In this analysis, I’ll leverage TipRanks’ Stock Comparison Tool to closely examine three leading AI investment opportunities. Although Nvidia (NVDA) has delivered an impressive five-year return of 2,524%, compared to under 200% for Microsoft (MSFT) and Google (GOOGL), I’m not convinced it represents the best long-term choice at this stage. Microsoft and Google, by contrast, offer greater medium- to long-term stability. Consequently, I am more bullish on these established Big Tech giants than on the newer AI-focused semiconductor player, Nvidia.

Nvidia Stock Is Trading on Borrowed Time

I’m currently neutral on Nvidia, even though it has delivered remarkable returns in recent years. Nvidia has experienced nearly 200% year-over-year revenue growth and a net income margin of 55% over the past 12 months (up from a five-year average of 31.4%). While 2025 is expected to be strong, with the new Blackwell GPU already sold out, the company is approaching a potential inflection point. Those familiar with semiconductor investments will recognize their cyclical nature.

Although it’s uncertain when Nvidia might see a revenue contraction, I believe it’s likely in the medium term. As Big Tech companies eventually taper their AI capital expenditures, Nvidia could experience a typical cyclical downturn. While future AI infrastructure spending cycles are expected, it’s unlikely the current upcycle will continue without significant demand fluctuations—especially if the first AI downturn coincides with a broader economic recession.

I believe Nvidia stock still has room for gains over the next couple of years, though I find its risk profile concerning. Market volatility could affect the stock heading into 2026, with 2027 and especially 2028 likely to be more challenging. For now, however, my rating is a Hold, with a conservative October 2025 price target of $155 and a bull-case target of $175.

How Do Wall Street Analysts Rate Nvidia Stock?

Wall Street remains highly bullish on Nvidia, with an average NVDA price target of $153.86, indicating a 13.6% upside. The consensus rating is a Strong Buy, based on 39 Buy ratings, three Holds, and no Sells. This supports the case for holding Nvidia until a potential medium-term downturn becomes clearer.

Microsoft Is Positioned for Long-Term Stability

I’m particularly bullish on Microsoft, viewing it as a long-term buy-and-hold investment rather than just a short- to medium-term play like Nvidia. As the AI leader in Big Tech, Microsoft is well-positioned for sustained growth without the heavy cyclicality facing AI semiconductor companies like Nvidia. Instead of relying on Big Tech capital expenditures, Microsoft benefits from recurring revenues through its AI-driven cloud subscription services.

Microsoft’s management under Satya Nadella has been exceptional. Since he became CEO in 2014, the company’s market cap has surged from $381 billion to over $3 trillion by 2024. Nadella’s pivotal shift toward cloud computing is now paying off significantly, boosted by Microsoft’s substantial stake in OpenAI, the creator of ChatGPT.

I see Microsoft as a stable, long-term investment. Its strong 10-year free cash flow annual growth rate of 14% and 28.6% margin support a bullish outlook. While its price-to-free-cash-flow ratio of 42 is above the 10-year median of 28.5 due to heavy AI investments, these should enhance earnings over time. At the moment, my rating is a Buy, with a bullish October 2025 price target of $490.

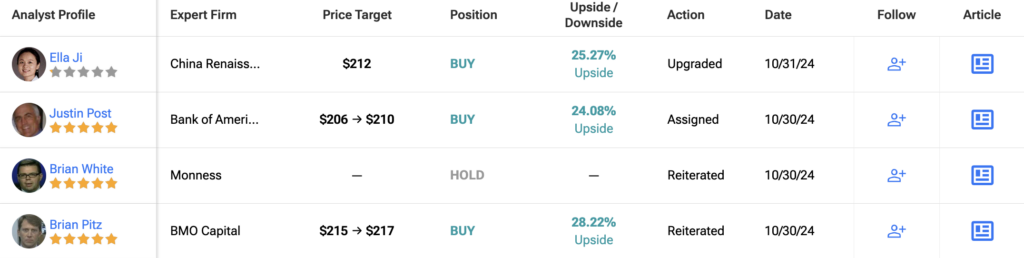

How Do Wall Street Analysts Rate Microsoft Stock?

Wall Street is also bullish on Microsoft, with an average MSFT price target of $503, suggesting a 22.6% upside. This is based on 27 Buy ratings, three Holds, and no Sells. This reaffirms Microsoft’s strength as an investment right now, according to the consensus of the banking community.

Google Is Potentially Vulnerable but Offers Great Value

I am particularly bullish on Google among the three AI investments we explored today. While I do have long-term concerns about the competitive threat from OpenAI’s ChatGPT potentially drawing market share away from Google Search, the investment remains highly compelling due to its distinct Big Tech valuation.

At a P/E ratio of 22.7—significantly below its 10-year median of 28.7—the stock appears attractively priced. Additionally, the company’s non-GAAP EPS has grown at a three-year annual rate of 32.3%, compared to a 10-year median of 27.6%. This combination of accelerating growth and a contracting valuation presents an appealing opportunity for investors at present.

While Google is likely to achieve higher earnings growth than Microsoft over the next three to five years, Microsoft will undoubtedly lead in free cash flow generation. Compared to Nvidia, Google may grow more slowly in the near term; however, over the long term, I consider Google the most stable Big Tech investment. As a long-term investor focused on secure and reliable passive returns, I favor Google for my portfolio—my October 2025 price target for the stock is $190.

How Do Wall Street Analysts Rate Google Stock?

On Wall Street, Google is rated a Strong Buy based on a consensus of 26 Buy ratings, six Holds, and zero Sells. With an average GOOGL price target of $207.40, the stock offers a potential 21.1% return over the next year. This positive outlook further reinforces my independent investment thesis on Google, reaffirming it as a valuable portfolio holding at this time.

See more GOOGL analyst ratings

Takeaway: Nvidia for Growth, Microsoft for Balance, Google for Value

For investors focused on near-term growth momentum, Nvidia may be an attractive option. However, as a long-term value investor, I am more inclined toward Microsoft and Google. While it may be tempting to capitalize on Nvidia’s growth from semiconductor sales driven by the AI infrastructure build-out, I prefer the slower, more stable growth provided by the recurring revenue opportunities in AI led by Microsoft and, even more so, the undervalued Google.