Shares of CleanSpark (NASDAQ:CLSK) are trading higher today after the Bitcoin (BTC-USD) mining company announced that it is buying GRIID Infrastructure (NASDAQ:GRDI) in an all-stock deal worth $155 million, which includes taking on GRIID’s debt. Along with this, it signed an agreement to use 20 MW of GRIID’s power right away. GRIID shareholders will get shares of CleanSpark based on a set formula that considers GRIID’s debt and CleanSpark’s stock price. The formula is:

($155M – GRIID’s outstanding liabilities net of cash) ÷ $16.587 (which is the volume-weighted average price of CleanSpark’s common stock)

CleanSpark will cover all of GRIID’s debt and has given it a $5 million loan for working capital and a $50.9 million bridge loan. It is also planning to build over 400 MW of infrastructure over the next three years. The deal is expected to close in the third quarter of 2024 if GRIID shareholders approve it and other usual closing conditions are met.

It’s worth noting that CleanSpark has been actively using acquisitions to grow its operations. In fact, it recently announced the acquisition of five Bitcoin mining facilities in rural Georgia for $25.8 million.

Is CLSK Stock a Buy?

Turning to Wall Street, analysts have a Moderate Buy consensus rating on CLSK stock based on two Buys, one Hold, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 292% rally in its share price over the past year, the average CLSK price target of $22.17 per share implies 33.72% upside potential.

Is Bitcoin a Good Investment?

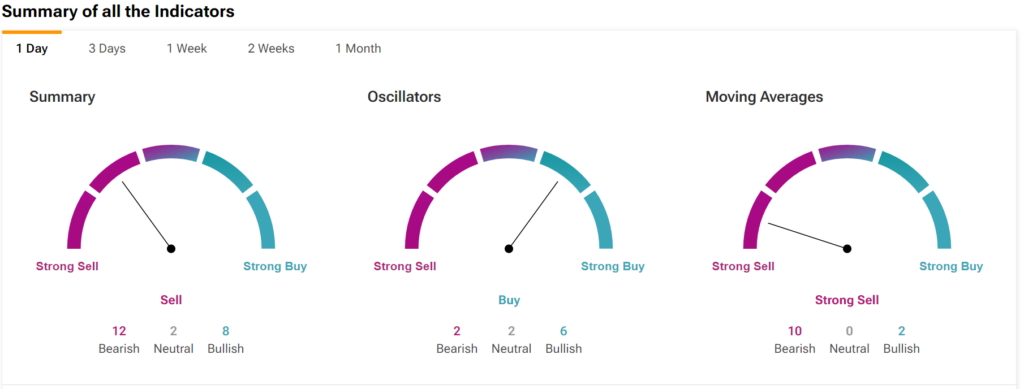

Using TipRanks’ technical analysis tool, the indicators seem to point to a negative outlook for Bitcoin. Indeed, the summary section pictured below shows that eight indicators are Bullish, compared to two Neutral and 12 Bearish indicators.