In Google Ads, where every click can be a potential sale, understanding your competition isn’t just strategic, it’s also absolutely necessary for creating a profitable ad campaign.

For our ecommerce clients, Google Merchant Center has long been a critical tool for managing unwieldy amounts of data.

When some ecommerce clients can stock thousands of SKUs or maybe even millions of SKU iterations, it enables us to manage shopping campaigns that would otherwise be impossible.

With new evolutions of machine learning and AI-powered Shopping on the horizon, making sure your store remains competitive in the massive landscape of ecommerce advertising is more important than ever.

Enter Merchant Center Next, which is the next evolution of Google’s product listing management tool. It’s designed to give ecommerce retailers a sharper edge in the competitive arena.

Here’s how you can use this tool not just for managing product feeds, but also for identifying huge opportunities in your competition.

Merchant Center Next is an upgraded platform that allows ecommerce stores to manage how their products appear on Google Shopping, both paid and organic.

But for this post, we’ll focus more on its analytics and insights features, which are a gold mine for competitive analysis.

How To Use Competitive Analysis Features In Merchant Center

First, you need to make sure your account actually has access to Merchant Center Next.

Although Google first announced a full rollout by September 2024, not all accounts have access yet. The integration with Google Ads is seamless, so it’s an easy click.

Second, take a look at the competitor visibility section. This section is reached by navigating to Analytics > Products, and then looking at different content tabs, labeled Traffic, Competitors, Popular Products, Pricing, and Promotions.

This shows you cards that highlight how your products stack up against the competition in terms of overall visibility. You can see who among your competitors is getting more clicks, where their ads rank, and how your own traffic compares.

Third, take a look at price competitiveness. Google Merchant Center Next provides insights into how product prices align with the overall market.

Are your SKUs priced above, similarly, or below the average price across the internet? The data within this section will help you adjust your pricing strategy easily.

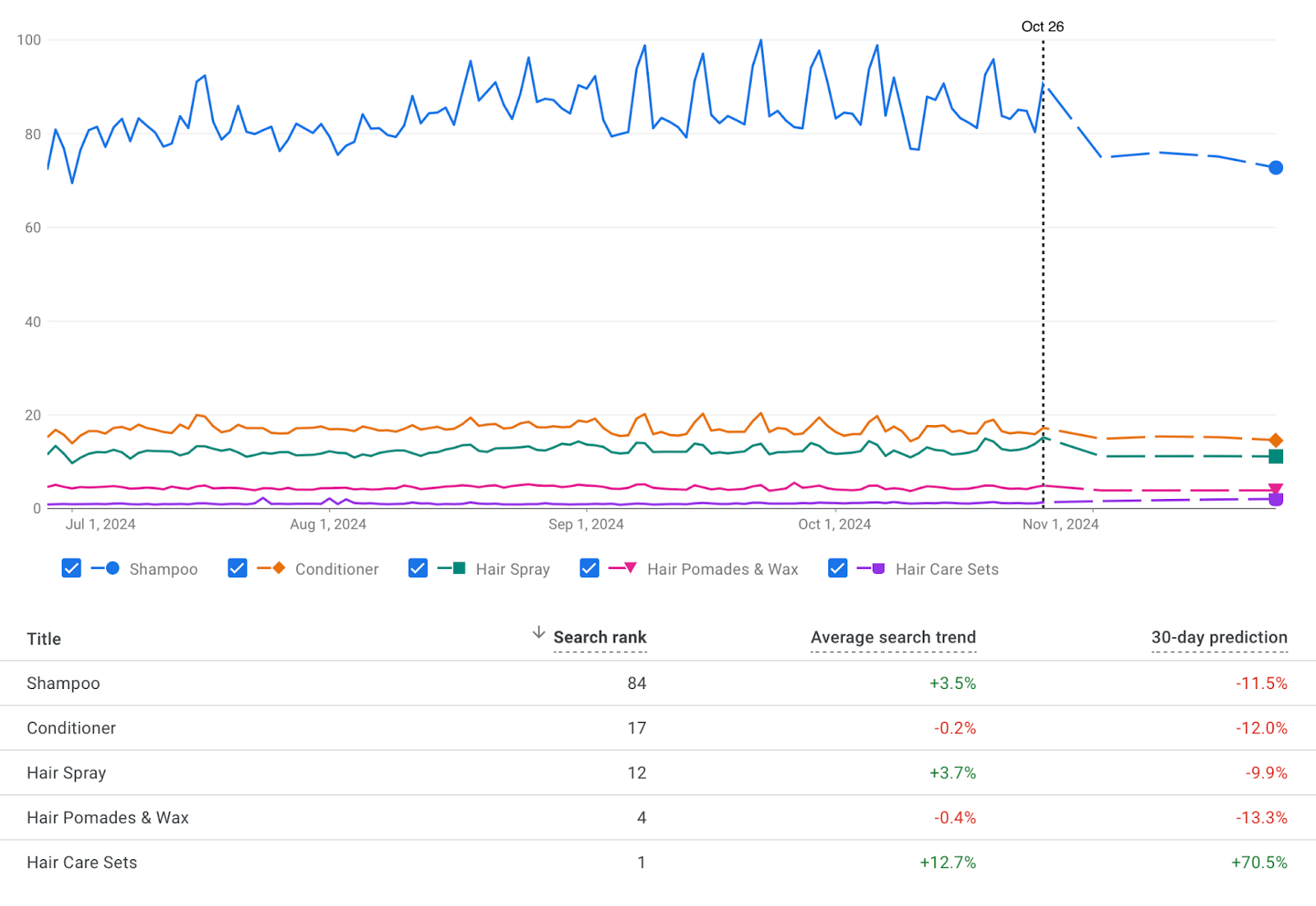

Next, look at search trends. This section allows us to have a closer look at and to understand what consumers are looking for in aggregate.

It’s not just about products or individual SKUs, but also entire categories and product niches you may not be aware of.

Doing a deep dive into product performance can be massively valuable.

Best Sellers allows you to identify products flying off your virtual shelves. If competitors are selling items you don’t currently offer, this is a good indicator to consider product line expansion.

Out-of-stock Insights gives you a heads-up that you may need to restock a product – inventory management is always a huge issue with popular ecommerce stores.

How To Interpret Data For Real-World Use

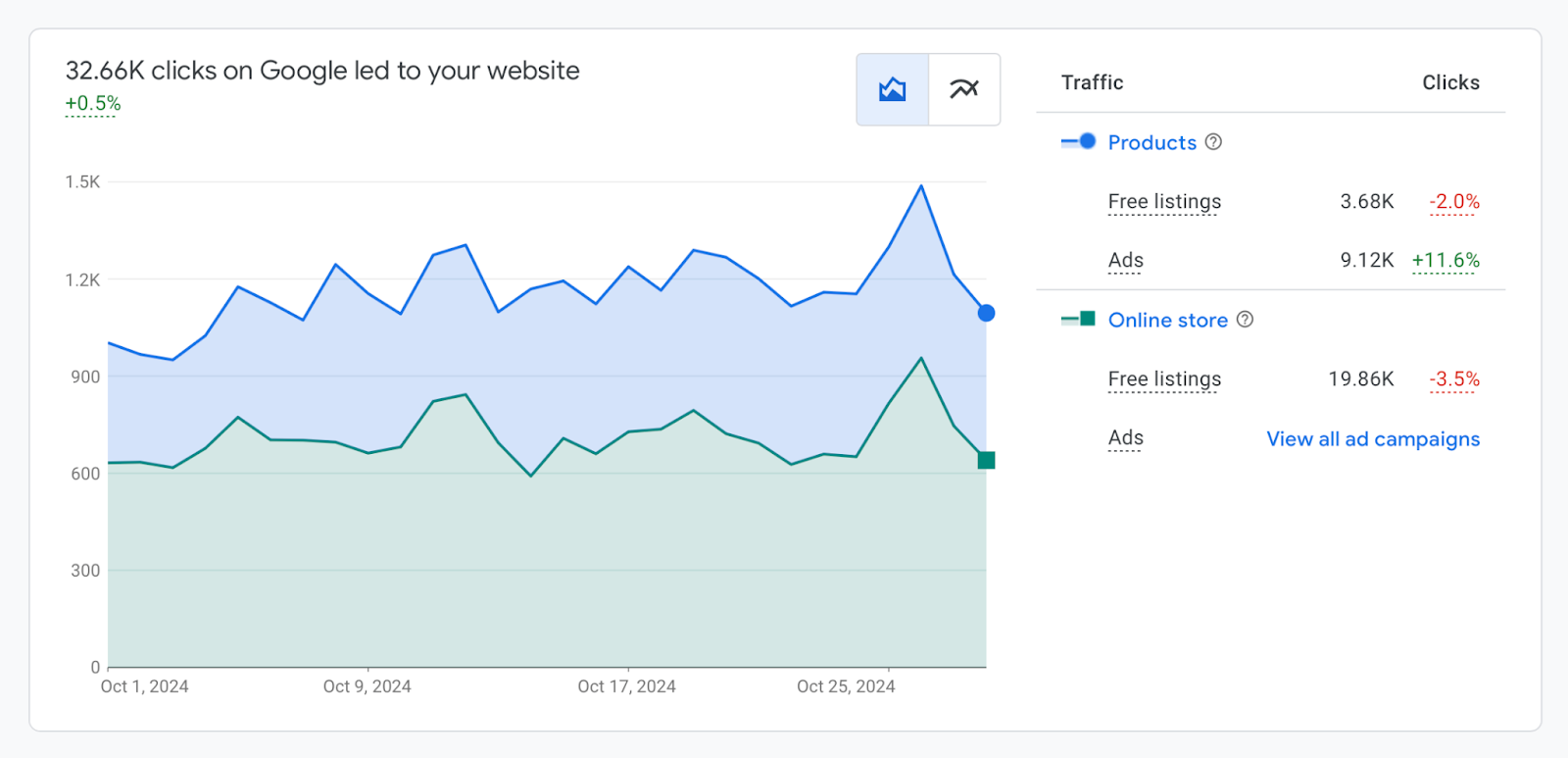

One of my favorite metrics in Google Merchant Center Next is the Ad/Organic Ratio Analysis. This metric tells us how much of the traffic per product is paid versus organic.

You can infer competitor ad spend from this. If you can see a competitor has a high ratio of paid to organic, it means they’re possibly spending a lot more on ads than you, so it might be time to ramp up your Google Ads spend (something you’ve likely heard from plenty of Google reps).

Ad/Organic Ratio Analysis in Google Merchant Center. Screenshot from Google Merchant Center, November 2024.

Ad/Organic Ratio Analysis in Google Merchant Center. Screenshot from Google Merchant Center, November 2024.Since Merchant Center isn’t only about paid traffic, you can also use search term insights in the Analytics > Summary tab to help with your ecommerce store’s SEO performance.

Use these insights into keywords to refine product titles, descriptions, or even URLs. If a competitor’s product with a similar title is ranking higher, this can indicate possible opportunities for improvement.

Continuous monitoring and adapting to the current market are critical. Nothing seems to change faster than the digital advertising landscape.

Using Merchant Center Next to identify market shifts means you can discover new entrants, changing consumer preferences, seasonal trends, and more.

Using Merchant Center Next to identify changing product trends. Screenshot from Google Merchant Center, November 2024.

Using Merchant Center Next to identify changing product trends. Screenshot from Google Merchant Center, November 2024.Using this newly available data within Merchant Center can help you outsmart the competition – spotting gaps where you may be able to see that competitors are missing out on certain categories or price points.

If you can see that no other competitor offers free shipping, or aren’t bundling products in unique ways, these are all ways to leverage the data for your own benefit.

More Data Is Coming For Shopping

One of the biggest complaints over time has been that Google Ads seems to continually remove granular data from our fingertips, making it harder to optimize and improve campaigns.

This is especially important to ecommerce advertisers who often have unwieldy amounts of SKUs and transaction data to analyze.

Google Merchant Center Next actually seems to be bringing some of this data back into the fold. By leveraging this data – specifically the competitive analysis tools – you cannot only keep up with the rest of the ecommerce market, but also maybe even jump ahead.

Plus, Google Ads has been making some major strides in consumer-focused customized experiences within Google Shopping.

These AI-powered custom shopping experiences are still in their infancy, but making sure your campaigns are fully optimized within Merchant Center Next is the first step to staying competitive even through these new changes.

After all, the data that Google uses to train these new experiences come directly from stores just like yours (which can sometimes feel like a double-edged sword, to be sure).

All indications seem to be that this data will continue to increase. Not only has Performance Max been offering more and more data recently, but shakeups at Google Ads seem to indicate that more granular data may be coming to us from more than one platform.

Ecommerce knowledge and data aren’t just power – they are profit!

More resources:

Featured Image: eamesBot/Shutterstock