With Google’s antitrust jury trial underway, Google claimed the U.S. Department of Justice has a “narrow view” of the ad tech market and that advertisers and publishers have many alternatives. However, the evidence suggests otherwise.

Google’s misleading claim of “hundreds of competitors.”

- While many ad tech providers exist, Google dominates key market segments such as ad exchanges, ad networks and demand-side platforms.

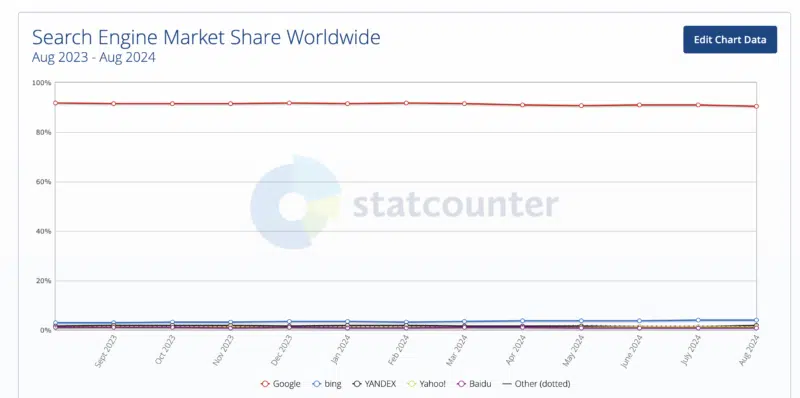

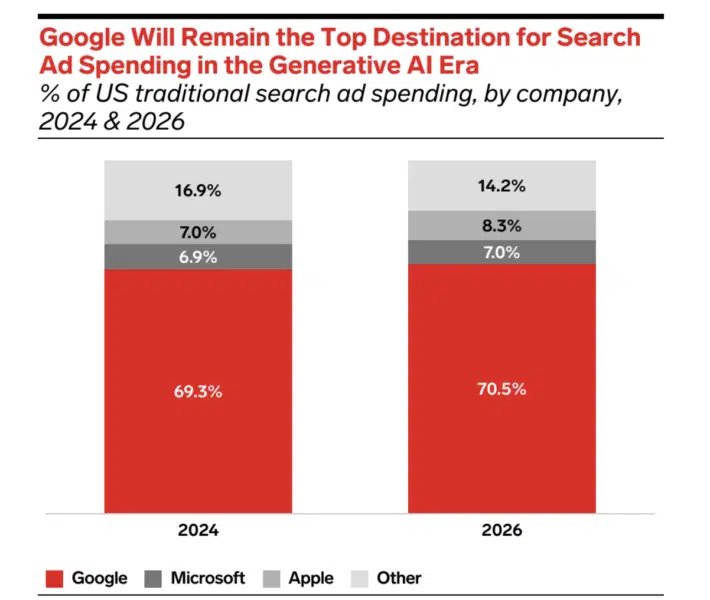

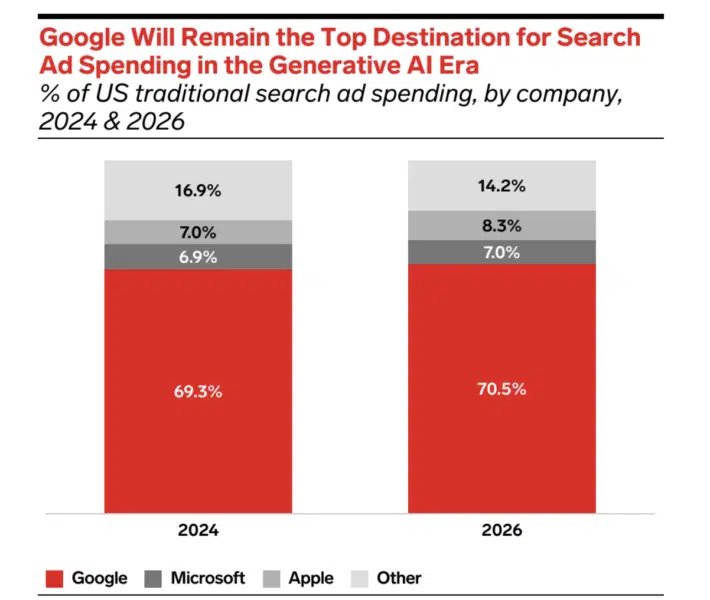

- Though Google has competitors in the most basic sense of the word (i.e., there are other players in search), the gap between their share of the market and the second largest (Microsoft) is vast and has been for many years.

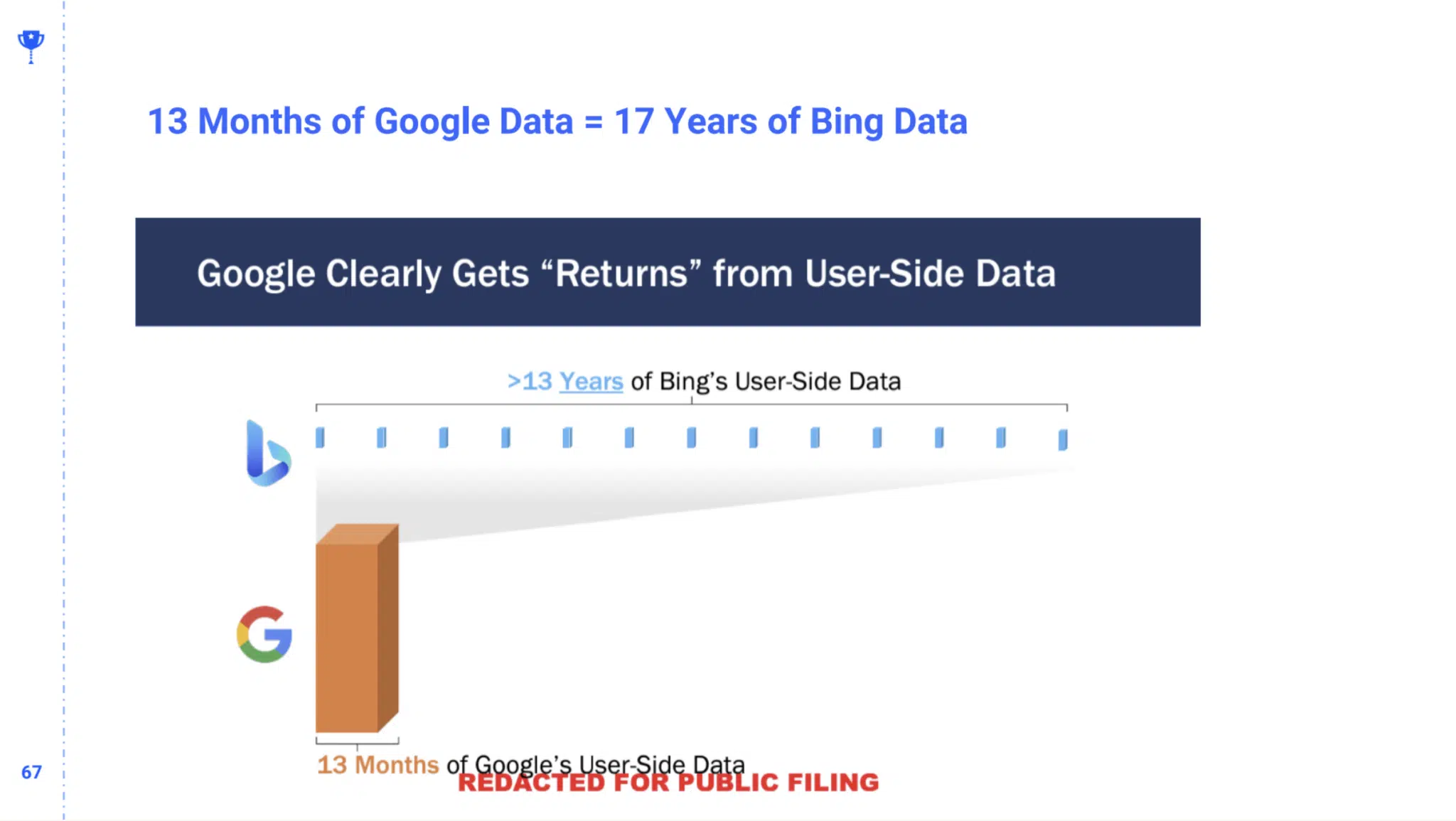

Advertisers and publishers don’t truly have free choice.

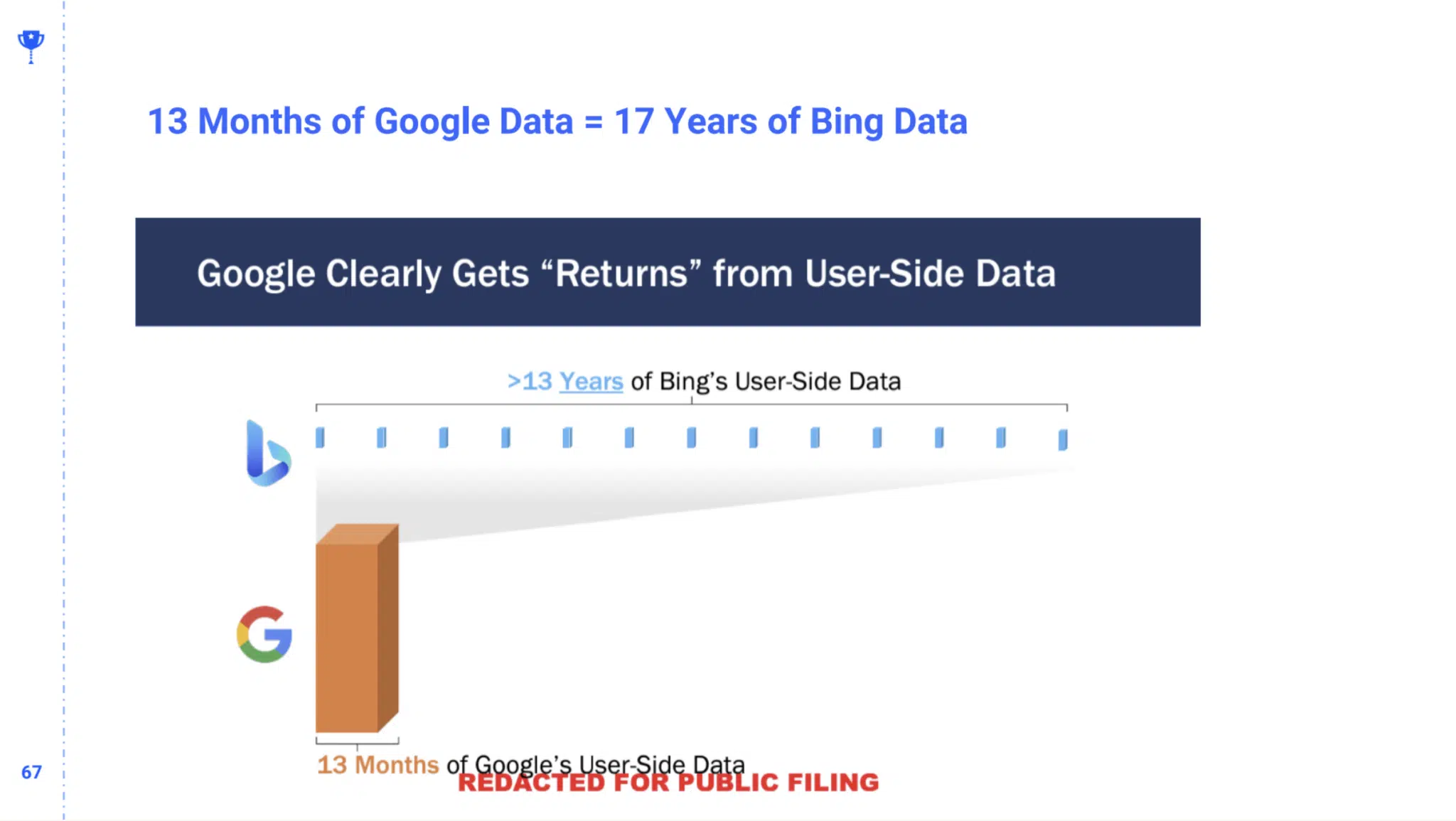

- Michael King of IPullRank presented in a recent SMX conference how it would take 17 years to collect the data Google get in 13 months.

Buying online ads isn’t cheap.

- Several reports this year have shown that advertising costs increased:

I asked some experts to discuss this blog post in which Google argued that:

- There are several other ad tech companies that compete in the space.

- Ad buyers mix and match tools with rivals; therefore, they don’t get all the fees.

- Their fees are lower than the industry average.

- Small businesses will be hurt the most by this case.

Robert Brady founder of Righteous Marketing, said Google is presenting a masterclass of painting oneself in a positive light:

- “The only statement I specifically disagree with is in the second to last paragraph where Google says ‘The ability to buy online ads cheaply and simply…’ Most searches with commercial intent (the ones SMBs want to put their ad on) are not cheap and Google Ads is not a simple platform anymore.

- “What Google doesn’t say is much more salient. They fail to mention their utter dominance of search, which is where you get search intent data.

- “That advantage, having 80%+ of the internet’s search intent data, is what puts every other piece of Google’s ads tools at a significant advantage against even large competitors like Microsoft. And as long as Google can leverage that search intent data in all their other products, they’ll own this industry.”

However Sam Tomlinson, EVP and Director of Digital Strategy of Warschawski, pointed out several issues with the DOJ’s case:

- He claims this to be an issue with market definition: “Honestly, Google is right on their market definition point. The relevant market should be digital advertising , not some ridiculous thing like “Non-product text based ads” — it would be absurd to say that Amazon has a monopoly on “eCommerce consumer retail”

- He doesn’t believe it is possible to assess what Google’s fees are: “[It’s] very difficult to assess Google’s fees vs. those charged by others due to the sheer volume of points in the value chain where fees can be added, often in non-transparent ways.”

- He thinks SMBs will lose if the DOJ wins SMBs: “End result to SMBs? Probably right, to be honest. That’s not what the ‘Google = evil’ people want to think, but the reality is that breakups would come with massive incremental costs that would be passed onto advertisers.”

Tomlinson said he thinks the system will get healthier if the DOJ wins, but that it will be a painful process:

- “Long run, we’ll probably get a healthier, more transparent ecosystem, but the short term pain to advertisers (and by extension, publishers) is going to be brutal.”

Between the lines. Google portrays itself as an enabler of the free and open internet, but the DOJ argues its ad tech dominance does the opposite – it limits choice, increases costs and harms publishers.

What’s next. The trial will test whether Google’s defiant claims hold up against the DOJ’s evidence of anticompetitive practices. A positive outcome for the DOJ, as Tomlinson noted, could reshape the digital advertising landscape.

New on Search Engine Land