This is just a sneak peek at the thousands of consumer insights available to CivicScience clients. Discover more data.

The “on-ramp” plan that was put in place to help student loan holders ease back into making payments after the pandemic pause officially came to an end on September 30. That means that late or missed payments can now be reported to credit bureaus, after one year of no credit penalties.

On top of that, courts moved to continue blocking the SAVE plan last month, the Biden administration’s income-driven repayment plan, which drew significant interest from student loan holders in June.

That leads to big questions for retail, finance, and nearly every industry across the board as to how borrowers with student loan debt – estimated to be 13% of the U.S. population – will react. Needless to say, many Americans carrying student loan debt aren’t exactly thrilled about these recent events. CivicScience data collected since September 30 found that the majority of borrowers are feeling concerned about the end of the on-ramp plan, with a greater percentage feeling ‘very’ concerned.

And for good reason – roughly 40% of those who are the most concerned about the end of the penalty-free period owe more than $30K in student loan debt, compared to around 30% of borrowers who aren’t at all concerned. Those concerned are also more likely to be parents of school-aged children, under age 45, and earning a household income of less than $75K per year, compared to those not concerned.

In general, Americans with student loan debt are financially worse off than those without it. Ongoing CivicScience tracking indicates they earn less income (although this is likely attributed to generational/age differences), they’re more likely to live paycheck to paycheck, and they’re significantly more likely to feel stressed out by their financial situation, with many citing ‘managing debt’ as their main source of financial stress.

Take Our Poll: How concerned are you about your level of student loan debt?

At the same time, though, student loan borrowers are resourceful – they’re more inclined to budget their finances and use budgeting apps to do so, and they report greater levels of financial literacy than non-borrowers.

Of course, not all people with student loan debt are the same. As shown above, 43% aren’t concerned at all about the end of the on-ramp period. Likewise, nearly half of borrowers reported feeling satisfied with their credit score in October, while 26% said they were dissatisfied.

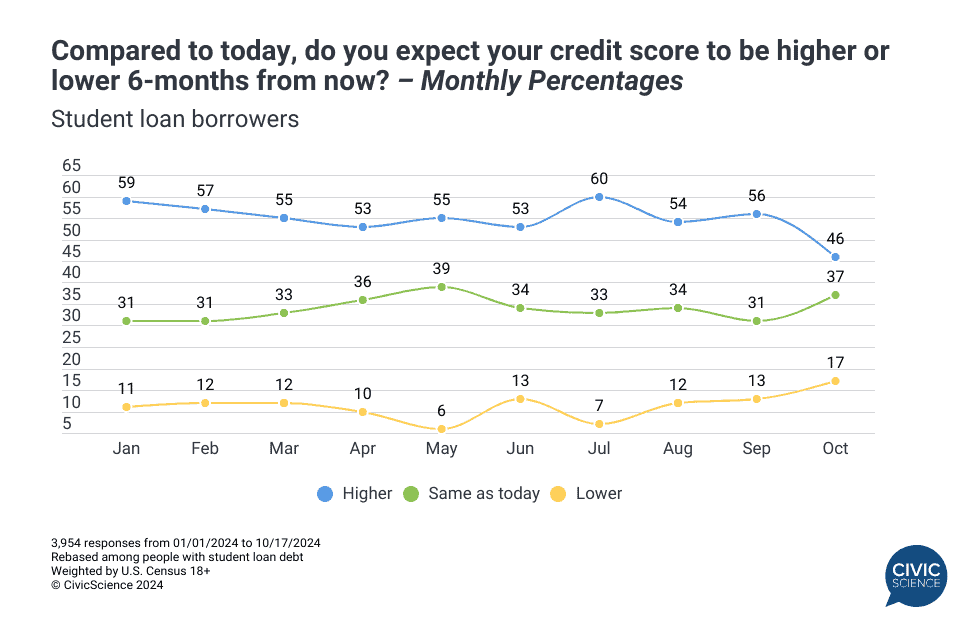

What’s key to note is that the percentage of student loan borrowers who expect their credit score to get worse more than doubled from July (7%) to October (17%), while those who expect it to get better fell from 60% to 46% during that same time period.

The big picture is that people with student loan debt are growing increasingly pessimistic about their credit score outlook, while the general population remains relatively stable. But the million – if not billion – dollar question is how that translates to changes in consumer behavior and spending.

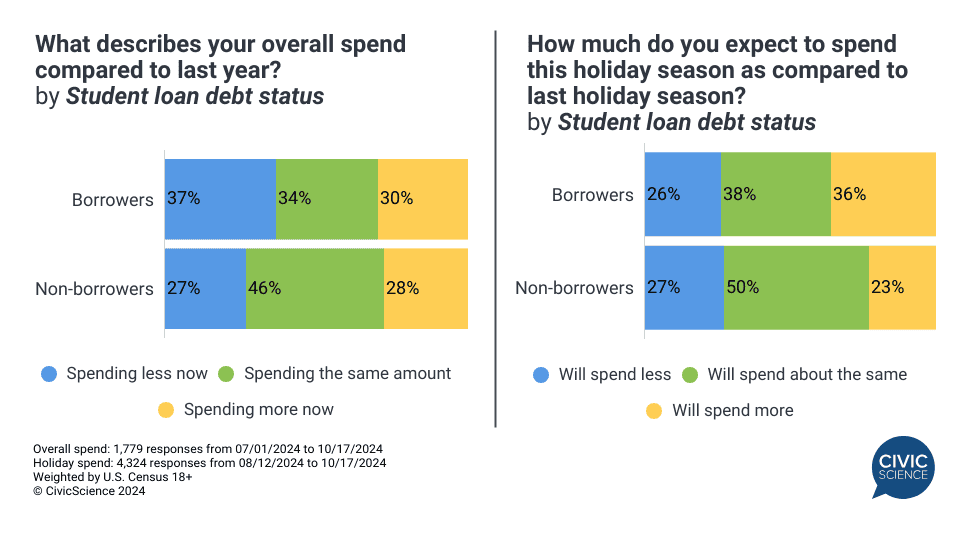

Not surprisingly, data suggest that student loan borrowers have pulled back on spending at higher rates than non-borrowers. Since July, more than one-third reported they’ve been spending less this year than last year, which is 10 points higher than non-borrowers. At the same time, 30% reported spending more, also outpacing non-borrowers.

But that flips when it comes to holiday spending. A noticeable 36% of student loan borrowers expect to spend more this year on the winter holidays than less, overshadowing 23% of non-borrowers. In fact, drilling down further shows that those who are the most concerned about the end of the on-ramp plan are the most likely to up their spending this holiday season. As mentioned, these borrowers are more likely to be parents of young children.

Join the Conversation: As student loans start impacting credit scores again, what level of concern do you have about the impact on your credit score?

Increased spending means more debt for many. Borrowers are twice as likely as non-borrowers to expect to take on debt for gift-buying this year. While debit card is the leading way student loan borrowers expect to pay for holiday purchases, credit is high on the list – 32% plan to use credit cards, 4% plan to use mobile payments, and 4% are likely to use buy now, pay later options as their primary payment method.

Like last year, student loan borrowers aren’t holding back on holiday spending, despite souring feelings about credit and uncertainty surrounding the future of debt relief. In the midst of inflation, a tumultuous presidential election, and escalating global conflicts, the holidays may be the one area left that many financially-strapped borrowers are looking forward to, and they’re willing to spend more on it even if that means acquiring more debt.

However, they’ll probably be making tradeoffs to shoulder the extra costs, with ‘dining out’ and ‘clothing’ the top two categories they’re likely to cut back on.