The past few weeks have been intense, with many discussions in the energy sector about Brazil’s prospects in the energy industry. Brazil’s potential to continue being a leader in biofuels and clean energy, along with decarbonization strategies, is undisputable.

However, Brazil’s increasing prominence as an oil and gas producer and the importance of these products to the country’s economic development cannot be underestimated. Brazil is currently the ninth largest oil producer and, according to data from the Brazilian National Agency for Petroleum, Natural Gas and Biofuels (“ANP”), is expected to continue reaching annual production records, potentially reaching 5M barrels per day (“bpd”) by 2030. (See additional information about Brazil’s production below.)

Due to the concentration of production units located far from the coast, oil production is transported by shuttle tankers. According to the International Energy Agency (IEA), Brazilian exports via tankers have increased year after year, reaching a record 1.6 Mbpd in 2023 (19% more than in 2022), with expectations that these numbers will continue to rise significantly in the coming years due to increased oil production and the limited projected increase in domestic refining capacity, forcing more oil toward export.

Maritime oil export operations can be conducted in four different ways:

- Ship to ship (“STS”) operations in open sea with ships underway

- STS operations with anchored ships

- STS operations with ships moored at marine terminals

- Storage and export operations from marine terminals

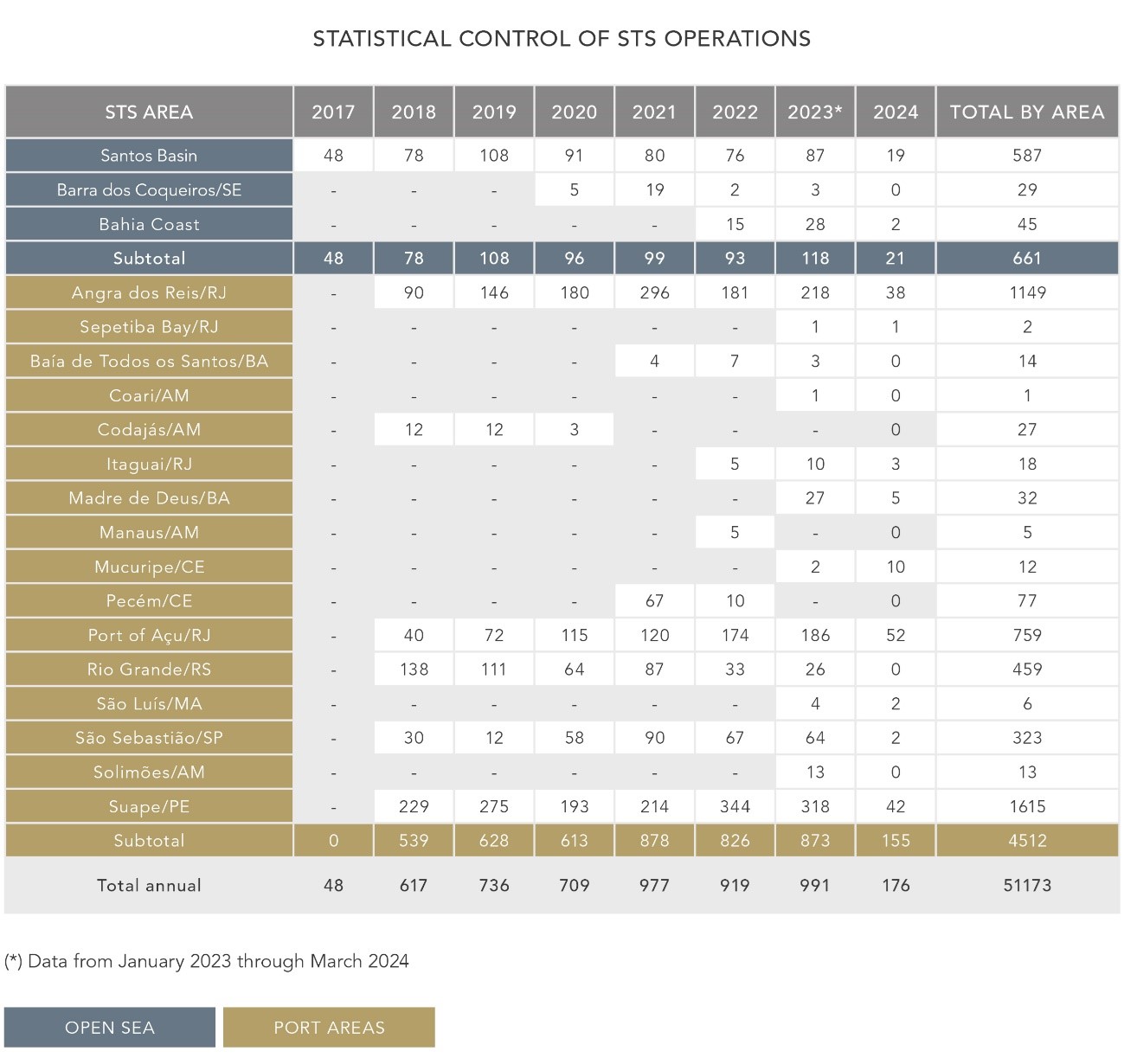

All four types of operations have increased in recent years, with a total aggregate increase of almost 50% in operations from 2017 to 2023, according to data from the Directorate of Ports and Coasts.

So the assets used in maritime transport operations will be in high demand in the coming years, specifically shuttle tankers, tankers, and marine terminals (for both storage and export, as well as STS operations). Investments in these assets in Brazil benefit from various incentives, including:

(i)Use of resources from the merchant marine fund for shipbuilding in Brazil

(ii) Flexibility for foreign tonnage requirements in coastal shipping, as provided in law 9.432/97 amended by BR do Mar

(iii) Subsidized financing with resources from the FMM – Fundo da Marinha Mercante (Brazilian Merchant Navy Fund) for both vessel construction and terminal works (especially for dredging)

(iv) REIDI and Reporto

[View source.]