AVNphotolab/iStock via Getty Images

Introduction

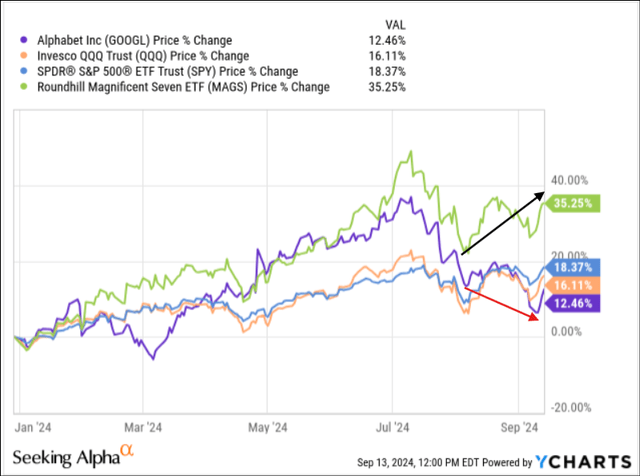

Amid well-publicized antitrust issues, Alphabet Inc. (NASDAQ:GOOG)(NASDAQ:GOOGL) stock has recently diverged from broader equity indices and its big tech peers. So much so that Google stock is now underperforming the S&P-500 (SPY) and Nasdaq-100 (QQQ) on a year-to-date basis after having outperformed significantly during the first half of 2024:

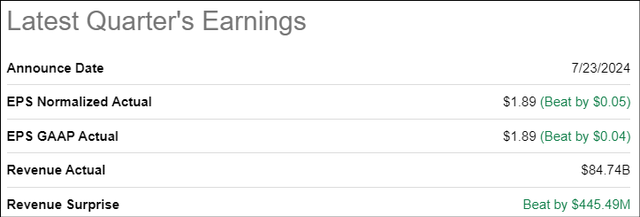

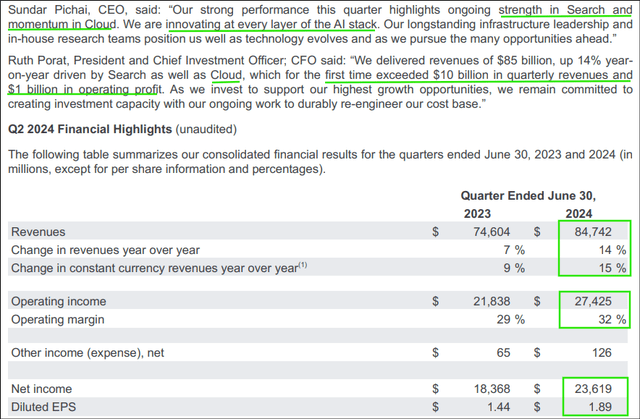

Given Alphabet’s robust business performance in Q2 2024 – revenue growth re-accelerating to +14% y/y, operating margins expanding by 300 bps y/y to 32%, and diluted EPS jumping +31% y/y – I think it is natural for market participants to ascribe GOOGL’s lack of participation in the broad market bounce off of early-August lows to its recent loss in the “Search” monopoly antitrust case and the kick-off of a second antitrust lawsuit [centered around Alphabet’s ad-tech business] last week.

Seeking Alpha Alphabet Investor Relations

While Alphabet faces no immediate remediations, a federal judge declaring Google a monopolist is an unnecessary distraction:

After having carefully considered and weighed the witness testimony and evidence, the court reaches the following conclusion: Google is a monopolist, and it has acted as one to maintain its monopoly. It has violated Section 2 of the Sherman Act.

– US District Judge Amit Mehta

On the one hand, Google bears have quickly drawn parallels with Microsoft of the early 2000s, whereas, on the other hand, bulls argue that any remediations from these antitrust lawsuits would have a muted impact on Alphabet’s business, with some going as far as suggesting a potential breakup of Alphabet as a catalyst for unlocking significant shareholder value, citing its sum-of-parts valuation.

Now, I have no clue which way the stock will swing based on the potential outcomes of these antitrust lawsuits. I am no legal expert, but I think Google will challenge any future negative verdicts—and it could be years before something happens on the fines/breakup front.

Is Alphabet Stock A Buying Opportunity At Current Levels?

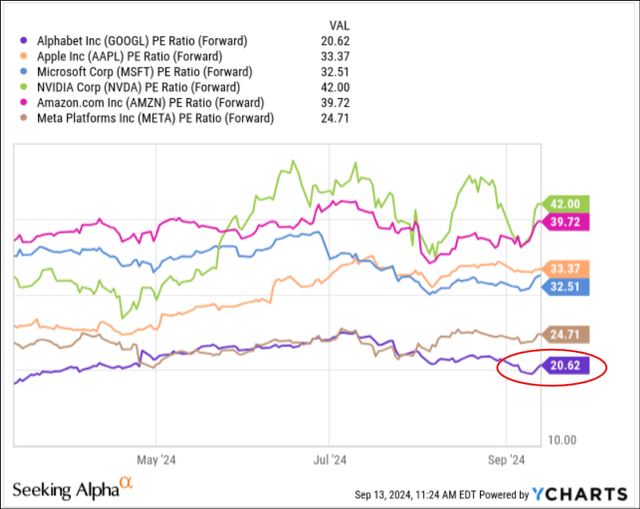

From a relative valuation standpoint, Alphabet is trading at a 20-50% discount to its peers based on forward earnings:

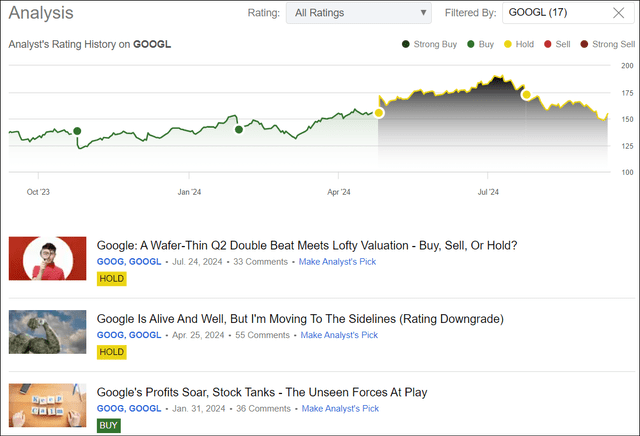

However, before we jump to any conclusions, please note that Alphabet was also trading at a relative discount to its peers back in April – when I downgraded Google stock to a “Hold” rating in the high-$170s, citing deterioration in its long-term risk/reward:

In Big Tech’s Big Breakdown, The Technical Setup Ahead Of Earnings, I highlighted Alphabet’s technical setup as the best one among big tech stocks reporting this week. And with Alphabet blowing past consensus expectations for Q1, the stock is off to the races. Now, as a long-term shareholder, I’m enjoying these gains. That said, GOOGL stock is now running well ahead of TQI’s fair value estimate and the long-term risk/reward from here isn’t attractive enough to warrant fresh buys.

Considering Alphabet’s business strength and valuation realities, I’m moving to the sidelines on this stock. We will continue to own all of our shares, but we won’t be buying again until GOOGL experiences a sizable time or price correction.

Source: Google Is Alive And Well, But I’m Moving To The Sidelines (Rating Downgrade)

Since then, Alphabet’s stock has declined by more than 10% over the past five months – justifying my caution. Let us now re-run Alphabet through TQI’s Valuation Model to see if its risk/reward has improved enough to warrant a rating upgrade!

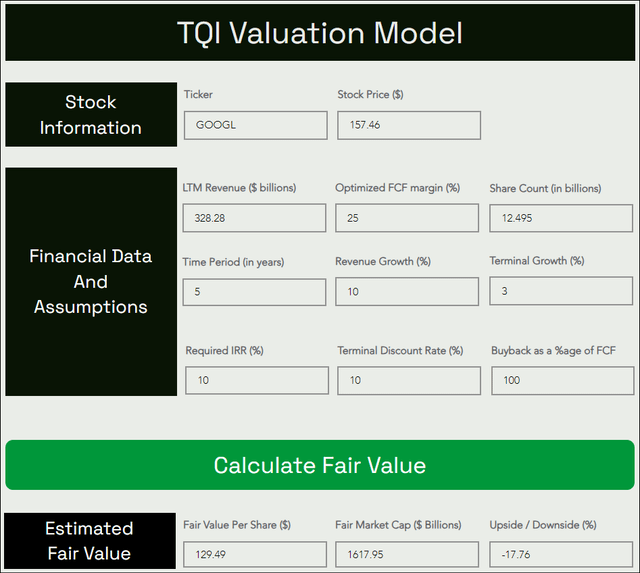

With the year drawing to a close, I am using Alphabet’s 2024E revenue of $347B (instead of TTM revenue) as the base for today’s exercise. For modeling-period sales growth and optimized FCF margins, I am sticking to our previous assumptions of 10% CAGR and 25%, respectively.

Generally, I utilize a 15% discount rate in my DCF models. However, considering Alphabet’s business resilience and robust cash flow generation, we will continue to rely on a lower discount rate of 10%, which I have only used for Microsoft (MSFT) and Apple (AAPL) in the past.

Here’s my updated valuation model for Alphabet:

TQI Valuation Model (TQIG.org)

As you can see above, TQI’s fair value estimate for Alphabet has moved up from ~$125 per share (or $1.56T market cap) to $129.49 per share (or $1.62T market cap). With GOOGL stock trading at ~$157 per share, it is still in the overvalued territory; however, if we add back Alphabet’s huge cash hoard of $100B+ (~$8 per share), the valuation premium is less than 15% now.

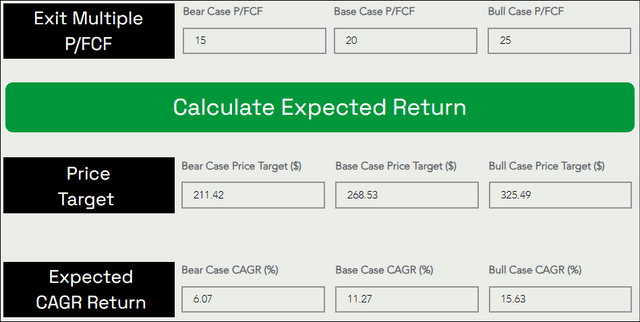

Assuming a base case P/FCF (exit) multiple of ~20x, Alphabet’s stock could rise from $157 to $269 at a CAGR rate of 11.27% over the next five years.

TQI Valuation Model (TQIG.org)

With Alphabet’s expected CAGR return improving from 7.7% at our last evaluation to 11.3% [above our 10% hurdle rate], I now view Alphabet stock as a worthwhile investment for long-term investors looking for a low-volatility tech stock.

Concluding Thoughts

Having published 15 “Buy/Strong Buy” ratings on Alphabet stock between mid-2021 to early-2024, I have never been a GOOG/GOOGL bear:

Author’s Coverage History on GOOG/GOOGL (Seeking Alpha)

And, if you have followed my work, you know that I have continued to appreciate Alphabet’s business performance despite rating it a “Hold/Neutral” in recent months.

Yes, Alphabet’s antitrust woes could lead to a multi-year price and/or time correction in GOOGL stock similar to what Microsoft experienced from the early 2000s to the mid-2010s [especially in the event of a hard landing]. On the flip side, we know that Mr. Market tends to have the memory of a fish, and Alphabet’s antitrust headline-driven weakness could just as well be a temporary blip.

Basing an investment decision on the potential outcome of a lawsuit is a fool’s errand, and I would never indulge in that game. With that said, Alphabet’s business performance remains robust in the face of negative antitrust headlines, and its long-term risk/reward has improved enough to warrant a rating upgrade. Hence, I am upgrading Alphabet to a “Buy”.

Key Takeaway: I rate Alphabet stock a “Buy” in the $150s.

Thanks for reading, and happy investing. Please share your thoughts, concerns, and/or questions in the comments section below.