We recently compiled a list of the 10 Micro Cap Stocks That Will Skyrocket. In this article, we are going to take a look at where SkyWater Technology, Inc. (NASDAQ:SKYT) stands against the other micro cap stocks.

One of the more well known quotes of Warren Buffett is “Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years.” The learning from this quote is simple. Buffett believes that the only investments one should make should be those that should accrete value over the long term. However, the biggest tech stock holding in Buffett’s latest 13F SEC filings is up by a whopping 181,533% since its shares started trading in 1984. However, the Oracle of Omaha only took a stake in this firm in 2016, when he became convinced that it had an unbeatable moat that would lead the industry in the future. Since his purchase, this stock has gained 692%, so safe to say, that while Buffett has undoubtedly reaped more returns by earning stable dividends through this stock, he nevertheless missed out on its fastest growth years.

Even though Buffett might have missed out on these returns because of his love of the margin of safety, compounded returns, and value investment in general, six digit percentage returns are all that a growth investor wants. This urge for growth versus the desire for stability through value stocks is at the heart of one of the oldest debates in the industry, namely, which is better, growth or value? For those seeking clarity and a definitive answer, it appears that there’s no single answer to this question.

Growth and value stock performance depend on the broader economic environment. Data shows that for the seven years between 1984 and 1991, value stocks led growth stocks by as much as 10 percentage points in an era marked by deregulation and tax cuts. This trend reversed between 1991 and 2001, when growth stocks led by 12 percentage points at the peak of the dotcom era. However, as the bubble popped, value stocks came back with a vengeance and led growth by as much as 17 percentage points between 2001 and 2008. Since then and until 2023, growth stocks are back and have led value stocks by as much as 15 percentage points.

Yet, even though research shows that value stocks are typically the best way to invest over the long term (no wonder Warren Buffett swears by them), no value stock has delivered absolute returns matching those of today’s biggest growth stocks. Warren Buffett’s top technology stock has posted 1,815x returns since it started trading, but it isn’t the only one to have done so. No one would have classified this stock as a growth stock, and the list of the 20 largest technology companies in the world is full of such examples. Within these, those that trade on U.S. exchanges, only one is in the red since its shares started trading due to its exposure to China. All others are in the green, and their price appreciations range from 5.04x for the world’s largest search engine provider to 4,251x for the operating system and cloud computing company that’s leading the artificial intelligence race.

Looking at these absolute returns that have the potential to transform a dollar into thousands of dollars over decades, you might be wondering which industries could provide similar returns in the future. One way to wager a guess at these industries is to see what newsletter writers are pitching. We’ve taken a look at dozens of such newsletters as part of our research of these pieces and found several sectors that have consistent features. Among these, the three most popular are quantum computing, nuclear energy, and energy infrastructure. Others that aren’t consistent but interesting niches are robotics and graphene. Of course, since we don’t want to waste your time, we’ve skipped artificial intelligence but safe to say, it is by far the most popular topic in newsletters, which often promise to pitch stocks capable of delivering anywhere between 10x to 100x in returns through price appreciation.

Delving deeper, let’s start by seeing how quantum computing and nuclear energy stocks are faring these days. We took a look at some quantum computing stocks are part of our coverage of 12 Best Quantum Computing Stocks To Invest In. Except for two, all of the pure play quantum computing stocks are in the red over the past 12 months. The two stocks that are in the green rank 12th and 5th and they are up by 90% and 45%, respectively. Similarly, we’ve also compiled a list of the 12 Best Nuclear Energy Stocks To Buy Today. In this list, out of the stocks that are either pure play nuclear firms or have significant exposure to it, the top two have delivered 45% and 83% in one year returns. As opposed to the quantum computing stocks though, all these are in the green. Among these, the two with the highest returns are ranked 12th and 5th.

One of the riskiest ways that some investors try to capture the triple digit absolute price returns that we’ve talked about above is by trying their luck with micro cap stocks. These are stocks with a market cap lower than $1 billion, and their low share prices offer a change of higher relative returns at the risk of pump and dump scams, low liquidity, and low media and analyst coverage. Additionally, while the image of micro cap stocks being risky is commonly present, data driven answers deliver a slightly different picture. For the twelve months ending in December 2022, micro cap stock investment management managers with the highest (25th percentile) returns posted 14.54%, 11.52%, and 13.46% in 20, 15, and five year returns, respectively.

On the other hand, small cap managers’ top returns were 12.01%, 9.98%, and 12.01%, respectively for a solid set of leads for the former manager group. Crucially, on the risk front, the three year risk adjusted returns for small and micro cap stocks as measured by the Sharpe Ratio are almost completely identical. As if this wasn’t enough to convince us to give micro caps a deeper look, you can also consider the returns of a private equity index and a microcap index. Between January 1995 and June 2020, the former gained 716% and the latter led it by 24 percentage points as it gained 740%.

Our Methodology

To make our list of micro cap stocks that might skyrocket, we decided to gather micro cap stocks covered by investment newsletters from Stock Gumshoe from newsletters dating as far back as January. These were ranked by the number of hedge funds that had bought the shares in Q1 2024 and the top ten stocks were chosen. Stock Gumshoe’s thesis and the date of each newsletter are also mentioned. Preference was given to NYSE or NASDAQ listed stocks, and when they weren’t available, the pink sheet stocks were ranked by their market cap, and the largest were chosen.

We also mentioned the number of hedge funds that had bought these stocks during the same filing period. Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

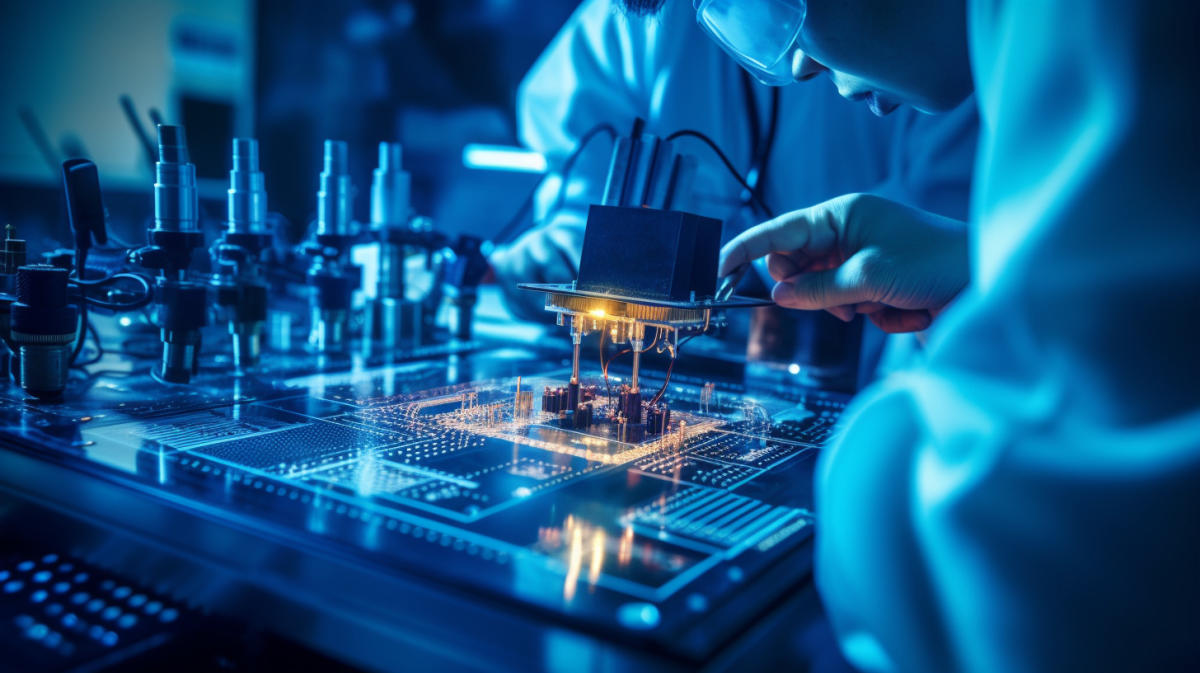

Technicians testing a microelectromechanical systems device for accuracy.

SkyWater Technology, Inc. (NASDAQ:SKYT)

Number of Hedge Fund Investors in Q1 2024: 10

Date of Newsletter: January 31st

If you’ve been following the semiconductor industry then you’ll know about the CHIPS and Science Act that has earmarked billions in spending to spearhead chip production in America. This stock comes from Eric Fry’s The Speculator newsletter, and while it was accompanied by a February deadline, we’ll cover it nevertheless. Fry believes that firms like this stock are the reason behind the CHIPS funding, as companies have to solve a key AI chip problem before it’s too late.

Sounds too important to ignore if you ask us, and Gumshoe believes that this stock is one of the few American pure play chip designers, SkyWater Technology, Inc. (NASDAQ:SKYT). It offers chip design and manufacturing services to customers, and it benefits from a close partnership with the US military. SkyWater Technology, Inc. (NASDAQ:SKYT) is also planning to build a $1.8 billion chip facility in Indiana, and Gumshoe notes that while it could benefit from CHIPS funding and associated tailwinds on the stock price, the firm is still burning cash.

Overall SKYT ranks 6th on our list of the best micro cap stocks to buy. You can visit 10 Micro Cap Stocks That Will Skyrocket to see the other micro cap stocks that are on hedge funds’ radar. While we acknowledge the potential of SKYT as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than SKYT but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: Analyst Sees a New $25 Billion “Opportunity” for NVIDIA and 10 Best of Breed Stocks to Buy For The Third Quarter of 2024 According to Bank of America.

Disclosure: None. This article is originally published at Insider Monkey.