onurdongel

The full title of the ETF I own and suggest for your due diligence is the Global X MLP & Energy Infrastructure ETF (NYSEARCA:MLPX). It has only 25 holdings. But those 25 companies probably control 75% of the pipeline and other infrastructure energy market in the US! Unlike the individual shares comprising the ETF (most organized as Limited Partnerships), this ETF does the required K1 reporting. As an investor in MLPX, we have no K1s to submit.

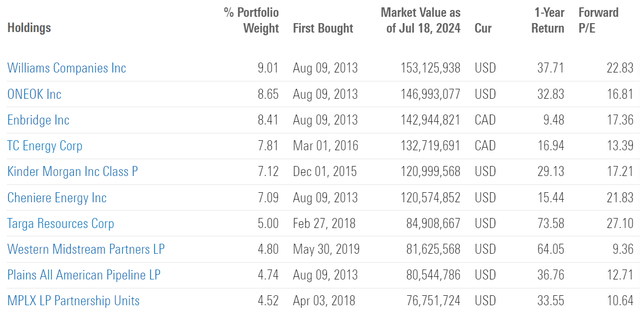

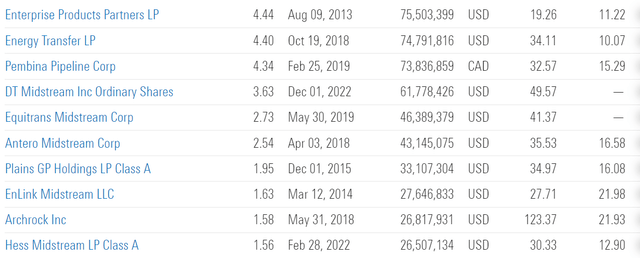

Here are the 25 companies and their share of the portfolio:

Morningstar

Morningstar

Morningstar

The blended yield of these holdings results in a dividend yield of 4.62% per annum, with payments in March, June, September, and December.

What Do These Companies Do?

These are the companies that either (in some cases, both) store oil and gas or keep oil and gas moving from the fields where they are found to the refineries where they are made into various products, then on to end users. In short, these are primarily pipelines and storage facility firms.

These companies do *not* depend on the price of oil and gas. Their profits come from the amount of product moved, not the price it fetches. This means they are considerably more stable and less sensitive to fluctuations in energy prices.

Even with the battery revolution, the world is using more oil and gas – not less. Buying these companies is a way to profit from this trend. Buying an ETF with many companies spread over a far greater geographic area than any one company would have means even less volatility.

OPEC’s production cuts and Russia’s self-induced (by attacking Ukraine) reduction in oil and gas exports mean that US and Canadian oil and natural gas output for export is likely to remain stable or increase from here. The shale revolution and advances in hydraulic fracturing and horizontal drilling technologies, pioneered by innovative US energy companies, have made the US the #1 producer of both oil and gas in the world.

With the help of the US midstream firms in the MLPX portfolio, the US can fill any gaps left by OPEC and Russia in supplying energy to the rest of the world.

In addition, regardless of who wins the upcoming presidential election, the United States will have a change of administration. Pipelines from Canada have been either restricted or constricted by the current administration. If that changes, and I believe it will, this will be yet another reason to own the midstream companies.

Your logic for buying MLPX could not be simpler:

- The world is using more, not less, oil and gas.

- The US is the largest producer of both.

- The midstream pipeline and storage companies in the MLPX ETF portfolio charge by the amount of product shipped or stored.

- The midstream pipeline and storage companies in the MLPX ETF portfolio do not depend on higher oil prices to succeed.

MLPX is one of two ETFs that I and many of our subscribers own. I will likely write an analysis of the other ETF in the coming weeks.

Even in this Growth-oriented market, Value plays a role. The “barbell” approach may be a bit lopsided occasionally, but even a volatile growth portfolio is made easier to bear with some solid value holdings – like MLPX.

Good investing!

Analyst

Unless you are a client of Stanford Wealth Mgmt, my portfolio management firm, I do not know your personal financial situation. Therefore, I offer my opinions above for your due diligence, not as advice to buy or sell specific securities.