By Chloe Harcombe, Ruth Bradley, BBC News, Somerset

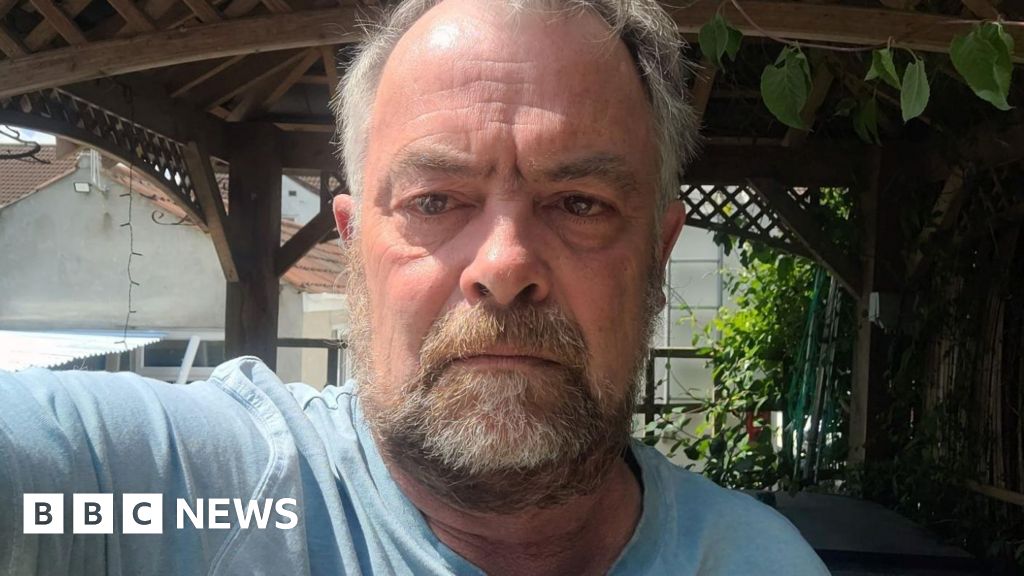

Doug Workman

Doug WorkmanWith the general election fast approaching, many people are thinking about what changes they would like to see from the next government. Pensions and retirement age are two issues people are focused on, and voters in Somerset have spoken to the BBC as part of the Your Voice Your Vote campaign.

Doug Workman, a 63-year-old builder from Chilcompton, near Radstock, wants the retirement age to be lowered as he is finding it “more difficult” to physically manage at work.

“I don’t know how I’m going to cope until I’m 67,” he said.

“How can it possibly be fair that I started work when I was 16, and I have to work until I’m 67?”

He said he finds it “most unfair” that children who stay in full time education until the age of 18 will work two years less than he has.

“I’ve obviously paid more stamps [National Insurance contributions] than they ever will, and have worked two years longer than they will,” he added.

He disagrees with the rising retirement age, and wants it to be lowered back to 65.

Michael Stancliff lives in Bridgwater.

The 86-year-old, who is originally from Yorkshire, had a career working in newspapers prior to his retirement.

He has voted throughout his life, but is currently unsure if he will in this election.

The current government has “let pensioners down badly”, by failing to implement any changes on tax or payment increases, he said.

“All my life it’s been tax, tax, tax,” he added.

In the future, Mr Stancliff wants to see private pensions become tax-free.

He receives four different pensions, and is taxed on all of them.

He receives £53 a week from one, but pays a “ridiculous” £12 tax on it.

“It’s all about pensions for me,” he said.

“I’ve been paying tax for 71 years. I’ll pay tax until I die.”

The government pays the state pension every four weeks to people who have reached the qualifying age and have paid enough in National Insurance contributions.

According to the Department for Work and Pensions, there are more than 12 million recipients in the UK.

Men and women born between 6 October 1954 and 5 April 1960, become eligible for the payments when they turn 66.

But for people born after this date, the state pension age is increasing:

- a gradual rise to 67 for those born on or after 5 April 1960

- a gradual rise to 68 between 2044 and 2046 for those born on or after 5 April 1977

A triple lock was introduced by the Conservative-Liberal Democrat coalition government in 2010.

It was designed to ensure the value of the state pension was not overtaken by the increase in the cost of living or the working population’s income.

Under the system, the state pension increases each April in line with inflation, average wage increase, or 2.5% – whichever figure measures highest.

Both the Conservatives and Labour have committed to keeping the triple lock.

The Conservatives have promised to introduce a “triple lock plus”, meaning fewer would pay income tax on their pensions.

But Labour said the plan is not “credible”.

The state pension cost the government £110.5bn in 2022/2023, but the Office for Budget Responsibility predicts the figure will grow.

Getty Images

Getty ImagesHow will different parties tackle issues around pensions?

The Conservatives have promised to introduce the “triple lock plus”, which will increase the personal tax-free allowance for pensioners. This would mean future rises in the state pension will not be hit by income tax.

Labour has said it will maintain the triple lock, which means the state pension is increased by whichever is highest of average earnings growth, CPI inflation, or 2.5%. The party has also said it will adopt reforms to workplace pensions.

The triple lock would also be maintained by the Liberal Democrats, the party has said, alongside a pledge to introduce measures to end the gender pension gap in private pensions.

The Green Party manifesto sets out a pledge to ensure that pensions are always uprated in line with inflation and keep pace with wage rises across the economy, as well as ordering UK pension funds to remove fossil fuel assets from their portfolios.

Reform has said it would undertake a review of pension provision, adding that the current system is too complex and comes at a huge cost.

What really matters to you in this general election? What is the one issue that will influence your vote? Click the button below to submit your idea, and it could be featured on the BBC.