Kwarkot

Introduction

If you’re an investor solely focused on investing for income, you’re likely over the age of 59 1/2 or the full retirement age of 66. REITs are great income vehicles due to their higher-than-average yields and reliability.

If you can find a REIT with an attractive yield in the mid to high single digits with solid fundamentals, then you should consider them for your portfolio.

So, if you’re scouring the market for one, you may be in luck. One that fits the bill is shopping center REIT, Saul Centers (NYSE:BFS), one primarily focused on owning properties in the Baltimore/DC area.

In this article, I discuss the company’s fundamentals, growth potential, and why income-focused investors should consider adding them to their portfolio.

Previous Buy Rating

So far in 2024, there have only been two articles published on Seeking Alpha pertaining to Saul Centers, with the last one written by me this past March.

The REIT is undercovered and has the potential to be a hidden gem, which I’ll touch on this more later in the article.

Since my last thesis, the share price has remained relatively flat before seeing some share price appreciation in the past few days. At the time of writing, the stock is up 1.83% in comparison to the S&P, which is up 6.74% over the same period.

Their dividend coverage was strong with a conservative payout ratio of 74.4% at the end of 2023, fairly low for a REIT. They also offered a strong upside to my price target of $49.50 which made them even more attractive.

I’ll discuss more later why I think BFS’s share price has remained flat in comparison to some peers, who are up nicely since the latest CPI report on July 11th.

Share Price Movement

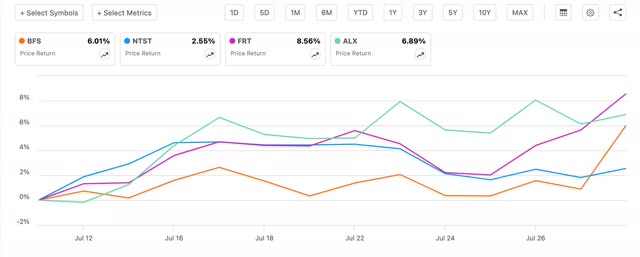

Since the latest CPI report on July 11th that showed inflation cooling, some REITs have enjoyed a nice rally with decent share price appreciation. I discussed this in an article on July 15th you can read here.

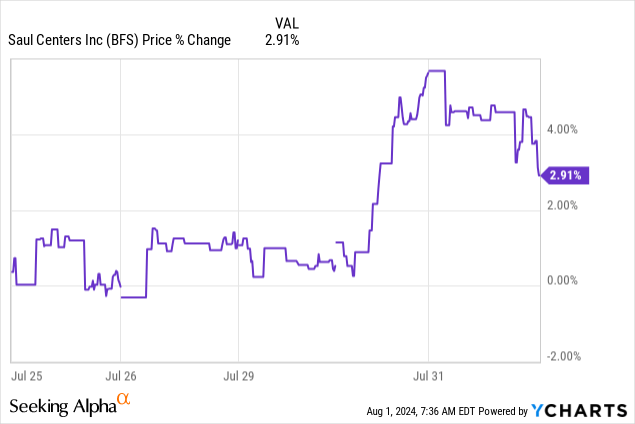

Additionally, Saul Centers recently saw its share price spike in the past week after remaining relatively flat over the past few months. The stock was up roughly 5% above $40 before settling back down.

In the chart below you can see peers like Federal Realty Investment Trust (FRT), Alexander’s (ALX), and NETSTREIT (NTST) are also up with Dividend King FRT leading the pack, up more than 8.5%. ALX’s share price has also appreciated nicely, up nearly 7% since July 11th.

One reason may be that all of them enjoy higher average volume with the exception of Alexander’s Inc. But like anything, Saul Centers’ share price remaining flat may be a good thing for long-term investors, here’s why:

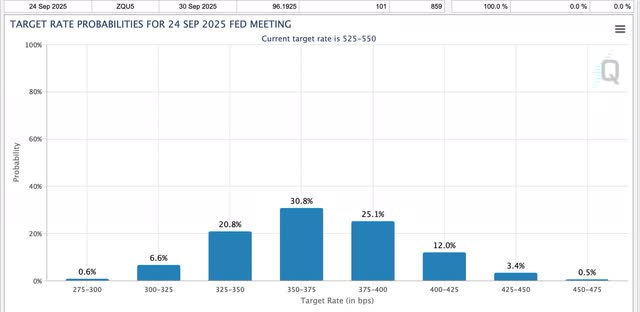

Interest Rates

Over the next 12 or so months interest rates are expected to be much lower which will likely benefit the REIT sector as this will provide the opportunity for REITs to acquire properties at more attractive spreads.

Lower interest rates will also incentivize sellers into M&A activity, likely propelling REIT growth in the process. There are others like lower interest expenses & debt refinancing that stand to benefit REITs.

Fundamentals

Another reason for BFS’s relatively flat share price before the recent spike is their exposure to the office segment. Although, this was relatively low at just 15% at the end of 2023.

As many may know, since the pandemic in 2020, many REITs with exposure to office properties have seen their share prices lag in comparison to their peers. This even led REITs like Realty Income (O) and W. P. Carey (WPC) to spin off their office properties into separate entities.

But Saul Centers’ fundamentals have remained strong. During their Q1 earnings back in May, the REIT reported some solid numbers, with FFO and revenue both seeing slight growth year-over-year. FFO increased by a penny to $0.80 for the quarter, while revenue increased nearly 6% from $63 million to $66.7 million.

|

Q1 2024 (in millions) |

Q1 2023 (in millions) |

|

$27.5 |

$26 |

|

$66.7 |

$63 |

|

$36 |

$35 |

|

$12.6 |

$11.8 |

Both were driven by higher commercial and residential-based rents. Same-property revenue and operating income both increased, up 5.8% and 3.8%, respectively.

Their shopping center and mixed-use property operating income also grew slightly due to higher rent collections. Their portfolio also saw a slight increase in occupancy with 94.6% leased compared to 93.9% in Q1’23.

Growth Potential

Aside from shopping centers, BFS also owns apartment buildings. These were 98% leased, above their 10-year average of 97.2%. They also have additional projects in Maryland, one expected to be delivered in late 2024 and the other in 2025.

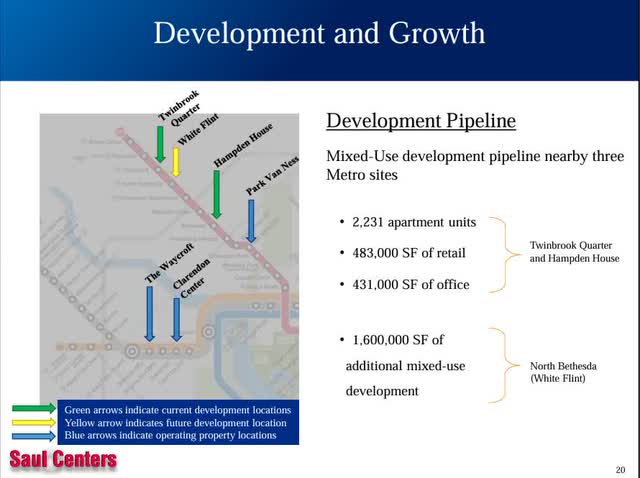

These are attractive as they have ground-floor retail stores to attract tenants and drive growth for the REIT. They also have a strong pipeline consisting of 2,231 apartment units and 483,000 square feet of retail. Furthermore, they have 1.6 million square feet of mixed-use development expected in the near to medium term in North Maryland.

BFS annual investor presentation

The REIT also owns land parcels, which they leverage to provide them with additional returns. From time to time, they lease these to existing tenants or freestanding retailers.

In 2023, they leased to quick-service restaurants The Wendy’s Company (WEN) and Shake Shack (SHAK). This also gives Saul reliable streams of income as ground leases can typically be much longer in length.

Dividend & Balance Sheet

The most attractive metrics about Saul Centers are their dividend profile and well-laddered debt maturities. Although they haven’t raised the dividend or have an investment-grade credit rating, both are impressive. Over the past 5 years, BFS’s dividend coverage has remained strong.

Even during COVID, the REIT did not cut the dividend and has continued to increase it, albeit only slightly. The dividend is expected to stay flat at $2.36 over the next two years.

But I wouldn’t be surprised if management raised the dividend sometime in the next 6-12 months. Especially, if interest rates decline and investment activity picks up.

Analysts also expect FFO to decline roughly 2.5% from 2023. I expect FFO in a range of $3.05-3.15 for 2024, a 0.32% increase at midpoint. Although their growth may not be as impressive as others, Saul Centers, in my opinion, may be a hidden gem for those seeking income in retirement.

Their dividend coverage during the quarter was strong, with a 74% payout ratio. For comparison purposes, FRT had a 66.4% payout ratio while NTST and ALX had payout ratios of 66.1% and 90.4%, respectively.

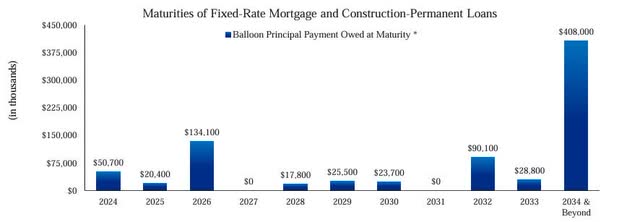

Furthermore, their well-laddered debt maturities give them financial flexibility as their debt is well-staggered through the next 17 years. Additionally, 81% of their debt was fixed-rate and had a weighted average interest rate of 4.68%.

They also have roughly $128 million on the revolver and $7.1 million in cash available to take advantage of investment opportunities as the macro environment will likely become more favorable in the near to medium term.

BFS annual investor presentation

Valuation

Currently, Wall Street rates the REIT a strong buy with some upside to their price target of $43.50, which I think Saul Centers could see by the end of the year. However, I do think this is if we get one or maybe two interest rate cuts during that time frame.

I anticipate their share price to remain in the $38-40 range, but they may experience some volatility if the market sees a correction over the next 4 months or so. Using Fastgraphs, BFS has a blended multiple of 18.02x, well above their forward multiple of 12.80x, signaling the stock could still be undervalued.

This also signals now may be a good entry point, especially for long-term investors. Although they won’t likely return to their 5-year multiple of 18.39x anytime soon, I think Saul Centers is a solid REIT that could see a 13-14x multiple over the next 12 months, implying a 7-10% upside by the end of the year.

Risks & Conclusion

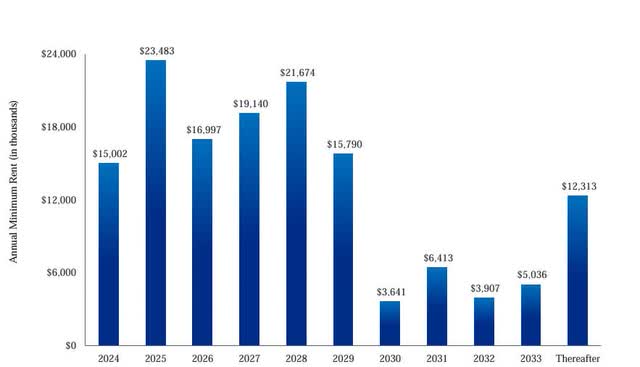

Two risks to consider investing in Saul Centers are their shopping center lease expirations in 2025 and office properties leasing percentage below their 10-year average.

The company has roughly $23.5 million worth of shopping center leases expiring in 2025, the most over the next 9 years. Additionally, this could impact their earnings going forward if tenants decide not to re-lease, or if the economy enters into a recession. If so, this would impact BFS’s top and bottom lines.

BFS annual investor presentation

Furthermore, with uncertainty surrounding the back-to-work policy for businesses, this has negatively impacted their office leasing activity, causing it to dip below their 10-year average of 88.7%. This currently stands at 86% and could also dip further if the economy experiences an unexpected downturn.

But all in all, I think if you’re an investor looking for reliable income from a stock with solid fundamentals, then Saul Centers fits the bill.

However, one shouldn’t expect much growth investing in this stock. Although, they could see some decent upside with lower interest rates over the next 12 months.

Additionally, their yield above 6% is attractive and well-protected, with a safe payout ratio of 74%. As a result of their solid growth year-over-year, prudent balance sheet, and well-covered dividend, I continue to rate Saul Centers a buy for long-term income investors.