da-kuk

Intro & Thesis

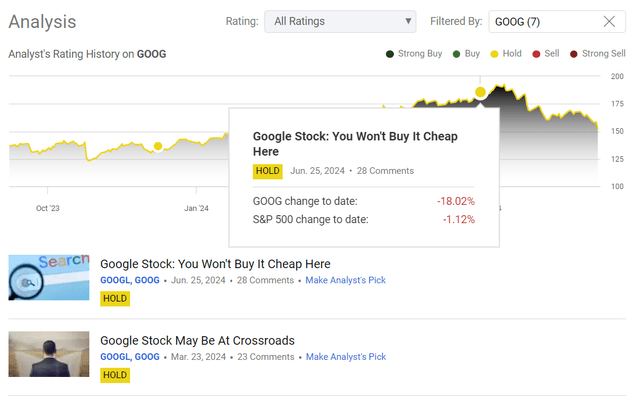

My coverage of Alphabet Inc. (NASDAQ:GOOGL) (NASDAQ:GOOG) (NEOE:GOOG:CA) stock was initiated here on Seeking Alpha back in November 2022. I initially had issued a neutral rating, and for the past 5 articles, I maintained it, pointing out that Google’s launch of Gemini, a large language model for AI applications, should challenge Microsoft’s (MSFT) “AI monopoly” and could boost Google’s projected EPS figures in the medium term, but the valuation seemed too hot for me to touch.

Since my last update on Google, the stock price has cooled significantly and has underperformed the broad market many times over:

Seeking Alpha, the author’s coverage of GOOG stock

Despite the current market pessimism regarding Google’s potential return on investment from its increased AI-related capital expenditure, I believe the stock is already attractive at its current levels. Although GOOG could fall further, I think investors might consider initiating a starter position. Therefore, I’m upgrading GOOG from “Hold” to “Buy”.

Why Do I Think So?

First off, let me address the primary factors likely driving Google’s stock downward at the moment. I see two main reasons: 1) the ongoing antitrust case and 2) concerns about Google’s return on investment from its AI-related capital expenditures.

On January 24, 2023, the US DOJ brought an antitrust suit against Google accusing the firm for illegally monopolizing the advertising technology (adtech) market “in violation of sections 1 and 2 of the Sherman Antitrust Act of 1890.” As Seeking Alpha recently reported, a victory for DOJ would “set the stage for them to ask U.S. District Judge Leonie Brinkema to order a breakup of the company”, which is a huge risk for shareholders, as you can imagine.

The company is expected to appear for the trial next week, but some analysts have already calculated the potential financial impact Google could receive after the trial. Here’s a quote of analysts from J.P. Morgan (proprietary source) I found:

We think the judge could require additional remedies to increase competition in the general search and text ad markets, such as Google providing patents or data for competitors to train on, though privacy should be a concern. While there is a wide range of outcomes across multiple variables, based on our scenario & sensitivity analysis we now believe Google is most likely to see up to 10% negative impact on its EPS, w/further (though less likely) downside scenario to 20% negative impact.

But they add that the in the base case scenario, the net negative impact on EPS for FY2026 would be in the range of 3-7%:

If we assume Google loses 10% share across Apple, third-party browsers, Android, & Chrome, and the TAC paid to Apple decreases by 10%, Google could see a 3% headwind to its 2026E GAAP EPS if changes apply only in the US and a 7% headwind if changes apply worldwide. In a further downside scenario in which Google could lose 25% share across distribution partners, EPS headwind could be 9%-21%.

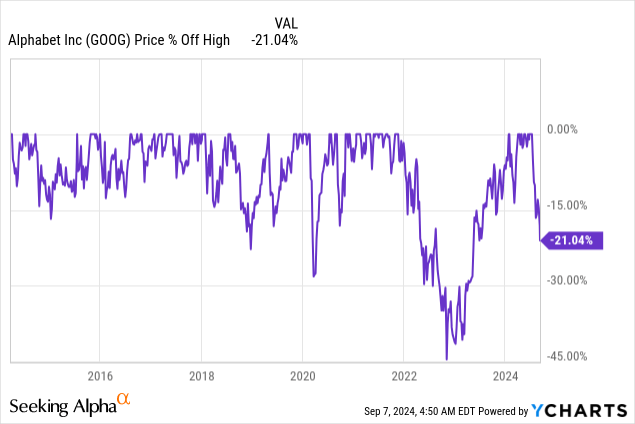

The net impact of 3-7% on earnings per share in 2 years is not a particularly strong shock in my opinion, which may explain the off-high of already over 20% that we see in GOOG stock:

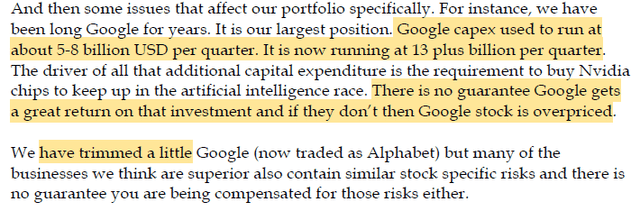

Another concern is the growing opinion that the massive investments the company has planned for the coming years in developing solutions to grow its business may ultimately prove unprofitable, making the stock overpriced as of today.

Librarian Capital, shared on X

The overvaluation was the primary reason for my downgrade a few months ago. I will revisit this point shortly, but for now, let’s examine how the company performed in its most recent financial quarter.

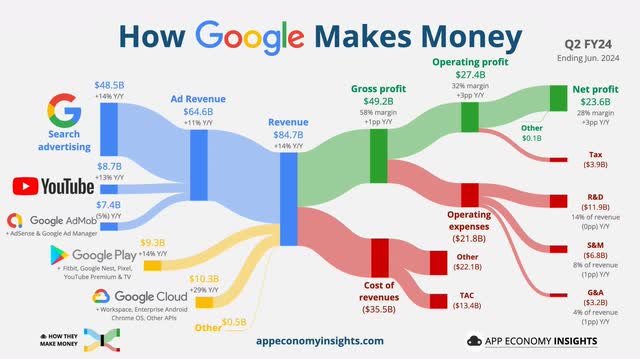

App Economy, publicly shared on X

Having made over $84.7 billion in sales and generated $1.89 in earnings per share in Q2 FY2024, Google marginally beat the consensus forecasts last quarter – by 0.53% and 2.54%, respectively (Seeking Alpha Premium data).

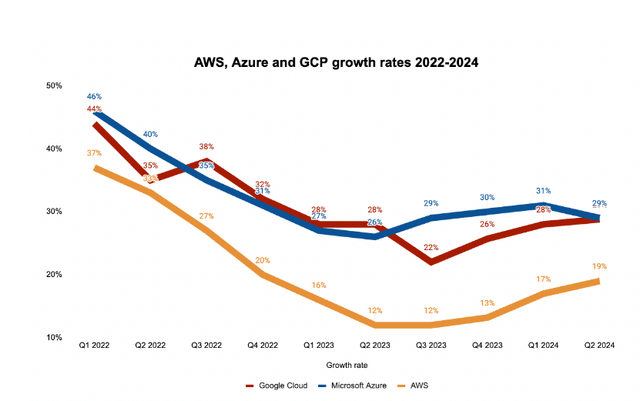

As you could see from App Economy’s chart above, Google’s advertising revenue, which is the primary income source for the firm, increased by 11% YoY to $64.6 billion, driven by 13.8% YoY growth in Search advertising and 13% YoY growth in YouTube ads (largely fueled by the retail sector). Google Cloud also showed robust performance with a 29% YoY revenue growth, slightly accelerating from previous quarters. The EBIT from this particular segment amounted to $1.2 billion. It’s still the third-largest cloud provider in the world by market share (~11% of total), but its expansion is going quite strong actually even amid peers like Microsoft’s (MSFT) Azure and Amazon’s (AMZN) AWS, which is good:

What also looked good in Q2 was the firm’s cost control: the total cost of revenue rose by 8.6% YoY while EBIT surged by 25.6% to $27.4 billion, leading to the operating margin expansion to 32.4% (by 310 b.p.). Traffic acquisition costs rose by 7%, with the TAC margin narrowing by 80 basis points to 21%. The Other Bets segment, including ventures like Google Fiber and Waymo, reported a larger operating loss compared to the previous year, but their weight in Google’s revenue structure was as always minimal.

Alphabet’s strategic focus on AI was highlighted during the recent earnings call for Q2, where the management noted that Google’s AI initiatives are now being utilized by >2 million developers worldwide, while Gemini AI model is now integrated into various Google products, “enhancing user experiences and engagement.”

Indeed, Google is investing heavily in its technical infrastructure, with a reported $13 billion in CAPEX for Q2 alone (primarily for servers and data centers) and plans to maintain or exceed this level of investment throughout the year. I generally agree with the skeptics that this level of investment significantly impacts the company’s chances of good ROIs, because it’s not just Google making such substantial investments – this is the cost of competitive struggle. However, without these investments, the company will certainly be unable to compete on equal footing with Microsoft, Amazon, and other tech giants in the long term. Maintaining its competitive edge is indeed a challenging task.

In my opinion, we can’t simply conclude that Google is in a difficult period and that its capital investments may not be justified, leading us to avoid buying the stock. I believe the situation should be assessed differently, focusing on how the company’s prospects will mathematically develop over the next few years, considering current uncertainties, risks, and opportunities. Therefore, I propose updating my DCF valuation model from the last quarter with new input data to see how the previous overvaluation I mentioned has changed.

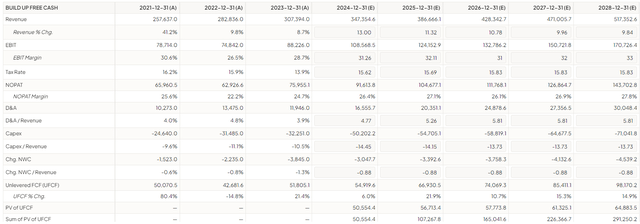

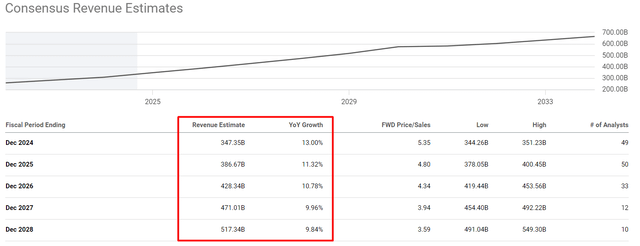

The market currently projects that the company’s revenue will grow at a CAGR of ~8.3% over the next 5 years (i.e. until FY2028). I will adopt this consensus as my baseline assumption:

Seeking Alpha Premium, GOOG, notes added

Last time I built the model I projected that Google’s EBIT margin would be between 35% and 36% in the coming years: Specifically, I projected it’d reach 36% in FY2027 and 37% in FY2028. This time, taking into account the antitrust trial risks, I’ll assume that the company’s margins will decline to 31% in FY2026. In FY2027, they will begin to gradually recover to 32%, and by FY2028, it’ll reach 33%. This is below today’s consensus, based on the free cash flow data I have.

I’ll also assume that the company’s cost of debt is only 4%, meaning the bonds it issues today would trade at a relatively narrow spread to the risk-free rate, as they have historically. With the current risk-free rate of just 3.56% and a market risk premium (MRP) of 5%, I get a weighted average cost of capital of ~8.7%, which is 50 basis points lower than it was 3 months ago.

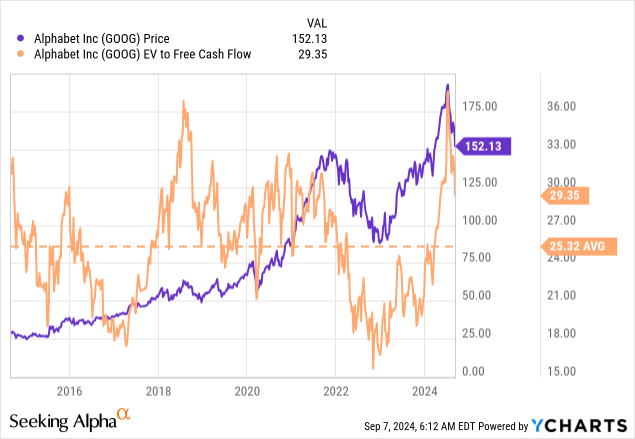

Despite its dip over the past few weeks, Google stock is currently trading at a 29x EV/FCF multiple, while the average over the past 10 years is about 25.3x. I assume that by 2028, as the company’s revenue growth rate declines, Google will trade at a 26-27x multiple – this reflects a natural erosion of valuation multiples, but share buybacks and the company’s existing moat should theoretically support at least some premium to the historical norm.

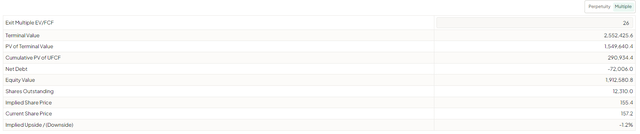

Given all the input data, I conclude that Google is approximately fairly valued today:

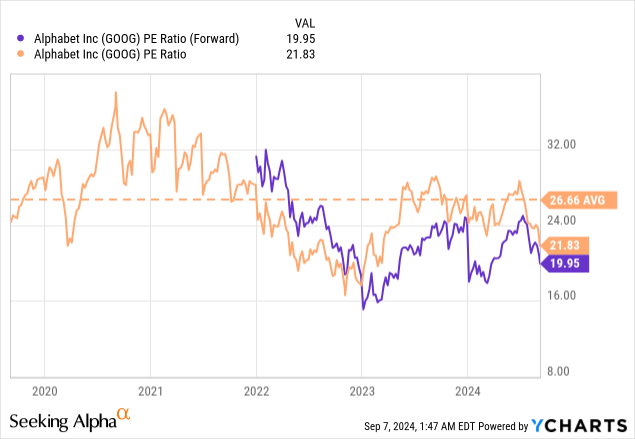

However, when I look at the company’s comparative valuation (through multiples), I find that today’s P/E, when considering forward EPS, actually indicates an undervaluation of ~25%, suggesting a growth potential in today’s valuation relative to the historical average (assuming the current consensus forecast for net profit is accurate).

As far as technical analysis is concerned, this is how I see it. First, the recent price decline has taken Google to its 52-week moving average, a level not reached even during the decline earlier this year. This coincides with relatively weak historical seasonality, as Google has posted positive returns in September only 30% of the time over the past 11 years. However, this represents a potential buying opportunity for investors as seasonality improves immediately after September and the long-term weekly trend remains intact.

TrendSpider Software, GOOGL stock weekly, the author’s notes

Second, one of the worst-case scenarios for Google right now is the potential testing of the price gap that formed after the earnings report earlier in the year. However, I believe that as the price approaches this level, we’ll see strong buying pressure that may serve as sufficient confirmation that the current correction is over.

So based on all of the above, I decide to cautiously upgrade GOOG to “Buy” again, as I anticipate that most of the existing risks are already in the price.

Where Can I Be Wrong?

First of all, let me explain why I’m “cautiously” raising my rating.

I’m genuinely concerned about investors who purchased Google a few weeks ago, before the recent dip, as there’s a risk that the price may not return to those levels for many months. This is particularly true if the ongoing legal litigation continues and results in outcomes more significant than analysts currently anticipate. If Google is forced to sell some parts of its consolidated business, it’d be a very serious blow to its ability to generate value for shareholders, in my view. This is a significant risk that cannot be overlooked.

Another risk to my current upgrade is the high level of competition. As you can understand, the intrinsic value of Google’s stock today is tied to several key components. Google’s growth story, its advancements in AI (the monetization of AI), can’t be separated from its cloud business. In this area, Google faces competition from numerous technologically advanced peers. Additionally, while Google Search generates the largest share of the company’s revenue and is largely a monopolist in its market, it still faces competition: Many people I know are already using ChatGPT to test hypotheses and solve minor problems instead of Google search engine, as it often provides more practical answers for them. If Microsoft and other competitors manage to outperform Google’s innovative achievements and provide greater value to users, this could pose a significant challenge to Google’s return on investments it expects to continue to increase.

There’s also a risk that I might misinterpret the current chart patterns. If we shift our focus from the weekly chart to the daily chart and change the 52-week moving average for a 200-day moving average, we’ll see a concerning picture: The price closing below its long-term SMA could theoretically signal the end of the uptrend.

TrendSpider Software, GOOGL stock daily, the author’s notes

The Bottom Line

Despite the obvious risks that keep putting significant pressure on Google today, I still believe that the likelihood of the company being forced to split up to comply with antitrust laws is greatly exaggerated. I generally agree with the analysis provided by JPM in their recent report, which focuses on negative impacts of only 3% to 7% to FY2026 EPS. So that’s why I don’t foresee a collapse or significant deterioration in the company’s business. From what we observed in Q2 FY2024, things are progressing well. Yes, the company has more than doubled its CAPEX because of AI spending and continues to increase it, with substantial expenses planned. However, these investments should ultimately bear fruit, as failing to make them would certainly mean losing the innovation race.

Even if we anticipate a drop in margins, as I did in my updated DCF financial model, the stock would turn out to be already fairly valued today, while based on valuation multiples, it may be even undervalued by about 25%. Therefore, I believe it’s now reasonable to consider Google stock for a long-term or medium-term purchase; perhaps not full position at once, but gradually.

I’m upgrading GOOG to “Buy” today.

Thank you for reading!