Earnings results often indicate what direction a company will take in the months ahead. With Q1 now behind us, let’s have a look at MRC Global (NYSE:MRC) and its peers.

Focusing on narrow product categories that can lead to economies of scale, infrastructure distributors sell essential goods that often enjoy more predictable revenue streams. For example, the ongoing inspection, maintenance, and replacement of pipes and water pumps are critical to a functioning society, rendering them non-discretionary. Lately, innovation to address trends like water conservation has driven incremental sales. But like the broader industrials sector, infrastructure distributors are also at the whim of economic cycles as external factors like interest rates can greatly impact commercial and residential construction projects that drive demand for infrastructure products.

The 4 infrastructure distributors stocks we track reported a weaker Q1; on average, revenues beat analyst consensus estimates by 1%. Stocks, especially growth stocks where cash flows further in the future are more important to the story, had a good end of 2023. But the beginning of 2024 has seen more volatile stock performance due to mixed inflation data, and while some of the infrastructure distributors stocks have fared somewhat better than others, they collectively declined, with share prices falling 1.4% on average since the previous earnings results.

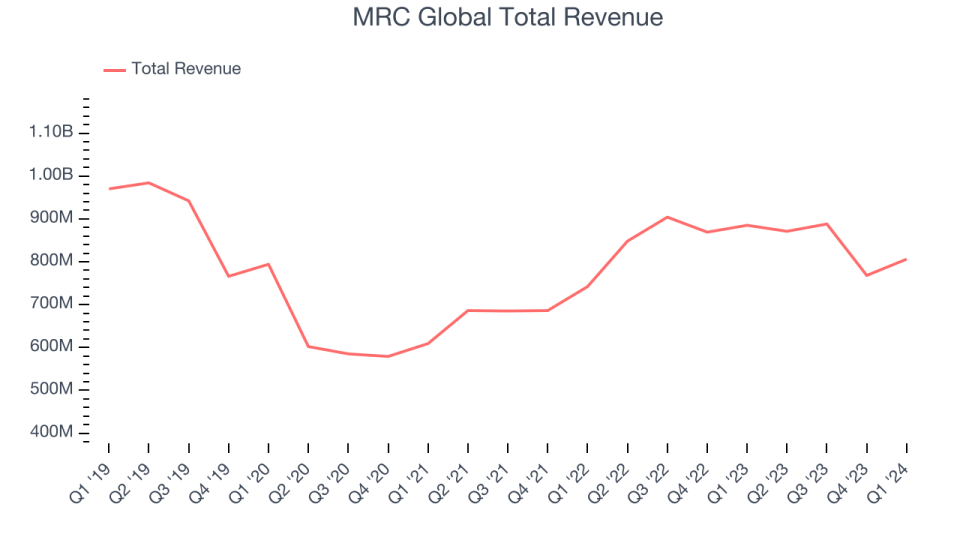

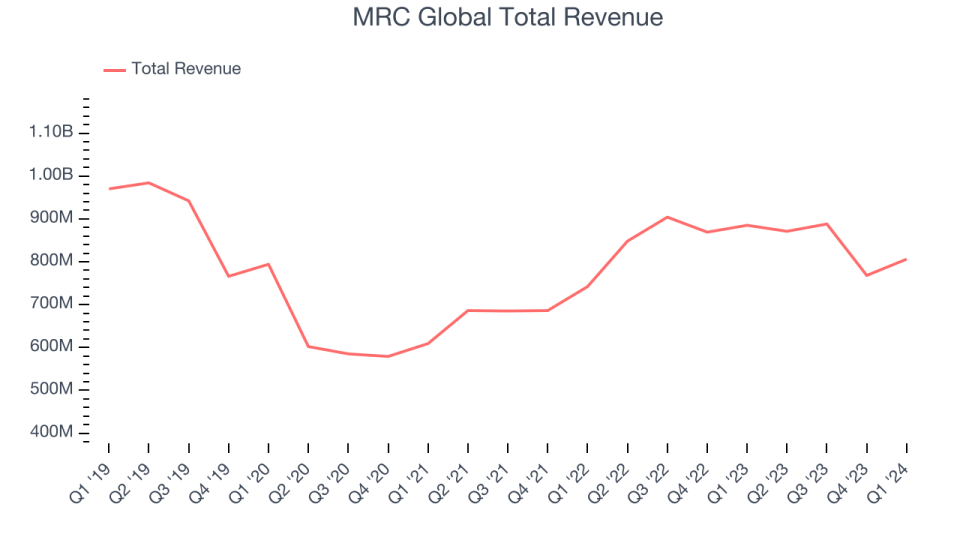

Best Q1: MRC Global (NYSE:MRC)

Originally founded in the 1920s as McJunkin Supply Company, MRC (NYSE:MRC) today offers pipes, valves, and fitting products for various industries.

MRC Global reported revenues of $806 million, down 8.9% year on year, topping analysts’ expectations by 6%. It was a very strong quarter for the company, with an impressive beat of analysts’ earnings estimates.

Rob Saltiel, MRC Global’s President and CEO stated, “Our commitment to improving capital returns, maintaining cost discipline and generating cash across the market cycle is reflected in our excellent results this quarter. We exceeded our expectations with sequential revenue growth of 5% and adjusted EBITDA margins of 7.1%. We believe that our business has turned the corner after the lower activity levels of the fourth quarter of 2023.

MRC Global achieved the biggest analyst estimates beat but had the slowest revenue growth of the whole group. The stock is up 4.6% since the results and currently trades at $12.26.

Is now the time to buy MRC Global? Access our full analysis of the earnings results here, it’s free.

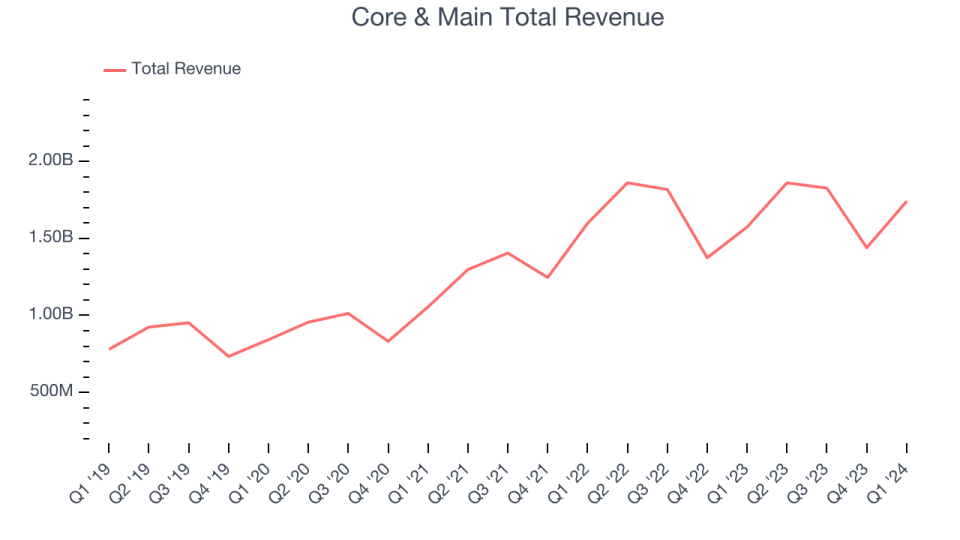

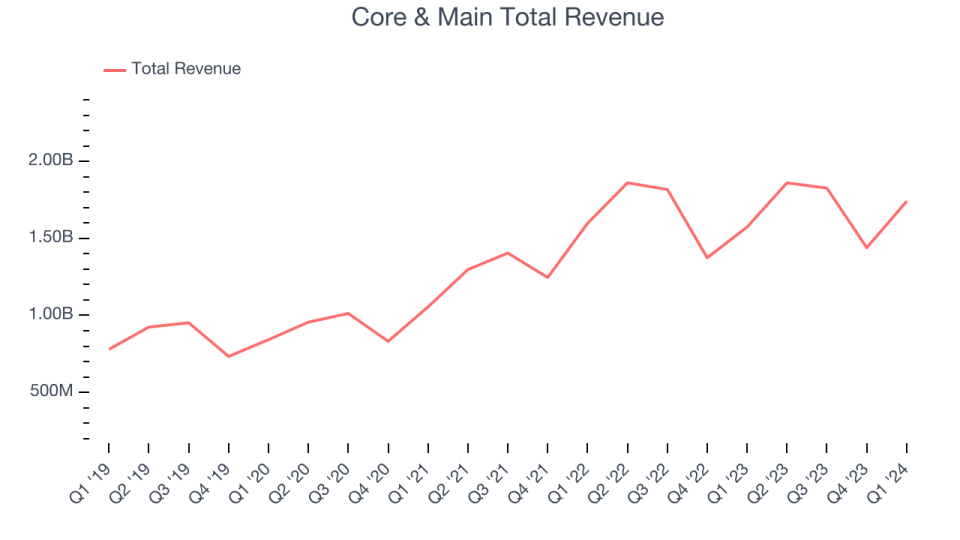

Core & Main (NYSE:CNM)

Formerly a division of industrial distributor HD Supply, Core & Main (NYSE:CNM) is a provider of water, wastewater, and fire protection products and services.

Core & Main reported revenues of $1.74 billion, up 10.6% year on year, outperforming analysts’ expectations by 1.1%. It was an ok quarter for the company, with a decent beat of analysts’ organic revenue estimates but a miss of analysts’ earnings estimates.

Core & Main pulled off the fastest revenue growth among its peers. The stock is down 13.9% since the results and currently trades at $48.35.

Is now the time to buy Core & Main? Access our full analysis of the earnings results here, it’s free.

Watsco (NYSE:WSO)

Originally a manufacturing company, Watsco (NYSE:WSO) today only distributes air conditioning, heating, and refrigeration equipment, as well as related parts and supplies.

Watsco reported revenues of $1.56 billion, flat year on year, falling short of analysts’ expectations by 2%. It was a weak quarter for the company, with a miss of analysts’ earnings estimates.

Watsco had the weakest performance against analyst estimates in the group. The stock is up 16.4% since the results and currently trades at $481.34.

Read our full analysis of Watsco’s results here.

NOW (NYSE:DNOW)

Spun off from National Oilwell Varco, NOW Inc. (NYSE:DNOW) provides distribution and supply chain solutions for the energy and industrial end markets.

NOW reported revenues of $563 million, down 3.6% year on year, falling short of analysts’ expectations by 1.1%. It was a weak quarter for the company, with a miss of analysts’ revenue and EPS estimates.

The stock is down 12.9% since the results and currently trades at $12.95.

Read our full, actionable report on NOW here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.