5./15 WEST

Introduction & Investment Thesis

Pinterest (NYSE:PINS) is a visual search and discovery platform where over 500M Monthly Active Users (“MAUs”) find and save ideas for various interests with the purpose of shopping for those interests later. I initiated a “buy” rating on March 15 where I expected the stock to continue delivering outsized returns as MAUs had started accelerating after the management made huge improvements in building an end-to-end shopping experience for the user, which I believed would drive higher ad load and user monetization. Since the time of my writing, the stock is up 28.4%, outperforming the S&P 500 by more than 4x.

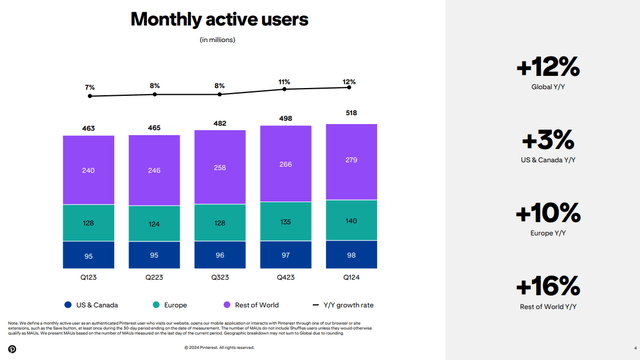

The company reported its Q1 FY24 earnings, where revenue and earnings grew 23% and 318% YoY, respectively, exceeding estimates, as it hit a new record high of MAUs of 518M. During the earnings call, the management continued to demonstrate its progress on its product innovation and AI to deepen user engagement as it wins over Gen Zs, while simultaneously building lower funnel solutions for advertisers to drive higher ROI on ad spend.

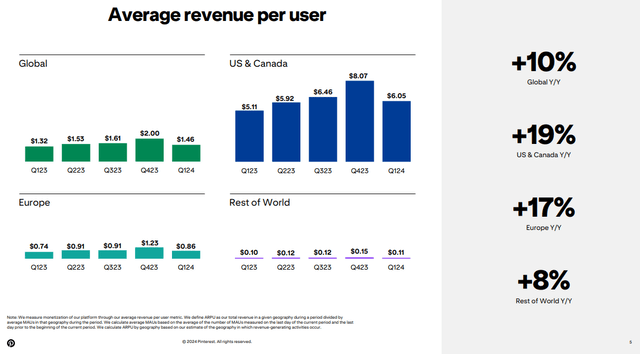

While Average Revenue Per User (“ARPU”) declined sequentially, the management is deepening its partnerships with Amazon Ads (NASDAQ:AMZN) and Google Ads Manager (NASDAQ:GOOG) to unlock monetization opportunities, especially in international markets.

Assessing both the “good” and the “bad,” I believe that the stock is attractively priced to continue to drive upside from its current levels, making it a “buy”.

The good: Strong Revenue growth as MAUs reach a record high of 500M+. Management is focused on driving user engagement, increasing ad load and partnerships with third-party advertisers.

Pinterest reported its Q1 FY24 earnings where revenue grew 23% YoY to $740M as it saw its MAUs reach a new record high of 518M growing 12% YoY, given the management’s strategic focus on deepening user engagement, increasing ad load by building lower funnel solutions, and driving demand through third-party partners and resellers.

Q1 FY24 Earnings Slides: Accelerating growth of MAUs

In this post, I will analyze the management’s progress across each of their strategic initiatives that they had laid out in their Investor Presentation in order to build the long-term investment case for the company.

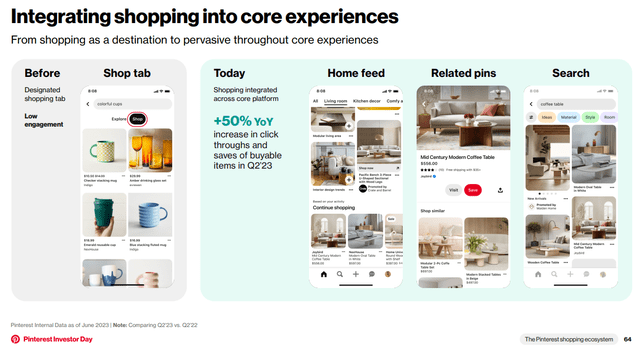

Its first strategic initiative is focused on accelerating user growth and deepening user engagement, and I believe the management is doing a particularly great job as it leans heavily into genAI and relevancy improvements to reinvigorate curation through boards and collages and satisfy commercial intent by driving actionability on its app. Particularly, when it comes to investments in AI, the company has transitioned from CPU to GPU serving, thus allowing them to serve larger and more complex models to drive gains in relevancy and personalization for their users by sharpening their focus on user intent through proprietary signals. During the earnings call, William Ready, CEO of Pinterest, discussed that one key source of user signals is human curation through boards and collages, which is an integral part of the buyer’s journey from inspiration to action. In fact, human curation is an area where the company is focused on driving a lot of product innovation to allow users on the platform to express their styles, tastes, and preferences in creative ways, especially as they integrate more shoppable content into their core services.

2023 Investor Day: Integrating shopping in core user experience on the app

One of the interesting outcomes of the management’s strategy is its success in attracting the Gen Z cohort, which represents 40% of all users on the platform, as they save more than other demographics and find value in curated collages and boards, which is distinct from the rest of social media. In other words, the company is “aging down,” which is atypical of consumer internet companies. What I like particularly is that the management is doubling down on this accelerating cohort by creating relevant marketing moments, such as hosting an immersive activation at Coachella. I believe that as Gen Z’s enter the workforce and progress through their careers, they will gain incrementally higher spending power, and given their preferences for closer connections, Pinterest will stand to benefit from the tailwind, thus boosting its MAUs and engagement metrics.

Turning our attention to the second strategy, which is centered on improving monetization, especially in the lower funnel opportunity, Pinterest is actively solving for actionability for items that users find on the platform by seamless connections to Mobile Deep Linking and Direct Links, enhanced ad platform capability, and improving measurement capabilities with API for Conversions. This is allowing them to accelerate clicks to advertisers, thus driving greater returns for advertisers and gaining access to performance budgets, as they are able to measure the results better. Furthermore, the company is re-orienting their sales and go-to-market functions that are focused on educating and implementing lower funnel best practices with advertisers to help them meet their goals, which I believe will help drive deeper adoption and capture value, while simultaneously building out an array of tools to build, optimize, and manage campaigns on Pinterest.

Finally, in terms of their strategy to accelerate their audience reach and monetization through third-party partnerships and resellers, they are currently scaling demand with Amazon Ads in the US and Google Ads Manager to gain market share in unmonetized international markets. To put things in perspective, the company has over 73% of its user base outside of the US and in Q1, where its Europe and Rest of World (“RoW”) segment grew 10% and 16% YoY, respectively, much faster than the 3% YoY growth rate in the US. However, monetization outside of the US is miniscule, with Europe and RoW at $0.86 and $0.11 of ARPU, while ARPU for the US stands at $6.05. Therefore, if the company is successfully able to grow its monetization rate outside of the US by partnering with Google Ads and local resellers, we should expect to see a further increase in global ARPU, which would boost its top-line and allow it to grow at its 3-5 year target of mid-high teens that it outlined in its Investor Presentation last year.

Q1 FY24 Earnings Slides: ARPU by geographies

The bad: Adjusted EBITDA Margins shrank sequentially driven by lower ARPUs globally, Monetization in Europe and RoW has ways to go, Macro Uncertainty remains.

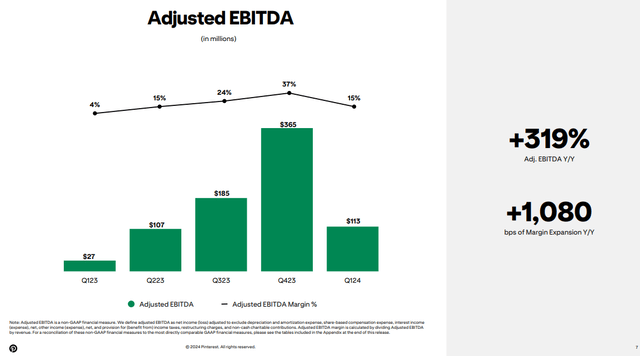

Although the management is committed to improving its profitability and has set 30-34% in Adjusted EBITDA margin where it sees growing ad load from higher user engagement on the platform as the management continues to build solutions for improving user curation, while leveraging AI to drive highly relevant personalized shoppable ads resulting in commercial action, it did see a sharp drop in sequential Adjusted EBITDA margin from 37% to 15% as cost of revenue and operating expenses grew 1.5% MoM as a percentage of revenue, while ARPU declined 27% sequentially. On the other hand, the company still managed to grow its Adjusted EBITDA margin by 1100 basis points when we look at it on a YoY basis. While this could be a combination of seasonal factors coupled with acquiring new MAUs at an accelerating pace that are yet to monetize, possibly in geographies that are less monetized as the US, I believe that the company’s monetization strategies in Europe and RoW need to be monitored carefully as it can negatively impact short-term profitability if it fails to gain the required traction.

Q1 FY24 Earnings Slides: Adjusted EBITDA Margin

Simultaneously, the uncertainty in the macroeconomic landscape of the US economy continues to persist. In its latest meeting, the Fed kept interest rates anchored while forecasting only one rate cut for the remainder of the year. This means that financial conditions will remain tighter for longer, which will further hurt consumer spending in the coming months. We are already seeing loopholes in the labor report, where full-time jobs are evaporating and the gain in the overall payroll number is driven by part-time workers. Simultaneously, the US consumer is sitting on record credit card debt, with Gen Zs increasingly tapping into “buy now, pay later” schemes to fund their payments. Therefore, if the labor market further weakens from current levels, I expect to see some form of a slowdown in MAU growth on Pinterest, which will negatively impact user engagement and ad impressions, leading to declining ARPUs and margin pressures.

Revisiting my valuation: Pinterest remains a “buy”.

Looking forward, the company expects to grow its revenue in Q2 by 18-20% YoY in the range of $835-$850M, while expecting to spend approximately $500M in non-GAAP operating expenses. Assuming that the Cost of Revenue as a percentage of Revenue remains unchanged YoY at 23%, then it should generate an Adjusted EBITDA of approximately $157M, which would translate to an Adjusted EBITDA margin of 18.6%, an improvement of approximately 360 basis points YoY.

Over a longer time horizon of 3-5 years, the management intends to generate revenue in the low to mid-teens, while it improves its Adjusted EBITDA margin to the low 30-s range, as it benefits from higher ARPU from higher user engagement and personalized ad loads, coupled with unlocking a higher degree of monetization in Europe and RoW.

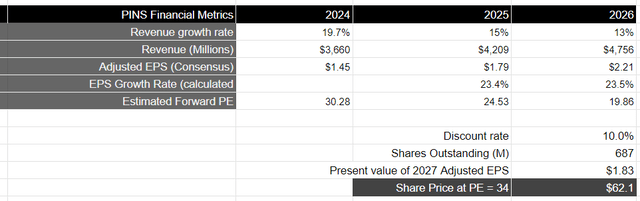

For the purpose of my valuation, I will take the consensus estimates into consideration, which are in alignment with the management’s long-term revenue and earnings estimates. Therefore, assuming that revenue grows in the high teens in FY24, followed by a slowdown in the mid-teens in FY25 and low-teens in FY26, it should generate $4.75B during this period of time, as it continues to drive AI-led product innovation to personalize shopping experiences for users while building robust tools for advertisers to deliver higher return on ad spend, leading to higher ad loads and third-party ad demand. From a profitability standpoint, taking the consensus estimates for Adjusted EPS of $2.21 in FY26, we see that it will be growing at a faster rate than overall revenue growth, which I believe will be possible from improving operating leverage from higher ARPUs, absent any major global macroeconomic slowdown. This will be equivalent to a present value of $1.83 in Adjusted EPS when discounted at 10%.

Taking the S&P 500 as a proxy, where its companies grow their earnings on average by 8% over a 10-year period, with a price-to-earnings ratio of 15-18, I believe that Pinterest should be trading at roughly twice the multiple given the projected growth rate of its earnings during this period of time. This will translate to a PE ratio of 34, which is higher than its current estimated forward PE of 19.8 for FY26, or a price target of $62, which represents an upside of 42% from its current levels.

Although there are risks pertaining to the uncertainty of broader monetization that can weigh down on Pinterest’s top and bottom lines, coupled with an uncertain macroeconomic environment, I believe that the company is well-positioned in the long term given the management’s focus to double down on its GenZ demographic, which will increasingly become a larger part of the working population in the coming years as they innovate their product features and leverage AI to drive deeper user engagement through curation, while leveraging the user intent to drive more targeted ads, thus closing the loop from inspiration to a shopping action on the app, creating a win-win for the user, the advertiser and Pinterest. I also believe there is plenty of whitespace when it comes to driving deeper adoption of its lower funnel solutions to advertisers, which will drive top-line growth in the future. Assessing both the “good” and the “bad,” I believe that Pinterest is positioned for further upside ahead, even if there are short-term bumps along the way, making it a “buy”.

Conclusion

I believe that Pinterest sits with a renewed product-market fit as it ties together user behavior and AI to drive a positive end-to-end shopping experience on the app. So far, the leadership under William Ready has been consistently executing on their strategic priorities. I believe the strength in execution will likely continue as they deliver on their long-term financial targets. Although there will be short-term volatility given the current state of the macroeconomic environment, I believe it is positioned to continue driving upside over a 3-year investment horizon.