Matteo Colombo

Introduction

I have often said that elevated yields tend to make me somewhat nervous, as the risk of buying a “sucker yield” becomes increasingly bigger the higher the yield.

As I wrote in a recent article, a company can control its dividend. It cannot control its dividend yield. That’s where the market comes in.

If the stock trades at $50, investors receive a 1% annual payout. If the stock trades at $10, the stock yields 10%. The market decides the yield.

That’s why so many stocks with elevated dividend growth still do not provide an elevated yield for new investors.

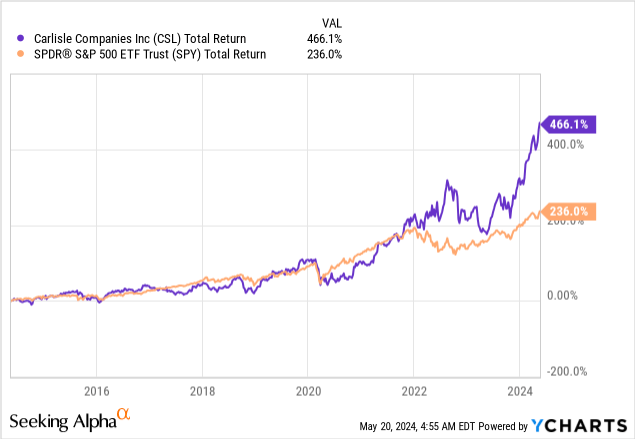

Carlisle Companies (CSL), for example, has a ten-year dividend CAGR of 14.5%(!). However, its current yield is just 0.8%. That’s because consistent capital gains have more than offset dividend growth.

In other words, if a stock has a very high yield, one needs to assess why the market hasn’t rushed to buy the stock, causing its yield to fall.

This brings me to Western Midstream Partners, LP (NYSE:WES), an oil & gas midstream MLP with a 9.1% distribution yield.

As I have never covered this company before, it’s time to take a closer look at what I consider to be a highly undervalued midstream opportunity in a market with an overall lofty valuation.

In this article, I’ll walk you through the company, explain what makes it so special, and why I expect its yield to be sustainable and a major part of what could potentially be elevated total returns for many years to come.

So, let’s get to it!

On a side note, please note that Western Midstream is a Master Limited Partnership. As such, it is taxed as a partnership, not a corporation. This has implications for investors (depending on your situation, it can be highly favorable). This also means “stocks” are called “units” and “dividends” are called “distributions.”

A Midstream Player With A Major Partner

I love midstream companies for a number of reasons.

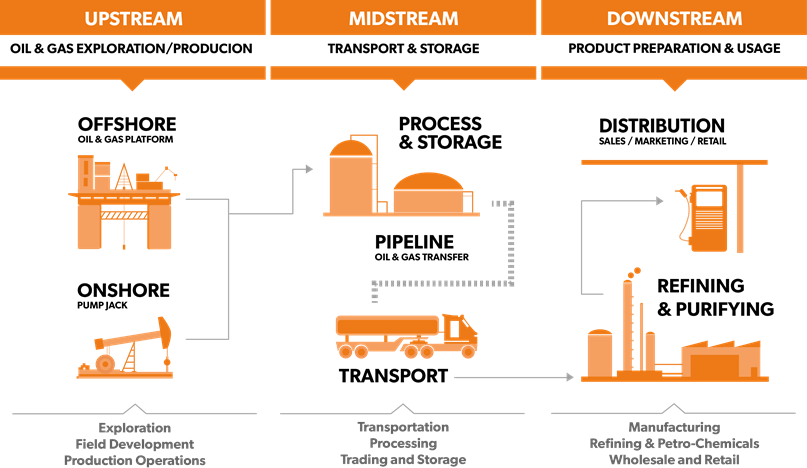

- They are critical to the energy industry, as they connect producers of oil and gas to customers who turn these commodities into value-added products. Without sufficient midstream assets, oil and gas output growth is not possible.

Eland Cables

- Due to their fee structure, midstream companies allow investors to buy high-yield energy dividends/distributions without being overly exposed to commodity prices.

- After many years of aggressive investments in their network, most midstream companies are now free cash flow positive, which has turned them into highly favorable high-yield investments.

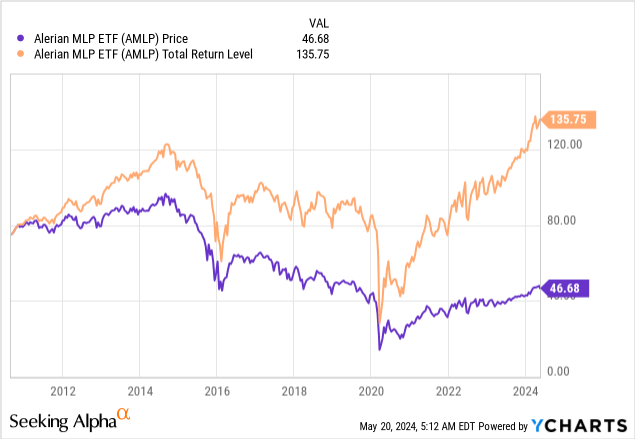

Using the Alerian MLP ETF (AMLP) as a benchmark, midstream companies have been horrible investments until the end of the pandemic. Before the pandemic, they dealt with sky-high investment requirements, commodity price insecurities, and a market that simply did not trust these income vehicles.

Now, midstream companies are a fantastic place to be for income, growth, and safety. Generally speaking. Not all midstream companies are great investments.

Western Midstream, however, is one of the companies I would put in the category of highly promising MLPs.

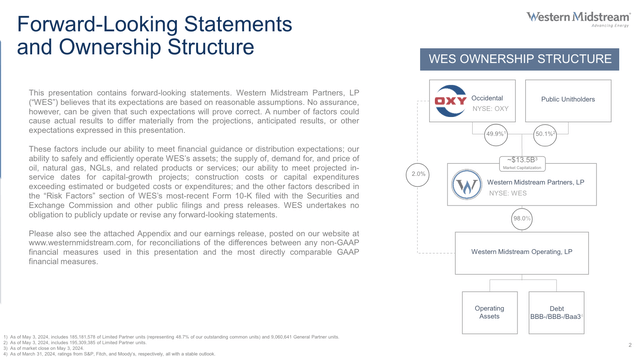

Western Midstream Partners is owned by two major unit holder groups. Occidental Petroleum (OXY), one of the world’s largest energy companies, owns 49.9% of its units. Public unit holders own 50.1%.

Moreover:

- 59% of total revenues come from Occidental operations.

- 34% of natural gas throughput comes from Occidental.

- 86% of WES’ crude oil and natural gas liquids (“NGL”) throughput comes from Occidental.

While one may make the case that dependence on one major player is a risk, I believe in midstream, that’s not the case.

After all, Occidental needs midstream assets to support its operations. It cannot easily switch to a competitor, as it is “forced” to rely on existing infrastructure.

Moreover, the relationship with Occidental allows WES to undertake expensive projects by leveraging Occidental’s upstream development plans. This adds a lot of visibility for long-term planning, as it aligns operations.

Personally, I own Antero Midstream (AM), which is owned by Antero Resources (AR). Their close relationship is one of the reasons why I invested in this C-Corp midstream company.

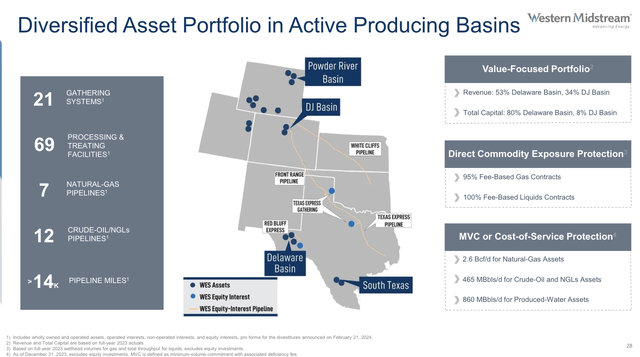

Having said all of this, Western Midstream owns 21 gathering systems, 69 processing & treating facilities, seven natural gas pipelines, and 12 crude oil/NGL pipelines.

These assets support operations in the Powder River Basin, the DJ Basin, and the mighty Delaware Basin, part of the Permian Basin.

These assets come with a high degree of safety, as 95% of gas contracts are fee-based. 100% of its liquid contracts are fee-based.

This limits commodity pricing risk.

Even better, the company also lowers throughput risks by applying cost-of-service protection and minimum-volume commitments.

Terrific News For Income-Focused Investors

I love the fact that this company has elevated Permian exposure, as it allows it to benefit from ongoing oil production growth and a rapid rise in associated gas production. Especially, the Permian is seeing insufficient midstream assets to take care of rising (natural gas) production.

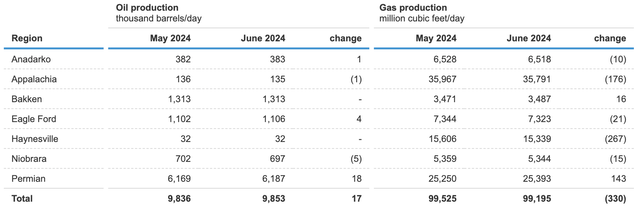

The Permian isn’t only the largest oil basin but also the only basin with notable growth. The same is visible in natural gas, as it now produces more than 25 billion cubic feet of natural gas per day.

Energy Information Administration

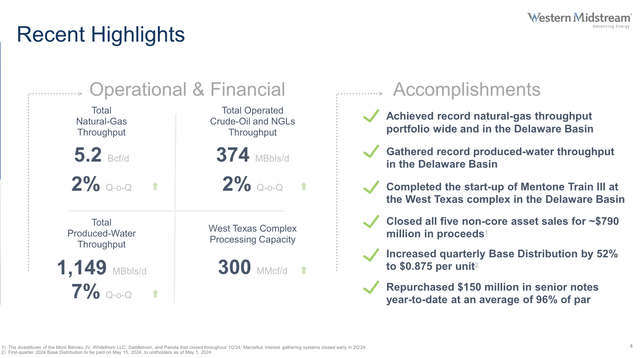

Based on this context, the company’s first-quarter performance was strong, driven by highly favorable producer activity levels and better rates following cost-of-service rate redeterminations that took effect on January 1.

To add some color here:

- Natural gas throughput rose by 2% quarter-on-quarter.

- The throughput of liquids rose by 2% quarter-on-quarter as well.

- Total produced water throughput rose by 7%.

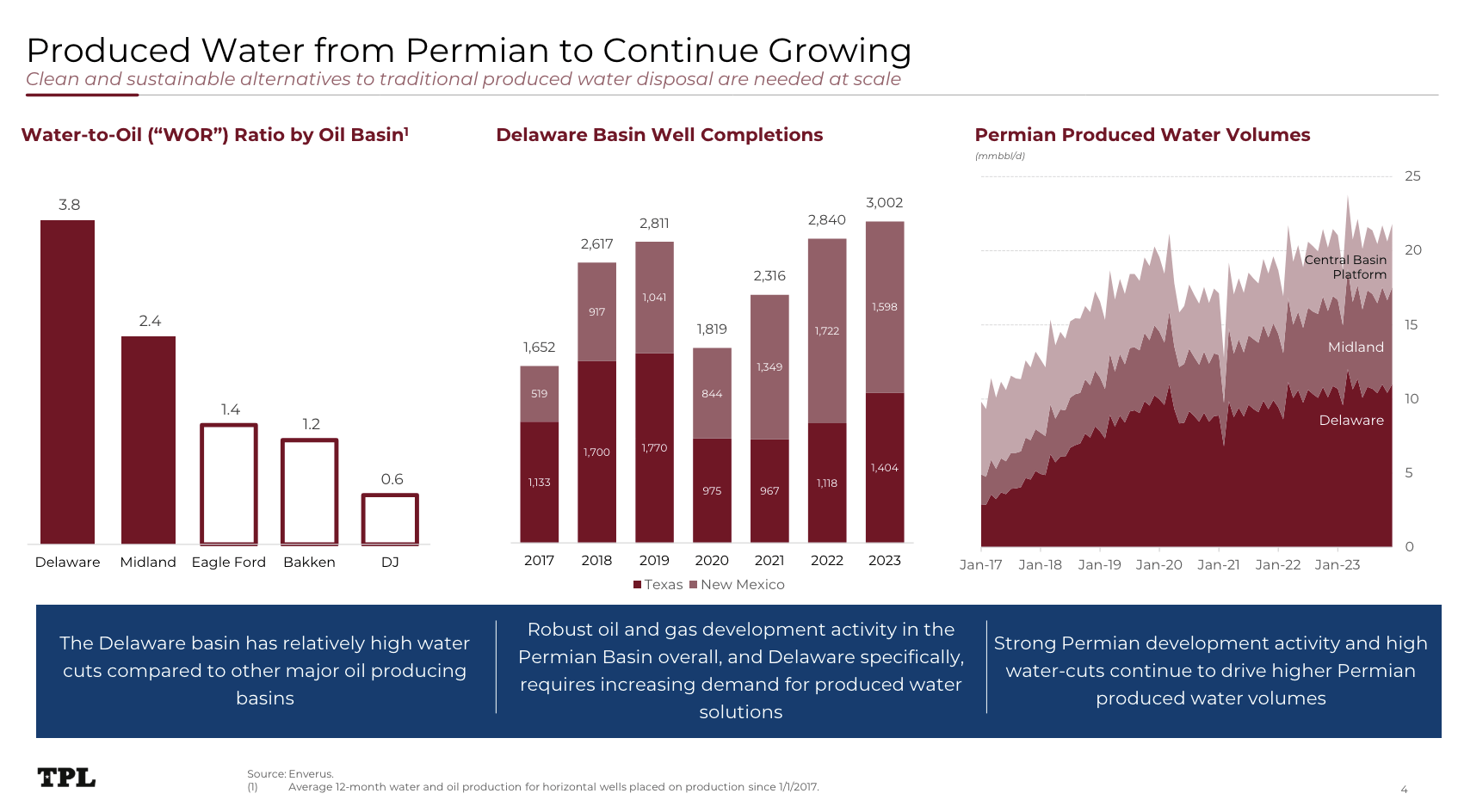

Please note that produced water is a by-product. Especially the Delaware Basin comes with elevated water levels.

In a recent article, I highlighted that for every barrel of crude oil, the Delaware Basin produces four barrels of water. This toxic water needs to be taken care of to allow producers to boost output.

Texas Pacific Land Corporation

The company also completed the Mentone Train III, which became operational in early April.

This project is the biggest project since WES became a standalone company and increases its natural gas processing capacity at its West Texas complex in the Delaware Basin by roughly 18%.

It also sold non-core assets for roughly $790 million in proceeds.

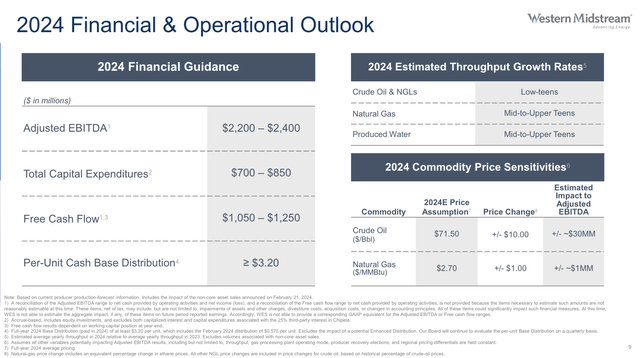

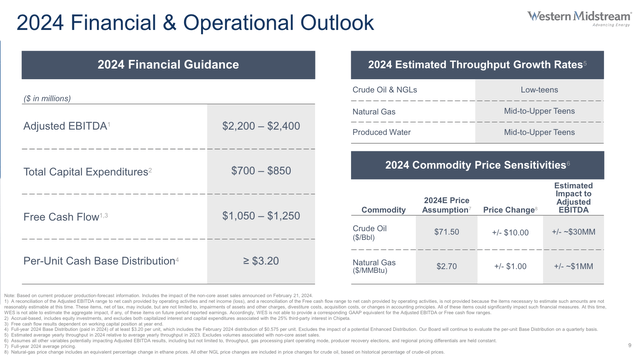

For 2024, the company expects to generate mid-to-upper teens percentage growth in natural gas throughput, low-teens growth in throughput of liquids, and mid-to-upper teens growth in produced water.

Unsurprisingly, the Delaware Basin is expected to see stronger year-over-year growth for all three products, driven by increased well activity.

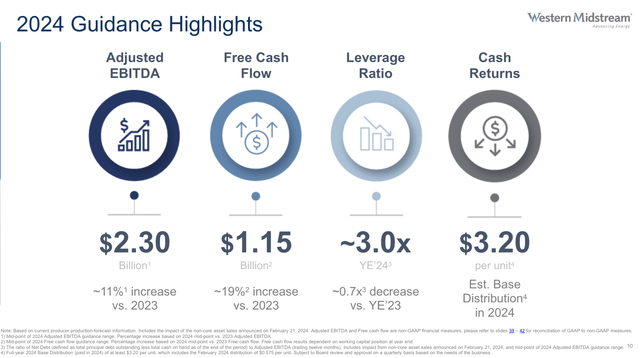

As a result, the company now expects to reach the upper range of its $2.2 to $2.4 billion adjusted EBITDA range this year.

It also expects to achieve the high end of its free cash flow guidance range of $1.05 to $1.25 billion, with a full-year distribution guidance of at least $3.20 per unit.

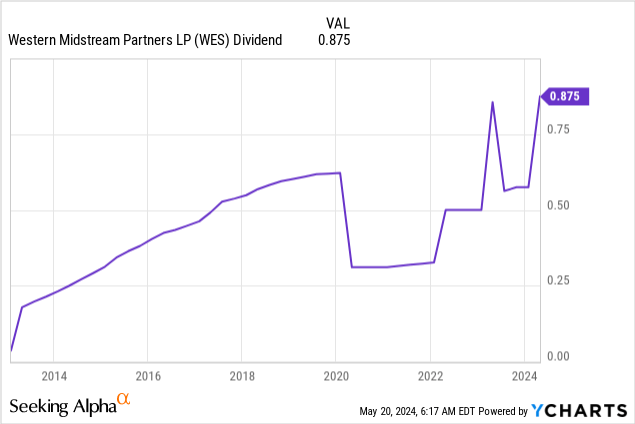

This finally brings me to the distribution (the dividend).

Western Midstream isn’t kidding around.

On April 19, it hiked its quarterly distribution by 52.2% to $0.975 per unit. This translates to a yield of 9.1%, one of the highest yields on the market – across all sectors.

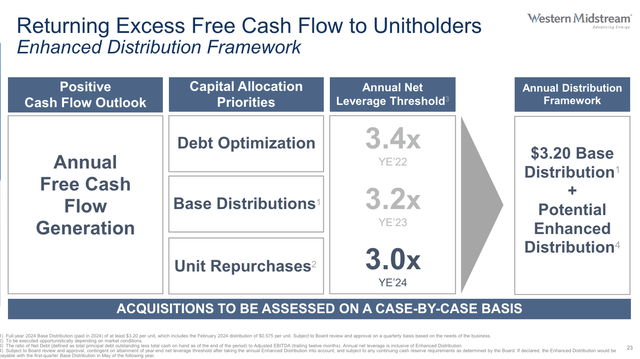

Improving distributions for 2025 will depend on the financial performance in 2024 and the company’s year-end leverage.

If performance materializes in line with current expectations, we would expect greater opportunity to evaluate increased returns of capital. As a reminder, any potential enhanced distribution payment in 2025 will be based on our full year 2024 financial performance governed by our 2024 year-end leverage threshold of 3x and subject to the board’s discretion. – WES 1Q24 Earnings Call.

By the end of this year, the company aims to achieve a 3.0x leverage ratio, which would be extremely favorable – for unit holders and financial stability.

It also has an investment-grade credit rating.

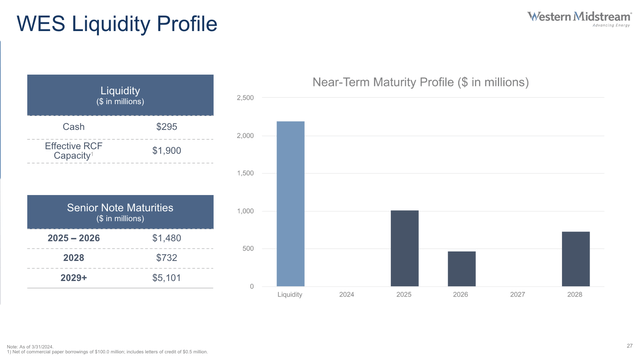

Adding to that, it has more than $2 billion in liquidity and less than $1.5 billion in maturing debt until 2028. This buys a lot of time in the current environment of unfavorable interest rates.

As we can see below, once the company achieves its leverage target, distributions and unit repurchases become increasingly important, which could unlock elevated dividend growth for years to come.

Expectations of strong future distribution growth are supported by analysts’ expectations.

The same goes for its valuation.

Valuation

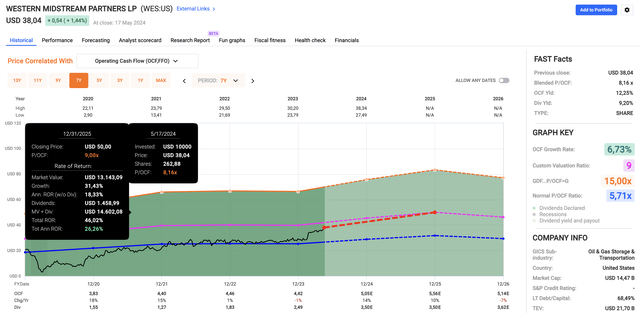

Using the FactSet data from the chart below, WES is expected to grow its per-share OCF (operating cash flow) by 14% this year, potentially followed by 10% growth in 2025.

While all of these numbers are subject to change, I do not believe that WES will see a 7% lower per-share OCF in 2026, which is why I’m sticking with 2025 expectations of $5.56 in per-share OCF.

Currently, WES trades at a blended P/OCF ratio of 8.2x. I believe it should not trade below 9x OCF in the 2–3 years ahead. I apply 9-10x multiples to high-quality midstream companies that are increasingly profitable and able to grow with subdued growth in CapEx.

Applying a 9x multiple to the expected 2025 OCF gives the stock a fair price target of $50. That’s 32% above the current price.

Although I believe it will likely take 1–3 years until this target will be received, when adding its 9% yield, investors are in a good spot to enjoy double-digit annual returns for many years to come, backed by an increasingly healthy balance sheet, a well-organized asset network, and strong secular growth in major basins like the Permian.

While I cannot buy MLPs as a non-American investor, I believe WES would make a lot of sense in my portfolio.

Takeaway

Backed by Occidental Petroleum and enjoying an impressive asset network, WES stands out in the midstream sector.

Its strategic position in the prolific Permian Basin, combined with strong financials, paints a promising picture for its future.

With a juicy 9.1% distribution yield and significant potential for capital appreciation on a long-term basis, WES presents an attractive opportunity for income-focused investors seeking income in what has become a very promising industry.

Pros & Cons

Pros:

- High Distribution Yield: With a juicy 9.1% distribution yield, WES offers attractive income potential for investors seeking elevated income.

- Permian Basin Benefits: WES benefits from a strategic position in the Permian Basin (Delaware), which provides stability and growth potential for its operations.

- Strong Financials and Asset Network: Backed by Occidental Petroleum, WES benefits from stability and visibility.

- Steady Cash Flow: WES’s fee-based revenue model and diverse portfolio contribute to steady cash flow growth.

- Potential for Capital Appreciation: Based on growth expectations and its advanced asset portfolio, I expect consistent earnings growth and capital gains.

Cons:

- Dependency on Occidental Petroleum: While offering stability, WES’s reliance on Occidental Petroleum could pose dependency risks.

- Market Volatility: While commodity price volatility risks are subdued, the company is subject to general market volatility.

- Regulatory and Environmental Risks: Regulatory risks could pose challenges for future operations.