Frederick Doerschem

Global listed infrastructure is set to benefit from significant structural growth drivers, including how the energy transition is leading to substantial investment into renewables and electricity networks, demographic shifts increasing infrastructure demand, and the rapid digitalization of services.

These trends will likely create significant investment opportunities over the next decade and position global listed infrastructure as an attractive portfolio diversifier.

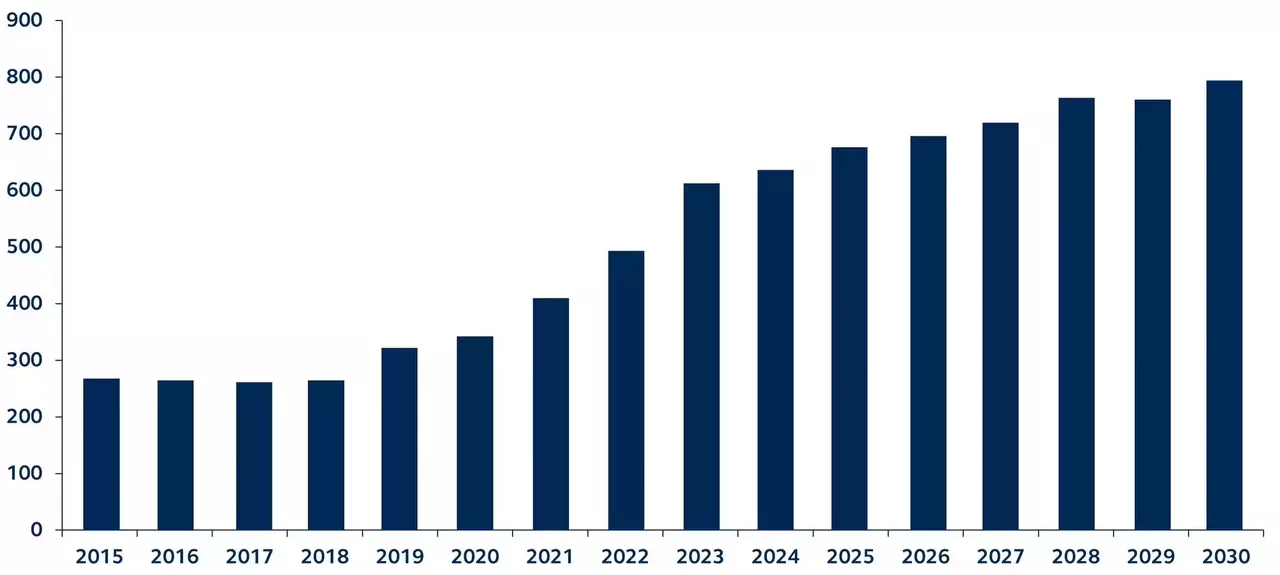

Annual investment in clean energy transition

USD billions, forecasted through 2030.

Source: S&P Global Commodity Insights. Data as of April 2023.

Global listed infrastructure (GLI) companies, which manage essential services like utilities, transportation, and communication systems, are poised to potentially benefit from accelerating structural growth tailwinds in the decade ahead.

Key drivers, such as the energy transition, demographic shifts, and increased digitalization, are creating substantial opportunities for investment and development within the asset class:

- Energy transition: Over 85 countries are setting or declaring net-zero targets. This shift is accelerating investment into renewable energy sources, electricity networks, hydrogen, and biofuels. The growing demand for electrification, driven by government incentives, positions GLI companies – many of which are critical players in clean energy generation and distribution – to potentially benefit from this trend.

- Demographic trends: The growing global population is increasing the demand for improved infrastructure. Examples like advanced transportation systems in densely populated regions and increased energy requirements in emerging markets are both opportunities for GLI companies to benefit.

- Digitalization: The surge in global data and technology usage necessitates additional infrastructure, such as cellular towers and data centers. This modernization effort, including the enhancement of electric grids and intelligent traffic systems, underscores the essential role of GLI in supporting a more connected and efficient world.

For investors, the convergence of these structural growth tailwinds highlights the robust investment potential within GLI. As these trends unfold, listed infrastructure companies are well-positioned to capitalize on the increasing global demand for sustainable, reliable, and modern infrastructure solutions.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.