They kept this quarterly distribution policy—which tends to be less desirable for income investors—for an extended period of time before reverting it back to a monthly payout schedule.

Given the share price and NAV per share parity, the current distribution rate works out to 8.14% on both fronts.

UTF Distribution History (CEFConnect)

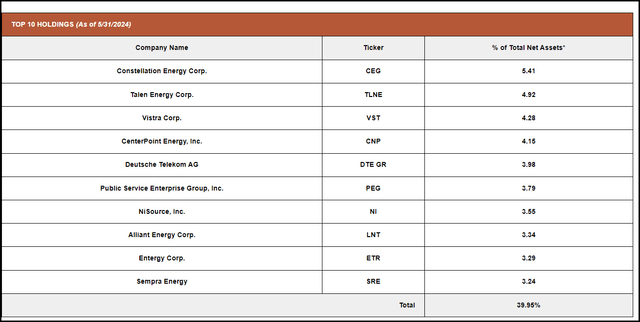

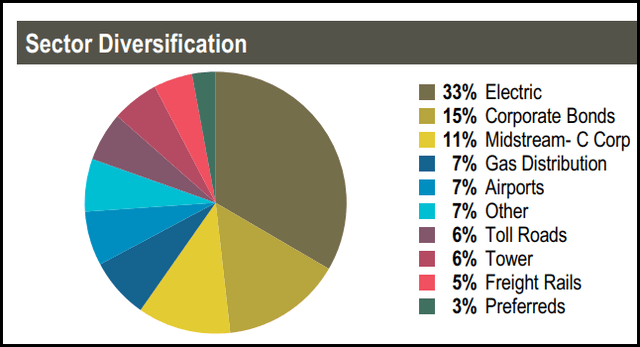

In looking at the top ten holdings, electric utilities are half of them, representing a fairly large allocation for the fund.

UTF Top Ten Holdings (Cohen & Steers)

However, in total, electric utilities make up around 33% of the fund, the largest overall allocation. American Tower Corp (AMT) may be UTF’s largest position, but that accounts for the majority of the tower sector diversification, which is relatively small. Crown Castle (CCI) is also a position in the fund, but that comes in at position number 16.

UTF Portfolio Breakdown (Cohen & Steers)

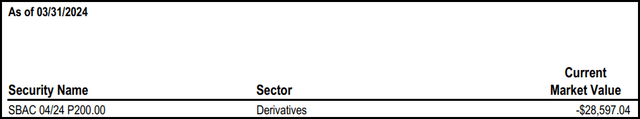

The other major tower REIT, SBA Communications (SBAC), isn’t a position in the fund. At least not at the time when they provided the full holding list. That said, it looks like the fund has written puts on SBAC. Writing puts can help bring in options premium to support the fund’s distribution, but it also means there is potential for the share to be put to the fund. That could have happened as well since the prior update.

UTF SBAC Option Position (Cohen & Steers)

As we can see above, the fund also has some fixed-income exposure. Between the preferred and the corporate bond exposure, those make up 18% of the fund, while the other 82% are equity positions.

Reaves Utility Income Trust

- 1-Year Z-score: -0.19

- Discount/Premium: 1.18%

- Distribution Yield: 8.31%

- Expense Ratio: 0.94%

- Leverage: 19.76%

- Managed Assets: $2.758 billion

- Structure: Perpetual

UTG’s investment objective is “to provide a high level of after-tax total return, consisting primarily of tax-advantaged dividend income and capital appreciation.” To achieve this, the fund “intends to invest at least 80% of its total assets in dividend-paying common and preferred stocks and debt instruments of companies within the utility industry.”

UTG is also leveraged and pays at a rate of SOFR plus 0.65%. Unlike UTF, the team here did not hedge their leverage costs through interest rate swaps or shorting futures. So, they have felt the full weight of the higher costs on their borrowings. On the other hand, they are more modestly leveraged at around a 20% effective leverage ratio.

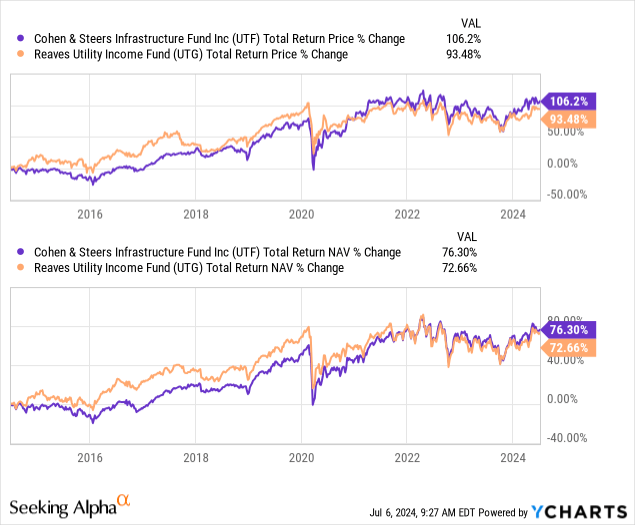

That could at least partially explain why UTF had been the better performer over the last few years. Which, admittedly both funds have only really slightly positive total NAV returns in the last three years, UTF at 2.2% and UTG at 0.52%. As I said, higher rates really put pressure on these funds in the last few years.

That said, what might be interesting is that over the last 10 years the performance on a total NAV return basis for these two comes in quite close. It was simply that prior to the higher rate environment, UTG was the leader between the two and not UTF has caught up to the same results.

Ycharts

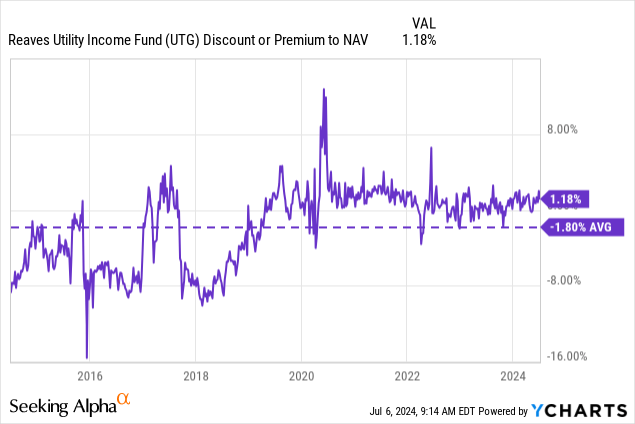

We had covered UTG more recently, but I wanted to give it another quick look as it shares several similarities with UTF, and I believe it is a worthwhile long-term investment. On a relative valuation basis based on the 1-year z-score, these funds are quite close, even with UTG still sporting a slight premium.

UTG has generally been the fund to trade closer to its NAV per share, and that has been reflected by the fund’s long-term average discount being quite narrow. Though it, too had, prior to the last five years, shown a propensity to trade at some meaningful discounts as well. More broadly speaking, CEFs had traded at some of the widest discount levels historically throughout 2022 and 2023. UTF and UTG both bucked that trend, though, so that’s interesting to note.

Ycharts

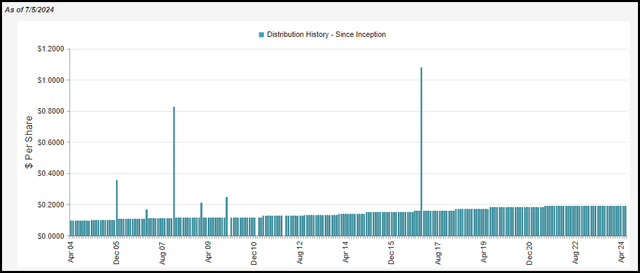

UTG has never cut its regular distribution to investors and, for its entire existence, has maintained a monthly distribution. That’s at least one thing they can boast about over UTF. The fund’s NAV rate currently comes out to 8.41%, just a bit higher relative to UTF. That also includes its share price distribution yield being a touch higher at 8.31% as well.

UTG Distribution History (CEFConnect)

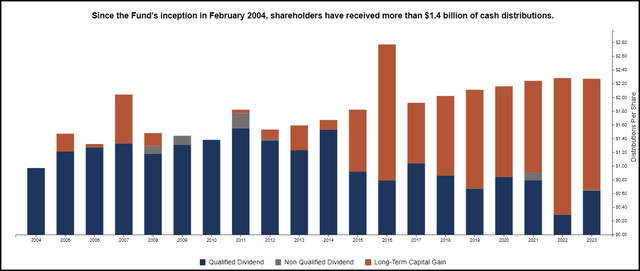

As both of these funds invest heavily in equity positions, they will require capital gains to fund their distribution. Simply put, these funds can’t deliver 8%+ payouts based on the underlying dividends they collect, they just don’t invest in that high of yielders. We can see that in the tax characterizations with UTG’s distribution that they have provided over the years.

UTG Distribution Breakdown (Reaves)

Some point that out as a negative, but that’s just how it works for these equity CEFs. With a more optimistic outlook moving forward, I don’t see that as unsustainable either currently. Of course, that can always change.

If the distribution NAV rates started pushing over 10% for an extended period of time, then it could make it harder and harder not to erode their NAV. Once NAV starts eroding, it becomes even more difficult to sustain, and the NAV rates end up heading higher, creating a vicious cycle.

At this time, UTG is quite heavily invested in utilities when looking at the top ten.

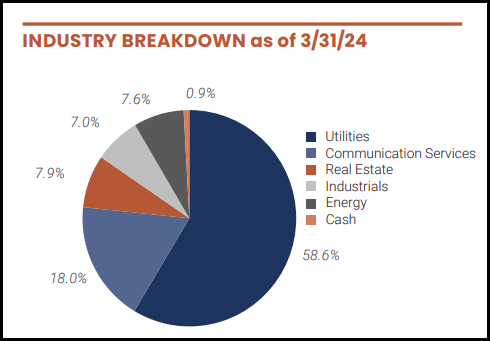

That makes sense, given the fund’s name, but they do still leave a meaningful amount of their capital invested elsewhere. Utilities make up around 60% of the portfolio, so that leaves another ~40% of their portfolio invested elsewhere. That includes the communication services, real estate, industrial and energy sectors.

UTG Portfolio Breakdown (Reaves)

Conclusion

Rate cuts can be beneficial for closed-end funds that utilize leverage; they can also benefit funds such as UTF and UTG, which are invested in areas of the market that also employ a liberal amount of leverage. The infrastructure and REIT space tend to use leverage for their massive capex budgets but also because they tend to provide steady cash flows that can support utilizing a higher amount of borrowings.

This area of the market is also an attractive area for income-oriented investors, so with risk-free rates rising over the last couple of years, there have been safer alternatives to receive income. With this looking set to reverse in the next year or two, it could turn into a tailwind for the sector. At least, the current outlook is that rate hikes aren’t on the table, so even just stabilized rates mean these funds have been able to stabilize as well.

UTF and UTG aren’t screaming buys today, as they continue to trade stubbornly near their NAV per share, not allowing a material discount to open up. However, with a more optimistic outlook going forward, this is still an area where I think an investor can feel fairly comfortable adding smaller amounts through a dollar-cost average type of approach.