Prykhodov

Tech valuations have come under considerable pressure this week, even after Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL) a.k.a Google presented rather good quarterly earnings for 2Q24.

Google’s profits exceeded the Street’s estimate and operating margins grew as well, thanks to a solid trajectory in search and cloud.

Google’s stock fell 5% on Wednesday, creating a fear-driven opportunity for rational investors to gobble up stock at a discounted price.

Uncertainty about AI spending might have added to the weak earnings response, but the earnings release as such contained many more positives than negatives, in my view.

With a profit multiple of less than 20x and double-digit profit growth anticipated next year, I am exploiting the uncertainty and scrambling to grab more stock out of the bargain bin.

My Rating History

Google’s solid search results and advertising rebound underpinned my Buy recommendation previously, as did the company’s share buyback program and the announcement of a dividend.

In the second quarter, we have seen ongoing momentum in search. While management could have done more to explain the specific benefits of its AI spending, I think that the market responded in an immature and short-sighted way to Google’s earnings.

2Q24 Results Were Good Enough, Cloud Now $40 Billion/Year Business, Search Strength

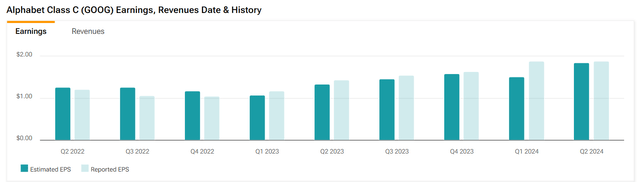

Google ended the second quarter with $1.89 per share in profits, which exceeded the Street’s profit estimate of $1.85 per share by 4 cents. Google’s 2Q was the sixth consecutive quarter in which the technology company reported better-than-expected profits.

Earnings And Revenue (Yahoo Finance)

If we look at Google’s earnings results, the technology company had a reasonably solid second quarter with major key financial targets growing in the double digits: Total sales rose 14% YoY to $84.7 billion, thanks to recovering growth in search.

YouTube sales were up 13.0% compared to last year and reached $8.7 billion. Cloud, which is now on a $40 billion annual run-rate sales basis, grew sales 29% YoY.

Google’s profit growth was impressive as well: The technology company earned $23.6 billion in net income, up 29% YoY thanks to robust demand for ad sales on the search platform, but also cloud, which made the biggest sales leap in the second quarter.

Importantly, thanks to continued scaling success in the search and cloud segment, Google has been able to grow its operating income margins from 29% to 32%. This growth is driven by search, which is seeing ad sales strength, as well as cloud.

Google’s cloud business is shaping up to become a real juggernaut of a business, with $10.3 billion in sales in 2Q24 and an operating income of $1.2 billion.

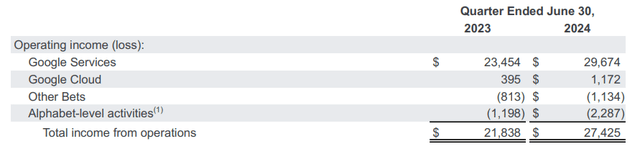

Though the cloud’s operating income profitability is still relatively low (it accounted for only 4% of total operating income), the segment is by far the fastest growing segment: Cloud tripled profits YoY whereas Google Services (which includes Google’s advertising platforms) grew its operating income 27%.

Though search is still the main source for the majority of Google’s operating income, the cloud is the most compelling story within Google from a growth angle.

Operating Income (Alphabet Inc.)

The Market Needs Certainty About Google’s AI Spending

Google’s 2Q24 earnings were not bad at all, but management failed to clarify on the earnings conference call what the specific benefits of the company’s AI investments will be.

While tech stocks really have had an impressive run so far this year, the lack of specific AI benefit guidance may have contributed to Google’s selloff on Wednesday and made a bad situation worse.

Presently, tech stocks have rotated out of favor with investors, with weakness also affecting other technology companies such as NVIDIA Corporation (NVDA), Advanced Micro Devices, Inc. (AMD), or Amazon.com, Inc. (AMZN).

Management has so far not been able to specifically lay out the benefits of its AI spending and explain (quantify) where these benefits will be generated. Google’s AI spending is part of Alphabet-level activities (shown in the previous table) and amounted to $2.3 billion in the second quarter. The lack of specific AI spending guidance may have added a layer of uncertainty here that investors have not reacted well to.

With that said, though, Google has been able to grow its business consistently through innovation over time. I think that the technology company deserves the benefit of the doubt, particularly since its actual profits are skyrocketing and the stock is quite cheap.

Low Profit Multiple For A Fast-Growing Tech Business

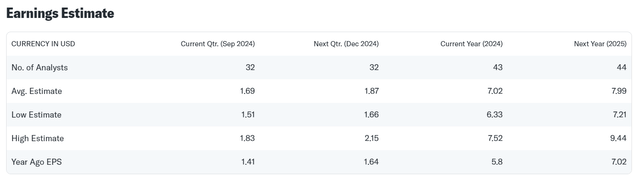

Google is presently selling for a profit multiple of 19.8x, based on next year’s earnings, which I don’t think is a rich multiple at all when considering the company’s quasi-monopoly position in search. Google is poised to see ongoing strength in advertising and the market and models a profit growth rate of 14% in 2025.

Earnings Estimate (Yahoo Finance)

Meta Platforms, Inc. (META), to which I have compared Google in the past due to comparable business orientation and reliance on advertising spending, is selling for a 19.6x profit multiple. This is also based on next year’s estimates, which reflect an implied YoY profit growth rate of 15%. Google and Meta Platforms are cheaply valued, given their dominant market positions in advertising, and I think that both stocks are value buys here.

Why The Investment Thesis Might Not Play Out

The present technology selloff may cause some investors to question how sensible Google’s AI spending is. Management did not specifically illustrate or quantify what the benefits of its AI investments are, which has created some uncertainty for investors. Thus, there is a risk that companies get carried away with their AI spending that might not translate to actual real-world benefits for shareholders.

Google’s underlying business performance in 2Q24 was solid, however, and I think that Google’s growth in key financial targets, such as operating income margins and profit growth, equate to an overall favorable risk/reward relationship.

My Conclusion

I am buying the tech carnage hand over fist because paying less than 20x leading profits for a company that essentially has a monopoly on search and a growing cloud footprint is an excellent bargain, in my view. Most importantly, Google is displaying an ability to translate this business growth into real profit growth.

Profits in 2Q24 skyrocketed by 29% and Google’s operating income margin increased 3 percentage points YoY. Cloud operating income growth tripled and though the percentage contribution is still relatively low, it is a highly promising business that now has a run-rate sales volume of $40 billion per annum.

The more investors pull back from Google at a time of a seemingly accelerating selloff in tech, the better I think the value proposition is. Buy.