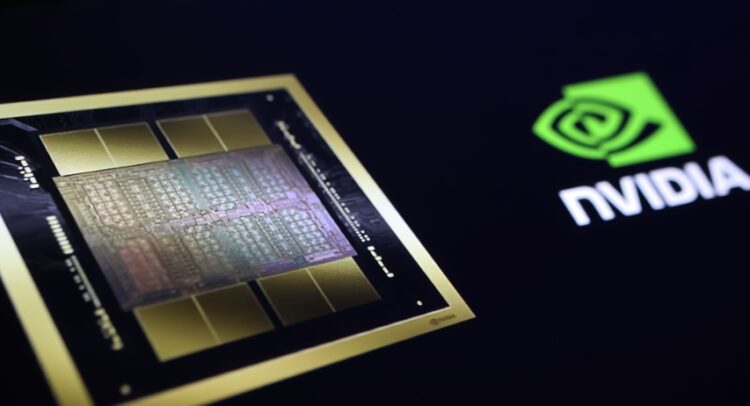

Nvidia’s (NVDA) is facing a significant setback in developing its next-generation AI chip, Blackwell. According to The Information, chip production has been delayed by at least three months due to unexpected design flaws. Tech giants who rely on these chips will feel the pain of the holdup.

The delay comes as a blow to Nvidia, which unveiled the Blackwell series in March. CEO Jensen Huang had high expectations for these chips, projecting substantial revenues in 2025.

The design issue has compelled the company to conduct new test production runs with Taiwan Semiconductor Manufacturing Company (TSM). This setback will push the timeline for large-scale shipments to the first quarter of 2025.

Impact on Tech Giants

This delay is expected to impact the company’s major tech clients, including Meta Platforms (META), Alphabet’s (GOOGL) Google, and Microsoft (MSFT), which have collectively placed large orders for these chips.

These tech giants rely on advanced hardware to power their AI models and services. Delays in the availability of these chips could disrupt their product roadmaps and impact their competitiveness in the AI race.

What Is the Prediction for Nvidia Stock?

The chipmaker’s stock has soared over 116% year-to-date, but analysts believe there’s still plenty of fuel left in the tank. Importantly, the data center market is seen as a major growth driver for the company.

Analysts have a Strong Buy consensus rating on NVDA based on 37 Buys and four Holds assigned in the past three months. The analysts’ average price target on Nvidia stock is $142.74, implying 33.07% upside potential from current levels.