Quanta Services Inc.’s PWR shares declined 4% during the Aug 1 trading session after it released its second-quarter 2024 earnings. The market’s negative reaction likely stemmed from the mixed results, wherein its earnings fell short of the consensus mark and revenues surpassed the same. Additionally, lower-than-expected performance in two of its three segments — Electric Power Infrastructure Solutions and Underground Utility and Infrastructure Solutions — may have further contributed to the decline.

Nonetheless, this leading specialty contracting services provider’s quarterly results benefited from solid contributions from its Renewable Energy Infrastructure Solutions. Also, its total backlog grew 15% year over year. The company’s 2024 guidance was raised, reflecting the contribution from the acquisition of Cupertino Electric, Inc. (“CEI”), which is split between both the Electric Power and Renewable Energy segments.

(Read more: Quanta Q2 Earnings Miss Estimates, 2024 Guidance Raised)

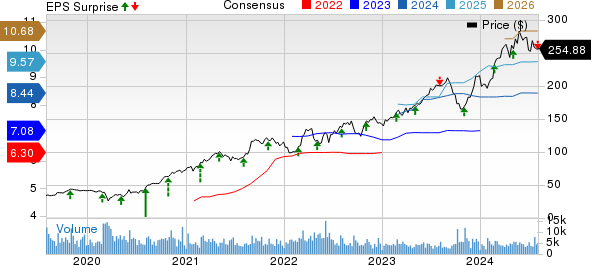

Quanta Services, Inc. Price, Consensus and EPS Surprise

Quanta Services, Inc. price-consensus-eps-surprise-chart | Quanta Services, Inc. Quote

Renewable Energy Continues to Support Growth

Renewable Energy segment revenues, which is its second-highest revenue source, accounted for 36.4% of second-quarter revenues, exhibited solid growth of 46.4% year over year and is well ahead of our expectation of 26.5% growth. The segment benefited from renewable generation project activity, including solar, wind and battery storage projects and high-voltage electric transmission and substation services.

The segment’s operating margin of 8% (ahead of our projection of 7.2%) was a sequential improvement due to better overall execution in the field, despite headwinds from challenging projects that were discussed in the first quarter of 2024.

As of Jun 30, 2024, the Renewable Energy segment’s total backlog was $7.8 billion, showing a sequential decline from the first quarter of 2024 due to typical timing variability of new awards. Notably, after the second quarter ended, Quanta secured $350 million in new renewable energy projects. While PWR anticipates periodic fluctuations in backlog due to the usual dynamics of award timing, it remains confident in achieving a multi-year compound annual growth rate of 8-10%.

The Renewable Energy segment’s growth is driven by strong customer relationships, a solutions-based approach, and a reputation for safe execution. Investments are being made to expand resources and capacity to meet the rising demand for large-scale solar, battery, and wind programs. This sector anticipates record revenue levels as demand for clean power grows.

Additionally, the pursuit of high-voltage transmission projects, which support renewable generation capacity and enhance system reliability, offers significant revenue opportunities. The company is well-positioned to secure future project awards due to its strategic visibility into project timelines.

A Look Into Electric Power Unit

Electric Power segment revenues, which is its primary revenue source, accounted for 43.8% of second-quarter revenues and experienced a tepid 1.5% growth, well below our expectation of 9.3% growth. Yet, the operating margin improved 70 basis points (bps) to 10.8% (above our projection of 10.2% growth).

The results were mainly driven by utility grid modernization, grid security and system hardening initiatives, strong execution, and effective resource management within our electric power and communications operations. The quarter’s margin performance was bolstered by approximately $94 million in emergency restoration revenues. Additionally, acquisitions made over the past 12 months contributed $65 million in revenues during the second quarter of 2024.

At the end of second-quarter 2024, the Electric Segment backlog reached a record $17.2 billion (up 4.2% year over year), fueled by multiple multi-year program awards. These awards bolster confidence in multi-year growth expectations and highlight the demand for electric power infrastructure solutions. Utilities across the United States are experiencing significant increases in power demand due to new technologies, federal and state policies, and growing Internet traffic and cloud computing. The rise in data centers and AI technologies is further straining grid capacity.

Additionally, the increasing adoption of electric vehicles (EVs) is pressuring the electric distribution system, necessitating substantial capital investment in the power grid. The company believes managing EV adoption will be a major industry challenge and feels uniquely positioned to address this demand with its customers.

CEI Acquisition & Upbeat Guidance

Quanta’s acquisition of CEI on Jul 17, 2024, enhanced its capabilities by integrating CEI’s end-to-end electrical infrastructure solutions and expanding its reach into the growing technology industry. This acquisition brings significant synergies, including a complementary customer base and workforce, positioning Quanta for growth in key strategic verticals. The deal is projected to boost Quanta’s revenues, cash flow, adjusted EBITDA, and earnings per share (EPS) immediately. CEI is expected to contribute $1-$1.1 billion in revenues and $80-$90 million in adjusted EBITDA for the remainder of 2024, with substantial growth anticipated in 2025. CEI’s backlog stood at $1.9 billion as of Jun 30, 2024.

Owing to the expected contributions from CEI, the company increased guidance for revenues, adjusted EBITDA and adjusted diluted EPS for 2024.

The company now expects revenues of $23.5-$24.1 billion, adjusted EBITDA of $2.21-$2.33 billion and adjusted EPS of $8.32-$8.87 versus prior estimates of $22.5-$23 billion, $2.13-$2.25 billion, and $8.15-$8.65, respectively.

Zacks Rank

With a Zacks Rank #3 (Hold) and a consistent track record of surpassing earnings estimates, Quanta demonstrates resilience and holds significant potential for growth. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

A Few Recent Construction Releases

KBR, Inc. KBR reported mixed second-quarter 2024 results, with earnings surpassing the Zacks Consensus Estimate and revenues missing the same. The top and bottom lines increased on a year-over-year basis.

KBR performed well across key metrics and expects this trend to continue for the rest of the year. Driven by robust performance in its core business, KBR raised its adjusted EBITDA and cash flow guidance for 2024.

Armstrong World Industries, Inc. AWI reported solid results for second-quarter 2024, wherein earnings and net sales topped the Zacks Consensus Estimate and increased on a year-over-year basis.

AWI’s growth trend was backed by solid contributions from the Mineral Fiber as well as Architectural Specialties segments. Growth was attributable to the increase in average unit value and volume. Also, contributions from recent acquisitions aided the uptrend.

Gibraltar Industries, Inc. ROCK reported strong second-quarter 2024 earnings despite top-line woes. Although both earnings and net sales missed the Zacks Consensus Estimate, the bottom line strengthened on a year-over-year basis.

ROCK has slightly reduced its net sales outlook for 2024 to reflect recent slower market conditions in both Residential and Renewables end markets, partially offset by strength in both Agtech and Infrastructure. Nonetheless, it remains focused on driving participation gains across the segments, with operational improvements to support solid second-half and full-year margin expansion and cash flow growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Quanta Services, Inc. (PWR) : Free Stock Analysis Report

KBR, Inc. (KBR) : Free Stock Analysis Report

Gibraltar Industries, Inc. (ROCK) : Free Stock Analysis Report

Armstrong World Industries, Inc. (AWI) : Free Stock Analysis Report