The holiday shopping season is now a retail marathon.

Consumers’ annual musings of Halloween decorations in July and Christmas and Halloween items competing for shelf space reflect a burgeoning trend: holiday cheer has surpassed the final weeks of the year.

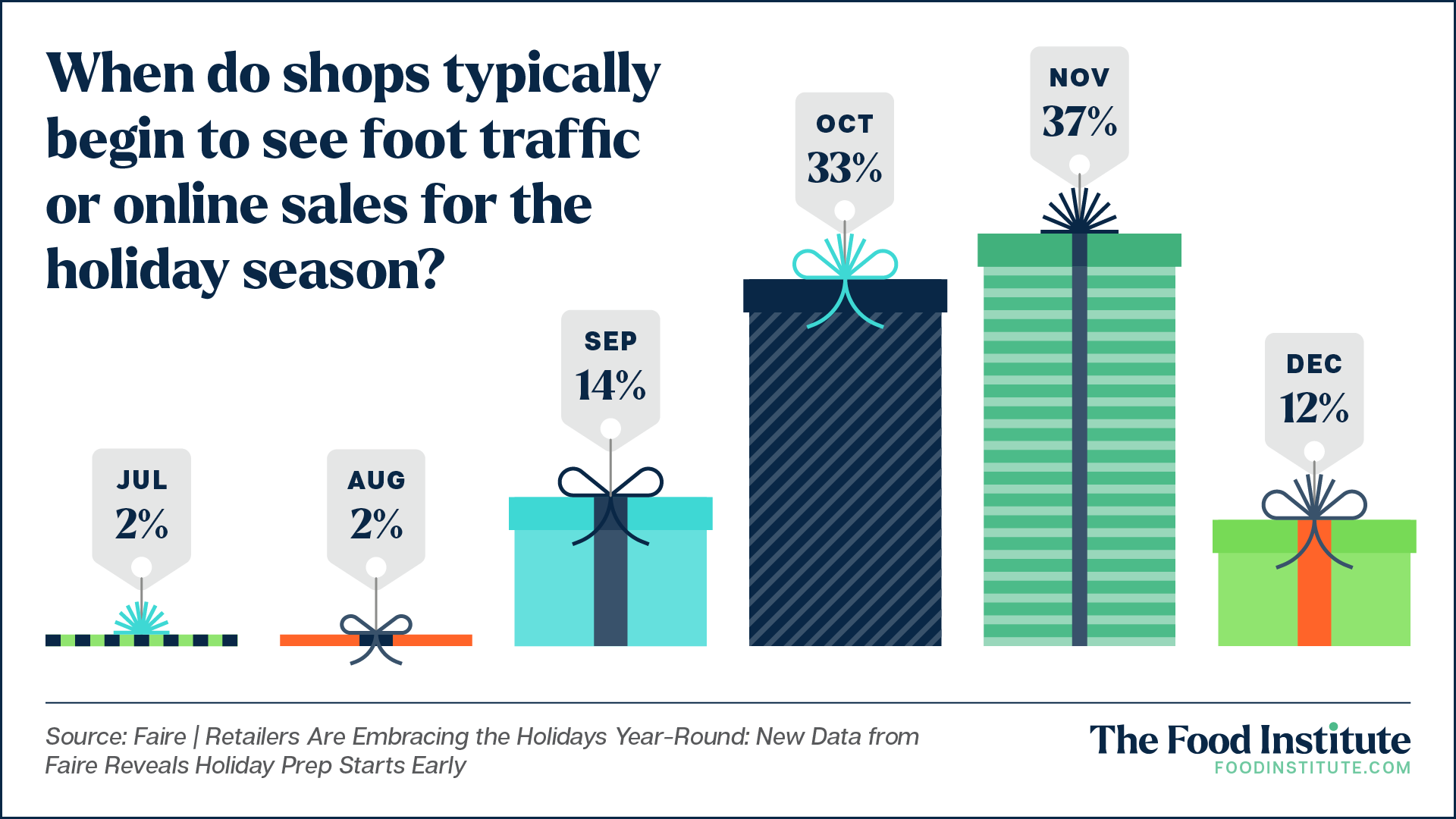

Shoppers demand a jumpstart on the season. New research from e-commerce service Faire found that retailers on the platform see a sales boost for December holiday transactions starting in September before spiking in November. In fact, purchasing begins as early as July and August for as much as 4% of eager customers.

The Faire report found that retailers, too, are keeping the holiday season top-of-mind throughout the year: over the past two years, retailers have searched the term “Christmas” on the platform every single day.

“Retailers are actively preparing for the holidays to meet increasing consumer demand,” Faire wrote. This year and 2023 followed similar trends, where an initial surge in holiday-related searches began in mid-August, roughly a month earlier than in 2022.

To meet the accelerating demand, retailers are purchasing holiday inventory year-round, with stores reporting having purchased inventory every month of the year, including January (12%) and February (9%). October is the highest purchasing month, with 73% of retailers indicating having completed holiday-related transactions over the period.

Consumers Value Festive Shopping Experience

Brick-and-mortar storefront owners will rejoice to learn that holiday consumers are enamored by the physical store experience. The report found that nearly 70% of multi-channel retailers say their holiday sales come from in-store purchases, rather than from online baskets.

“While online shopping offers convenience, consumers still seem to crave the in-person experience—whether it’s browsing for a special item, getting gift ideas from shopkeepers, or enjoying the festive atmosphere that a physical store brings,” said Faire.

This may be why even Spirit Halloween owner Spencer Gifts is dabbling in the holidays, testing the market with roughly a dozen Spirit Christmas stores throughout the Northeast slated to open.

“Our goal is to create a festive retail experience that captures the spirit of the season, much like we do for Halloween,” the company said in a statement to Fast Company. Winter-themed locations will debut between October 18 and early November and stay open through the holidays.

The Christmas Bump

A recent report from Numerator took a closer look at holiday celebrations, finding that the most widely purchased Christmas items remain gifts and foods, enjoying purchases from 80% and 79% of Christmas celebrators, respectively.

To celebrate the season, consumers plan to participate in the following:

- Cooking or baking at home (61%)

- Hosting others at home (33%)

- Going out to eat (18%) or for drinks (10%)

- Ordering food for takeout or delivery (10%)

The report noted that, although 17% of consumers plan to spend more on Christmas than last year, 26% intend to pull back on their spending.

Roughly 79% of consumers expect to spend $200+ on the season by the holiday’s end.

A recent report from Circana warned of an unexpected consumer behavior trend ahead of the winter holiday season – pre-promotion pullback. During the fall retail promotion season, consumers dialed back on purchases in anticipation of upcoming deals. Nevertheless, the winter season tends to be more fruitful.

“There is consumer optimism ahead of the holiday shopping season, but more is needed to fuel retail growth,” said Marshal Cohen, chief retail industry advisor for Circana. “Retailers and manufacturers need to get consumers to see the importance of purchases or optimize based on their needs at every step, from inquiry to intent.”

To bridge the gap, Faire discovered how its independent retailer partners plan to inspire profits throughout the season. Methods include:

- In-store events like holiday markets, DIY workshops, and other special celebrations

- Free gifts with purchases to provide an extra shopping incentive

- Complementary gift wrapping to facilitate holiday shopping ease

- Limited-edition products to provide a more robust, exclusive selection

The Food Institute Podcast

Restaurant results for the second quarter weren’t stellar, but people still need to eat. Are they turning to their refrigerators, or are restaurants still on the menu for consumers? Circana Senior Vice President David Portalatin joined The Food Institute Podcast to discuss the makeup of the current restaurant customer amid a rising trend of home-centricity.