Since the industrial revolution of the late 1700s, technology has informed and led a series of radical changes in our societies and economies. The pace has picked up speed in recent decades, as the world turned digital, and now AI is powering a so-called fourth industrial revolution, based on a rapid exchange of data and information.

Against this backdrop, tech stocks have led the way in market gains. The tech-heavy NASDAQ rose an impressive 43% last year, and the S&P 500 rose 24%. Both indexes are continuing to post strong numbers this year; for 2024 year-to-date, they are up 24% and 17% respectively.

This has Wedbush analyst and tech expert Daniel Ives bullish on tech stocks, noting: “The first half of 2024 has been a very strong run for tech stocks led by Big Tech stalwarts Nvidia, Microsoft, Amazon, Meta as this 4th Industrial Revolution has just begun to play out in our view in this 1995 Moment (not 1999) with many bears still yelling from their hibernation caves… We believe NASDAQ has another strong 2H ahead as tech stocks will be up 15% the rest of 2024 in our view with tech fundamentals set to accelerate as AI use cases materially expand.”

Against this backdrop, we’ve opened the TipRanks database to look up two of Ives’ stock picks – well-known tech giants – and see how his takes stack up against the Wall Street consensus. Here are the details.

Microsoft (MSFT)

First on our list, Microsoft has been leading the field in PCs and operating systems since the 1970s, and has become one of the world’s most iconic brand names. In recent years, the company, based in Redmond, Washington, has continued its long commitment to advancing technology, by staking out a strong position at the leading edge of the artificial intelligence field. Microsoft has a long-standing interest in AI, and was an early backer of OpenAI, the company that brought us generative AI and Chat GPT at the end of 2022. The company’s cumulative investments in OpenAI are in the neighborhood of $10 billion.

From the user perspective, Microsoft has several highly visible AI initiatives. These include the integration of generative AI tech into the Bing search engine, in effort to make Bing more user friendly, with an improved interface and search results, aiming at a stronger competition with Google. Also, Microsoft is incorporating AI into the updates for the Windows and Office software packages. Prominent among these additions to the iconic software products is the Copilot, Microsoft’s new AI-powered online assistant. The Copilot is designed to provide real-time user assistance, informed by the user’s own work and content creation histories.

Perhaps the largest-scale use of AI in Microsoft’s product delivery can be found in its cloud computing platform, the Azure subscription service. Azure is a package of cloud-based apps and tools, more than 200 all told, and Microsoft is incorporating AI into the platform – customers will be able to choose AI-enhanced versions of the Azure apps. The move promises to both make Azure a more user-friendly product, with greater flexibility, and to make the platform a stronger competitor to Amazon’s AWS and to Google Cloud.

A look at Microsoft’s last financial report, which covered fiscal 3Q24, shows that the AI upgrade to Azure is bearing fruit. Azure is part of Microsoft’s Intelligent Cloud segment, which generated $26.7 billion in revenue for the quarter, up 21% year-over-year and 43% of the quarterly top line. The company’s total revenue for fiscal Q3 was up 17% year-over-year, and reached $61.9 billion, beating the forecast by $1.01 billion. At the bottom line, Microsoft saw earnings of $2.94 per share, a figure that was 11 cents per share better than had been expected – and was up 20% from the prior-year period.

Shares in Microsoft have shown strong performance over the past year; unsurprising given the solid financial results. The stock has gained 42% in the last 12 months, and is up almost 25% so far this year.

For Ives, the key point here is the potential of AI to unlock additional gains as MSFT goes forward. He writes, “We believe the stock still has yet to price in what we view as the next wave of cloud and AI growth coming to the Redmond story with a strong competitive cloud edge vs. Amazon especially and Google in cloud bake offs. Our recent partner checks have been incrementally strong around Copilot deployments with MSFT customers and ultimately we estimate this could add another ~$25 billion to Redmond’s topline trajectory by FY25. Here is the key as the multiplier ripple impact from the Godfather of AI Jensen and Nvidia is just starting to be felt on the cloud/software layer as the 2nd derivatives of the AI Revolution play out in the field.”

The tech expert goes on to give Microsoft shares an Outperform (Buy) rating, along with a price target of $550, suggesting a one-year upside potential of 18%. (To watch Ives’ track record, click here)

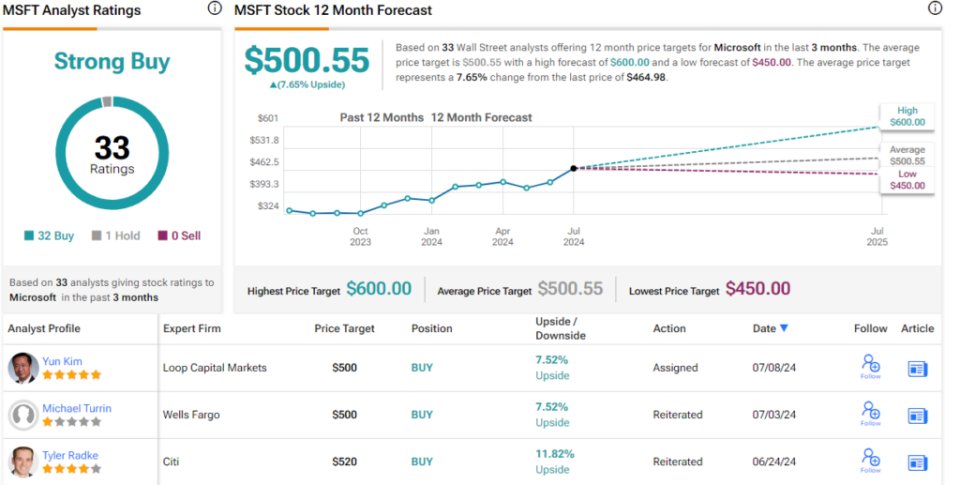

This venerable tech firm has picked up 33 recent analyst reviews, with a lopsided split of 32 Buys to 1 Hold giving the shares a Strong Buy consensus rating. The stock is priced at $464.98, and its $500.55 average price target implies it will gain 7.5% in the coming year. (See MSFT stock forecast)

Salesforce.com (CRM)

Next up is Salesforce, a well-known name in the field of customer relationship management, or CRM. Salesforce gives a good definition of CRM, describing it as a system for managing company interactions with all customers, current and potential, with the simple goal of improving relationships and expanding the business.

Salesforce has been in the CRM business since 1999, and has perfected the system. The company offers an industry-leading, cloud-based software platform that streamlines CRM activities, including sales calls, marketing emails, and customer service interactions. The platform tracks these interactions and builds up a unified database comprised of customer and company information.

In recent years, Salesforce has integrated AI technology into its CRM software products, further enhancing the abilities of both developers and users to customize the platform, fitting it to any scale or business purpose. The company’s AI integration streamlines data retrieval, improves communications, automates repetitive tasks, and generates actionable insights through autonomous data analysis. Salesforce is also making use of generative AI for automated creative purposes – generating personalized customer communications, including targeting marketing contacts and determining the best timing for their release.

Salesforce has, in its years of operation, made itself an essential part of the business universe, offering a necessary service, based on the latest technology, and delivering solid results for its customers.

As for Salesforce’s results, the company reported its fiscal 1Q25 financial release at the end of May and beat the forecast on earnings while missing on revenue. The company’s revenue came to $9.13 billion, up almost 11% from the prior year but $20 million less than had been expected. The bottom line was reported as $2.44 by non-GAAP measures, for a 44% y/y increase – and beating the estimates by 7 cents per share.

The company reported some additional metrics that should pique investor interest, including $8.59 billion in subscription & support revenue, up 12% year-over-year and a main driver of the overall revenue growth. Free cash flow was up in the quarter, by 43% y/y, to reach $6.08 billion. Salesforce finished the quarter with $9.96 billion in cash and liquid assets on hand, as of April 30 this year.

While these results were sound, shares in Salesforce dropped sharply after the release – mainly when the Q2 forecast failed to impress. Company estimates for both revenue and earnings in Q2 came in below the consensus estimates. Currently, the stock is flat for the year-to-date.

Dan Ives, in his coverage of Salesforce, takes an investor’s perspective – and he’s impressed by the company’s current capabilities and near-term potential. Ives writes of Salesforce, “In our view, CRM is on the path to a higher growth, margin, and FCF trajectory and this is just a small bump in the road during a transitionary growth period… CRM [remains] one of our favorite tech names to own over the next year as the AI story starts to take shape. We would be buyers on weakness… as seeing the forest through the trees this is a turnaround in motion for a premier tech stalwart with a massive installed base led by one of the best CEOs in the global tech landscape in our view.”

Taking these comments forward, Ives rates CRM as Outperform (Buy), with a $315 price target that suggests a 21% gain in the months ahead.

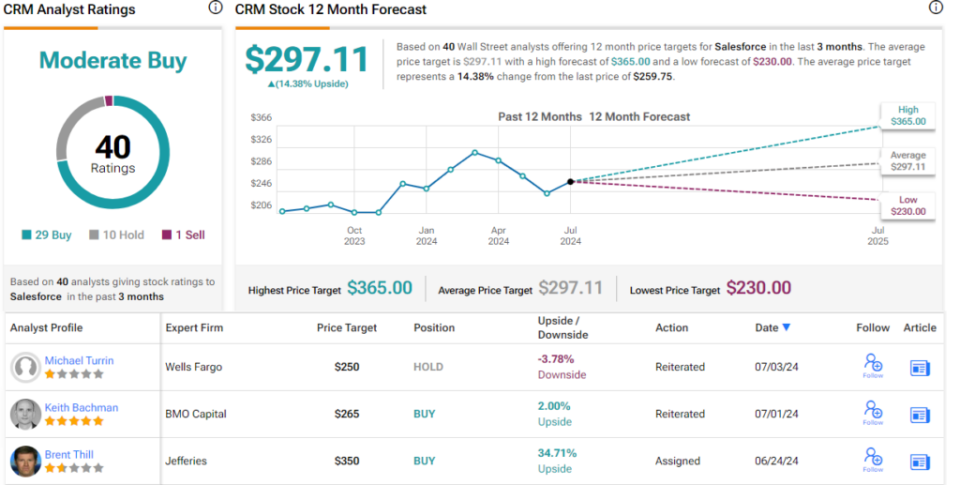

There are 40 recent analyst reviews on record for Salesforce shares and they break down to 29 Buys, 10 Holds, and 1 Sell, giving the stock its Moderate Buy consensus rating. The shares are priced at $259.81, with a $297.11 average target price that indicates potential for a 14% upside on the one-year horizon. (See CRM stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.