Lisa5201/iStock via Getty Images

The First Trust NASDAQ Clean Edge Smart Grid Infrastructure Index Fund ETF (NASDAQ:GRID) invests in companies within the electric infrastructure sector, with an emphasis on those focusing on smart grid features, including digital solutions. GRID is well-positioned to take advantage of surging electricity demand and production, due to the shift towards clean energy, EVs, and AI data centers. It also sports a slightly cheaper valuation than the S&P 500. GRID’s strong growth prospects and reasonable valuation make the fund a buy. With a 1.1% yield, the fund is an ineffective income vehicle.

GRID – Overview and Analysis

Index and Portfolio

GRID is an index fund, tracking the NASDAQ Clean Edge Smart Grid Infrastructure Index. It is a bespoke index, including companies classified as smart grid, electric infrastructure, EV network, smart building, and related activities, as determined by Clean Edge, long-time analysts in this area. As these are not strict or well-defined terms, Clean Edge has some leeway when constructing the index. It is a market-cap weighted index, with weight caps meant to ensure diversification. Pure play grid operators must account for 80% of the index, with more diversified players accounting for 20%. In my opinion, it is a reasonable index without any clear negatives or risks.

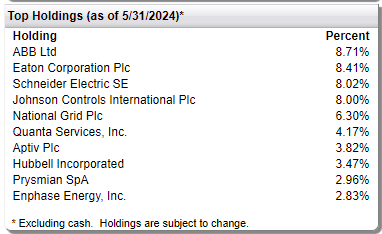

GRID invests in just over 100 companies, quite a bit for a small market niche. Largest of these are as follows:

GRID

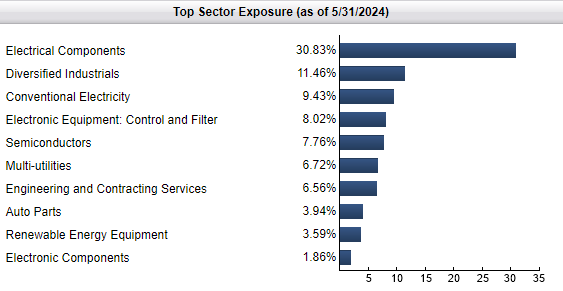

GRID seems to be overweight companies manufacturing electrical components, including cabling, solar inverters, substations, electric meters, and assorted digital products. As per the fund, these encompass almost a third of its portfolio, much higher than other segments.

GRID

The same is true of the fund’s largest holdings, with ABB (OTCPK:ABBNY) and Eaton Corporation (ETN) both focusing on electrical components. You also have more traditional grid operators, including National Grid plc (NGG), focusing on electricity distribution and transmission in the UK. A couple focus on clean energy, including Enphase Energy (ENPH) and SolarEdge Technologies (SEDG).

GRID is a global ETF, although it only invests in developed market equities. As per its latest semi-annual report, U.S. equities account for 30% of its portfolio, Ireland comes next at 18%, with no other country reaching double-digit weights. Most global equity ETFs have higher U.S. equity allocations, with the benchmark Vanguard Total World Stock ETF (VT) investing 62% of its portfolio in these securities.

Strong Growth Prospects

GRID’s investment thesis is quite simple, and rests on the fund’s strong growth prospects. Growth comes from several sources.

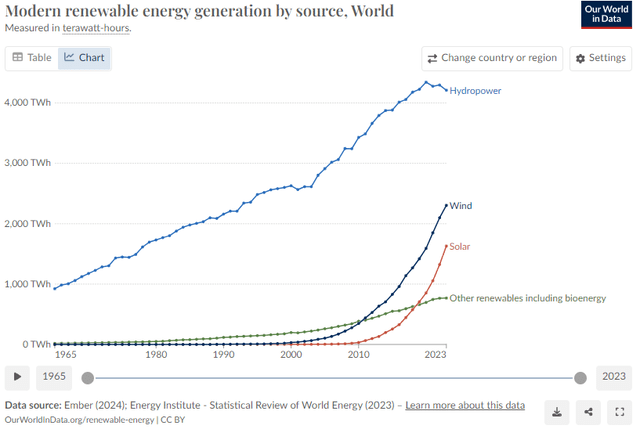

First, we have the clean energy transition, with renewable energy generation, mostly solar and wind, surging across the globe.

Our World In Data

Surging renewable energy generation has a significant positive impact on GRID’s underlying holdings. For some, the benefit is direct. Enphase energy might sell more solar panels, for instance. For most, the benefit is indirect. National Grid might need to invest in new transmission lines to connect UK wind farms to the national grid. Utilities are generally regulated, so such investments will almost certainly generate good profits for the company, and for its investors. As renewable energy is intermittent, companies will have to invest in energy storage, another key growth driver.

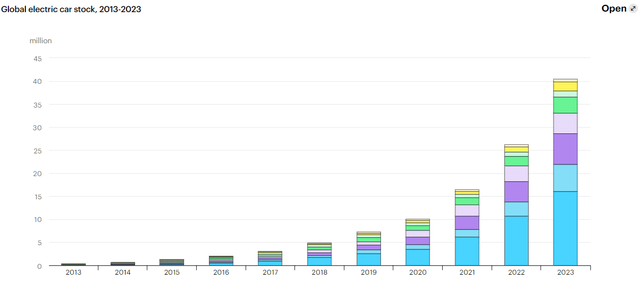

Second, the continued adoption of EVs should increase grid investments, similar to the above. More EVs means higher electricity demand, which means investments in energy generation, transmission, storage, etc. EVs are seeing massive growth, and so are a massive growth driver.

IEA

Third, we have the datacenter growth. Training and deploying AI models requires massive amounts of energy. Investments must be made to meet rising energy demand, with all the benefits that entails.

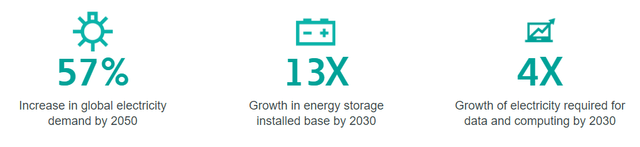

Overall, analysts expect low-to-moderate increases to energy demand, but higher increases to transmission lines, storage needs, and other assorted necessities. Some relevant figures.

Eaton Corp.

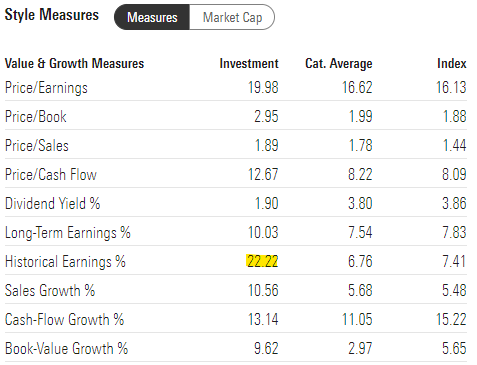

GRID is already benefitting from the trends above, with the fund’s underlying holdings seeing an average of 22.2% EPS growth in the past.

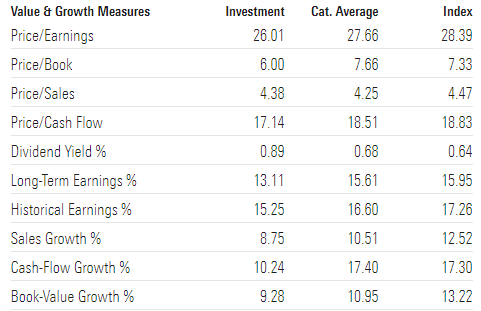

Morningstar

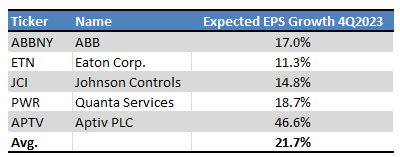

Expected growth seems about average at 10.0%, as per Morningstar figures. This is lower than I expected, and lower than EPS growth expectations for the fund’s largest holdings.

Morningstar

In my opinion, and notwithstanding the above, GRID will benefit from current economic and industry trends, and see significant, above-average revenue and earnings growth moving forward.

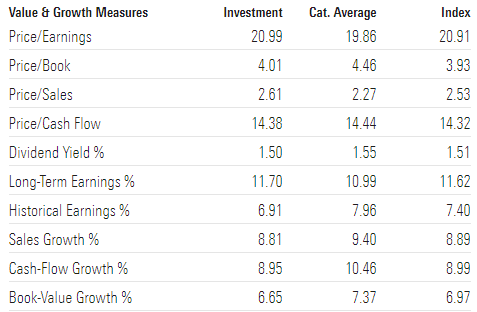

For reference, growth figures for the S&P 500.

Morningstar

Putting aside questions about the effectiveness or soundness of these trends, I’m in favor myself, I think we call all agree that the trends are real and will have a significant impact on the market moving forward.

Reasonable Valuation

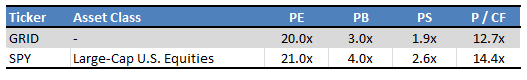

Growth investments tend to sport premium valuations, but that is mostly not the case for GRID. The fund’s valuation is slightly cheaper than that of the S&P 500, for instance.

Morningstar – Table by Author

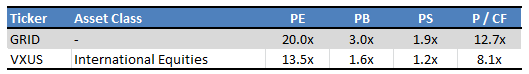

On the other hand, the fund is quite a bit more expensive than benchmark international equity index ETFs.

Morningstar – Table by Author

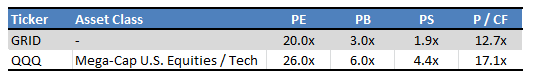

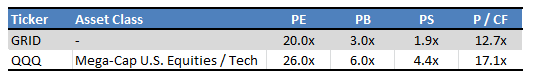

On a more positive note, the fund is massively cheaper than the Nasdaq-100:

Morningstar – Table by Author

and has seen higher earnings growth too, of 22.2% compared to 15.3% for the Nasdaq-100:

Morningstar

Overall, I would characterize GRID’s valuation as reasonable. It is higher than the international equity average, lower than the growth stock average, and very slightly lower than the S&P 500. Seems reasonable enough, to me at least.

GRID’s strong growth prospects and reasonable valuation are a solid combination. Investors must generally pay premium prices for strong growth, but that is not the case for GRID.

Performance Track-Record

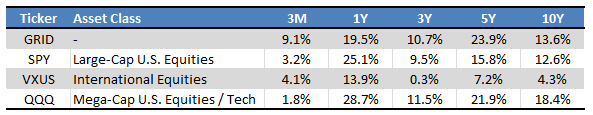

GRID’s performance track-record seems reasonably good, with the fund outperforming the S&P 500 and international equity benchmarks these past ten years. Performance has been particularly strong since early 2019, as clean energy stocks soared from 2019 to 2021, and as international equities have performed somewhat better post-pandemic. Although GRID has underperformed the Nasdaq-100 long-tern, it has outperformed these past five years.

Seeking Alpha – Table by Author

Overall, GRID’s performance track-record is reasonably good, especially for an international equity ETF.

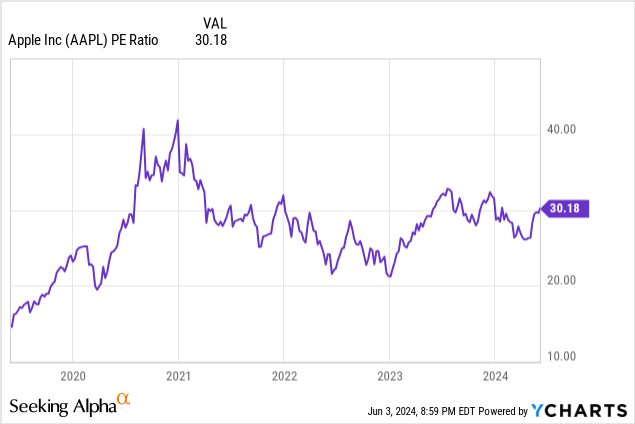

For many tech and growth names, higher share prices have led to skyrocketing valuations. As an example, Apple’s PE ratio has doubled these past five years, reaching 30.2x these past few weeks.

Data by YCharts

PE ratios for the fund’s largest holdings seem to have increased, but it does vary company to company. GRID does maintain a much cheaper valuation than the Nasdaq-100, too.

Morningstar – Table by Author

Conclusion

GRID invests in companies within the electric infrastructure sector, which are poised to benefit from the ongoing clean energy transition, massive EV adoption, and increased AI datacenter demand. GRID’s strong growth prospects and reasonable valuation make the fund a buy.