Taiwanese Data Center Market

Dublin, May 21, 2024 (GLOBE NEWSWIRE) — The “Taiwan Data Center Market – Investment Analysis & Growth Opportunities 2024-2029” report has been added to ResearchAndMarkets.com’s offering.

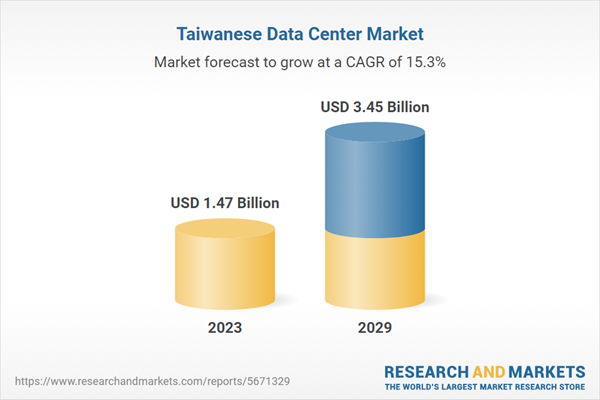

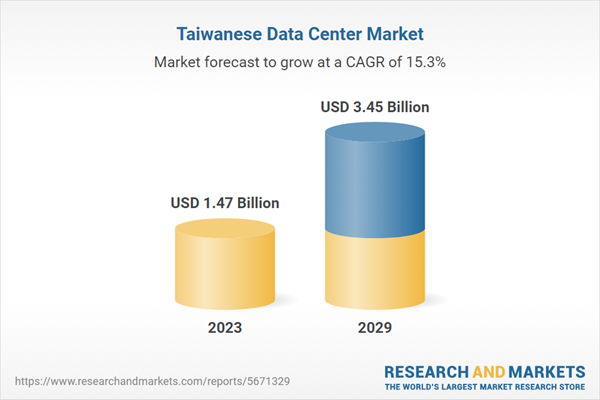

The Taiwan data center market by investments is expected to grow reach $3.45 billion by 2029 from $1.47 billion in 2023, growing at a CAGR of 15.26%

This report analyses the Taiwan data center market share. It elaboratively analyses the existing and upcoming facilities and investments in IT, electrical, mechanical infrastructure, general construction, and tier standards. It discusses market sizing and investment estimation for different segments.

The Taiwan data center market for IT infrastructure is dominated by global vendors such as Lenovo, IBM, Fujitsu, Hewlett Packard Enterprise, Dell Technologies, Cisco Systems, Broadcom, and others, which has resulted in the high availability of efficient and advanced infrastructure in the market.

Regarding support infrastructure, multiple global vendors have a presence in the market and have been offering their products and services to data centers for several years. Some major Taiwan data center vendors include Eaton, Cummins, Caterpillar, ABB, Airedale, Legrand, and others. In terms of construction contractors, the market has local and global contractors who have been providing their services for multiple data center projects over the years. For instance, DLB Associates has provided its services to Google data centers in the country.

Taipei is the hub for data center development and foreign investments in the Taiwan data center market. Other cities are also expected to grow in the coming years. For instance, in March 2024, Vantage Data Center announced receiving over USD 64 million in loans from Taiwanese banks to construct its first facility, TPE11, in Taipei.

The Taiwanese government launched digitalization initiatives and other projects to attract foreign market investments. For instance, according to Taiwan government FDI statistics, from January to December 2023, Taiwan recorded 568 outbound investment projects (excluding Mainland China), totaling USD 23.58 billion. This reflects a 4.03% rise in project numbers and a 136.67% increase in investment amount compared to the same period in 2022.

The Taiwanese government is taking initiatives to increase the country’s power availability and reliability. For instance, it set up a target for producing around 20% of electricity from renewable sources, 30% from coal, and 50% from gas by 2025 under its 20-30-50 plan. The government plans to generate around 60%-70% of electricity from renewable energy sources by 2050.

NTT DATA, Acer Edc, Taiwan Mobile, Far EasTone Telecommunications, Chunghwa Telecom, Chief Telecom, and Chunghwa Telecom are prominent colocation providers in the Taiwan data center industry. Local operators lead the market, but global operators are expected to increase their investments and activity during the forecast period.

WHY SHOULD YOU BUY THIS RESEARCH?

-

Market size regarding investment, area, power capacity, and Taiwan colocation market revenue is available.

-

An assessment of the data center investment in Taiwan by colocation, hyperscale, and enterprise operators.

-

Investments in the area (square feet) and power capacity (MW) across cities in the country.

-

A detailed study of the existing Taiwan data center market landscape, an in-depth market analysis, and insightful predictions about market size during the forecast period.

-

Snapshot of existing and upcoming third-party data center facilities in Taiwan

-

I. Facilities Covered (Existing): 15

-

II. Facilities Identified (Upcoming): 05

-

III. Coverage: 6+ Cities

-

IV. Existing vs. Upcoming (Area)

-

V. Existing vs. Upcoming (IT Load Capacity)

-

-

Data Center Colocation Market in Taiwan

-

I. Colocation Market Revenue & Forecast (2023-2029)

-

II. Retail vs Wholesale Colocation Revenue

-

III. Retail & Wholesale Colocation Pricing

-

-

The Taiwan data center market investments are classified into IT, power, cooling, and general construction services with sizing and forecast.

-

A comprehensive analysis of the latest trends, growth rate, potential opportunities, growth restraints, and prospects for the industry.

-

Business overview and product offerings of prominent IT infrastructure providers, construction contractors, support infrastructure providers, and investors operating in the industry.

-

A transparent research methodology and the analysis of the demand and supply aspects of the industry.

KEY QUESTIONS ANSWERED

-

How many existing and upcoming data center facilities exist in Taiwan?

-

How big is the Taiwan data center market?

-

What is the growth rate of the Taiwan data center market?

-

What factors are driving the Taiwan data center industry?

-

How much MW of power capacity will be added across Taiwan during 2024-2029?

-

Who are the key investors in the Taiwan data center market?

Key Attributes:

|

Report Attribute |

Details |

|

No. of Pages |

115 |

|

Forecast Period |

2023 – 2029 |

|

Estimated Market Value (USD) in 2023 |

$1.47 Billion |

|

Forecasted Market Value (USD) by 2029 |

$3.45 Billion |

|

Compound Annual Growth Rate |

15.2% |

|

Regions Covered |

Taiwan |

VENDOR LANDSCAPE

IT Infrastructure Providers

Data Center Construction Contractors & Sub-Contractors

Support Infrastructure Providers

Data Center Investors

New Entrants

-

Empyrion DC

-

SC Zeus Data Centers

-

Vantage Data Centers

EXISTING VS. UPCOMING DATA CENTERS

REPORT COVERAGE

IT Infrastructure

-

Servers

-

Storage Systems

-

Network Infrastructure

Electrical Infrastructure

Mechanical Infrastructure

Cooling Systems

-

CRAC & CRAH Units

-

Chiller Units

-

Cooling Towers, Condensers & Dry Coolers

-

Economizers & Evaporative Coolers

-

Other Cooling Units

General Construction

-

Core & Shell Development

-

Installation & Commissioning Services

-

Engineering & Building Design

-

Fire Detection & Suppression Systems

-

Physical Security

-

Data Center Infrastructure Management (DCIM)

Tier Standard

-

Tier I & Tier II

-

Tier III

-

Tier IV

For more information about this report visit https://www.researchandmarkets.com/r/wh1tzf

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900