With schools out for the summer and prime vacation season in full swing, now may not be the most obvious time to start thinking about holiday shopping. However, that’s exactly what’s on the minds of 16% of holiday gift givers who have already begun to make purchases in anticipation of the end-of-year festivities, according to CivicScience data from June.

How does that compare to years past, and who exactly are these out-of-season shoppers? The latest CivicScience data answers these questions and more.

Those beginning their holiday shopping in the summer have held steady since 2023. Although the percentages are not quite as high as in 2022, when 19% of respondents had begun their holiday shopping by August, the numbers are still much higher than pre-pandemic levels. In July of 2019, just 9% had begun their holiday shopping.

Additionally, the largest percentage of those who will be buying gifts are doing so before Thanksgiving – they just haven’t started yet. This group has seen an increase over the years and is up eight points since last July, suggesting shoppers will start even earlier this year.

Women and those who are between the ages of 25 and 34 are also the most likely to have already begun their holiday shopping.

Join the Conversation: Do you think it’s too early to start thinking about winter holiday shopping?

How Finances Fit In

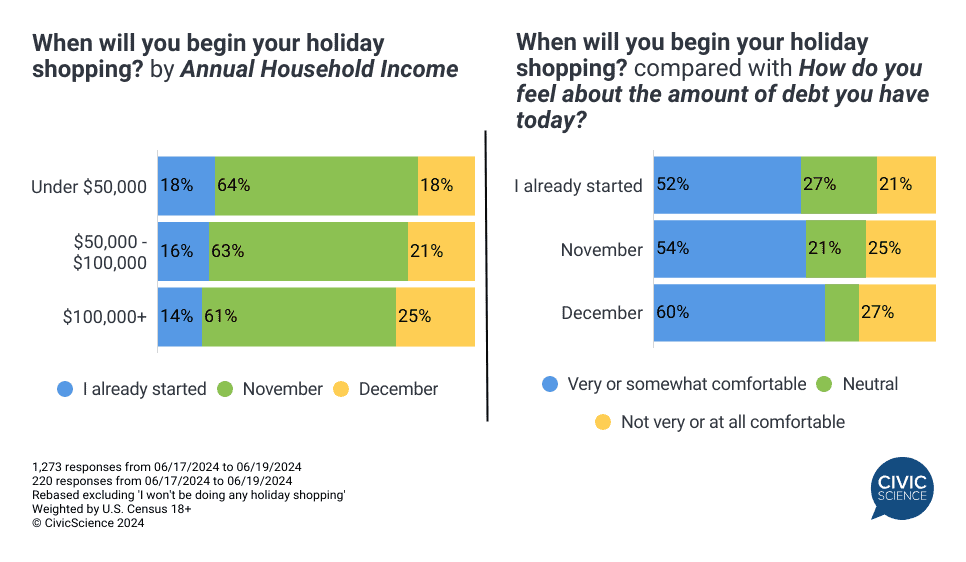

Those who make $50K or less each year are the most likely to have already started their holiday shopping, while those who earn more than $100K are the most likely to do their shopping last minute, when money can buy convenience.

Given the fact that early shoppers are also the most likely to feel neutral about their current amount of debt, the choice to shop early may be in an effort to continue feeling that way, by spreading out “extra” purchases throughout the year.

Of course, debt isn’t the only financial matter on consumers’ minds. Inflation remains an enduring hot topic, and those who have already begun their holiday shopping are the most likely to be concerned with this issue.

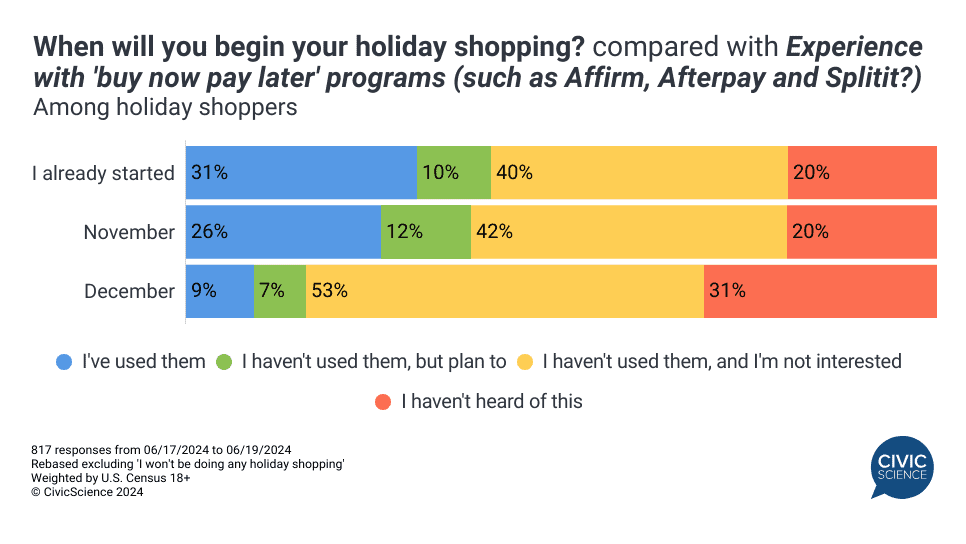

Early Holiday Shoppers Will Buy Now, Pay Later

One way that early holiday shoppers may be seeking to avoid the perils of inflation and potential over-spending is to enroll in a buy now, pay later program when they shop. As the data show, early holiday shoppers are the most likely to have used these types of services, such as Affirm or Afterpay. However, previous data has shown that buy now pay later users often find themselves in more debt, so whether or not these options help or hurt the budget-conscious is up for debate.

Answer our Polls: Do you think “buy now, pay later” services are generally positive or negative?

As temperatures skyrocket into summer, it’s clear that getting an extra head start on holiday shopping is still relevant for some consumers. Additional data show that 31% of adults do not think June is too early to start thinking about winter holiday shopping, and another 17% say they’ll start thinking about it soon.1

That said, those who are choosing to get ahead on their holiday hauls may be doing so with their bottom line in mind, and with an eye on their debt and avoiding the impact of inflation in the process.

This is only a preview of the insights and “always-on” data available to CivicScience clients. Want to see CivicScience data’s full capabilities and learn how you can leverage it?