Kenneth Cheung

Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) has struggled to enjoy the same AI boost seen at tech peers, in spite of posting resilient fundamental results. I suspect that Wall Street remains hesitant in light of emerging competition in search from the likes of both Microsoft (MSFT) and OpenAI. Wall Street’s fears may be causing it to overlook the strong earnings power of the core businesses, as well as the upside potential from the fast-growing cloud unit. It may surprise some readers to learn that Google Cloud accounts for an insignificant amount of overall earnings, yet is arguably worth as much as 25% of the current market cap. I reiterate my strong buy rating for the stock.

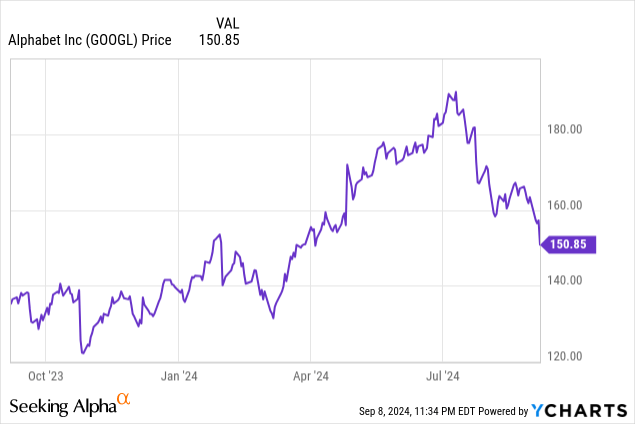

GOOGL Stock Price

I last covered GOOGL in June, where I discussed how the stock can thrive in a generative AI world. The stock has underperformed the broader market by double-digits since.

The stock offers an attractive setup which offers significant re-rating potential and high prospective annual returns while we wait.

GOOGL Stock Key Metrics

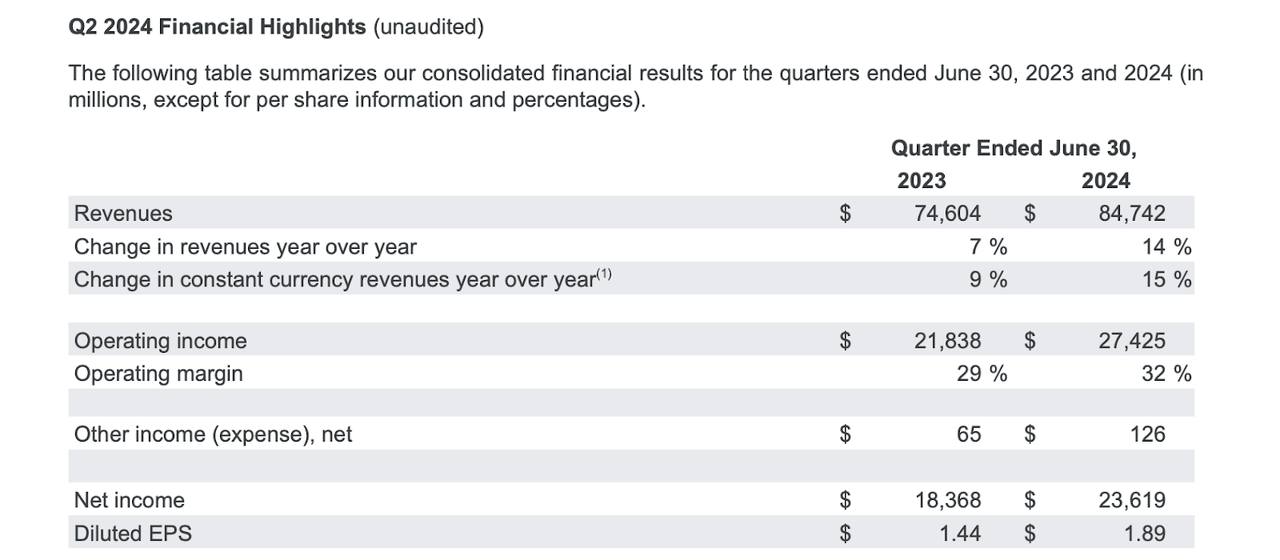

In the most recent quarter, GOOGL saw continued strength, with revenues growing 14% YoY – representing some sequential deceleration but a significant acceleration on a YoY basis – and earnings growing by 33% to $1.97 per share (I have adjusted for unrealized gains and losses on investment securities). Crucially, management has committed to cost discipline, as evidenced by the sequential decline in headcount and the 300 bps jump in operating margin. On the earnings call, management noted that headcount should rise sequentially in the third quarter due to the onboarding of new graduates.

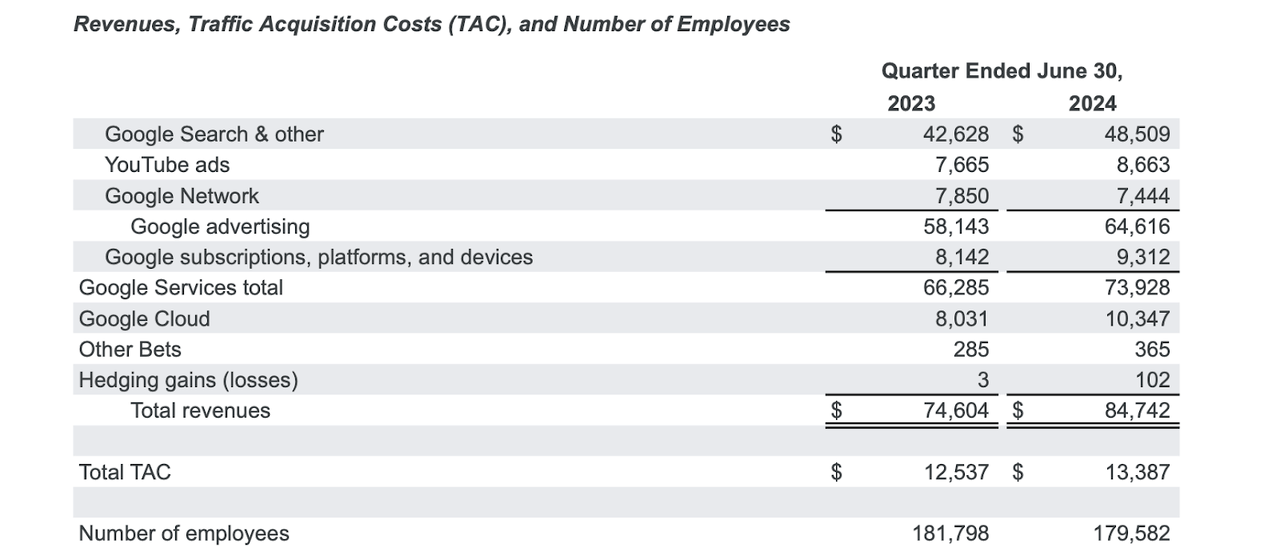

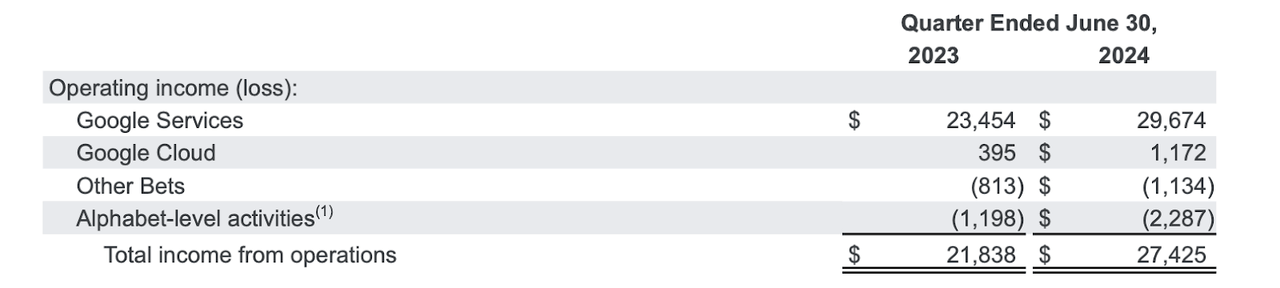

GOOGL saw around 13% revenue growth in both Google Search and YouTube. The company’s results for YouTube apparently missed some consensus estimates, but I view this segment as being more of a long-term story than one that should be judged on a quarter-to-quarter basis. GOOGL saw Google Cloud revenues grow by 29%, representing a slight acceleration on a sequential basis.

On the profitability front, Google Cloud notably breached $1 billion in operating income for the first time (I note that just 3 quarters ago that number stood at $266 million). This represents an 11% operating margin, but I continue to be of the view that margins should converge towards the 37% (and rising) margins seen at Amazon.com, Inc. (AMZN).

GOOGL ended the quarter with $100.7 billion of cash and $34 billion of non-marketable securities versus $13.2 billion of debt, representing a $7 billion sequential decline in the net cash position. That was due to the company spending aggressively on returning cash to shareholders, as the $15.7 billion of share repurchases and $2.5 billion of dividends exceeded the $13.5 billion of free cash flow.

On the call, management was optimistic about “increases in search usage, and increased user satisfaction with” their roll-out of AI overviews. It will be interesting to see how the search market develops given the recent entrance of OpenAI’s competitive search product. Management, however, did caution that the third quarter will see the company lapping a tough comparables, as the second half of last year saw a recovery in spending from APAC-based retailers. Management also guided for quarterly CapEx to hover at around $12 billion, which would likely outpace depreciation & amortization costs and thus be a continued drag on free cash flow conversion. Regarding spending on the AI infrastructure, management stated that “the risk of under-investing is dramatically greater than the risk of over-investing,” an eerily similar rhetoric to what is often said in past bubbles. That said, I note that this spending does not outpace depreciation & amortization expenses by so much and the company maintains a strong net cash balance sheet – thus failure to derive strong return on investment from these investments might not have such a catastrophic impact on the stock valuation. Notably, management committed to a “a new multi-year investment of $5 billion” for their self-driving segment, Waymo. Waymo has been making great progress on rolling out its services and continues to offer additional catalysts for upside beyond the core thesis.

Is GOOGL Stock A Buy, Sell, or Hold?

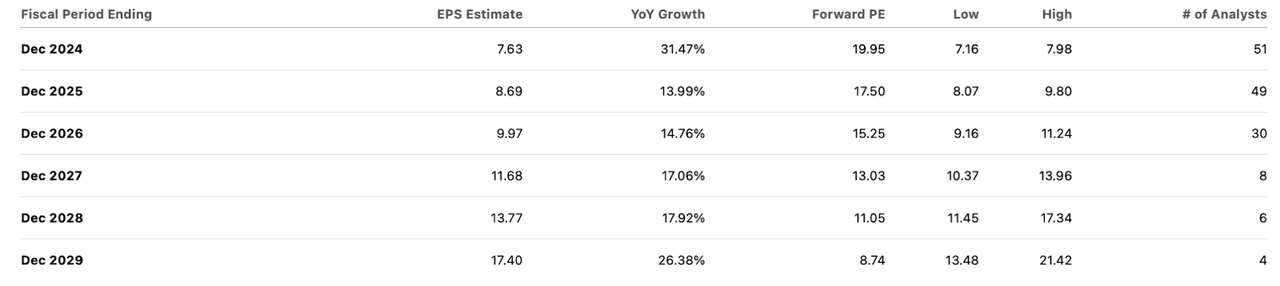

As of recent prices, GOOGL found itself trading at just around 20x fwd earnings.

That in itself looks easily justifiable, and therein lies the investment thesis. Substantially all of the profits still come from the advertising businesses. Between the net cash position and the persistent secular growth, 20x earnings looks quite appropriate here. The cloud business has a $40 billion annual revenue run-rate and is growing at a 29% clip. I see 30x earnings as being a reasonable, if not still too conservative, multiple. Based on my projection of 40% long-term net margins, that equates to 12x sales, $480 billion in value, or $38 per share in excess value. The cloud segment alone implies 25% potential upside, and that is in addition to any upside from ongoing growth.

GOOGL Stock Risks: What About OpenAI Search?

If that valuation exercise felt too easy, there might be something to that. Perhaps investors might be skeptical that OpenAI search can take meaningful market share, or at the very least make enough of a dent in the growth story to make 20x earnings unjustifiable. In theory, that is a reasonable assumption given that GOOGL is still benefiting from various long-term tailwinds, including continued adoption of the internet (more users) and an increasing move towards digital advertising (more advertisers). The company may also be able to benefit from higher prices over time as well – there appears to be so many levers available to at least keep this in growth mode.

The potential hiccup is if Apple’s (AAPL) announced partnership with OpenAI eventually leads to the iPhone maker replacing Google with OpenAI (or someone else) as the default search engine. That said, the stock valuation can still look reasonable even assuming search revenues decline by 30% (roughly equivalent to iOS market share). Assuming 70% gross margins, a 30% decline in search revenues might lead to a 44% decline in net income. The stock would be trading at 35x earnings under such a scenario. That might imply around 42% potential downside (again assuming 20x earnings), but remember that Google Cloud can cushion around half of that number. That suggests that GOOGL stock might have around 20% potential downside under this worst-case scenario. Other risks include a faster than expected deceleration in top-line growth rates – perhaps consensus estimates prove too aggressive. Perhaps another competitor will emerge not just for search but also for YouTube. I also note that at 20x earnings, the stock may still have downside if the market overall were to face weakness.

GOOGL Stock Conclusion

I find it more likely that GOOGL continues to show secular top-line growth alongside rapidly growing profitability as it benefits from the aforementioned secular tailwinds. It appears that the stock continues to trade at low valuations due to fears about disruption from OpenAI or others, but the market may be underestimating the potential upside from Google Cloud and others (like Waymo). While this is not the cleanest story, I still see a path to market-beating upside, especially given management’s commitment to returning cash to shareholders. I reiterate my strong buy rating.