Shortly after Donald Trump declared victory in the election, the heads of major tech companies rushed to congratulate him. “Congratulations President Trump on your victory!,” Apple CEO Tim Cook wrote on X (formerly Twitter). “We look forward to engaging with you and your administration to help make sure the United States continues to lead with and be fueled by ingenuity, innovation, and creativity.”

Facebook founder and CEO Mark Zuckerberg wrote on Threads: “Congratulations to President Trump on a decisive victory. We have great opportunities ahead of us as a country.” Similar congratulations came from Google CEO Sundar Pichai, Amazon founder Jeff Bezos, Amazon CEO Andy Jassy, Microsoft CEO Satya Nadella, OpenAI CEO Sam Altman, Intel CEO Pat Gelsinger, and many others. Each hopes to curry favor with the president-elect, who will have significant power to influence their industries over the next four years.

However, the question of which companies will ultimately win Trump’s favor is not easy to answer. Trump’s approach to tech companies and various technology policies is shaped by a complex web of sometimes conflicting interests and influences around him. It’s likely to be inconsistent, unpredictable, and if past behavior is any guide, impulsive. Still, enough is known about Trump, his positions, and his motives to attempt an analysis of how he might approach relations with major tech companies.

Under President Biden, the Department of Justice (DOJ) and the Federal Trade Commission (FTC), led by FTC Chair Lina Khan, adopted an aggressive stance on antitrust, filing sweeping lawsuits against Meta, Google, Amazon, and Apple. Historically, Republican administrations tend to adopt a more lenient stance toward big corporations. Trump will appoint a new Attorney General and is expected to replace Khan, signaling a potentially softer approach to regulation.

However, this may not mean a retreat from action against Meta and Google. Both companies have longstanding conflicts with Trump and Republicans, who have often accused them of bias against conservative viewpoints. Trump also has a specific grudge against Meta, which was the first platform to suspend his account after the January 6 incident.

The first DOJ antitrust suit against Google, in which the company lost a round in August (with a second suit filed in September), and the FTC’s case against Meta were initiated in Trump’s first term. Continuing these cases aligns with his previous stance. While Trump’s DOJ may not pursue drastic measures like company breakups, they may still press for moderate concessions rather than the extreme remedies proposed under Biden.

Zuckerberg and Pichai will likely seek compromises and hope the White House might be more receptive this time. This is especially true for Zuckerberg, who has previously praised Trump’s boldness. Ego-driven leaders are often susceptible to flattery, so this strategy could influence Trump’s stance.

Amazon’s situation is more complicated. Biden’s administration filed an antitrust lawsuit against Amazon, raising the possibility that Trump might seek a settlement or withdrawal. However, Trump’s history with Amazon and its founder, Jeff Bezos, is contentious. Trump has previously accused Amazon of tax evasion, harming traditional retail, and overburdening postal services, famously saying, “Amazon is doing great damage to tax-paying retailers.”

Recently, Bezos has tried to mitigate tensions by keeping the Washington Post, which he owns, from endorsing a candidate. Whether this will improve Trump’s view of Amazon remains uncertain, though the incoming administration may indeed adopt a more lenient approach.

Apple could emerge as one of the biggest beneficiaries of a Trump administration. Tim Cook cultivated a close relationship with Trump during his first term, positioning himself as an advisor to the administration. If he maintains this rapport, Apple may see favorable treatment on several fronts, including the antitrust suit filed by the DOJ earlier this year. Close ties with Trump could facilitate a settlement rather than prolonged litigation.

Additionally, Apple’s goals align with Trump’s on certain issues, notably China. While Apple relies heavily on China for manufacturing and sales, it has been diversifying manufacturing, expanding its focus on India as an alternative hub. Trump, who has a favorable relationship with India’s Prime Minister Narendra Modi, could support Apple’s India plans.

The chip market (and Intel)

The Biden administration focused on the chip industry, imposing export restrictions on advanced chips to China while incentivizing domestic chip manufacturing. This aligns with Trump’s previous economic strategy, as he initiated the trade war with China and prioritized domestic manufacturing.

Trump has a unique opportunity to take credit for the new chip factories opening in the next four years due to Biden’s subsidies. Although Trump criticized subsidies in an interview with Joe Rogan, he may still uphold them, as a reversal would be impractical. This would particularly benefit Intel, which has received significant federal support and embodies Trump’s ideal of a competitive American tech company.

During his first term, Trump took a hard line on TikTok, attempting to block it unless ByteDance, its Chinese owner, sold its U.S. operations. The Biden administration continued this policy, recently setting a deadline for ByteDance to sell TikTok or face a U.S. ban.

Although TikTok’s fate may seem sealed, Trump has recently opposed such a sale, arguing it would strengthen Meta’s position. Given the timeline, Trump may leverage his executive powers to delay or obstruct enforcement of the ban, potentially granting TikTok a reprieve.

The Biden administration implemented significant oversight for AI and cryptocurrencies, including an executive order requiring companies to disclose AI training methods and establish an AI safety institute. Trump is likely to take the opposite approach, with key campaign backers like Elon Musk, Marc Andreessen, and Ben Horowitz, who favor minimal regulation in these areas.

Trump has also become an outspoken supporter of Bitcoin, partly to court crypto advocates, even proposing a federal Bitcoin repository. His administration would likely reduce regulatory burdens on AI and crypto, potentially giving these fields a substantial boost. This enthusiasm for cryptocurrency was reflected as Bitcoin reached a record high of $80,000 on Sunday.

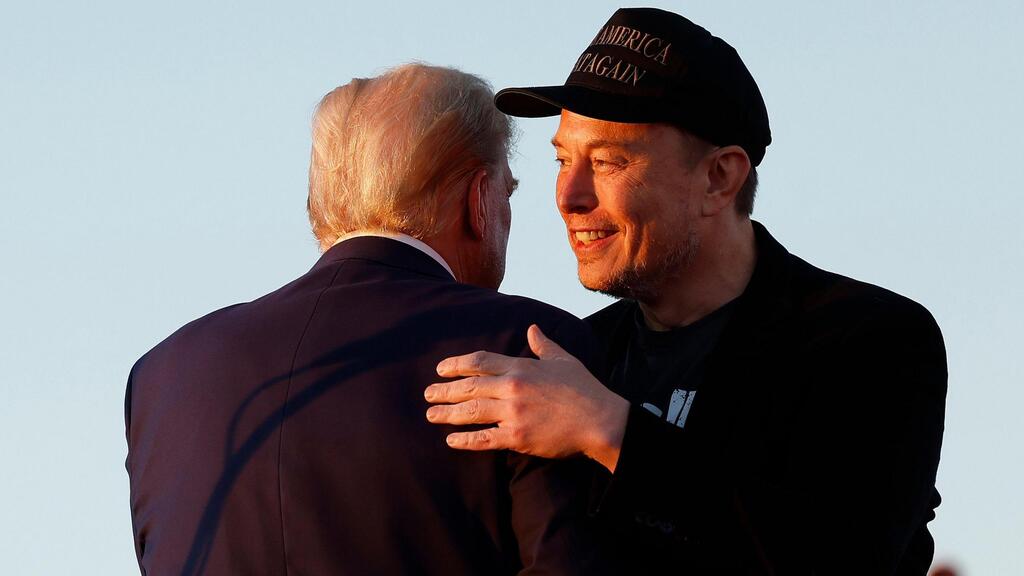

Perhaps the biggest winner of the 2024 election, besides Trump, is Elon Musk. Musk, the wealthiest person globally and the owner of X, Tesla, and SpaceX, heavily supported Trump’s campaign and attended rallies in recent months. Trump has hinted Musk might take a federal role focused on government cuts, though it’s unlikely Musk would leave his empire for a government position.

Nevertheless, Musk is expected to maintain close ties with Trump and act as an influential advisor. From this position, Musk could see regulatory relief across his businesses, including subsidies for SpaceX, favorable policies for Tesla and Neurolink, and perhaps even government action against X’s competitors. These next four years could significantly bolster Musk’s fortune.