Ingus Kruklitis

In recent weeks, Google’s (NASDAQ:GOOG)(NASDAQ:GOOGL) shares have depreciated as part of the overall market selloff despite the fact that the company has delivered a stellar earnings report for Q2 in which it exceeded expectations. I believe that the depreciation of Google’s shares is unjustified since the company has everything going for it to continue to show an impressive performance thanks to the implementation of new AI tools and higher advertising spending due to the favorable macro environment. Even though some risks will continue to haunt the company in the foreseeable future, I believe that overall Google remains a solid investment at the current price and that’s why I retain my BUY rating for its shares.

Google Once Again Exceeds Expectations

Back in May, I published my latest bullish article about Google where I noted that the company has the potential to generate excessive returns in the foreseeable future. While since that time its shares have depreciated by ~6% and underperformed against the broader market, I still believe that its shares remain an attractive long-term investment, especially at the current relatively depressed market price.

If we go through Google’s latest earnings report for Q2 which was released last week, we’ll see that there’s nothing not to like about the company at this stage. During the quarter, its revenues increased by 13.6% Y/Y to $84.74 billion and were above expectations by $450 million. At the same time, its GAAP EPS of $1.89 was above the expectations by $0.04. Such impressive growth coupled with the better-than-expected performance show that Google is set to end the current fiscal year on a high note and potentially create additional shareholder value along the way.

One thing that can help the company retain its momentum in the following quarters is the improving macroeconomic environment. The latest economic data shows that the American economy is improving at a healthy rate while the inflation risks are easing. This has already prompted the Federal Reserve to consider cutting interest rates next month, which could lead to a decrease in borrowing costs and the quicker growth of the overall economy.

The improving economic activity could also lead to a higher advertising spend, which would be beneficial to Google which primarily relies on advertising revenues to grow its overall business. Digital ad spending is already projected to reach a record $740.3 billion this year alone, with the search segment getting the most advertising dollars among all of the segments within the digital advertising market.

Considering that Google managed to retain its leadership position in the search engine market despite the increased competition from Microsoft’s (MSFT) search engine Bing, it would be safe to assume that the company will once again become the biggest beneficiary of the increased ad spending within the search segment in the following quarters. We already saw that in Q2, Google’s search revenues increased by 13.8% Y/Y to $48.5 billion, and it’s likely that the search business will continue to expand in Q3 and beyond given the improved macro environment.

What’s more, is that Google’s active role in implementing various AI tools within its ecosystem to help users efficiently browse the internet and help advertisers improve their conversion rates could also help the company’s search business retain its momentum in the following quarters. During the recent conference call, the company’s management noted that its recently launched Google AI Overview assistant already has experienced an increase in search usage. At the same time, the implementation of various AI-driven tools has also helped business owners better connect with customers and improve their advertising campaigns. Considering all of this, it makes sense to believe that as long as Google continues to improve the user experience and makes it possible for advertisers to run more efficient ads within its ecosystem then its own business will continue to flourish.

On top of all of that, the continuous growth of YouTube, which experienced a 13% increase in revenues in Q2 to $8.66 billion, and growth of the cloud business, which experienced an impressive 28.8% increase in revenues in Q2 to $10.35 billion, indicates that Google has enough growth opportunities in businesses beside search where it can also drive sales. The potential ban of TikTok in the United States next year can give a boost to its YouTube business as millions of users would likely look for alternative short-form video platforms to replace TikTok. At the same time, with the cloud market expected to double in size in the next four years, we’ll likely see the aggressive growth of Google’s cloud sales as well in the foreseeable future.

What’s Next For Google’s Shares?

At this stage, it seems that Google has everything for it to continue to exceed expectations and create additional shareholder value along the way. By scaling its AI initiatives, having one of the best technology infrastructure builds in the world, and sitting on over $100 billion in cash reserves, the company is poised to benefit from the improved macroeconomic environment and there’s nothing not to like about its business at this stage.

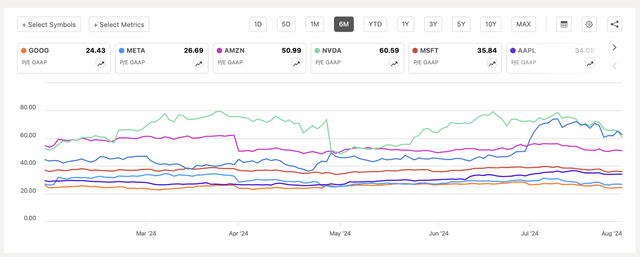

On top of that, by trading at lower multiples than its major peers like Meta Platforms (META), Amazon (AMZN), Nvidia (NVDA), Microsoft (MSFT), Apple (AAPL), Tesla (TSLA), and expecting to grow its revenues and earnings at a double-digit rate in the following years, I believe that Google is an attractive investment right now.

Google’s P/E ratio against its Magnificent 7 peers (Seeking Alpha)

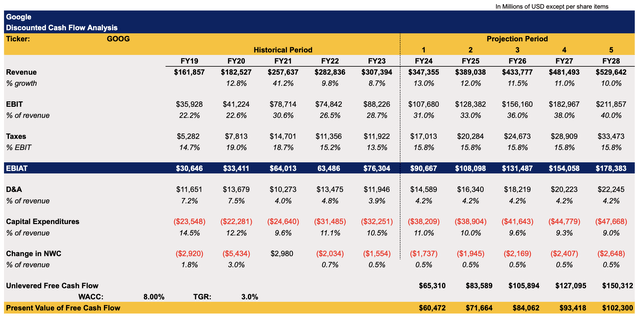

In addition to a solid outlook, Google’s stock also represents a significant upside at the current price. Below you can see my DCF model, which primarily assumes slightly higher revenue growth rate expectations for the following years in comparison to my previous model from the last article. This is due to the fact that a favorable macro environment coupled with the implementation of various AI tools across its businesses should help the company continue to grow at a double-digit rate in the foreseeable future. The new revenue assumptions for the next couple of years also closely correlate with the overall consensus.

At the same time, the latest successful earnings report also showed that the company has more than enough growth catalysts to expand its margins, which haven’t been this big in more than a decade, and even more in the future. That’s why a higher EBIT is also assumed in the model. The CapEx is also expected to increase due to the need to scale its AI-related infrastructure and scale its AI-related initiatives. The expectations for the rest of the metrics closely align with Google’s historical performance. The WACC in the model is 8%, while the terminal growth rate is 3%. Both are unchanged from the previous model.

Google’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

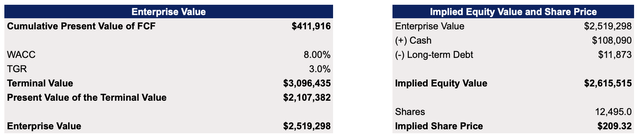

This model shows that Google’s fair value is $209.32 per share, which represents an upside of ~24% from the current market price.

Google’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

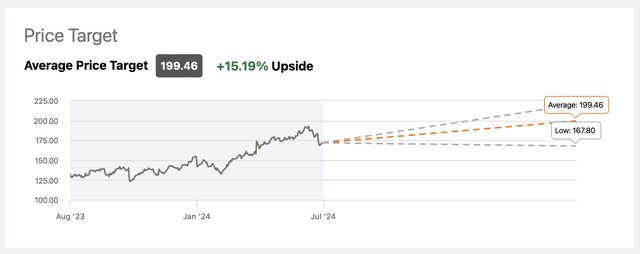

My price target is slightly above the overall consensus, but the street also believes that the upside is in the double digits.

Google’s Consensus Price Target (Seeking Alpha)

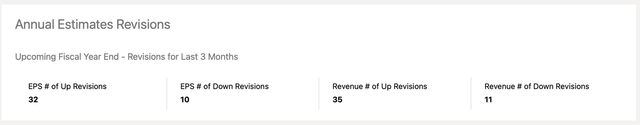

Considering that in the last few months, we’ve seen dozens of upward revenue and earnings revisions, there’s a decent chance that the consensus will be higher by the end of the year and closer to my price target if Google continues to exceed expectations. That’s why I’m doubling down on Google at this stage.

Google’s Revisions (Seeking Alpha)

The Growth Is Not Guaranteed

Despite all the growth opportunities, there are nevertheless several risks that investors need to be aware of. First of all, the c hanging regulatory environment could negatively affect Google’s ability to expand its business in the future. Just recently, it was reported that the company’s partnership with the AI startup Anthropic is under inquiry by British regulators, while the European Commission earlier this year started an investigation for the potential breach of the Digital Markets Act by Google and its peers. Meta Platforms already could face a fine of up to 10% of its 2023 worldwide revenues by the European regulators later this year for abusing its dominant position in the social media field. Google could also face similar fines in the future and experience the potential disruption of its business operations by the end of the current decade.

In addition to the increasing regulatory pressure, the latest escalation of the Sino-American trade war could also derail the recovery of the global economy and slow down advertising spending, which could negatively affect Google’s performance. Currently, the Biden administration is considering tougher trade restrictions against the Chinese chip industry. At the same time, Donald Trump aims to increase tariffs on Chinese imports to over 60% if reelected, while Chinese policy analysts don’t believe that the presidency of either Donald Trump or Kamala Harris will result in the improvement of relationships between the two countries. In June, the IMF has already warned that tougher trade restrictions risk wiping out 7% of the global GDP, but that did not stop the European Union from increasing tariffs on Chinese EVs last month.

On top of all of that, OpenAI started to test its AI-powered search under the name SearchGPT last week, while Microsoft has recently introduced a new generative AI tool for its search engine Bing. Even though Google remains a dominant player in the search segment, its market share could nevertheless start to decline if its competitors figure out a way to undermine its leadership position with their new tools and applications.

The Bottom Line

Some of the risks described above will certainly continue to haunt Google in the foreseeable future. However, in its current state and at the current price Google appears to be a solid investment with a significant upside. In my opinion, its growth opportunities outweigh the risks right now and the latest depreciation of its shares is nothing more than a market overreaction. That’s why I retain my BUY rating for Google, and its shares continue to account for a decent percentage of my overall portfolio.