On Episode 291 of Frequent Miler on the Air (Rocking Shopping Portals for Huge Rewards), we talked about our favorite shopping portals and tips/techniques for stacking rewards. In response, a reader alerted us to the existence of a portal we hadn’t seen — and in turn, that caused me to think about the opportunity cost of using their preferred portal and how the same math could apply to many other situations, including the American Airlines Loyalty Points games and now earning status with Alaska through online shopping. I will run the numbers first through the lens of the reader who asked, but the idea is that the same type of math should be applied in many other portal comparisons. Spoiler alert: I can’t answer the title question, but hopefully the post makes you think about your answer.

Yes, you can stack portal rewards with elite benefits, elite night credit, and hotel rewards

The reader who I’ll call Bill reached out to ask this question:

I am currently interested in using a portal sponsored by Penn Gaming. I see that they offer Penn Cash as well as Tier Credits when you purchase through them. They have two partners, Choice Hotels and Marriott Bonvoy on their site that are of particular interest to me. Last night after watching your episode, I went to the portal and clicked on both hotel companies just to see what would happen. I expected it would take me somewhere that I could purchase gift cards for use at the property. Instead, it took me to their respective booking pages.

As I had landed on the booking page via a third-party site, I was not signed in with my rewards number. I am an elite member with both Choice and Marriott. My question is, could I sign in and collect both the shopping portal benefits and the reward points, stay credits and elite member benefits? Or by signing in would I destroy the link between the two sites? Or, since hotel companies do not typically offer points and benefits when you book through a third party, would I be out of luck?

Let’s get a base-level understanding out of the way: clicking through a shopping portal to a hotel-branded website is a great way to stack both portal rewards and hotel rewards / elite credit / elite benefits. The scenario Bill is describing is one that works through many/most portals — you click the portal link to the hotel website and then book directly through the hotel and receive rewards from both the portal and the hotel program. That is not a third-party booking since you’re not booking through a third party website (like Expedia, Priceline, Rocketmiles, et al) but rather booking directly through the chain. Contrary to popular belief, you don’t need to book a prepaid rate! Booking a rate that you pay later at the hotel is fine — you’ll earn rewards based on the rate offered at the time when you clicked through and booked, but you’ll earn your rewards sometime after the stay is completed (typically 30-90 days after the stay).

So yes, Bill can click through from the PENN Gaming shopping portal and it will take him to the Marriott or Choice Privileges home page and he can sign in to his respective accounts and proceed to book and he’ll earn rewards from both the PENN Gaming portal and Marriott or Choice and he’ll get any elite benefits he is due as well.

However, when I took a look at the PENN Gaming portal, I understood why Bill was interested in using it, but I encouraged him to do the math to compare rates.

A portal offering “cash” back + elite credit

Bill’s preferred portal in this case is the PENN Gaming shopping portal. PENN Gaming is a casino company that operates numerous casinos across the country (many branded “Hollywood Casino”, though they have casinos under other brand names also). You can find locations here.

The PENN Gaming shopping portal is called PENN Marketplace, and it offers the chance to earn “PENN Cash” and PENN Play tier credits.

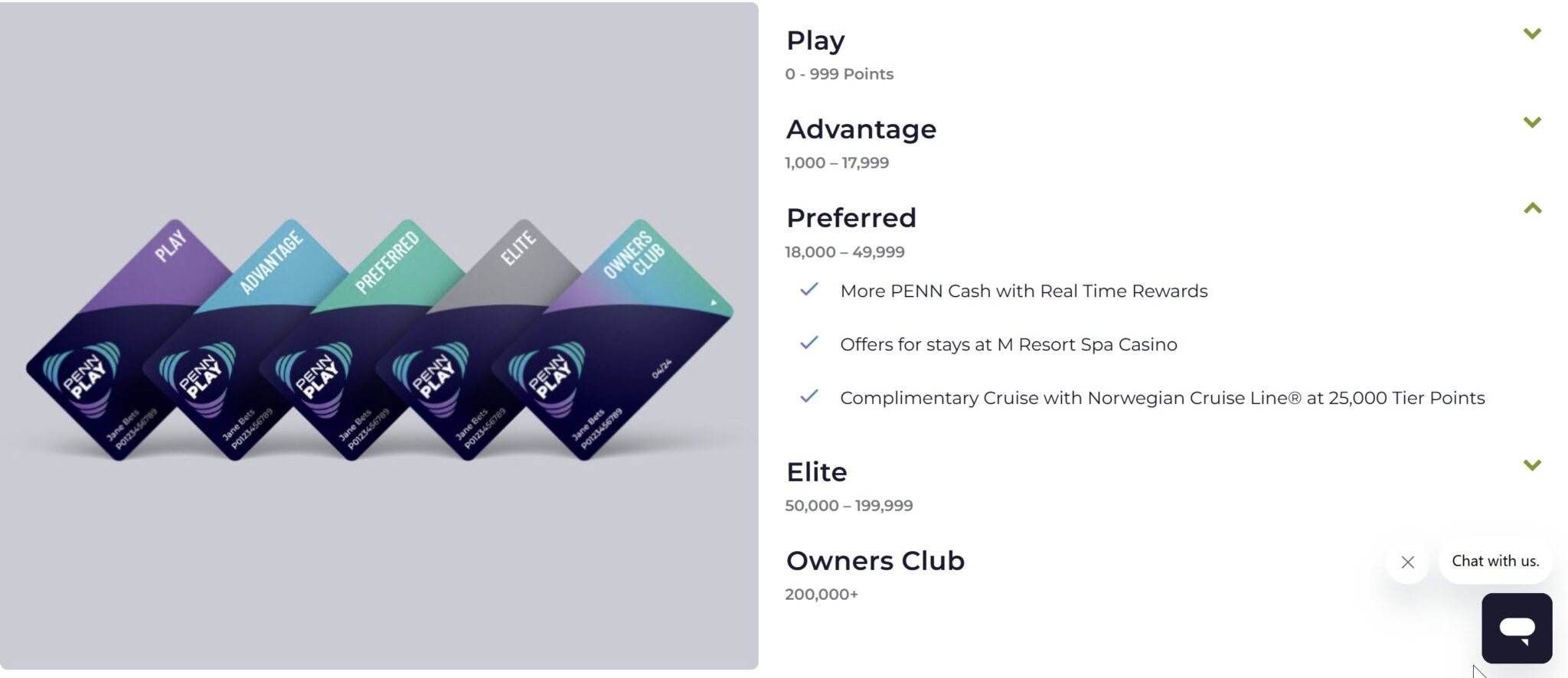

Like most casino rewards program, PENN Gaming offers a rewards program, in this case called PENN Play. The program offers the chance to earn rewards that can only be spent at their casinos (“PENN Cash” in this case) and they also offer an elite status program whereby those who earn enough “tier credits” can enjoy various benefits. You can read more about PENN Play Rewards here, but below is a look at their tier point requirements for various statuses (note that I’ve intentionally expanded the benefits at the mid-tier “Preferred” level on the right):

As you can see, members start at the “Play” level and need to earn 1,000 tier points for the “Advantage” level, 18,000 tier points for the “Preferred” level, and so on. I intentionally expanded the benefits for the Preferred level because the free cruise with Norwegian at 25,000 tier points seemed like the first benefit that could conceivably be worth chasing. It’s worth noting that both “Elite” and “Owners Club” tiers specify a complimentary 7-night Norwegian cruise, whereas the Preferred level doesn’t mention the number of nights for the cruise.

Again, making purchases through the PENN Marketplace offers the chance to both earn “cash back” (that can only be used at PENN properties) and PENN Rewards tier credits. Bill was excited to learn that on top of those things he can also earn Marriott Bonvoy points or Choice Privileges points and elite credit / benefits for his stay. But is it a good trade to use this portal over other available options? How much are tier points worth? It isn’t easy to definitively answer that last question, and that is how a portal like this one encourages people into irrational decisions.

What’s the cost of using the PENN Marketplace portal?

What initially stood out to me about Bill’s question is that loyalty programs are designed to influence irrational decisions. Many of us chase status at a real cost that should make us question the value of chasing. Bill’s situation closely mirrors and is relevant to those of us chasing status with many airline or hotel programs (like through airline shopping portals).

In Bill’s case, he’s considering using the PENN Marketplace portal to book paid Marriott and Choice Privileges hotel stays. At the time of writing, PENN Marketplace is offering:

- 1.35% back in PENN Cash + 4% in tier points for Marriott

- 0.68%*** back in PENN Cash + 4% in tier points for Choice Hotels

Before I dive in further, I want to note the asterisks next to the rate for Choice Hotels to highlight a common occurrence: many shopping portals list rates for a hotel chain (like Choice Hotels) and also list separate rates for individual brands within that chain. In this case, PENN Marketplace lists Choice Hotels at 0.68%, but they list Comfort Inn, Comfort Suites, and Quality Inn (and maybe others?) separately at 1.69% back. Clicking through from any of those brands really just brings you to the Choice Hotels home page. If you click through from the Comfort Inn link but ultimately book another brand (like Clarion/Cambria/Radisson etc), you will most likely get the 1.69% back so long as you start on the Comfort Inn / Quality Inn / Comfort Suites page at PENN Gaming. The moral of the story is that Bill could be earning 1.69% back at any Choice property.

However, what should stand out to those who are frequent shopping portal users is that those rewards rates are well below average for either chain.

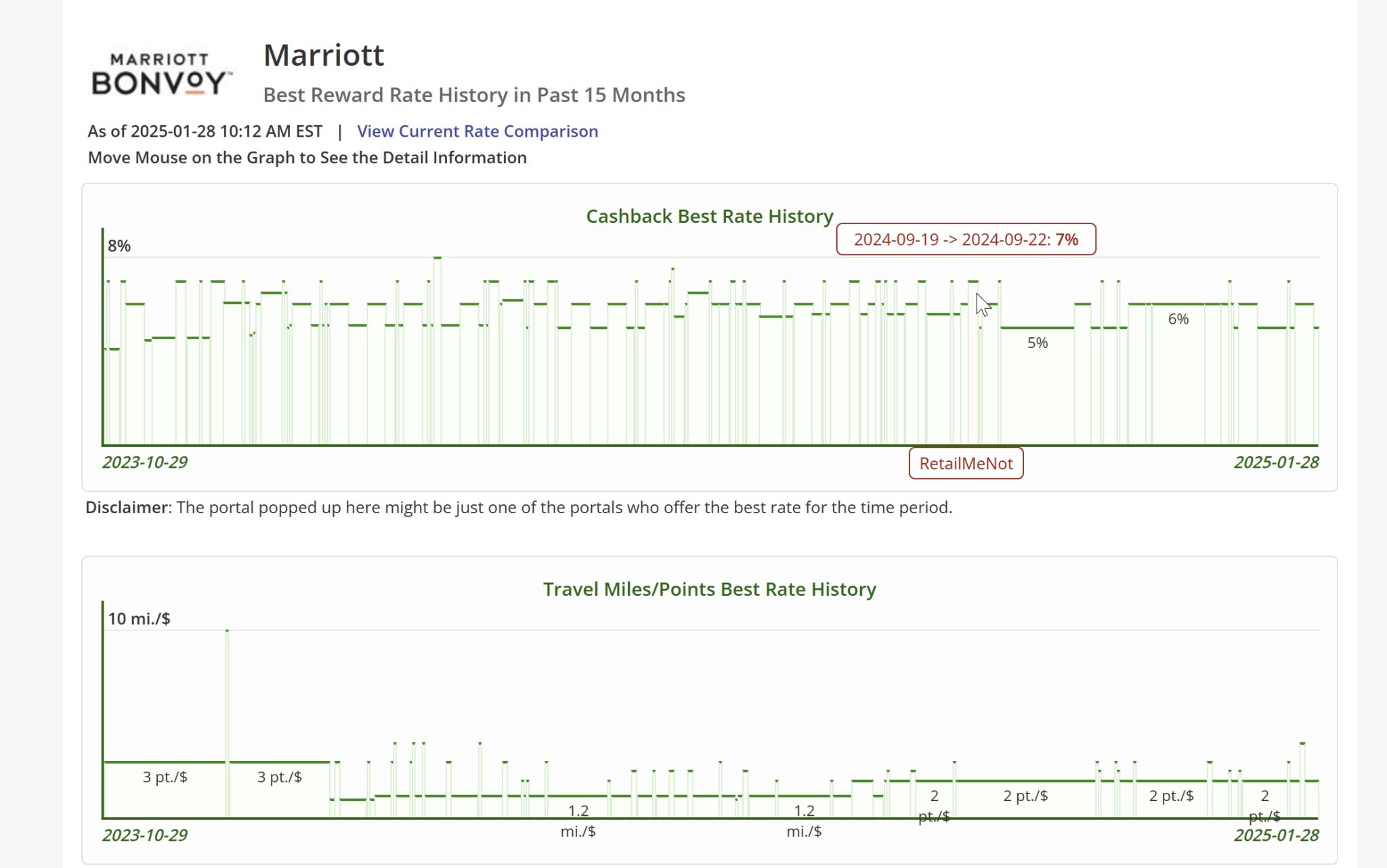

A quick look at shopping portal comparison site Cashbackmonitor.com shows that current rates for Marriott are as high as 5% cash back.

However, that’s not even the whole story. Looking at the 15-month history, we can see that Marriott is almost always available with a portal rate of at least 5% and we’ve seen the rate climb to as high as 7% with some frequency, particularly during the fall (hovering over the bars shows which portal offered the high rate — the 7% mostly came from either TopCashBack or Retailmenot).

Furthermore, Capital One Shopping users know that targeted rates can climb significantly higher yet. I’ve received offers for as much as 18% back at Marriott (rare, but I’ve gotten it more than once) and 30% back at Choice (I’ve gotten this rate quite a few times).

The opportunity cost of using PENN Marketplace is quite high.

To put some numbers to that statement, let’s imagine that Bill were going make a $1,000 Marriott booking. He could choose one of the following portals:

- PENN Marketplace: Earn $13.50 in PENN Cash and 40 tier points

- Hoopla Doopla: Earn $50

- Rakuten: Earn $40 or 4,000 American Express Membership Rewards points

Bill has a stated preference for earning through PENN in order to earn both “cash” rewards and tier credits. But how much are those tier credits costing him?

Let’s first compare PENN Marketplace against earning 5% cash back. With PENN Marketplace, Bill earns $13.50 in rewards that can only be used at PENN properties (or perhaps with their online casino/marketplace?) and 40 elite tier credits. If Bill instead chose to earn 5% cash back, he’d have $50 in his pocket that he could use any way he chooses. If he wants to spend $13.50 at PENN, he can do that and have $36.50 left over. In other words, after using some of his cash to account for the maximum value of the $13.50 being offered by PENN, his choice is to earn an additional $36.50 in cash or 40 tier credits.

- $36.50 / 40 tier credits = $0.9125 per tier credit

As you can see in the equation above, in that scenario, every 1 tier credit is costing Bill the chance to have earned more than 91 cents. That may not sound like a lot on a small scale, but let’s expand that to more meaningful numbers: at that rate, every 1,000 tier credits costs him $91.25. Every 10,000 tier credits costs him $912.50. The 25,000 tier credits necessary for the “free” Norwegian cruise costs him $2,281.25 that he could have had in cash if he had chosen to earn 5% back instead of what PENN is offering. That might have been enough cash to straight up purchase the cruise outright — and remember that’s accounting for the $13.50 in Penn cash each time! The actual amount of shopping portal spend that would be required to earn enough tier credits for the “free” cruise based is $100,000 in purchases. If Bill spent $100K through their portal on Marriott bookings, he’d earn 25,000 tier credits and $1,350 in PENN cash. But if he earned 5% cash back on the same spend, he could have alternatively had $5,000 in cash in his pocket! That’s almost surely enough to pay for the cruise and have more than $1,350 left over to spend at PENN casinos — or anywhere he wants.

To be clear, Bill didn’t mention the cruise or why he was after PENN status, and I can’t imagine that anyone would make $100K in hotel bookings to earn elite status with a casino chain. I’m just using that as an example that makes the comparison more concrete. I imagine that someone who cares about PENN elite status is probably gambling enough to earn some significant portion of tier credits based on their play and is really only looking to the portal to supplement that. Still, the opportunity cost is high.

However, in this example, the portal currently offering 5% back is Hoopla Doopla. I’ve personally never used Hoopla Doopla, but I took a look at their restrictions for Marriott and it isn’t as simple as the math above — they only offer the headline rate for the first $300 in a booking, then 1%, and blah blah blah. I wouldn’t personally choose Hoopla Hoopla in this case, but I used that as a point of comparison because TopCashBack sometimes offers as much as 7% back without the list of “gotchas” and Capital One Shopping frequently offers far more. The purpose here was to show how far behind PENN is even when compared against 5%. The gap can widen quickly when compared against even better portal rates.

Another option included above is Rakuten, which is one of our favorite portals. That is in part because of positive past experience, but also because of the ability to earn Amex Membership Rewards points. We value those points at 1.55c per point according to our Reasonable Redemption Values, so 4% at Rakuten, which we choose to earn as 4x Membership Rewards points, is roughly equivalent to an expected 6.2% return with minimal effort at maximizing. Realistically, I know I’ll very likely use the points to even better value.

The same comparison points offer similar perspectives, but this time let’s imagine that Bill makes ten bookings of $1,000 each for a total of $10,000 spent. He could earn:

- PENN Marketplace: $135 in PENN Cash + 400 tier credits on $10K spend

- Rakuten: $400 cash back or 40,000 Membership Rewards points on $10K spend

The 40,000 Membership Rewards points are alternatively nearly enough points for a one-way business class award ticket to Europe with some programs (particularly with a transfer bonus). Alternatively, you could book multiple round trip short-haul domestic trips via some transfer partners. Either way, I’d have to really value the combination of PENN Cash and tier credits for that to move the needle toward PENN — and since the PENN Cash is more restrictive than actual cash, I wouldn’t actually consider it to be worth its face value.

Now let’s imagine a world where Bill could get a targeted Capital One Shopping offer of at least 18%. That same $10,000 in bookings would yield $1,800 in gift cards. Capital One Shopping Rewards can only be redeemed for gift cards, but Bill could nonetheless redeem for gift cards to places like Kroger, Safeway, DoorDash, Uber, Hotels.com, etc and have eighteen hundred dollars instead of $135 in funny money and 400 tier credits. That’s a huge difference. Keep in mind that there’s no guarantee that Bill will get a similar targeted offer, nor that such an offer will be around on the day when he needs to make a booking, but the bottom line is that it’s possible to do far better than 1.35% and 4% back in tier credits. At the time of writing, the best public portal rate for Choice Privileges is 8.08% back, though I got targeted for a rate of 30% back from Capital One Shopping just a few days ago.

For someone chasing a “free” cruise with rewards, it might be worth chasing Capital One Shopping offers instead of PENN Marketplace since one of the redemption options through Capital One Shopping is Celebrity Cruise Lines gift cards. Now that I say that out loud, that might just be my next cruise to chase :-D.

Why am I picking on this example and how is it applicable to other things we do?

To be clear, I’m not picking on Bill. Stacking portal rewards and hotel rewards is unfamiliar territory for many people. Since learning that he can stack with hotel benefits, Bill may have already been doing the math and quickly seeing that the PENN Marketplace isn’t ideal for him. This example isn’t really about making a mountain out of Bill’s molehill as much as it is about hopefully encouraging everyone to carefully consider which shopping portal is best — and, more importantly, how much it is worth forgoing in the name of elite credit with murky value.

For instance, the American Airlines eShopping portal offers the opportunity to earn both airline miles and elite status credit in the form of Loyalty Points. When American began offering that combination, I had assumed that I would likely earn a lot of Loyalty Points through shopping — likely enough for some level of elite status each year.

However, I’ve found myself choosing the AAdvantage eShopping portal much less than I originally anticipated, largely because of the fact that the payouts at other portals, particularly Capital One Shopping with targeted offers, have been so high as to make the prospect of using the AAdvantage eShopping portal feel pretty expensive.

As an example, I’ve made a number of purchases at GiftCards.com. American Airlines AAdvantage eShopping has mostly been offering 1 or 2 miles per dollar spent at GiftCards.com. Even on the rare occasion when the payout has hit 3 miles per dollar spent, it simply hasn’t been worth it to me over other portals. I’ve had an almost constant Capital One Shopping offer of 9-10% back at GiftCards.com (and occasionally as high as 18% back, though that’s been rare). To keep numbers simple, imagine a $1,000 purchase: At the best rate we’ve seen from American Airlines, I could have earned 3,000 American Airlines miles (and 3,000 Loyalty Points). If I value the miles at 1.5c per mile, that’s $45 worth of miles. It is far harder to pinpoint an exact value on the Loyalty Points, so let’s reverse-engineer that: at my common 9-10% targeted rate, I could be earning $90-$100 back from Capital One Shopping. Are $45 worth of miles and 3,000 Loyalty Points worth more than $90 or $100 in gift cards? I certainly haven’t thought so.

But the point of the post isn’t really to tell you that the Loyalty Points or Bill’s PENN Play tier credits aren’t worth it, but rather to encourage you to consider the cost of earning them as compared to your next best alternative. Maybe Bill currently has 24,960 PENN Play tier credits and he is just 40 tier points shy of that free cruise with Norwegian. He could make that single $1,000 Marriott booking through PENN Marketplace to reach that valuable benefit. In that case, it probably is worth using the PENN Marketplace since he may only be missing out on ~$40 in additional rewards value on the individual purchase, but the would be gaining a perk (that free cruise!) that is worth much more. The same is true for other situations where an individual purchase (or maybe even a couple of purchases) could bridge the gap to a super valuable reward.

Bottom line

Loyalty programs often make us do irrational things like spending more money, booking hotels that we don’t actually need, or choosing a shopping portal that offers elite credit over one that offers more cash in our pockets. That might make sense if we can get a valuable perk for a reasonable cost, but make sure that you’re doing the math so that you’re not giving up so much value that you could have bought the perk and had money left over.

Want to learn more about miles and points? Subscribe to email updates or check out our podcast on your favorite podcast platform.