This is just a sneak peek at the thousands of consumer insights available to CivicScience clients. Discover more data.

Thanksgiving is now just two weeks away, which means American holiday shopping is likely to start heating up quite a bit. Holiday shopping certainly encompasses many different types of gifts, though gift cards appear likely to feature prominently this year.

New CivicScience data indicate that toys are set to play a slightly larger role in holiday shopping this year. Sixty-four percent of U.S. adults report plans to purchase toys this holiday season – a two-point increase over 2023. Additionally, Americans are ready to spend more, with 14% expecting to spend over $200 on toys, up from 11% last year.

As Americans prepare to spend more on toys, it’s unsurprising to see that ‘price’ (36%) and ‘quality and durability’ (34%) are the leading factors in guiding which toys they buy. These attributes greatly outshine ‘brand’ (8%), ‘availability online’ (7%), and ‘popularity/trendiness,’ highlighting what matters most to holiday shoppers selecting toys.1

Let Us Know: Do you plan on buying toys this year for the holiday season?

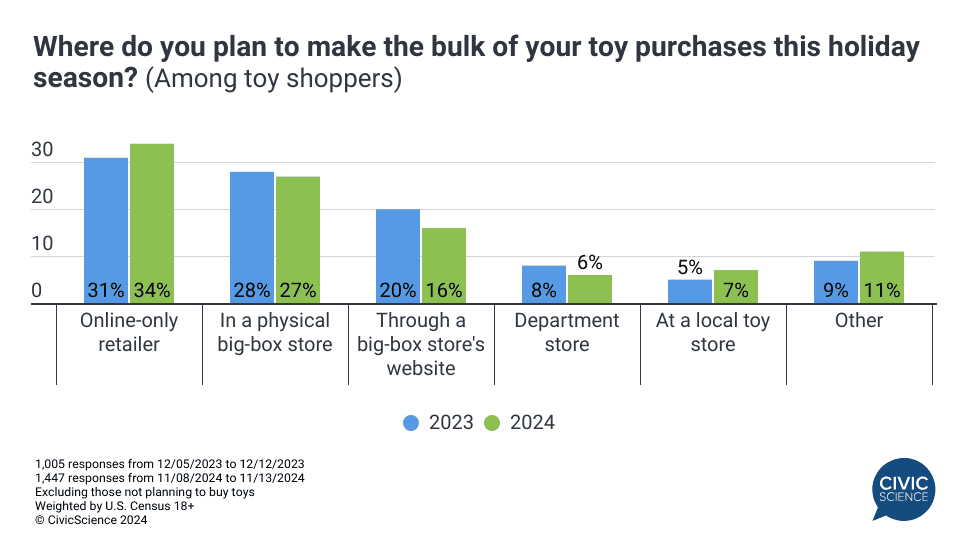

Although this holiday season looks promising for big-box retailers overall, toy shoppers might not be the main drivers of that trend. Currently, 43% of toy buyers plan to purchase most of their toys from big-box stores, either in-store (27%) or through their websites (16%) – with the overall percentage down five points from last year. Meanwhile, the share of consumers planning to do the majority of their toy shopping through online-only retailers (like Amazon) has gone up from 31% to 34% YoY. Local toy stores also saw a modest increase, gaining two percentage points over that same time frame.

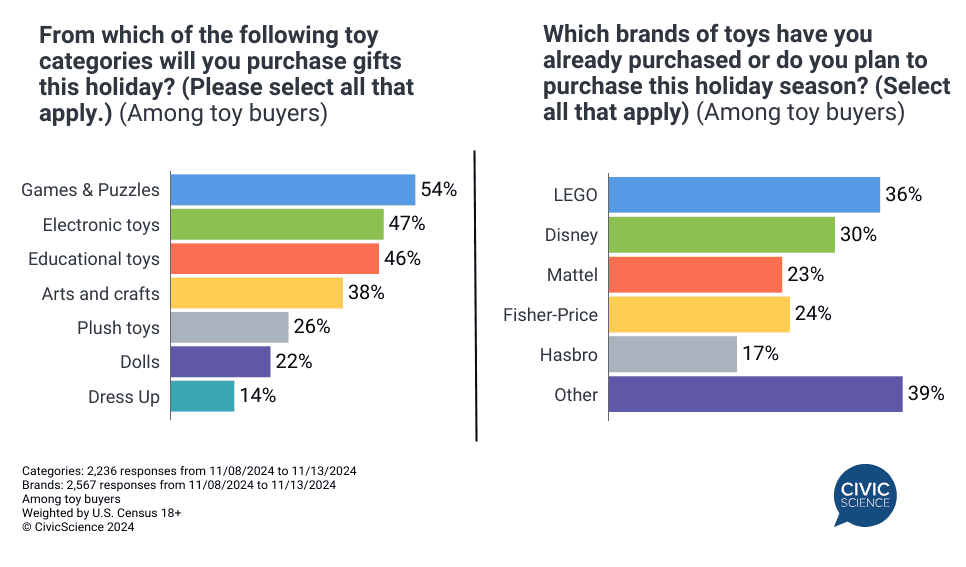

Which toys are holiday shoppers likely to target this year? The latest CivicScience data show several categories of toys will be in demand, most notably led by games and puzzles, electronics, and educational toys. Honing in on specific brands, LEGO, like last year, is a clear leader, followed by Disney.

Join the Conversation: Are you a fan of LEGO toys?

Mattel, despite a recent mishap with an unfortunate misprint on a Wicked movie doll, continues to hold its own among its competitors in terms of demand. CivicScience data in the aftermath of the misprint show just 8% of consumers say they are less likely to purchase one of the Wicked dolls, while 13% report they are just as likely to purchase them. Interestingly, 6% say they are more likely to purchase one of the dolls following the mistake. Perhaps luckily for Mattel, data show nearly half of consumers (45%) aren’t familiar with the printing mistake altogether.2

With holiday spending on toys set to rise, retailers will likely see increased competition as online shopping grows and consumers prioritize quality and price. Established brands like LEGO and Disney appear well-positioned, though shifting preferences indicate that shoppers are looking for lasting value over trendiness.