400tmax

When Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL) reported its Q1 24 earnings at the end of April this year, hidden in their press release and filings – like the precious nugget of information that it is – was the announcement of a cash dividend that it expects to pay on a quarterly basis. Annualizing that 20-cent payout to the coming fiscal year equates to a forward yield of 0.4%. Why should that matter to any investor?

This article tells you exactly why, and urges you to jump on the GOOG bandwagon ahead of Q2 earnings later this month so you can reap the yield – literally – down the road, 10, 20 years from now and beyond. I’m going to be making a few assumptions here, one being that I expect GOOG to keep its common stock dividend payments year after year, and the second being that I expect it to keep growing these at a rate not dissimilar to that of Microsoft Corporation (MSFT), which, at roughly 10%, I’ll use as a comparator to Alphabet’s new dividend tale. The third is actually a range of assumptions designed to outline best-, base-, and worst-case scenarios.

What the 0.4% Yield Actually Represents

To be blunt, the dividend payout or yield isn’t what’s attracting me to this stock; it’s that I believe that 20 years from now and beyond, it’s likely that the dividend will offset your cost basis to a significant degree. Of course, that would be in addition to holding GOOG as part of your growth stocks as well, so there’s a dual benefit here if the company can keep growing its cloud revenues alongside its core ad revenues and maintain robust topline growth.

Let’s get into some calculations to see how this might pan out.

First of all, our assumptions:

-

My first assumption is that GOOG isn’t going to stop this dividend stream for the foreseeable future. There’s no need to, now that a decision to initiate the first payment has been made. I seriously don’t see the board spending more than a couple of minutes – if that – approving this agenda point ahead of Q2 2024 results at the end of July.

-

The second assumption: An 80-cent annual dividend that grows 10% YoY from FY25. This is supported by the fact that GOOG’s forward EPS for FY24, per Street estimates and as captured on Seeking Alpha, is $7.55 as of this writing. That would mean a forward payout ratio of under 11%, which circles back to support my 10% annual growth assumption; there’s ample room to grow this dividend. An additional consideration here is that EPS growth estimates through FY29 currently indicate nothing less than 13.7% (FY25) and all the way up to 30% for the current fiscal year in progress, which means my 10% dividend growth estimate is quite conservative, and exactly how I like projections to be.

-

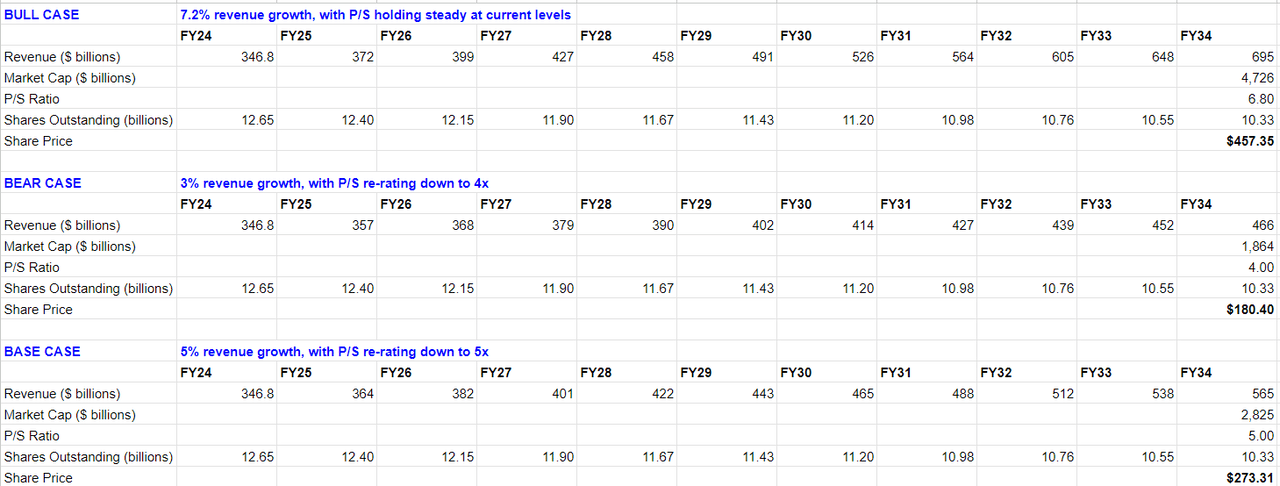

My third assumption is that Street analysts are being cautiously conservative about Alphabet’s revenue growth estimates, pegging it at around $640 billion by FY33. Alphabet is already posting nearly $320 billion in revenues in the TTM period, so a doubling of revenues in the next ten years doesn’t seem like a stretch. It’s about 7.2% annually, and that’s about the average that Street analysts are expecting through 2033. Once again, being conservative, let’s go with that as our bull case scenario. Now, assuming GOOG is able to hold on to its P/S Forward ratio of 6.8 and the estimated 7.2% growth rate, we’re at a $4.7 trillion market cap by FY34. If we reduce our revenue growth estimates to 5%, with a P/S ratio of 5x, we’re still at a $2.8 trillion market cap at the end of that 10-year period – not too far from where we are today. Worst-case scenario: GOOG gets re-rated down to 4x forward revenues and revenues only grow by 3% over the period, which we could equate to a perpetual growth rate, we’re down to about $1.9 trillion in market capitalization. I think that’s a very unlikely scenario.

-

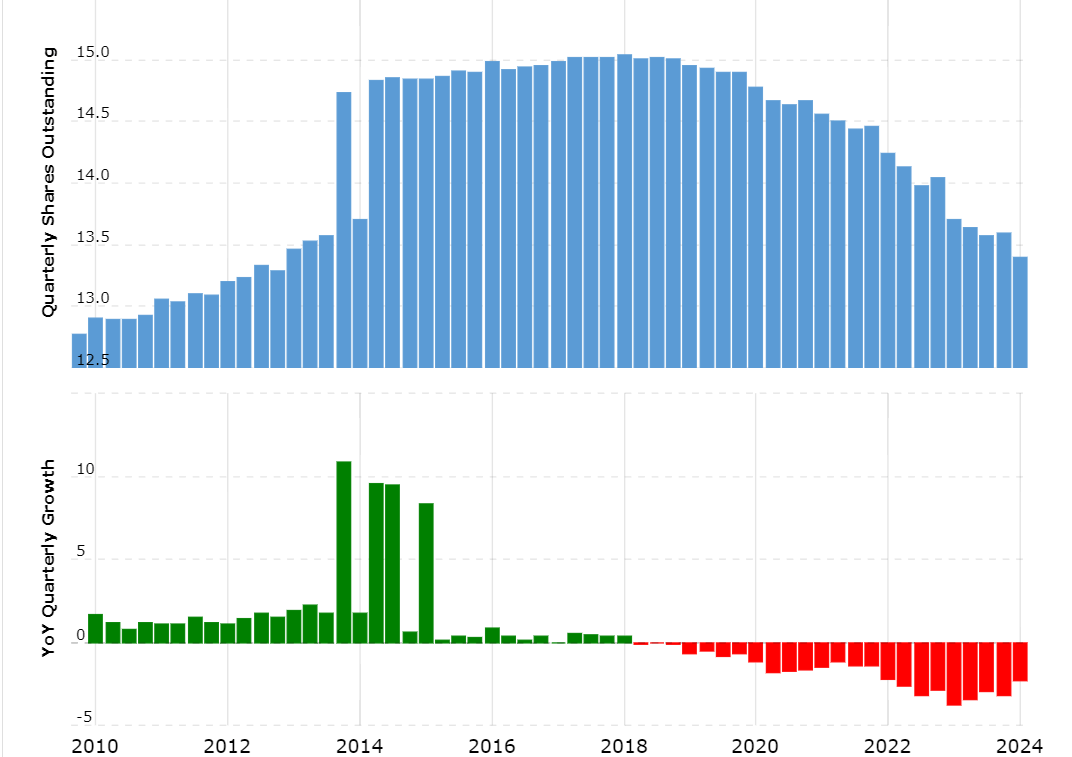

I’m also assuming a gradual share count reduction of around 2% per annum, amply supported by historical buyback levels, as made implicit in the graphs below from Macrotrends.

Macrotrends

Now that we have our assumptions in place, let’s first take a look at our bull, bear, and base case scenarios for the stock. The projections are through FY34 to make sure we have a full decade of growth figures from the current fiscal year.

Author’s calculations based on mentioned assumptions and estimates

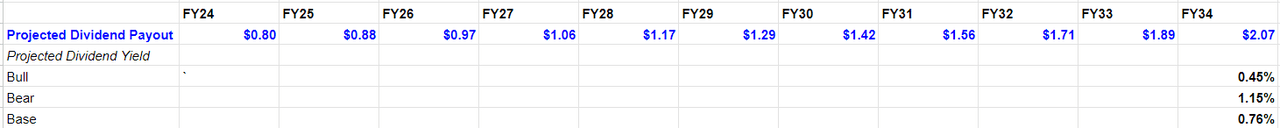

Now, under these scenarios, what’s the dividend going to look like?

Author’s calculations based on mentioned assumptions and estimates

In the bull case scenario, your dividend yield is going to be fairly steady through the decade, only increasing by 0.05% over that period. In the base case, it increases by about 0.36%; not really something to shout from the mountaintops. Even in the bear case, it’s only a 0.75% increase in yield.

So, what’s the big deal, and why do you need to pay attention to this dividend story?

The real gain is going to come from your yield on cost. Yield on cost is basically nothing more than the actual yield you currently get based on the price you purchased the security at. YoC is a powerful compounder, and all it takes is patience.

Assuming Alphabet keeps increasing its dividend by 10% every year and you bought shares at $190 today, your YoC in 20 years will be a little more than 2.8%, which is already 7x what it is now. That might not seem like a lot, but this kind of compounding can grow very aggressively if you give it enough time. Take MSFT, for instance. If you’d invested in the stock thirty years ago in 1994, when it was trading under $3, your YoC is currently at 110% – that means the stock is yielding more than it was purchased for – EVERY YEAR! Essentially, whatever realized dividends and unrealized gains you’re enjoying today is basically “free” money, inflation, taxes, and commissions notwithstanding, of course.

That’s the kind of investment that you want to hold on to as a legacy for the next generation and beyond. Of course, that would need to be complemented by a meteoric rise in share price over that 30-year period, but if you’re a long-term investor, isn’t that the reason you bought GOOG in the first place? Now that there’s a dividend, you have icing on that cake.

My thesis is very simple. Don’t laugh at the current yield thinking it’s miniscule. Look at the potential for dividend growth and stock price appreciation. If your stock has a payback period in decades, so what? If you’re confident that the business you’re investing in will be around in 30, 40, 50 years from now, and it pays a steadily growing dividend, I’d say snatch it up with both hands and don’t let it go.

Risks and Mitigating Factors

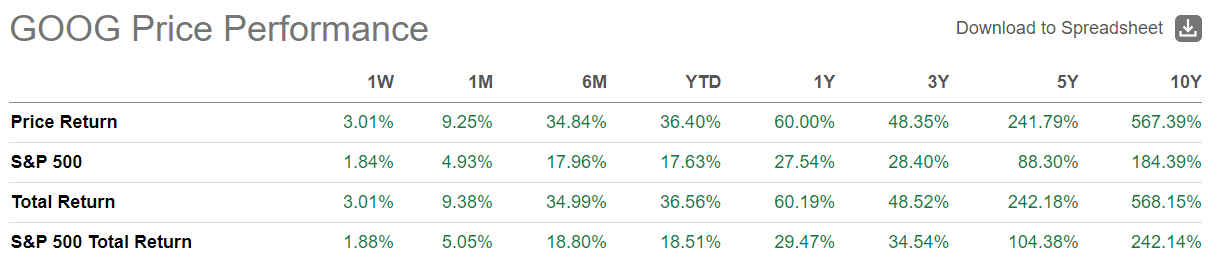

The first risk is that Alphabet is not going to grow its revenues. We already saw a bear case where the stock price remains stagnant over the next decade. That’s not likely because there’s strong revenue growth momentum right now. Analysts expect double-digit growth for the most part of this decade, as you can see in the Earnings Estimates section of the GOOG page. That doesn’t necessarily mitigate this risk, but what does is the fact that actual revenue growth over the past five years is well into double digit percentages. That’s your downside protection, in a way.

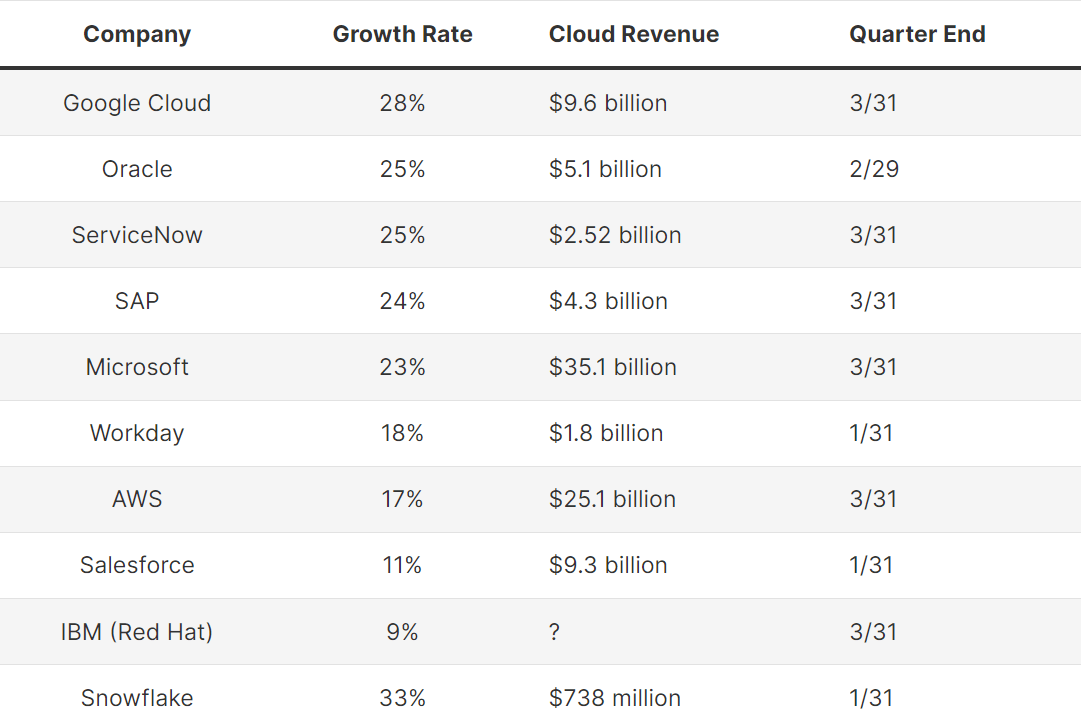

Another sign that this risk is minimal is the growth rate of Google Cloud revenues, which puts even cloud giants like Amazon (AMZN) and Microsoft to shame. Granted, it’s still several times smaller, but as of Q1 2024 it was the fastest-growing cloud unit in the segment.

Acceleration Economy

So, while a lack of revenue growth is the major risk that I see in the long run, with spending on public cloud services projected to grow to nearly $680 billion by the end of this year and global AI spending projected to grow at nearly 37% every year through the end of this decade, that risk is largely mitigated even if Alphabet’s ad revenues see some erosion from market share loss in search, which is down to 87% globally and a more alarming 77% in the United States.

Bing is clearly eating some of its lunch, but Google isn’t going to sit around and wait for it to get worse. We’ve yet to see the full impact of this on Alphabet’s top line, and Google Services actually delivered some impressive numbers in Q1, reporting $70.4 billion against the prior period’s $62 billion. That’s definitely worth watching, though, but my stance is that if you’re already holding Alphabet stock, get in even deeper on any revenue or EPS misses. That hasn’t happened in the last five quarters, but revenue estimates for FY24 are showing a 13% increase YoY, with EPS expected to grow 30%. If there’s a miss this quarter for any reason, some investors are naturally going to panic, because they’re currently sitting on a price to forward sales multiple that’s nearly 500% over the sector median and a price to forward adjusted earnings multiple of nearly double the median for the sector.

To summarize, what I wanted to convey was the fact that any growing company (including mega-caps) that pays a growing dividend is bound to compound your yield in the long run, and that’s in addition to the price appreciation. We’ve already seen the bull case where you gain nearly 150%, and even in the bear case, you likely don’t lose a massive chunk of your investment. Of course, your opportunity cost is much higher if that happens, especially in a high interest rate environment when fixed income assets have very attractive yields, but the likelihood of the bear case playing out is quite minimal, in my opinion. Naturally, that comes with the caveat that we need to watch how Alphabet navigates the challenges posed by AI to its core services revenues, but we haven’t seen any strong negative trends from which to extrapolate a doomsday scenario.

SA

I might not recommend a confident Buy at this point, but there’s no denying that momentum is on Alphabet’s side for the moment. As such, I’m comfortable rating it a Hold for now, ahead of Q2 earnings, but assuming we continue to see revenue and earnings strength, I might be willing to concede and assign a Buy rating down the road. That would be based on Q2 figures in large part, but also on how other companies in this peer group fared during the second quarter. I think a comparative study after all of them report their June quarter earnings would certainly make for an interesting read. In the meantime, this is a Hold-and-buy-the-dips call from me.