ake1150sb/iStock via Getty Images

Thesis

Jacobs Solutions (NYSE:J) has significant exposure to the growing infrastructure sector, with new contract awards accumulating and 13.6% growth in the critical infrastructure business unit. Growing sectors such as semiconductor, pharma & life sciences as well as data center growth make the business valuation appealing at 17 times 2024 earnings. Shareholders will be rewarded through an increasing dividend, growing at 11.4% CAGR over the past five years, as well as opportunistic share repurchases.

Introduction

Jacobs Solutions is a leading provider of technical services across a range of sectors across both public and private industries. In the latest Engineering News Record, Jacobs was named the #1 Design Firm in out of a selection of 500 firms. Design is just one of the many accolades this company has collected over the years, which includes being the #1 Program Management Firm three years running.

The Infrastructure Investment and Jobs Act (IIJA) signed into law in November 2021 approves the funding of $1.2 trillion of Infrastructure programs, which has begun to release funding after receiving approval in 2021. Jacobs is already an important supplier to the Infrastructure sector and has vast experience with government contracts in the US, and I expect the number of contract awards from this funding.

As an industry leader, Jacobs services are in high demand, and that demand looks set to continue for the foreseeable future with $29.4 billion in order backlog. The critical infrastructure business increased sales 13.6% YoY in Q1 2024, and guidance suggests this business will generate the majority of earnings post spin-off of the CMS business. Combined with growing revenues and an 11.5% increase in the dividend, there remains $775 million on the authorized share repurchase program available for opportunistic share repurchases.

Growing Sources of Revenue

New mega-Infrastructure projects continue to break news every few weeks with announcements of new contract awards, many of which Jacobs have been successful in adding to the order backlog. The scale of these contracts varies from multi-million to multi-billion dollar framework agreements with long contract durations, such as the recently announced £3 billion United Utilities water infrastructure upgrades in the UK, where Jacobs will act as project delivery partner.

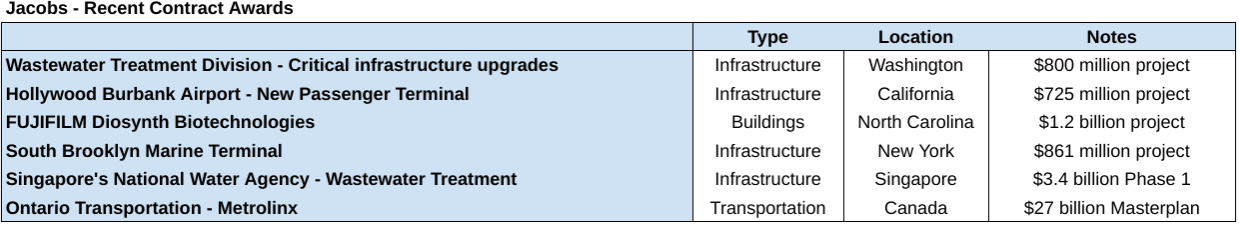

Due to the volume of contract awards in recent months, I decided to compile a brief list demonstrating the growth Jacobs Solutions are seeing in the market.

Jacobs – Contract Awards (Company Filings)

Jacobs has a long history of providing services to the defense sector, having provided services to the US Department of Defense for over 70 years, as well as the UK Ministry of Defense, the Australian Department of Defense, and a host of other international customers. The team continues to win new contracts as tailwinds in the sector increase capital expenditures.

I expect Jacobs will continue to be a major beneficiary of the increased spend in the sector, where strict security clearance requirements mean the competition for many of these projects can only be tendered to pre-selected bidders. A good example of this situation is the renewed ‘base operating support services contract’ for the US Department of Defense. The extension of this service amounts to $56 million, bringing the total value of this contract to a whopping $445 million and counting.

Alongside their existing clients, Jacobs has been a beneficiary of the growth in data centers, semiconductors and the pharmaceutical & life sciences companies that make weight-loss drugs, each of these sectors have experienced rapid growth. As Jacobs has been heavily involved in these areas and with most of the major corporations in the sector, I believe these sectors will be positive for revenue growth in tandem with more traditional Infrastructure projects such as roads, rail, aviation, electrical grid, and wastewater.

To summarize the above information, the key takeaway is the scale of the order backlog now standing at $29.4 billion, paving the way for long-term revenue growth. To further put that into context, annual revenue was $16.9 billion in 2023. Just under two years of orders on the books provides a steady supply of revenue, combined with the growth of the critical infrastructure sectors mentioned above. I believe the outlook for Jacobs to be very positive for growth in revenue, and if profitability can maintain its peer group leadership, I expect share price growth given the fair valuation at which the business trades.

Business Progress

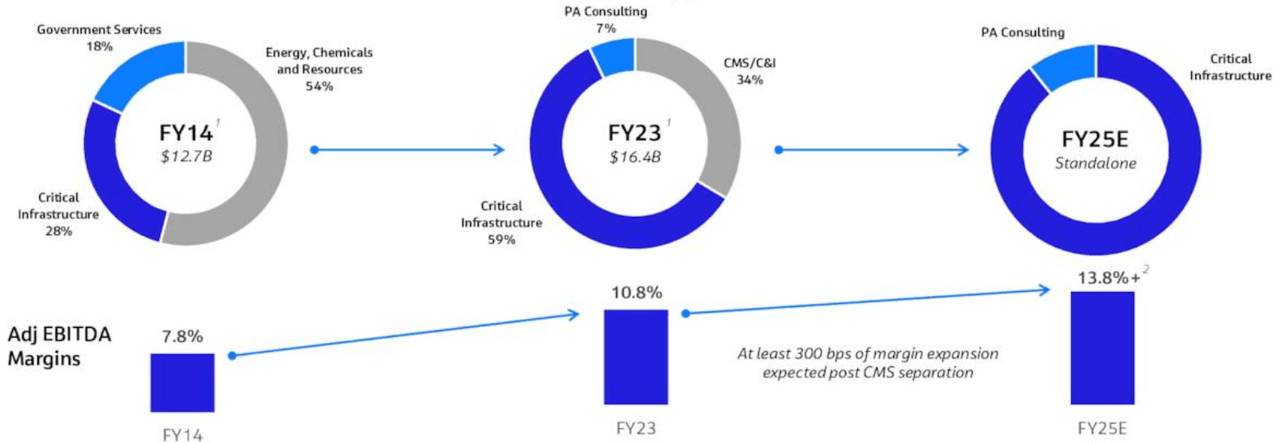

Group revenues are generated through three distinct units: PA Consulting, CMS/C&I and Critical Infrastructure. Although, the business structure is set to change as a result of the spin-off of the CMS business, expected to complete in the second half of 2024 as the company switches its focus to its critical infrastructure business, which is the area where the above contract awards will be adding revenue. Existing shareholders of Jacobs will retain a 51% ownership stake in the spin-off business enabling shareholders to benefit from the transaction, furthermore, $1 billion in cash will also be paid to Jacobs Solutions as part of the deal.

Revenue Breakdown (Jacobs Q1 Earnings)

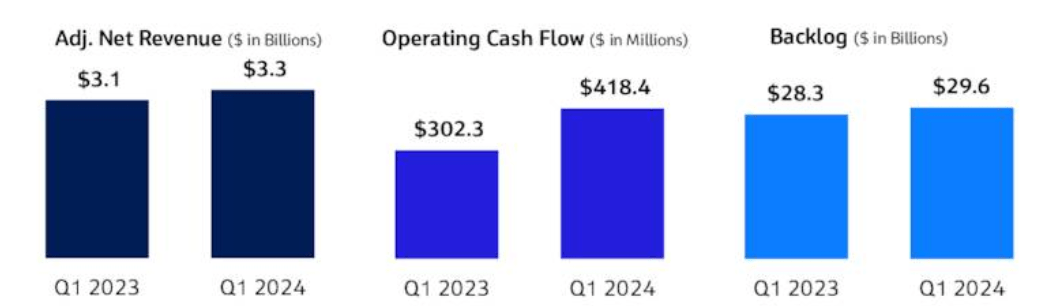

Year-over-year performance continues to improve, with revenues rising 9.5% from $3.1 billion in Q1 2023 to $3.3 billion in Q1 2024. More impressive is the 38% Q1 growth in operating cash flow. And as highlighted in the above chart, Adjusted EBITDA Margins are expected to expand to 13.8% following the spin-off.

The order backlog has increased by $1.3 billion YoY, a positive sign for the remainder of the year, as annual capital expenditure budget allocations are typically required to be in place prior to the end of the year.

Key Performance Metrics (Q1 Presentation)

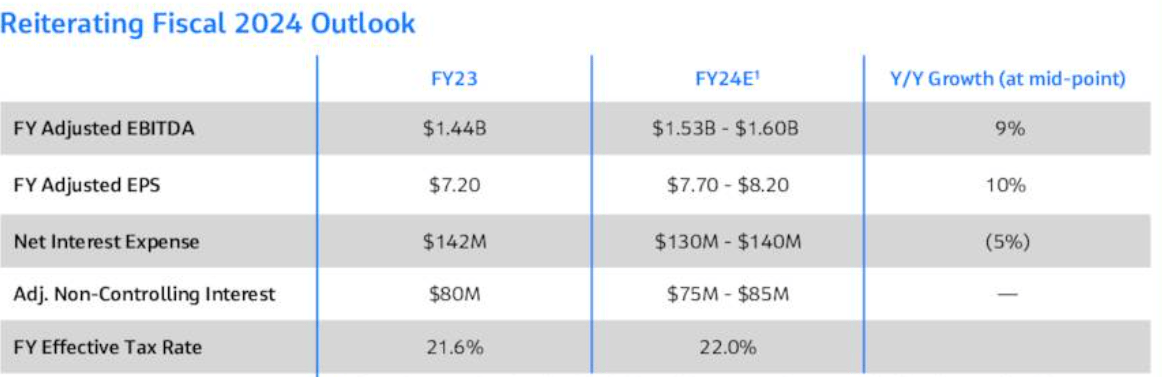

Guidance for 2024 was reiterated in Q1, committing to double-digit, multi-year earnings growth driven by accelerating revenue, improving margin performance, a strong backlog and a robust global sales pipeline.

Jacobs 2024 Outlook (Q1 Presentation)

Competitors

Technical consulting services is a battleground of competition, with each tender hotly contested across public and private clients. Jacobs has positioned itself as a market leader in a diverse array of sectors and services; however, I consider a peer group review an important part of evaluating the potential for investment.

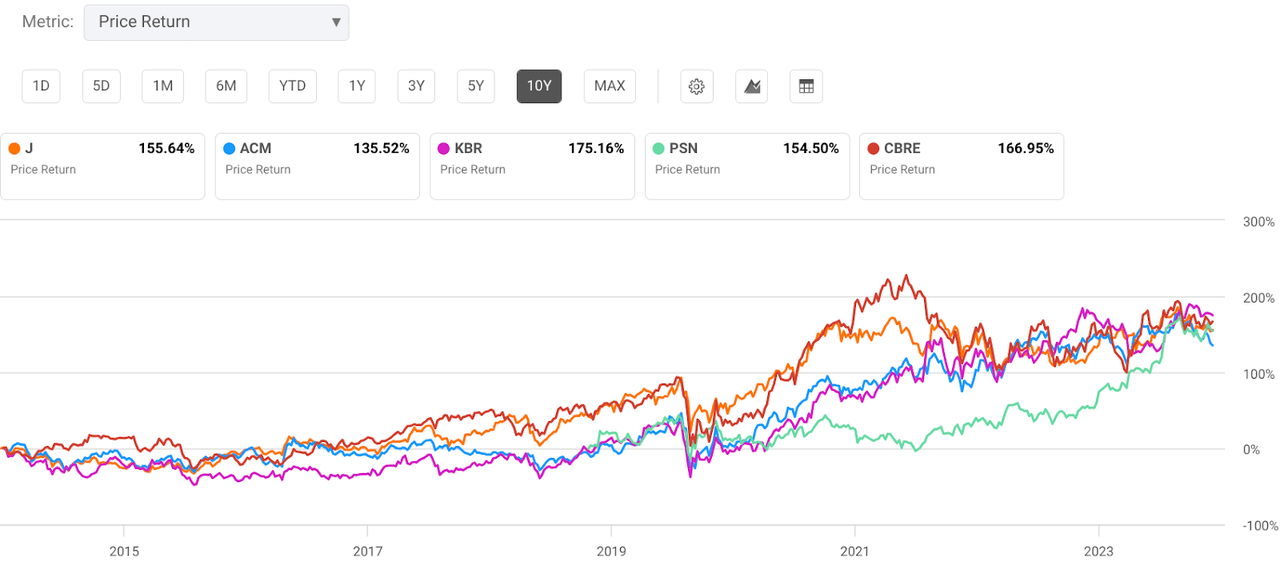

Starting with the share price returns for Jacobs and their close competitors, we can see the price return amongst the selected group is very comparable, indicating strong secular growth due to ongoing demand for these specialist technical services.

The group comprises five listed companies including Jacobs, benchmarked over a ten year timespan, displaying the share price return over the period:

-

Jacobs Solutions (J) – 155%

-

AECOM (ACM) – 135%

-

KBR, Inc. (KBR) – 175%

-

Parsons Corp. (PSN) – 154%

-

CBRE (CBRE) – 166%

Peer Group Share Price Returns (SA)

In a recent article on AECOM which can be read here, in which I rated the company a buy based on tailwinds in the sector, and the situation is similar for Jacobs. As can be seen in the above chart, Jacobs and their peers share price returns have been reasonably similar, and I expect this trend will continue due to the growing order backlog across the industry. I included CBRE in the list of competitors despite having less overlap in terms of services provided, however both operate across the same industries, as CBRE is more real estate-focused while the remainder of the peer group leans more towards the infrastructure sector.

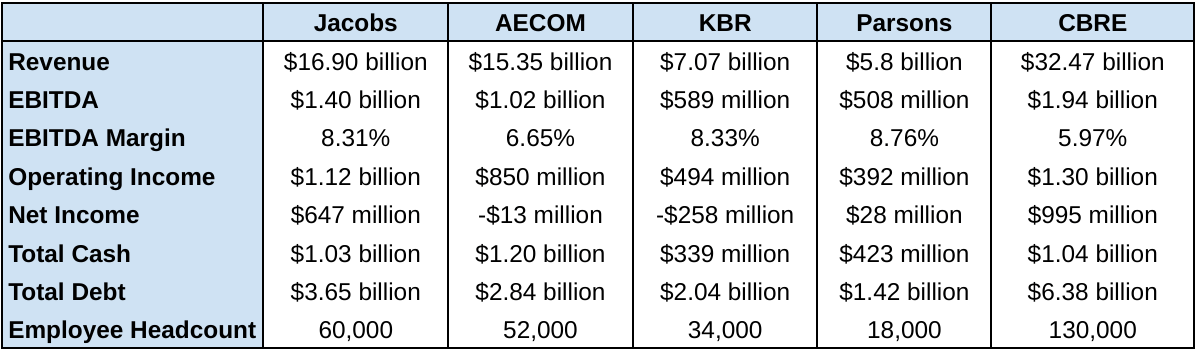

Taking a deeper dive into the peer comparison, the table below highlights Jacobs as a top performer compared to the group. Good profitability and a manageable debt position provide support for the forward price to earnings ratio at 17x.

Author (Company Data)

Risks

Macroeconomic conditions pose a threat to Jacob’s business. With operations in over 50 countries, this provides a sense of the specific country risks Jacobs are exposed to give the global nature of the business.

Labor availability – As a provider of technical services, skilled labor is an ongoing challenge for Jacobs. One method Jacobs uses to maintain and increase headcount is through upskilling and its graduate program, which enrolls freshly minted graduates into its training and mentorship programs, somewhat mitigating labor constraints.

The spin-off announced in November 2023 is scheduled for completion in the second half of 2024. As with any large corporate transaction, there is considerable risk involved, complicating matters further the spun-off business will form a merger in tandem with Amentum adding further risk.

Conclusion

Having been aware of Jacobs Solutions for over 15 years, and working in conjunction with some of their engineering team, this is the first deep dive I have conducted on the inner workings of the business. To say I am impressed with the company would be an understatement. I have been impressed by the growth in revenue, the increasing dividend and the potential benefits from the upcoming spinoff. However, at the same time, I am regretful that I have not started a position in Jacobs Solutions earlier! That said, I recently started a small position and will look to increase the position on any share price weakness. I rate Jacobs Solutions a Buy due to their industry-leading position with growing revenues and almost two years of work order backlog. The dividend may be small at present, however, growing over 11% annually should satisfy investors, furthermore, I believe Jacobs has the potential to become a long-term compounder and potentially a dividend growth investor’s pick of choice in the industrial sector, having 6 years of growing dividends and counting.