eAlisa/iStock via Getty Images

It has been almost a year since our last article on the largest dredging outfit in North America (33% market share), Great Lakes Dredge & Dock (NASDAQ:GLDD). The stock and shareholders of this infrastructure concern have had a wild ride over the past 12 months, but the equity has moved sharply higher since the company posted much better than expected first quarter results. Can the rally continue? An updated analysis follows below.

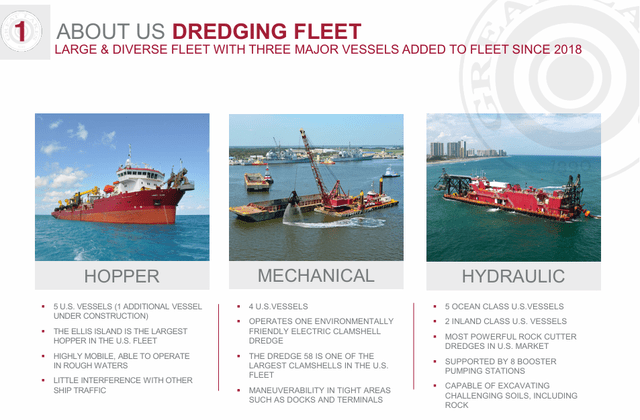

Great Lakes Dredge & Dock headquarters is in Houston, TX. The company primarily serves federal, state, and local government entities and operates hydraulic dredges, hopper dredges, mechanical dredges, unloaders, drill boats, and material and other barge equipment. These vessels are utilized for infrastructure projects like port expansion projects; coastal restoration and land reclamations as well as also dredging activities related to the construction of breakwaters, jetties, canals, and other marine structures. The company also involved in offshore wind projects as well as LNG facilities. The stock currently trades just under nine bucks a share and sports an approximate market capitalization of $600 million.

As you can see below, the company operates just under 20 vessels. These include the largest hopper in the U.S. fleet, and the company has one other of these types of vessels currently under construction. It is due to be completed in 2025. The company took possession of a 6,500-cubic-yard-capacity hopper dredge earlier this year. Another inclined fallpipe vessel for subsea rock installation also should be completed in 2025, which will be used for offshore wind farm developments.

Recent Results:

Great Lakes Dredge & Dock posted its Q1 numbers on May 7th. The company easily bested both the top and bottom-line consensus by large measures, as it delivered GAAP earnings of 31 cents a share in the quarter. This was almost a quarter per share above expectations. Net income for the quarter was $21 million, which compares quite favorably to the $3.2 million loss the firm had in the same period a year ago. Revenues rose nearly 26% on a year-over-year basis to $198.7 million, more than $20 over the average analyst firm estimate. The revenue beat was primarily attributable to higher capital and coastal protection project revenues.

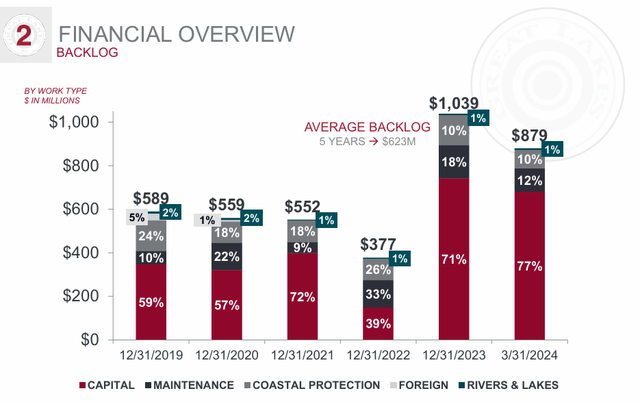

The order backlog did come down from the record $1.04 billion it started the year at, but is still historically high. This has been boosted significantly by all the largess via legislation over the past couple of years. This has boosted investment in these types of projects, but also is just one of many reasons the federal deficit is currently running at 6.7% of GDP, according to the latest update from the CBO.

Analyst Commentary & Balance Sheet:

Despite a decent size market capitalization, Great Lakes Dredge & Dock gets sparse coverage from Wall Street. Noble Financial did reissue its Buy rating and $11 price target on GLDD soon after first quarter results hit the wires. However, that is the only analyst firm commentary I can find around Great Lakes Dredge & Dock so far in 2024.

There has been no insider activity in the stock for just over a year now, after several insiders bought just over $2 million worth of equity collectively in the first half of 2023. Great Lakes Dredge & Dock ended the first quarter with just under $23 million in cash against just over $380 million worth of debt.

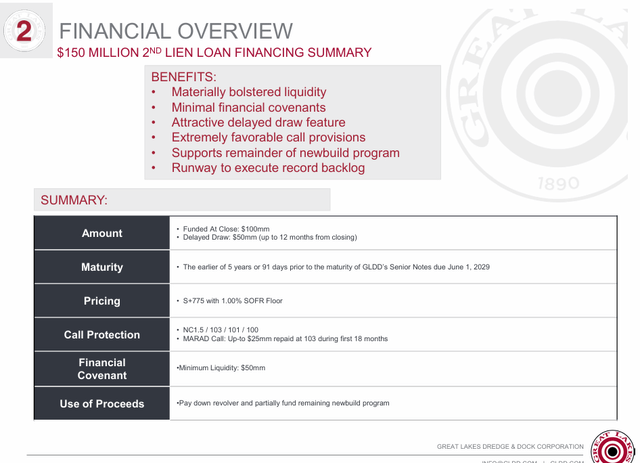

In April, Great Lakes Dredge & Dock entered into a 12 month $150 million second-lien credit agreement with Guggenheim Credit Services. This agreement provided an aggregate principal amount of $100 million and a delayed draw term loan facility in the aggregate amount of $50 million. It provides the financial flexibility to complete the company’s current build program. Net interest expense for the first quarter ran $3.9 million according to the 10-Q management filed for the quarter.

Conclusion:

Great Lakes Dredge & Dock made 21 cents a share in FY2023 on just over $589 million in revenue. The current analyst firm consensus has profits more than tripling in FY2024 to 72 cents a share as sales jump to $746 million. They project profits of 80 cents a share in FY2025 on five percent revenue growth.

GLDD stock has jumped some 30% since first quarter results hit. A justifiable action given how well the company executed in the first quarter. However, given its industry and debt load, 12 times forward earnings seems a fair valuation as both revenue and earnings growth are set to slow markedly in FY2025. If the stock drifted back down to the low $7 or high $6 range, I would probably start to accumulate some shares at that time. I am a ‘Neutral’ on the equity at current trading levels.