Competition for the title of most valuable company in the world is heating up. Earlier this week Nvidia (NASDAQ: NVDA), after its monster run over the last few years, leapfrogged Microsoft and Apple to become the largest company in the world by market capitalization (market cap), the total value of all publicly traded shares of a company.

After topping its rivals, Nvidia slid back to third place, but this isn’t any reason to fret. It’s a tight race and the three are likely to be trading places for some time. The next round of earnings later this summer will be a major catalyst that could move the needle to a more stable place if any of the companies beat their own guidance and Wall Street’s expectations — or fall short.

No investing theme is more popular right now than artificial intelligence (AI) and Nvidia is its poster child. Investors are salivating at the incredible returns the company is delivering consistently quarter after quarter — its revenue last quarter was up 260% year over year — with the promise of continued growth into the future. Its rapid ascent since AI captured the public’s attention is one for the record books. But what should investors pay attention to long-term?

Understand what makes Nvidia special

Nvidia holds a unique position in the market. The company was so ahead of the curve that it was able to capture roughly 80% of the AI chipmaking business.

Of course, like most wildly successful companies, it was a matter of a little bit of luck and a lot of foresight. CEO Jensen Huang made a bet. Nvidia made chips called graphics processing units (GPUs) that were, for a large chunk of the company’s history, accessories to the all-powerful central processing unit (CPU) that made Intel what it was. He saw that the industry was reaching the limits of scaling CPU technology and that his company’s GPUs could step into the spotlight.

Turns out he was right. Without getting into too much technical detail, if you shift the focus to chips that are very like GPUs — such as the company’s Grace Blackwell “Superchip” — with CPUs running a supporting role, you can run power-hungry applications and continue to scale them up. And AI is undoubtedly power-hungry.

Nvidia doubled down on this tech before it was fashionable, so when AI exploded onto the scene, the company was already there, supplying the entire industry with its tech. Now AI servers run by the likes of Alphabet, Amazon, and Microsoft are powered by Nvidia chips.

Whether AI pans out — and when — is critical

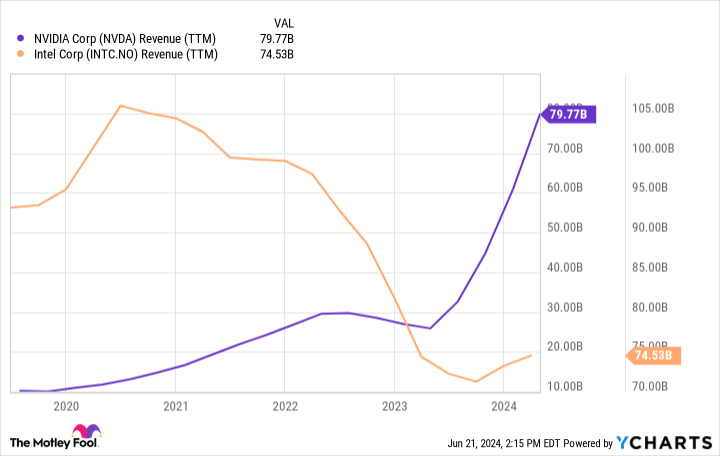

Nvidia went from a relatively niche computing company, mostly servicing the video game industry, to one of the largest companies in the world. Just look at this reversal of fortunes from the once-dominant CPU maker, Intel. The chart shows revenue for both companies over the last 10 years on a trailing-12-month (TTM) basis.

That is a twist of fate. But fate can be fickle. Nvidia’s future largely depends on AI delivering on its promise. Much has been made of its revolutionary power, but there is still a lot to prove. It wouldn’t be the first time a technology failed to deliver on the hype surrounding it. Still, I think there’s more reason to believe AI isn’t a fluke than some past hype cycles, so then it’s a matter of when it can deliver.

If the AI value chain is a river, Nvidia is somewhere in the middle, upstream from the companies that actually deliver AI products to the end market. If those companies have overpromised on their products’ value or can’t deliver in time, the river gets dammed up downstream, potentially leading to a glut of unwanted chips. For Nvidia to continue the incredible growth it has been experiencing, enough to justify the premium value investors have placed on it, end-user demand has to keep the river flowing freely.

Keep an eye on how well the end-user AI applications are doing. Try some out. Do you see the value? The more useful these tools are, the higher the river’s watermark and the more likely Nvidia is to deliver on its sky-high expectations.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $775,568!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 24, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Johnny Rice has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Apple, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short August 2024 $35 calls on Intel, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Nvidia Is No Longer the Most Valuable Company in the World. Here’s What Investors Need to Know. was originally published by The Motley Fool