The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how water infrastructure stocks fared in Q2, starting with Energy Recovery (NASDAQ:ERII).

Trends towards conservation and reducing groundwater depletion are putting water infrastructure and treatment products front and center. Companies that can innovate and create solutions–especially automated or connected solutions–to address these thematic trends will create incremental demand and speed up replacement cycles. On the other hand, water infrastructure and treatment companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 5 water infrastructure stocks we track reported an exceptional Q2. As a group, revenues beat analysts’ consensus estimates by 6.1%.

Inflation progressed towards the Fed’s 2% goal recently, leading the Fed to reduce its policy rate by 50bps (half a percent or 0.5%) in September 2024. This is the first cut in four years. While CPI (inflation) readings have been supportive lately, employment measures have bordered on worrisome. The markets will be debating whether this rate cut’s timing (and more potential ones in 2024 and 2025) is ideal for supporting the economy or a bit too late for a macro that has already cooled too much.

Thankfully, water infrastructure stocks have been resilient with share prices up 5.6% on average since the latest earnings results.

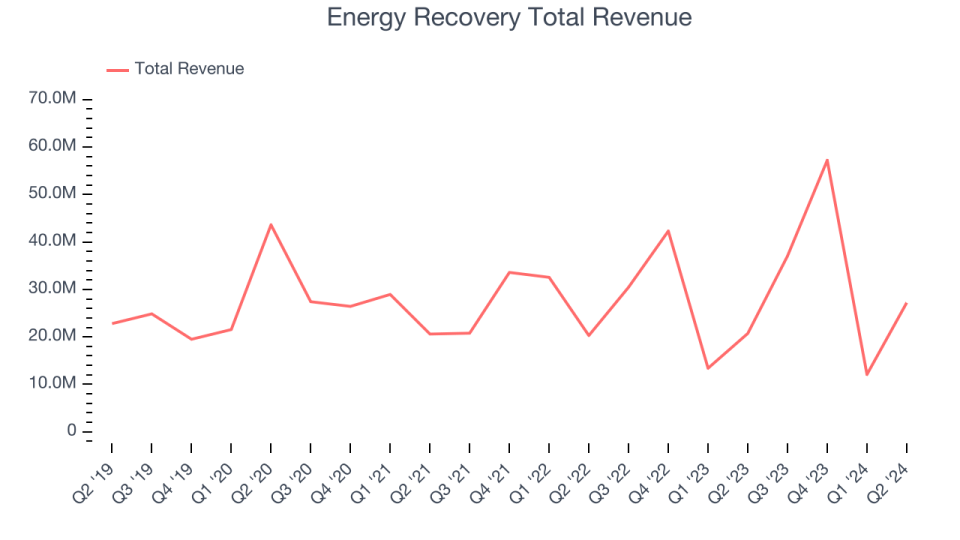

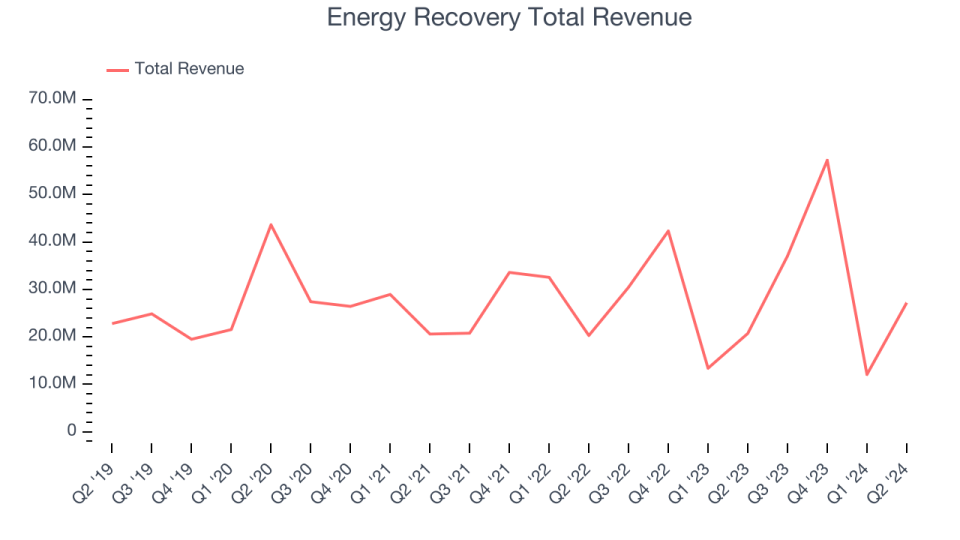

Energy Recovery (NASDAQ:ERII)

Having saved far more than a trillion gallons of water, Energy Recovery (NASDAQ:ERII) provides energy recovery devices to the water treatment, oil and gas, and chemical processing sectors.

Energy Recovery reported revenues of $27.2 million, up 31.3% year on year. This print exceeded analysts’ expectations by 18.6%. Overall, it was an incredible quarter for the company with an impressive beat of analysts’ earnings and operating margin estimates.

David Moon, President and CEO, commented on the financial results: “Operationally, the second quarter played out as we expected and second quarter revenue of $27 million exceeded the top-end of our guidance of $20–$25 million. As we have stated since the beginning of the year, this year’s revenue cadence is heavily weighted to the third and fourth quarters, and we reaffirm our full-year revenue guidance of $140–$150 million.”

Energy Recovery achieved the biggest analyst estimates beat and fastest revenue growth of the whole group. Unsurprisingly, the stock is up 15.8% since reporting and currently trades at $16.90.

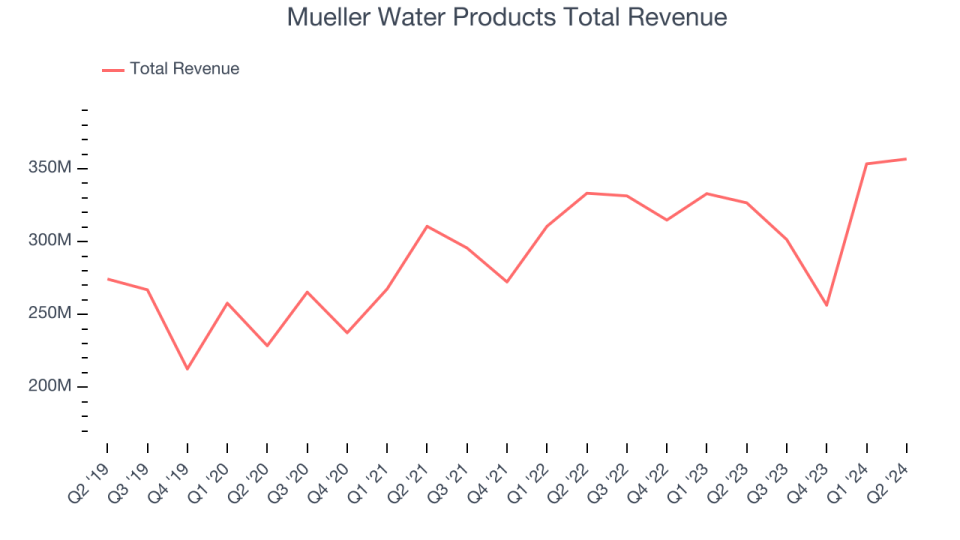

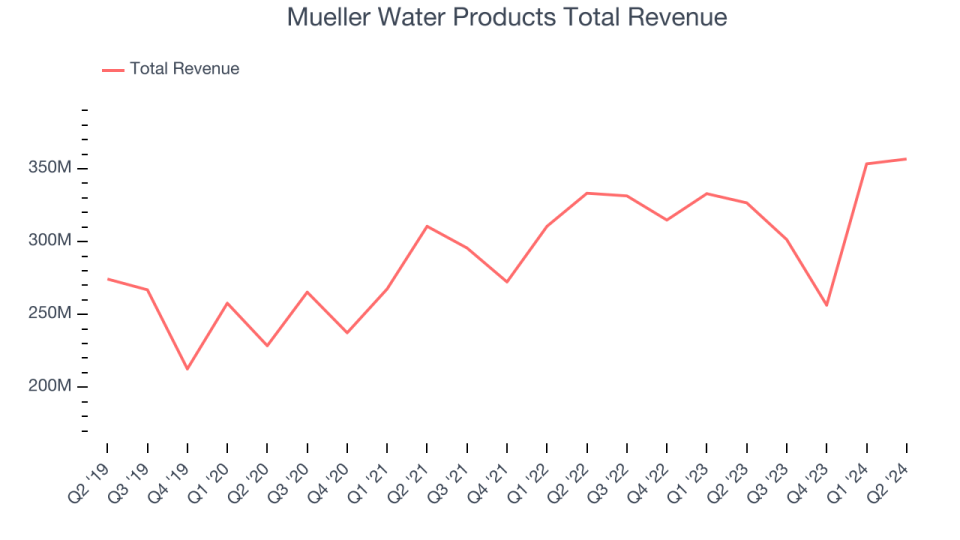

Mueller Water Products (NYSE:MWA)

As one of the oldest companies in the water infrastructure industry, Mueller (NYSE:MWA) is a provider of water infrastructure products and flow control systems for various sectors.

Mueller Water Products reported revenues of $356.7 million, up 9.2% year on year, outperforming analysts’ expectations by 8.2%. The business had an incredible quarter with an impressive beat of analysts’ organic revenue and earnings estimates.

The market seems happy with the results as the stock is up 16.4% since reporting. It currently trades at $22.06.

Is now the time to buy Mueller Water Products? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Tennant (NYSE:TNC)

As the world’s largest manufacturer of autonomous mobile robots, Tennant (NYSE:TNC) designs, manufactures, and sells cleaning products to various sectors.

Tennant reported revenues of $331 million, up 2.9% year on year, exceeding analysts’ expectations by 1.2%. It may have had the worst quarter among its peers, but its results were still good as it also locked in full-year revenue guidance beating analysts’ expectations and a narrow beat of analysts’ earnings estimates.

Tennant delivered the highest full-year guidance raise but had the slowest revenue growth in the group. As expected, the stock is down 4% since the results and currently trades at $91.99.

Read our full analysis of Tennant’s results here.

Xylem (NYSE:XYL)

Formed through a spinoff, Xylem (NYSE:XYL) manufactures and services engineered products across a wide variety of applications primarily in the water sector.

Xylem reported revenues of $2.17 billion, up 26% year on year. This number surpassed analysts’ expectations by 1.2%. It was a strong quarter as it also recorded an impressive beat of analysts’ organic revenue estimates and a decent beat of analysts’ operating margin estimates.

Xylem had the weakest performance against analyst estimates and weakest full-year guidance update among its peers. The stock is down 5.6% since reporting and currently trades at $133.47.

Read our full, actionable report on Xylem here, it’s free.

Watts Water Technologies (NYSE:WTS)

Founded in 1874, Watts Water (NYSE:WTS) specializes in manufacturing water products and systems for residential, commercial, and industrial applications globally.

Watts Water Technologies reported revenues of $597.3 million, up 12.1% year on year. This number surpassed analysts’ expectations by 1.3%. Overall, it was a very strong quarter as it also produced an impressive beat of analysts’ organic revenue estimates and a solid beat of analysts’ operating margin estimates.

The stock is up 5.7% since reporting and currently trades at $204.95.

Read our full, actionable report on Watts Water Technologies here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.