CHUNYIP WONG

Dear readers/followers,

In this article, I intend to give the Canadian REIT Primaris (OTC:PMREF) a real once-over. A reader contacted me about this company and asked whether I would consider it an attractive potential in line with some of the other REITs that I invest in and that I cover. I am happy to take such requests, of course.

However, typically I cover REITs initially when I believe them to be a “BUY”. And while Primaris certainly has some advantages, aside from having a really “cool” name, the REIT isn’t in a place where I would consider it a screaming, table-pounding sort of buy that some might hope for in this environment.

So in this article, I mean to show you why Primaris, despite all the advantages considered and presented, does not currently meet my investment criteria and why I would be careful “entering” the investment at this particular time.

REITs are a great investment, provided you pick “good” ones. I would say that at the right price, Primaris represents an acceptable speculative risk-reward ratio where I can see myself purchasing. I also say the company has strong fundamentals and a potential very strong upside.

Primaris REIT – A Canadian, near-unheard of shopping player

So, despite me calling the company speculative, I want to go on record saying that there is plenty of safety to Primaris.

How so?

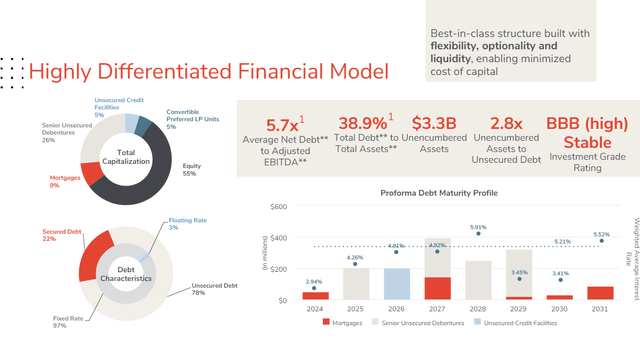

The company has a gross leasable area, or GLA, of 12.5M square feet valued at $3.8B in value, with over $3B of unencumbered assets, and a BBB-rating in terms of credit, meaning that Primaris manages investment grade here. The company targets a 45-50% target FFO payout ratio, with an average net debt to adjusted EBITDA of 5.7x with a committed occupancy rate of over 94%.

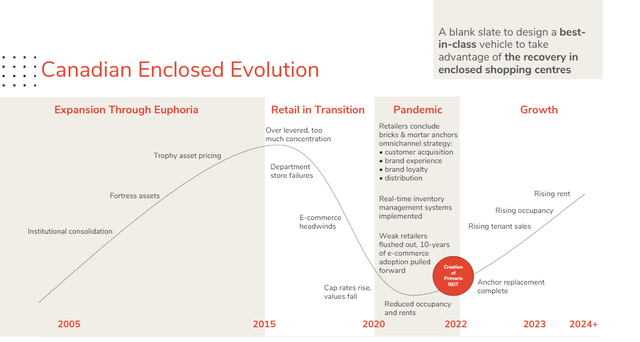

The company’s history can be viewed here, and you can see clearly that Primaris is in actuality a very new player with less than 2 years of market history behind it.

Primaris IR (Primaris IR)

So, the “bad” things. Primaris is a mall REIT. Since leaving behind most of my shopping center and mall investments, I have been very careful investing in the space due to location economics, e-commerce, and the general uncertainty in the sector, where I find other REIT and real-estate subsectors having much more attractive overall economics.

That is not to say that there are not attractive parts of the mall space and sub-areas where this may shine.

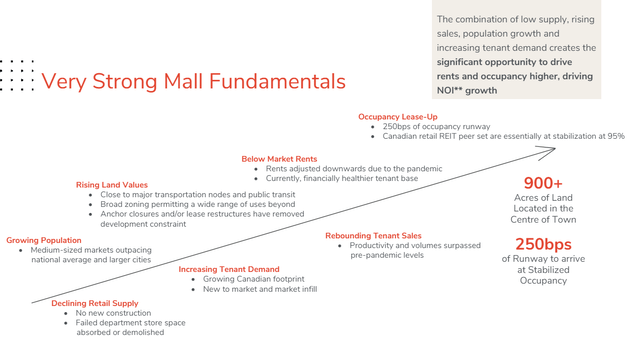

Primaris IR (Primaris IR)

These arguments are, of course, arguments we REIT investors have heard before. Land values, population growth, urbanization, retail supply decline, technical tenant demand, some rebound after COVID-19 – none of these are unique or unheard-of arguments in the space.

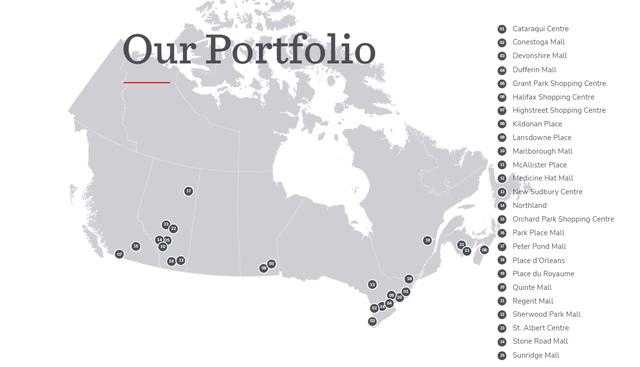

The company’s strategy is centered around a broad-based, Canada-oriented appeal with a national portfolio of shopping centers. It’s a full-service operator with an internal, national platform and a targeted payout FFO ratio that goes nowhere above 50%.

So despite me calling it “spec” compared to some other, much larger mall operators, the company is, in fact, quite conservative from some perspectives.

Primaris IR (Primaris IR)

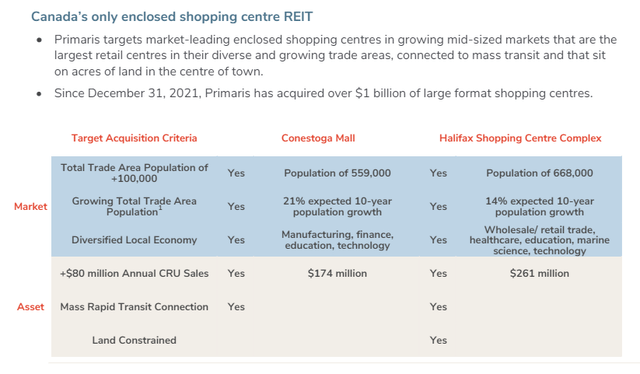

The company also refers to a strong consolidation opportunity in the Canadian mall and shopping center space, which is currently ongoing. This is especially in what is known as the growing mid-market size of shopping centers, which to my mind comes with both a greater risk but also a greater overall reward potential. Here are some examples of this.

Primaris IR (Primaris IR)

Also, here we see what the company focuses on. The company has an ambition to acquire high-quality target assets in terms of productivity and volume. A good example of this was the acquisition of the Conestoga Mall, a trophy shopping center back in 2023 in July, which is a regionally leading enclosed center in Ontario (Kitchener-Waterloo), with a very close distance to the Conestoga station, which is a light rail mass rapid transit system, and a property that has seen investments totaling $122M, and with over $180M in retail sales and over 96% in in-place occupancy.

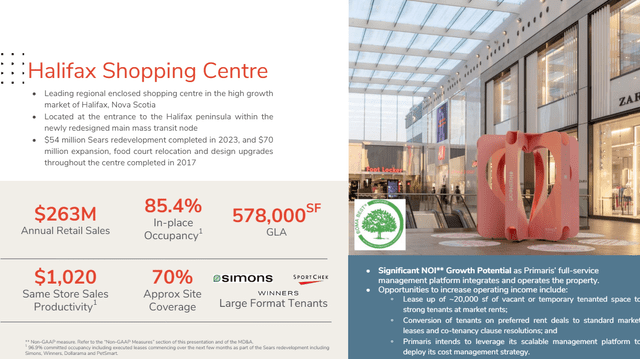

Halifax Shopping Center is another good example.

Primaris IR (Primaris IR)

Now, as I said before, none of these goals or ambitions are in their character unique. Plenty of shopping center REITs and real estate companies are looking at these sorts of strategies. What it comes down to is actually what the company can achieve in terms of performance for its assets, and how this influences NOI and FFO. The fact that shopping center space is declining, there is no one arguing with that. Primaris also points it out, the declining supply of retail space despite population growth. There is a low supply, rising sales, and pop. growth with what the company sees as increased tenant demand. Some of these trends are indeed visible, but the question is: How much space demand even in quality shopping centers are we actually going to see in the future?

This uncertainty is part of what is driving the commoditization in the cheaper and less “large” parts of this segment, and what is also driving the fact that Primaris is trading at what I would consider a relatively cheap valuation.

Primaris REIT follows its capital allocation strategy, where maximum leverage of 6x is key, and the AFFO payout ratio, while above its stated target of around 50%, is trending down going forward.

Financials and debt are as follows.

Primaris IR (Primaris IR)

The company has a strong leadership team and has a very good track record of managing occupancy levels. It has never once since its inception dropped below 90% and manages a so-so NOI growth overall historically, but has been growing especially (or reversing, rather) since 2021, 2022, and 2023.

Canadian retail tenants are strong here, and sales numbers and figures are good. Primaris is in no area in Canada where there isn’t a growth in the population expected, which is of course another positive. The highest growth is expected in Stone Road Mall, where the population is expected to grow by 22%.

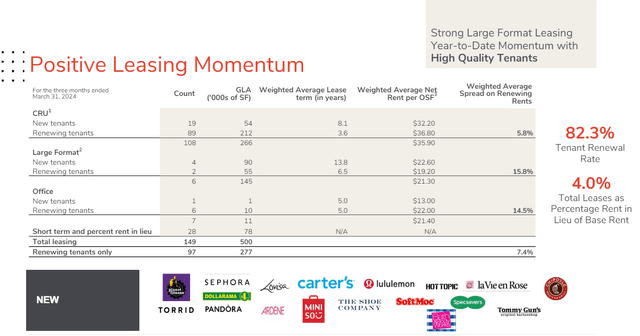

Leasing momentum is also positive, adding to the appeal of the company here.

Primaris IR (Primaris IR)

For 1Q24, which is the latest set of results we have for the company, we have an increase in expected 2024E FFO, now at upwards of $1.64 per share in terms of FFO, including agreements to sell some non-core in Garden City Square, increasing liquidity. When I say that the company is BBB-rated, I also mean by DBRS – which is a service, but not S&P Global, Moody’s, or Fitch, which is typically what companies use. So this needs to be considered as well.

The company expects a 2% growth in same-store property cash NOI, with a 94.1% occupancy that is contractually committed. No specific improvement is expected in leverage at this time.

However, what the company points to is a specific discount to the NAV when we look on a per-share basis. If assuming a per-share basis for the company here, Primaris has around $21.86 per share, compared to a current native share price for the units at $13.43. That is a considerable discount here, well over 25%. Now, I would argue that they shouldn’t trade anywhere close to full-value given size, credit, and a market capitalization of $1.31B (Canadian dollars, as elsewhere in the article) – but could it indeed be worth more?

Let’s take a look.

Valuation for Primaris – The upside exists, but I view it as thin, and the risk as somewhat elevated

Primaris needs to be viewed, as I see it, as a combined income/upside play in the REIT space. The unfortunate news is that there are many attractive income/upside plays in this space, and Primaris does not really stand out in any way. By this, I mean that the company has a yield of 6.25% and an FFO-based upside of less than 8% given an average FFO multiple of around 8-9x.

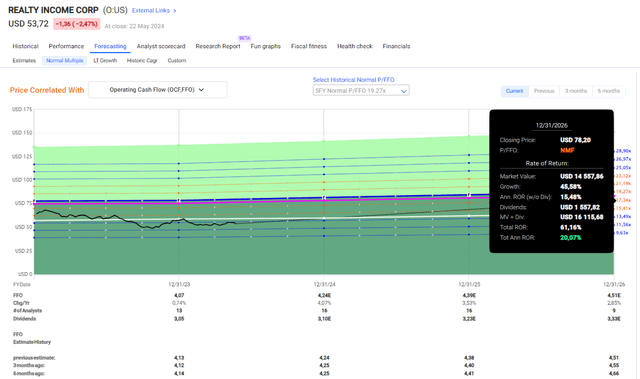

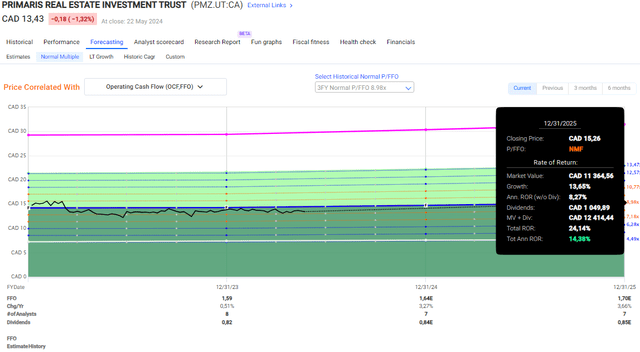

Primaris REIT upside F.A.S.T Graphs (Primaris REIT upside F.A.S.T Graphs)

That needs to be taken into comparison to something like investing in giant, scaled REITs like Agree (ADC) or Realty Income (O), both of which currently yield over 5% and which are markedly better in terms of their normalized upside on a forward basis. For ADC, the respective number here is almost 20% annually – yes, at a far higher multiple in terms of AFFO, but still something where the company has traded prior. What’s more, both of these companies are at BBB or above, and from S&P Global.

Realty Income Upside F.A.S.T Graphs upside (Realty Income Upside F.A.S.T Graphs upside)

Realty Income, especially here, presents what I consider to be a very strong case for investing in the business, with very few downsides, a strong yield, and fundamentals with an A-rating in terms of credit that makes it one of the most compelling investments in the REIT space at this time.

Therefore, I do not view Primaris as holding much comparative appeal next to Realty, despite the somewhat higher yield that’s on offer here.

In terms of what other analysts consider to be interesting here, 7 other analysts do follow Primaris, and give it a target range starting at $15.5 and going to $18, with an average of about $16.5. That means a 23% upside, at a current price to NAV of around 0.67x.

I view Price/NAV per share as a decent valuation method for this company (or many REITS), and I would be interested in the company at something like 0.55x or 0.5x, given the relatively small size of the business. Given today’s valuation, I would consider this too high – also expressed in the sub-15% annualized RoR that’s currently available at the discount (though keep in mind that the average discounted multiple here only has a very short 2-year history, and should be taken with a pinch of salt). Instead, NAV multiples seem the better choice here for now – that and keeping a close eye on if the company actually manages to grow its FFO here.

My future updates on the company will cover mostly the performance and how the company, if anything, manages to outperform unless it’s being severely discounted.

Because the company/REIT is not being severely discounted here, however, I would consider it to be a “HOLD”, with the following introductory thesis.

Thesis

- Primaris Real Estate Investment Trust, or Primaris REIT, is not a bad company or a bad REIT. It’s a Canadian-based retail REIT with a considerable portfolio spread across the nation of Canada, with a focus on population growth areas. I would liken it to sunbelt REITs in the US, given their respective focus on these areas, and this is potentially attractive.

- Mall and shopping center investments are far from a risk-free proposition, however, and this needs to be considered as well. The company is a small player, and while it has an FFO growth rate annually of around 6.5%, much of that comes from the change to 2022 when the company also initiated its dividend. Primaris is now expected to grow far less than 6-7% going forward.

- Given this, and what else is available on the market at far safer fundamentals, I would characterize Primaris at best to be a spec buy, and I would want a 50% discount to NAV. That comes to around ~$11/share, which also becomes my share price target.

- Because of that, my initial rating for this company is a “HOLD”, and no more than that.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

The company fulfills 3 out of my 5 criteria, making it a “HOLD” here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.