gazanfer/E+ via Getty Images

I last covered Google (NASDAQ:GOOGL) (NASDAQ:GOOG) in June; I issued a hold rating at the time on overvaluation concerns. After a 7% decline in price since then, I am upgrading my rating to a Buy again. Google is one of my favorite investments and companies of all time-in my opinion, its structure, management, and valuation make for one of the most stable and least volatile big tech investments on the market. Despite this, the risks of AI usurping Google Search are mounting, in my opinion, and to date, I do not think Gemini, Google’s commercial AI offering, has enough utility to offer enough growth prospects, even though it does offer resistance against competition.

Google Is Solidifying Its Moat In Search With AI

After reviewing the Q2 earnings call transcript, there are several areas that caught my attention about how management is dealing with the current changing AI landscape.

First of all, Google has introduced visual search, including Google Lens, Circle to Search, and Multisearch tools. These are likely to help Google fend off chatbots like OpenAI and, even more commonly now, capabilities within Meta’s (META) family of apps. This visual search technology is revolutionizing the search industry because users are now able to find products using images, which leads to higher conversion rates.

This brings me to why grounding with Google Search is so important for the company’s AI capabilities; it also helps it to establish somewhat more of a nuanced moat than other tech companies offering chatbots, as many of these chatbots use Google as a third-party to crawl data, but Gemini and Google AI have proprietary access to the code and full database.

Furthermore, it is already well-known that Google is integrating ads into its AI-generated search answers, known as AI Overviews. However, management has now strategically decided to integrate ads into its AI Overviews, which are relevant to the query and the information in the AI Overview. This is a monetization tool that other chatbot providers do not have, who rely on subscriptions-it arguably protects Google quite a lot from the monetary drawbacks of rising AI competitors.

More broadly, Google’s Tensor Processing Units and the recently announced Axiom processor, as well as its AI-optimized data centers, represent a full-stack approach to AI. While Google’s frontier AI models are not open-source (but arguably could and should be to aid in leadership and iteration efficiency), TensorFlow, its machine learning framework, is open-source. Furthermore, Google has developed Vertex AI, which is a machine-learning platform that simplifies the full development of AI models. In my opinion, these developments, which are only a few of its many, are helping Google to stay competitive in the AI arms race with an infrastructure that can only be matched by other big tech firms like Amazon (AMZN) and Meta.

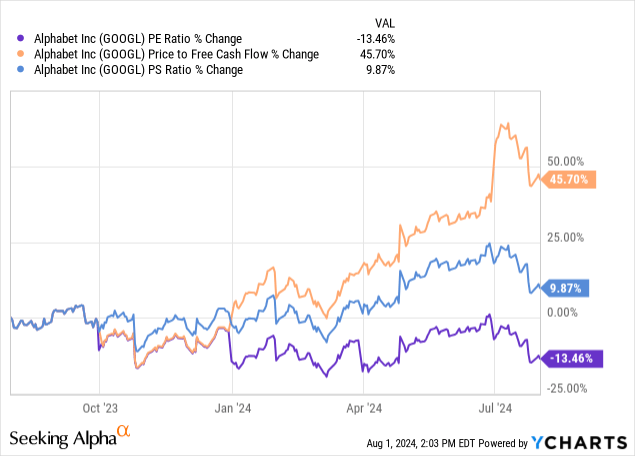

Google Is Now Fairly Valued Again, Making It A Buy

In my last analysis of Google, I outlined that the stock had likely become moderately overvalued after the significant undervaluation in 2022. The result of my analysis at that time was a price CAGR of roughly 15.5% over the next 10 years in a bull-case outcome. I also mentioned that there were short-term downside risks related to the overvaluation at the time; now, I estimate that these have largely already come to pass. As a result, my price CAGR forecasts for Google have now increased.

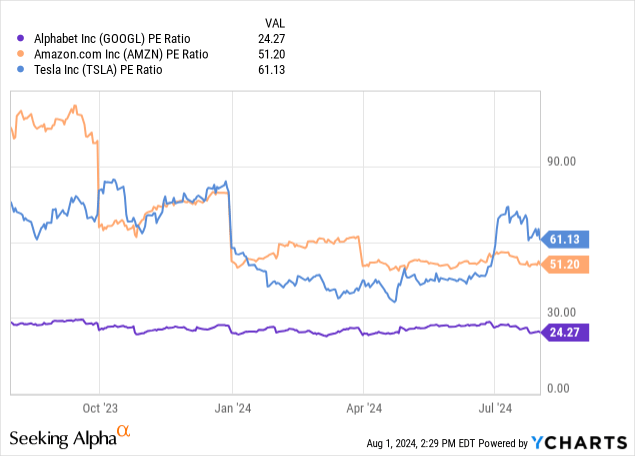

Google is one of the largest investments I have, and I am proud of this fact despite the fact that it may lack the same ruthless competitive advantages that companies like Amazon and Tesla (TSLA) have. Google has famously gained a reputation as somewhere where it’s hard to get fired, but it’s also got the reputation of hiring the brightest, most elite talent in its field. As a result of Google’s financial and organizational strategy, which I believe is centered on developing a stalwart nature (slow and steady rather than fast and volatile), the stock is incredibly attractively valued due to its lower growth prospects than some other big tech firms.

Amazon Earnings Estimates (Seeking Alpha)

Google Earnings Estimates (Seeking Alpha)

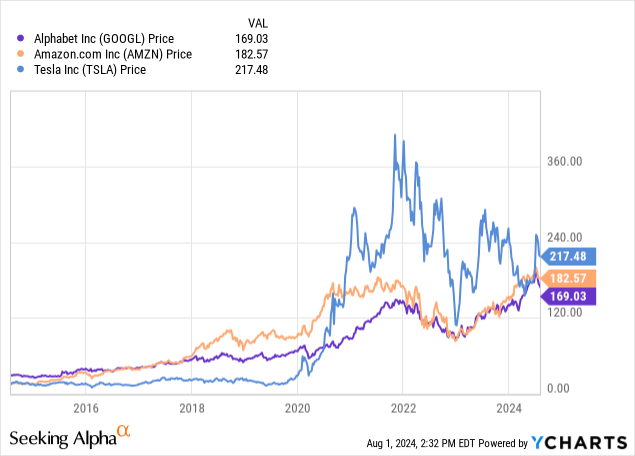

This valuation is incredibly attractive to me, and it has demonstrated much more stability as a result of this low valuation for big tech. This is made evident by the lower volatility in its price compared to Amazon and Tesla. I have actually come to the conclusion after studying countless companies that the stock price chart is an accurate reflection of the values that companies hold. Radical growth at the expense of stability can be seen in the TSLA price history, high growth but higher volatility can be seen in AMZN, and moderate growth and moderate volatility can be seen in GOOGL. In other words, Google is less aggressive operationally, and as a result, investing in it at a fair valuation is much more appealing than investing in Amazon and Tesla, which are better to invest in when undervalued, in my opinion, to remove downside volatility risk.

My new estimated 5Y price CAGR for GOOGL is based on a 5Y EPS annual growth forecast of 18% and a PE ratio estimate for the company of 25 in 5 years’ time. The result of these forecasts is a basic EPS of $16 in August 2025 and a stock price of $400. This indicates a 5Y price CAGR of approximately 19% from the present stock price of $170.

Closed-Source Risks, The Growing Moat From Meta, And The Changing Nature Of Search

The fact that Google is closed-source for frontier models means that it restricts access to external developers. Despite it having an open-source machine learning framework, which provides development access to third-parties, this is a revenue generator rather than a model iteration benefit. Google would arguably need to release its frontier models as open-source to engender the level of competition necessary to give it a sincere competitive advantage in AI over the long term.

In my opinion, Google does need this, as while Gemini is strong on benchmarks, anybody who uses these models regularly can tell you that Gemini currently has limited utility in professional settings. ChatGPT-4o has much broader and more significant usability. Alphabet can change this by open-sourcing Gemini’s frontier iterations because Google is not solely reliant on Gemini for revenue.

Also, Gemini has a strong reputation being attached to Google, so even if new developers offer a model by using Google’s open-source (or, as Meta does it, open-weight, calling it open-source), it would likely not have the same traction as Gemini. The point here is that in the AI arms race, it is not revenue from AI models that matters; it is the power of the AI, which will be the moats that have the largest capital utility in the long term. I think Google needs to consider that it is, in fact, behind on AI commercial utility despite its currently formidable position in the field.

I think Meta is significantly undervalued in the AI race right now, despite the now growing common sentiment that it is likely to be an AI leader. In my recent analysis of Meta, I ascertained that it was conceivable that Meta would become the first to develop AGI as a result of its open-source, or open-weight, approach to frontier AI. This creates some uncertainty for Google; however, despite the competition, I agree with Zuckerberg that multipolar AGI is how the future of AI will look, with multiple players developing independent AGIs. The concern is that Google may not be one of the first to achieve this, and this could have financial repercussions, especially if clients begin to favor in-app searches on Meta’s apps.

It is undoubtable that the nature of search is changing, but Sundar Pichai and Google’s board are very well aware of this. That is why the company shifted to an AI-first strategy, and it is certainly working hard to retain its moat in search. In my opinion, however, more still needs to be done. But as Pichai has stated many times, Google does not dance to other people’s music-it works at its own pace. Therefore, it is conceivable that while companies like Meta have a short-term win, Google wins the AI war.

Conclusion

After the recent pullback in price, Google is definitely a Buy based on my analysis. I consider the company to be the stalwart of big tech; it is one of the largest holdings in my portfolio, and I believe it is likely that over a long time horizon of 10+ years, Google will start to be perceived as the leader in accessible AI, despite the conceivable reality that OpenAI and Meta develop AGI first. Whatever the future of multipolar AGI looks like, Google will certainly be one of the major players, and I think it is the company’s reputation and values that will remain incredibly attractive to users once its commercial AI models and more useful for professional use cases.