cagkansayin/iStock via Getty Images

I last covered Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) (NEOE:GOOG:CA) in April; at the time, I put out a Buy rating, and since then, the stock has gained 19% in price. Since my first thesis on the company, the stock has gained around 31.5% in price. Now, I am putting out a Hold rating because I believe that the stock does not offer the best value after the recent price growth. This does not mean that I do not believe in the long-term growth trajectory of Alphabet; I very much do. I am an Alphabet shareholder, but I am currently holding my position rather than adding to it. There are a couple of reasons that I am doing this, primarily related to the valuation, particularly its price-to-earnings ratio and price-to-sales ratio compared to historically, but also as a result of potential near-term struggles that the company is likely to continue to face in its artificial intelligence developments. In my opinion, Alphabet’s position in AI is likely overvalued in the short term but undervalued in the very long term. Therefore, I think investors would be wise to assess the near-term volatility that could occur.

Persisting Near-Term AI Deficiencies

I think Alphabet’s AI is currently not as advanced as it needs to be to remain competitive from a user’s perspective. Recently, its new AI Overviews feature has been responding with dangerous suggestions about diet, and it has also provided historical inaccuracies, such as claiming that former US president Andrew Johnson earned university degrees between 1947 and 2012, despite his death in 1875.

As a result of the mistakes, the company has scaled back its AI Overviews feature for certain queries. However, the issues that this incident has outlined, along with its past errors related to DEI-appropriated responses, outline a more general concern AI users are faced with. The notion of AI ‘hallucinations’ is not a new one, but the negative effects of these are becoming more pronounced as these tools scale and are being used more widely for various applications across the globe.

Alphabet’s Gemini models are designed to handle multiple types of data simultaneously, such as text, images, code, and audio, through a single user interface. The intention is for this to provide more reliable analysis across data types. Management claims that Gemini, particularly the Ultra version, outperforms other AI models on leading benchmarks. For example, Gemini Ultra reportedly scored 90% on the MMLU benchmark, exceeding the performance of both GPT-4 and expert-level humans. However, in my opinion, at this stage, the user experience of Gemini versus ChatGPT 4o is not strong enough. Gemini is consistently reserved in answering questions, for example, surrounding upcoming elections or related to health, and its answers are often less direct in general. This doesn’t mean that the model doesn’t have significant merit at this time, but I believe that its long-term AI growth and iteration trajectory are likely to be where the value lies. In the near term, I expect issues to persist until the competence of the model for mainstream commercial and professional use cases becomes more reliable.

Long-Term Growth Trajectory

CEO Sundar Pichai’s long-term vision for AI is very strong, in my opinion. In addition, coupled with this, I think that his leadership style is conducive to a strong long-term position in the field of AI. After watching many interviews with Mr. Pichai, I think he holds strong values, and I believe these are also held by Sergey Brin and Larry Page, which are then reflected in the broader company. This has been evidenced by the fact that during this time of rising automation, Alphabet is looking at reallocating its workers as much as possible rather than laying them off for short-term efficiency gains. The culture that Alphabet has built appears to be based on long-term prosperity, boding very well for the long-term development and character of its AI systems. That being said, shareholders need to be aware that this is a double-edged sword, as the culture can also become complacent.

Pichai has mentioned that he sees immense innovation capabilities ahead with the shift to AI, with Alphabet positioning itself to be one of the top opportunists. His vision is to make AI technology accessible to everyone globally, which is likely to drive significant economic benefits like cheaper costs of production. In addition, while this has not been explicitly stated in recent interviews, DeepMind (an Alphabet subsidiary) has the long-term goal of creating artificial general intelligence, often also called artificial superintelligence.

The long-term advantage Pichai and the Alphabet team have is developing AI responsibly—this effort is bolstered by its collaborations with experts and governments to address potential risks. In theory, the short-term mistakes that were made with DEI-appropriated responses show a willingness to develop ethics within Alphabet’s AI models, it was just executed poorly in the initial stages. Therefore, the company needs to make sure that the essential values it holds are congruent with its long-term success. It is becoming quite apparent that a company’s values are very clearly reflected in the responses of its AI systems.

Financial Analysis

Alphabet’s Q1 earnings results from April were very telling about the long-term financial strategy that the company is developing through its AI initiatives. Sundar Pichai has emphasized the monetization of AI through various channels, including advertising, cloud services, and subscriptions. However, it is worth remembering that advanced AI development requires high costs, which has the potential to reduce margins as the expenses for data centers, as a crucial example, scale further. This cash flow risk is further exacerbated by the competition from other leading AI players like Microsoft (MSFT) and Amazon (AMZN).

In Q1, the cloud segment, which houses much of Alphabet’s AI technology, delivered a 28.4% YoY increase in revenue, reaching $9.57B. Google Cloud reported its second consecutive profitable quarter. In essence, the data is stacking up that Alphabet’s AI initiatives are substantially conducive to growth. However, there are likely to be some periods of economic stagnation in regard to organizational restructuring as the company grows in its long-term strategy of making AI the core driver of its business model.

I mentioned in my previous analysis that the company has already undergone layoffs, for example, approximately 12,000 employees in January 2023, in an effort to streamline its operations and focus on AI. However, further workforce adjustments are likely to come, with reskilling initiatives placing short-term financial pressures on the company as a result of periodical productivity losses. That being said, Alphabet is not the only company facing this issue—Microsoft, Amazon, Meta (META) and other leading tech giants will be facing similar restructuring dilemmas.

Core to my thesis here is that the long-term financial benefits of AI for Alphabet include margin expansion, increased user engagement and more professional users of the company’s research engines driving revenue growth, and the potential to cultivate one of the dominant moats in AI infrastructure.

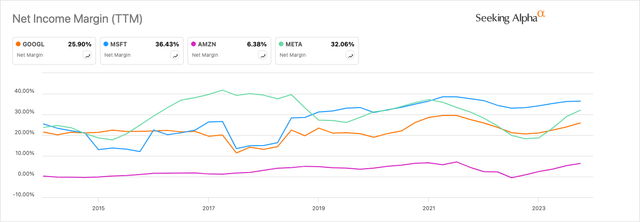

However, thus far, Microsoft has proven much more skilled at expanding its net margin, which is one of the leading reasons why MSFT has delivered a 10-year price return of around 971% against GOOGL’s 506%. It also needs to be recognized that Microsoft arguably has the lead in building artificial general intelligence at this stage, and there is likely to be a compounding effect of the capabilities of these superintelligences, which could drive a leaner culture at Microsoft sooner than at Alphabet due to increased automation capabilities. Coupled with Microsoft’s reputation as being uncompromising in its personnel policies compared to Alphabet, this means that it might continue to outperform Alphabet on a pure financial front, although this might be at the expense of its long-term progress in cultivating ethical AI over profitable AI.

Valuation & Price Target

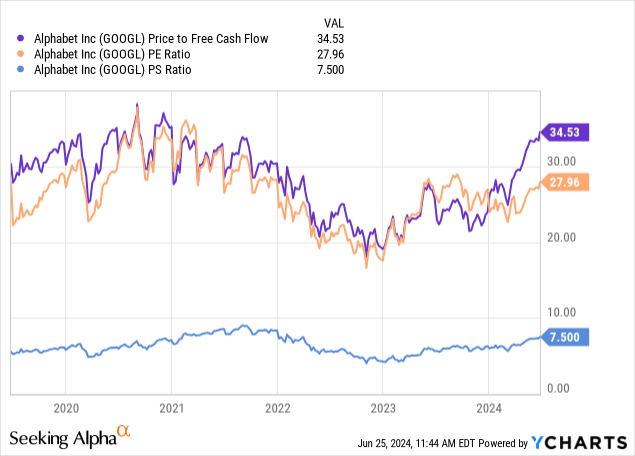

In my opinion, Alphabet shares are likely overvalued at the moment. Its forward price-to-sales ratio has expanded from its five-year median by 12.52%. Also, while its forward P/E ratio shows a contraction of 8.45% from the five-year median, its price-to-free-cash-flow ratio has expanded from a 10-year median of 30 to around 34 at this time.

In my last analysis of Alphabet, my discounted cash flow model outlined that Alphabet likely had a fair value of around $190 per share. At the time of publication, the stock price was $152.78; now, it is $182.63. Therefore, I think it is advisable that some caution be introduced, and I am refraining from buying more of the shares at this time because I believe that the company is now likely fairly valued.

In this analysis, I am presenting a 10-year price target, which estimates that the P/E ratio is likely to be 25 after 10 years. I am estimating 17.5% basic EPS growth over the period, which is favorable due to higher levels of adoption of Alphabet’s services as a result of its continued scaling of AI. The TTM basic EPS is $6.57. That makes my 2034 price target $823.75, which implies a CAGR of 15.5% from the current stock price. While this is arguably a reason to invest, my Hold rating is intended to guide that the valuation opportunity is less pronounced now than it was in early 2023 and earlier this year. In addition, certain future risks hold the potential to reduce this 10-year CAGR estimate significantly.

Further Risk Analysis

The company’s main competitor, Microsoft, needs to be given deeper analysis here, as I believe OpenAI is still an undervalued threat to Alphabet’s search model. Although CEO Sundar Pichai and Alphabet’s management are doing the right thing by moving the company toward an AI-first approach, there is still a large vulnerability here. At the moment, Alphabet processes approximately 90% of total platform search queries and approximately 95% of mobile search queries, according to leading sources, but if this reduces to 80% of total platform search queries and 85% of mobile search queries due to the growing utilization of search bots, Alphabet’s advertising revenue would be hit significantly.

There are also regulatory and legal challenges ahead that are likely to intensify as Alphabet has a more dominant AI superintelligence. The company is already under significant regulatory scrutiny globally, and the U.S. Department of Justice has active antitrust cases against the company, which focus on its search market dominance and business practices. In Europe, Alphabet has already lost antitrust cases, and Japan’s Fair Trade Commission recently accused Google of implementing anti-competitive advertising-search restrictions. In my opinion, cases like these are likely to become more severe as its AI becomes more powerful, especially as the use cases for its AI models become more apparent in professional services, with areas like healthcare likely causing significant concern for safety reasons. These cases will be especially important considering AI’s continued tendency to make significant errors. Therefore, investors should not be surprised if there are periods of growth inhibition or major setbacks in fields of potential expansion.

Conclusion

Alphabet is one of the largest positions in my portfolio, and I don’t plan on changing this. However, at this time, I am refraining from increasing my position because I think that the company is likely fairly valued now. As a result, my rating at this time is a Hold, but it is likely to be a Buy again in the future when I think the valuation has become more appealing. My outlook on its future AI strategy is very positive, although I recognize it is facing short-term challenges and the competition from its major competitor, OpenAI, should not be underestimated.