Funtap

Introduction

With interest rates likely to decline soon as many are projecting, the REIT sector will most likely see some nice upside as a result. Of course not all REITs will, but the higher-quality ones I think will definitely see a nice pop.

Additionally, as reliable income vehicles, I think dividend investors should own at least a decent percentage of them in their portfolios. Especially if you’re a retiree of age as you can hold them in a tax-advantaged account.

One that I think has long-term growth prospects is InvenTrust Properties Corp. (NYSE:IVT), a small-cap REIT that focuses on grocery-anchored shopping centers in the Sun Belt region. And in this article, I discuss the company’s latest earnings, growth and fundamentals, and why they are a shopping center focused REIT you should consider owning.

Why InvenTrust Properties?

Some may not prefer shopping center related REITs as they seem to experience slower growth. Everyone loves a fast-growing stock with fast-growing dividends. However, I think shopping center REITs are perfect as their income streams are as reliable as ever.

One reason is that they are typically recession-resistant, although they do experience some volatility during economic downturns. Reason being is most of IVT’s properties are anchored by grocery stores. And no matter what is happening in the economy, people have to shop and eat.

InvenTrust’s properties derive 87% of their annual rent from grocery stores, so their income streams are likely reliable in the face of adversity. Additionally, some of their top tenants include well-known companies like Kroger (KR), Albertsons (ACI), Publix, Best Buy (BBY), and Ulta Beauty (ULTA).

Attractive Growing Markets

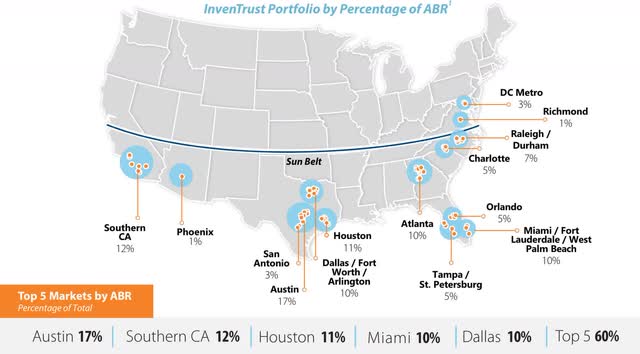

Aside from strong, well-known retailers, IVT also has a strong focus in attractive markets. Most of these are located in the growing Sun Belt region. Their top 5 markets include Austin, Dallas, Houston, Southern California, & Miami.

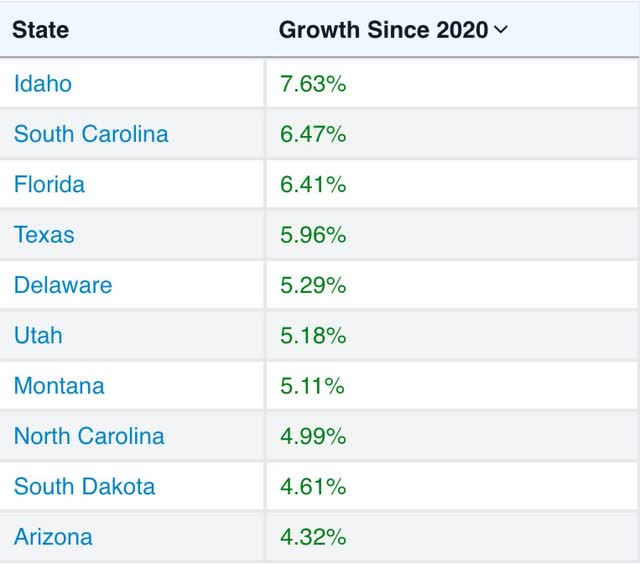

If you notice, 3 of their 5 top markets are in the state of Texas. Since the pandemic, Texas has experienced the 4th highest growth rate amongst states in the U.S. And I don’t anticipate this slowing down anytime soon due to a cheaper cost of living. Especially comparing them to states like California and New York.

As a resident of Southern California currently, I can attest to the cheaper costs in states like Florida and Texas. Moreover, with high inflation and prices likely not going back to pre-pandemic levels, states with cheaper costs of living will likely continue seeing growth in the coming years.

Out of the top 25 fastest-growing cities projected for 2024 – 2025, InvenTrust Properties has a great deal of theirs located in these cities. These include the likes of Tampa, Phoenix, Austin, and Orlando. During their most recent quarter IVT closed on an acquisition in Phoenix, their first one for 2024. And seeing how the REIT only has 63 properties, they will likely continue this in the coming years.

Another REIT with a focus on shopping centers and grocery-anchored stores is Dividend King, Federal Realty Trust (FRT). Comparing InvenTrust Properties Corp. to them, IVT presents better growth prospects in my opinion. FRT is a well-established REIT with a long operating history founded in 1962.

But because IVT is smaller and has a focus on the Sun Belt region, I think they will likely see better long-term growth. Most of FRT’s properties are located on the Eastern side of the United States in places like Boston, New York, and Philadelphia. They do have properties in Southern California as well as Florida.

But most of their properties are focused on the Eastern region. Additionally, FRT’s property locations are in states with the highest outbound migration, likely due to higher taxes and weather. Especially when it comes to states like California and New York.

Earnings & Guidance

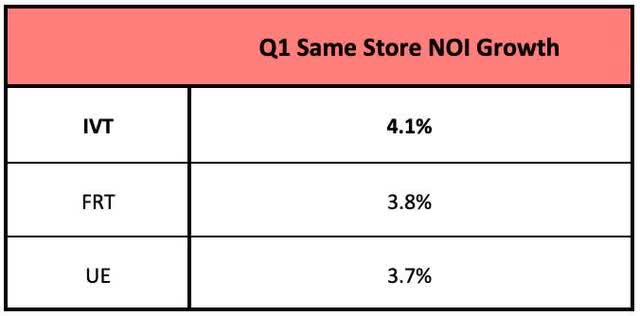

InvenTrust Properties most recently reported their Q1 earnings with FFO of $0.45 and core FFO of $0.44. This was up 9.8% from the prior year, signaling strong growth from the REIT. Core FFO grew slightly higher year-over-year, up 10%. This was primarily driven by same-store NOI growth, which came in at 4.1%. This was also driven by acquisitions.

For context, IVT’s same-store NOI growth was higher than both peers Federal Realty Trust & Urban Edge Properties’ (UE) 3.8% and 3.7% respectively. This strong growth led to management updating their NOI guidance, which is now expected to come in between 2.75% – 3.75%, up 50 basis points. FFO guidance was also raised, with core FFO expected to be $1.67 – $1.71. This represents a growth rate of 2.42% at mid-point from $1.65 the REIT brought in for 2023.

Dividend

InvenTrust Properties’ yield may not seem attractive at less than 4%, but their retained cash means the REIT can conduct larger increases in the future. For Q1, IVT’s core FFO was $30 million, up from $27.4 million a year ago. This gives them a very conservative payout ratio of roughly 51% using the company’s shares outstanding.

Additionally, this gives them plenty of extra capital for organic growth in the future. It also gives them an extra cushion for larger increases, although I suspect the REIT will focus on allocating their capital towards growing with acquisitions. Moreover, shareholders will likely see small increases while IVT focuses on growth efforts.

Balance Sheet

IVT’s balance sheet was also solid with an investment-grade credit rating from Fitch. Furthermore, their balance sheet was one of the lowest-leveraged with a net debt to EBITDA of just 5.1x. This is in comparison to Urban Edge Properties’ 6.6x and Tanger Inc.’s (SKT) 5.7x. Federal Realty Trust had a net debt to EBITDA of 5.9x.

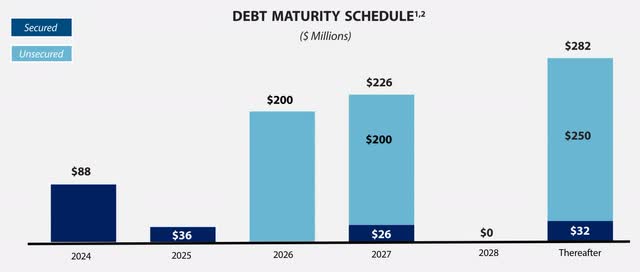

InvenTrust also had a manageable amount of debt maturing over the next two years and ample liquidity in the amount of $421 million. They also had a healthy fixed-charge coverage ratio of 4.3x and a weighted-average maturity date of nearly 4 years.

Valuation

InvenTrust Properties forward P/FFO currently stands at 14.45x. This is in comparison to SKT’s 13x and Urban Edge Properties 14.5x. So, while the REIT is not necessarily cheap, I think they still will see some upside in the coming months as a result of lower interest rates.

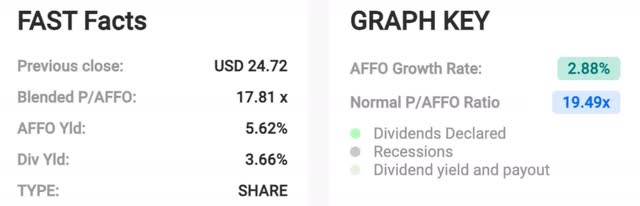

Additionally, the stock has buy ratings from both Quant and Wall Street with roughly 15% upside. Shortly after the first interest rate hike, the stock traded above $31 a share, implying a P/FFO multiple over 18x. IVT has a blended multiple of 17.81x, which I think the stock could potentially see again in the coming months. This implies a price of $30, 23% upside from the current (price) of $24.76.

Risks & Conclusion

IVT’s biggest risk at the moment is interest rates. Although I do anticipate them to decline in the back half of the year, the FED could decide to keep rates elevated to continue battling inflation.

If so, this could push the economy into a recession, likely impacting the REIT’s financials. It may also lead to lower occupancy ratings, especially in the small-shop portfolio. Although their overall portfolio is healthy at 96.3% leased, their small-shop portfolio’s occupancy is lower at 92.1%.

And if the economy does fall into a recession, this would likely negatively impact smaller retailers in the process. In the coming months, this is something investors should keep an eye on going forward. Although I suspect the company will be fine, it is all dependent on the severity.

InvenTrust Properties has all the makings of a long-term growth vehicle. Strong tenants, recession-resistant business structure, and solid growth anticipated going forward.

And although their dividend yield is lower, their payout ratio makes them great for long-term growth moving ahead. Moreover, IVT is not necessarily cheap, but I think this speaks to their quality. And still, they offer double-digit upside. As a result, I rate InvenTrust Properties Corp. a buy.