asbe/iStock via Getty Images

Thesis Summary

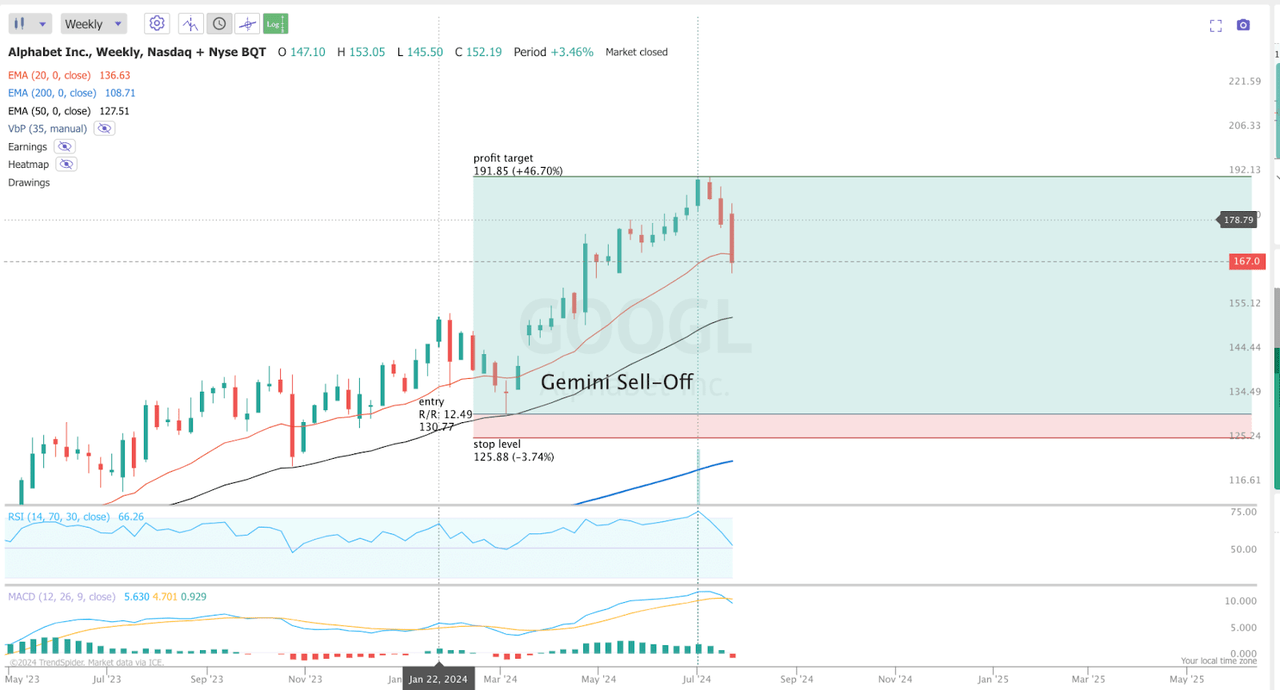

Over the last few weeks, Alphabet, Inc. aka Google (NASDAQ:GOOG, NASDAQ:GOOGL) has experienced a strong rally, catching up with some of its AI peers.

This rally has stalled just as the company released its latest earnings, despite an earnings and revenue beat.

Investors are concerned about the high costs of AI, and also the competition that Google faces from Microsoft (MSFT)-backed Open AI.

But given Alphabet’s wide moat, plus its profitability and revenue outlook, I still think the stock looks attractive, and any pull-back is a buyable one.

Google’s AI comeback

Since I last wrote about GOOGL, the stock has rallied over 24%, beating the S&P 500 (SP500) and the Nasdaq (COMP:IND) by quite a margin.

I pointed out a few months ago that the controversy surrounding Gemini was a good opportunity to buy, and that was the case until recently.

Alphabet had actually been catching up to its AI peers and outperforming the Nasdaq 100 (NDX). But the stock has sold off sharply after earnings.

Let’s find out why.

Alphabet Q2 Earnings: AI Is Expensive

Results for the actual quarter were anything but good.

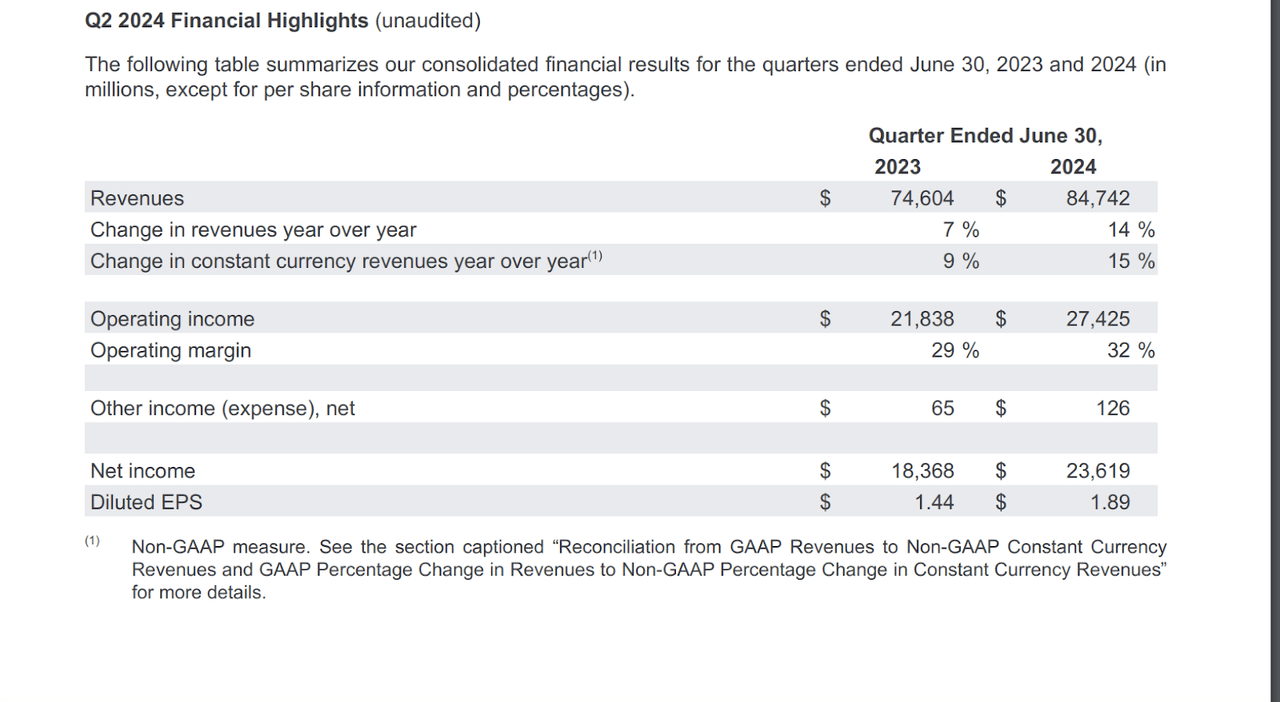

GOOGL Q2 Financial Highlights (Press Release)

Revenues were up 15% YoY, while operating margin increased to 32%.

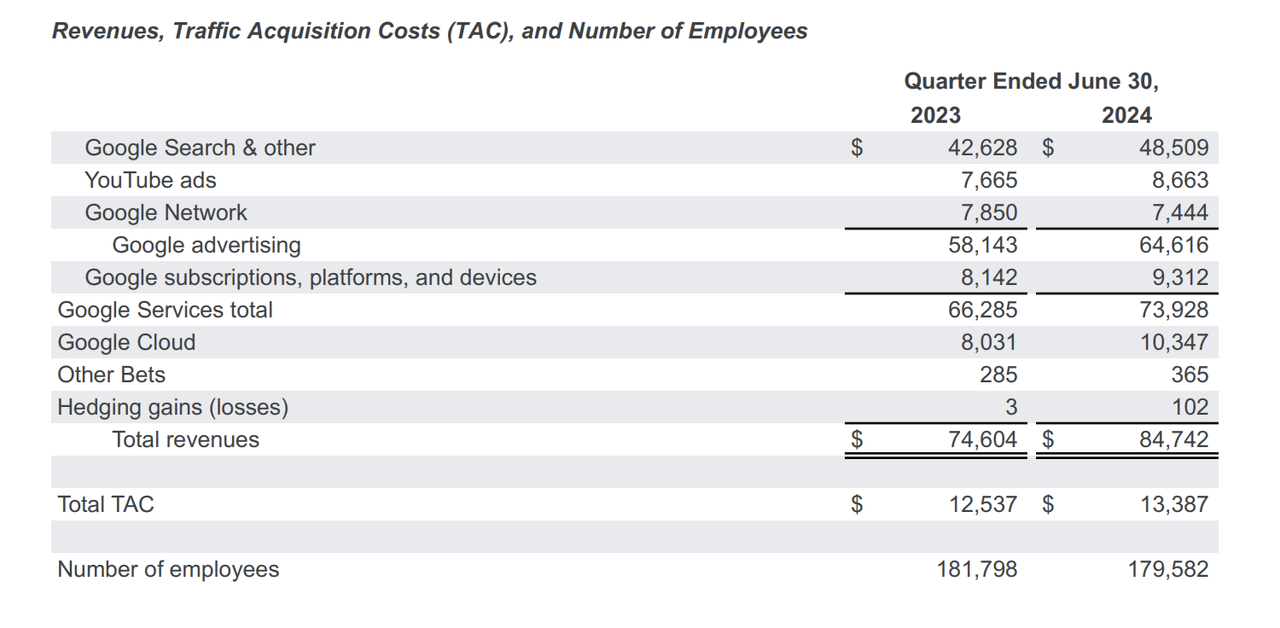

GOOGL Q2 Revenue breakdown (Press Release)

The company beat expectations with its Google Search and Cloud revenue, which were positive highlights. However, YouTube ads did grow a bit less than expected.

Nonetheless, growth was overall strong, with Google Services up 11.5% and Cloud up 30% YoY.

So what’s not to like? The sell-off may have had something to do with management’s guidance for next quarter, specifically when it comes to the operating margin.

However, in the third quarter operating margins will reflect the impact of both the increases in depreciation and expenses associated with the higher levels of investment in our technical infrastructure, as well as the increase in cost of revenues due to the pull-forward of hardware launches into Q3.

Source: Earnings Call.

All this investment in AI is taking its toll on margins. And will it really be worth it at the end of the day?

This seems to be the topic du jour, especially following this tech sell-off.

AI: Costs vs. Benefits

In a recent report, Goldman Sachs questioned the potential cost-benefit analysis of AI

AI investments are projected to increase to over $1 trillion over the coming years. But what will companies have to show for it?

In an interview with Goldman Daron Acemoglu, author of “Why Nations Fail: The Origins of Power, Prosperity, and Poverty,” the Institute Professor at MIT expressed his belief that expectations around AI may indeed be overblown.

Acemoglu estimates that only a quarter of AI exposed tasks will be cost-effective to automate within the next 10 years, implying that AI will impact less than 5% of all tasks

Source: Daron Acemoglu Interview.

Less than 5% of all tasks certainly doesn’t sound like a lot, and $1 trillion seems like a steep price to pay.

Acemoglu also questions whether AI adoption will create new tasks and products, saying these impacts are “not a law of nature.” He estimates that total factor productivity effects within the next decade should be no more than 0.66%-and an even lower 0.53% when adjusting for the complexity of hard-to-learn tasks. And that figure roughly translates into a 0.9% GDP impact over the decade.

Source: Daron Acemoglu Interview.

As is often the case with revolutionary technologies, it may take us a lot longer than we think to exploit its benefits truly.

So, will AI truly revolutionize the world, or is this another instance of investor over-enthusiasm?

In either case, Google seems like an obvious buy.

Google Set To Outperform Either Way

When this whole “AI mania” began, GOOGL was actually singled out as one of the potential losers from this.

Google’s Search revenues suddenly came under threat from ChatGPT, and this is doubly true now that the company has begun to test out SearchGPT.

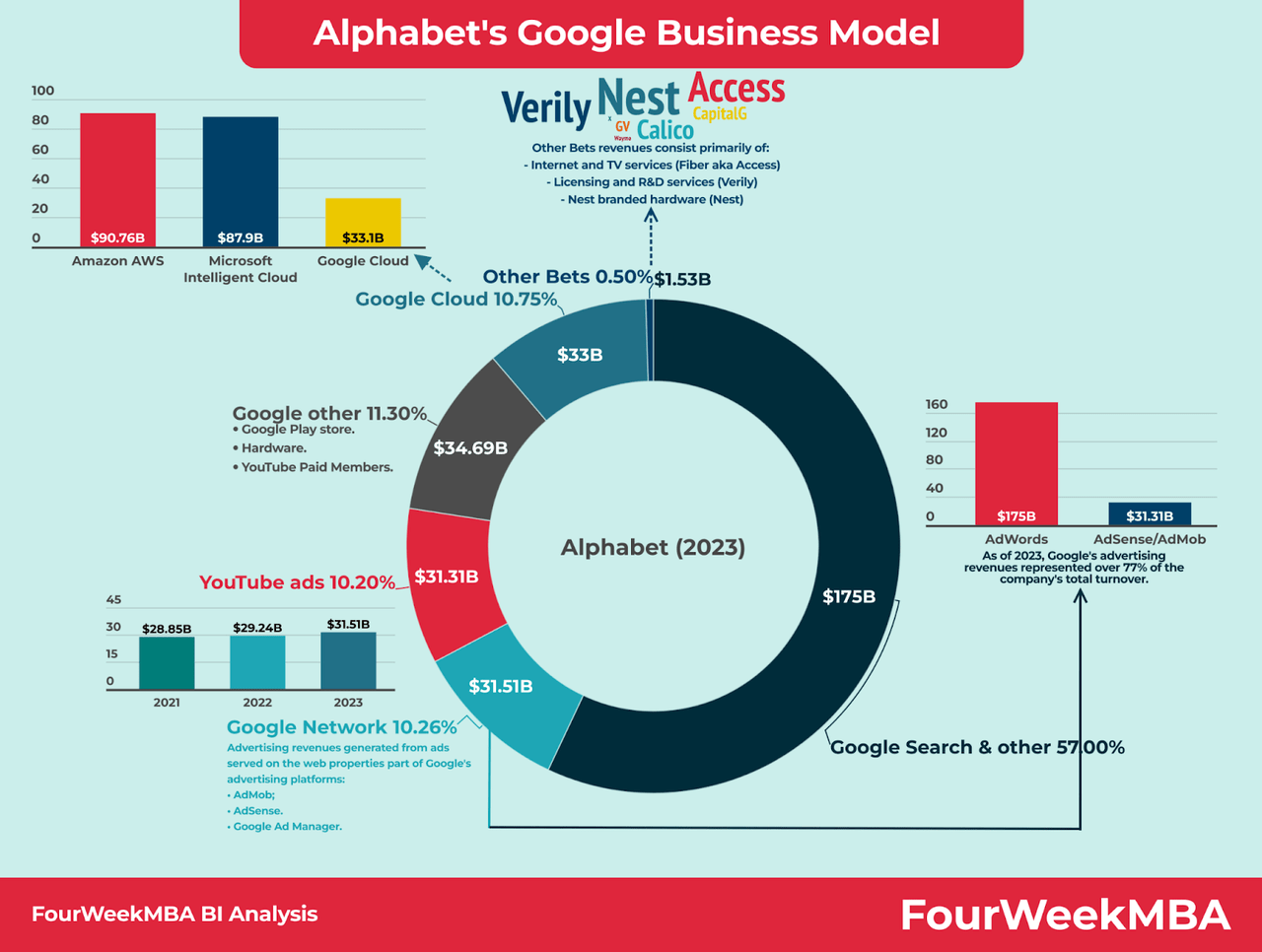

Still, GOOGL continues to dominate Search, with revenues for the segment growing close to 10%.

But if AI really will not be that impactful, relatively speaking, Google is in a great position compared to some other tech names, which rely more heavily on AI.

This could be a boon to search revenue, Google’s largest segment.

YouTube, which has been one of the fastest-growing segments, will also continue to do well. E&M is projected to grow at a 3.5% CAGR, but YouTube can likely outperform that as it displaces legacy media.

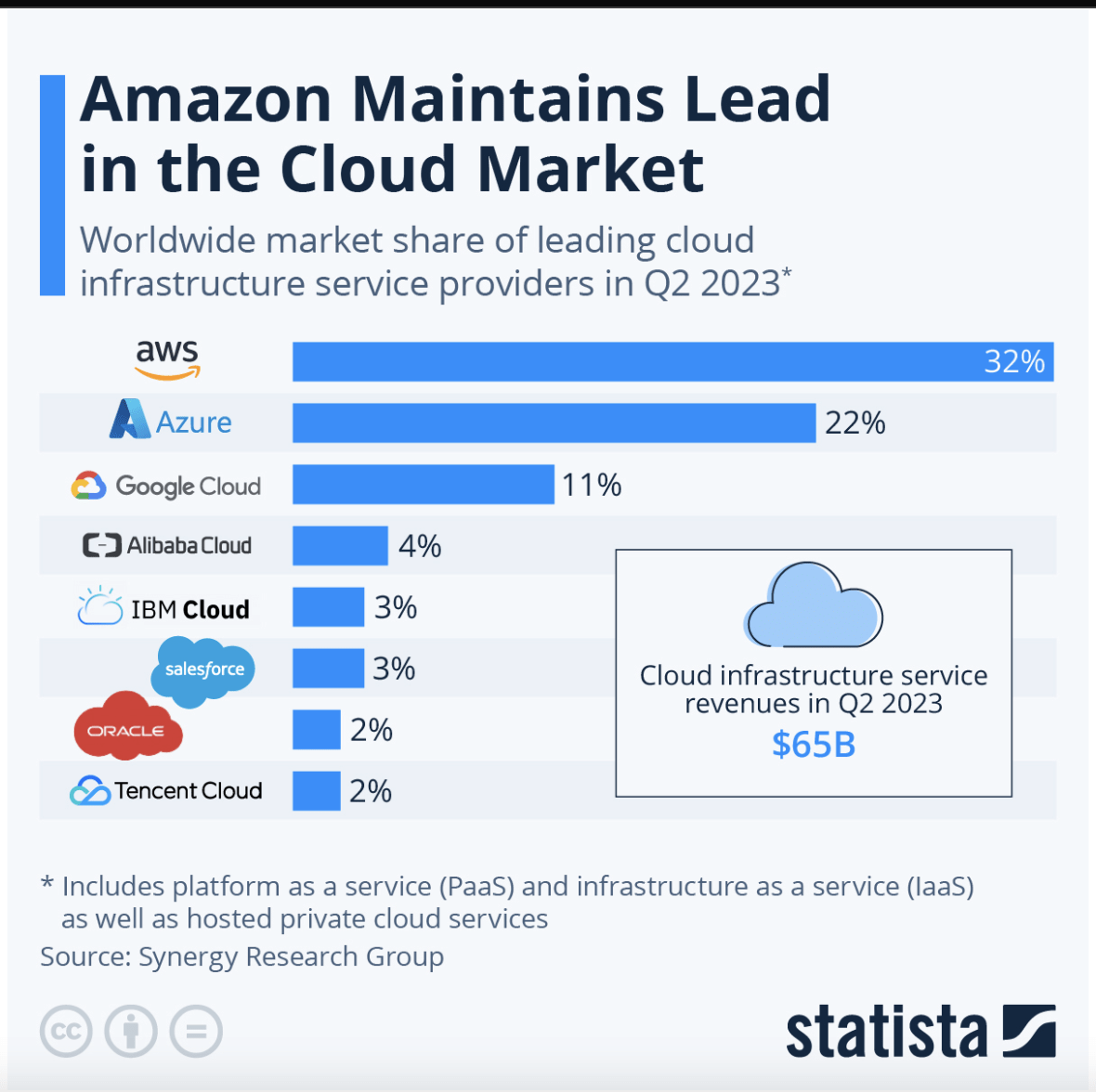

And lastly, Google Cloud will also continue to do well, even without AI.

Cloud market share (Statista)

Google is still well positioned within the market to keep growing, and while immediate demand could fall if the AI bubble bursts, Cloud as a whole will continue to do well.

Ultimately, GOOGL is insulated from the bursting of the AI narrative, as it has well-diversified sources of revenue.

Alphabet Business Model (4weekMBA)

Understandably, Google is also chasing AI, which at this point it can’t afford not to do. As I’ve discussed before, the company has actually done some great work with its TPUs, of which it has just released the 6th version.

Plus, if anyone can afford to invest in AI, it’s a company like GOOGL which has over $100 billion in cash, and enough market cap to easily acquire and absorb promising new start-ups.

GOOGL is Cheap Again

Following the latest sell-off, GOOGL’s valuation is back at very attractive levels.

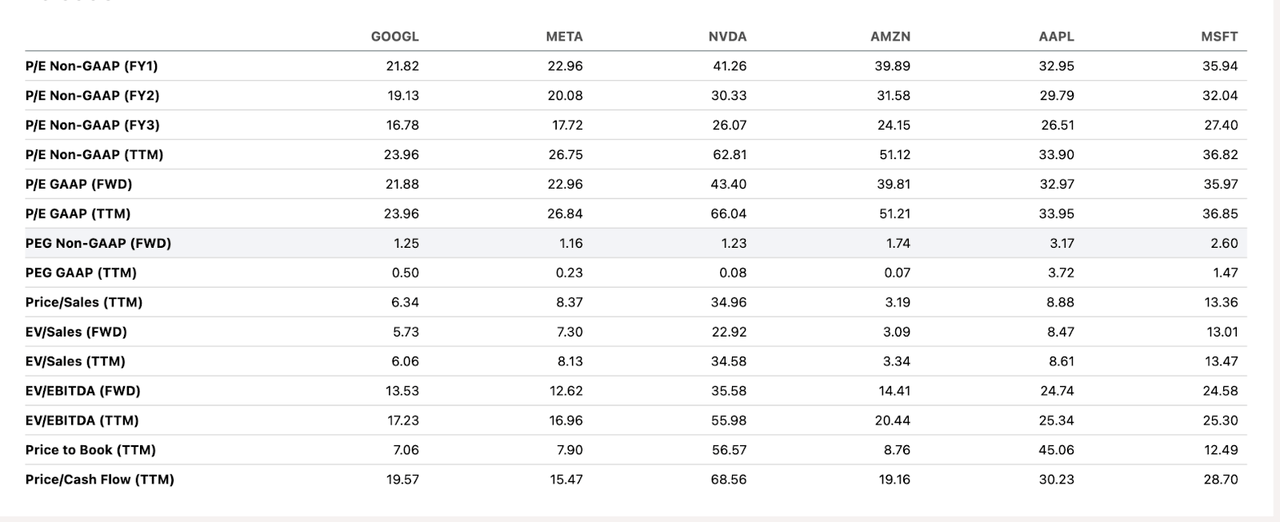

GOOGL and peers valuation (Seeking Alpha)

The company trades at the lowest P/E of the Magnificent 6, Tesla (TSLA) not included.

It has a PEG under 1, and a Non-GAAP FWD PEG of 1.23, which is pretty low. Yes, companies like Meta Platforms (META) and Nvidia (NVDA) have lower forward PEGs, but they also have much higher growth estimates due to the AI narrative.

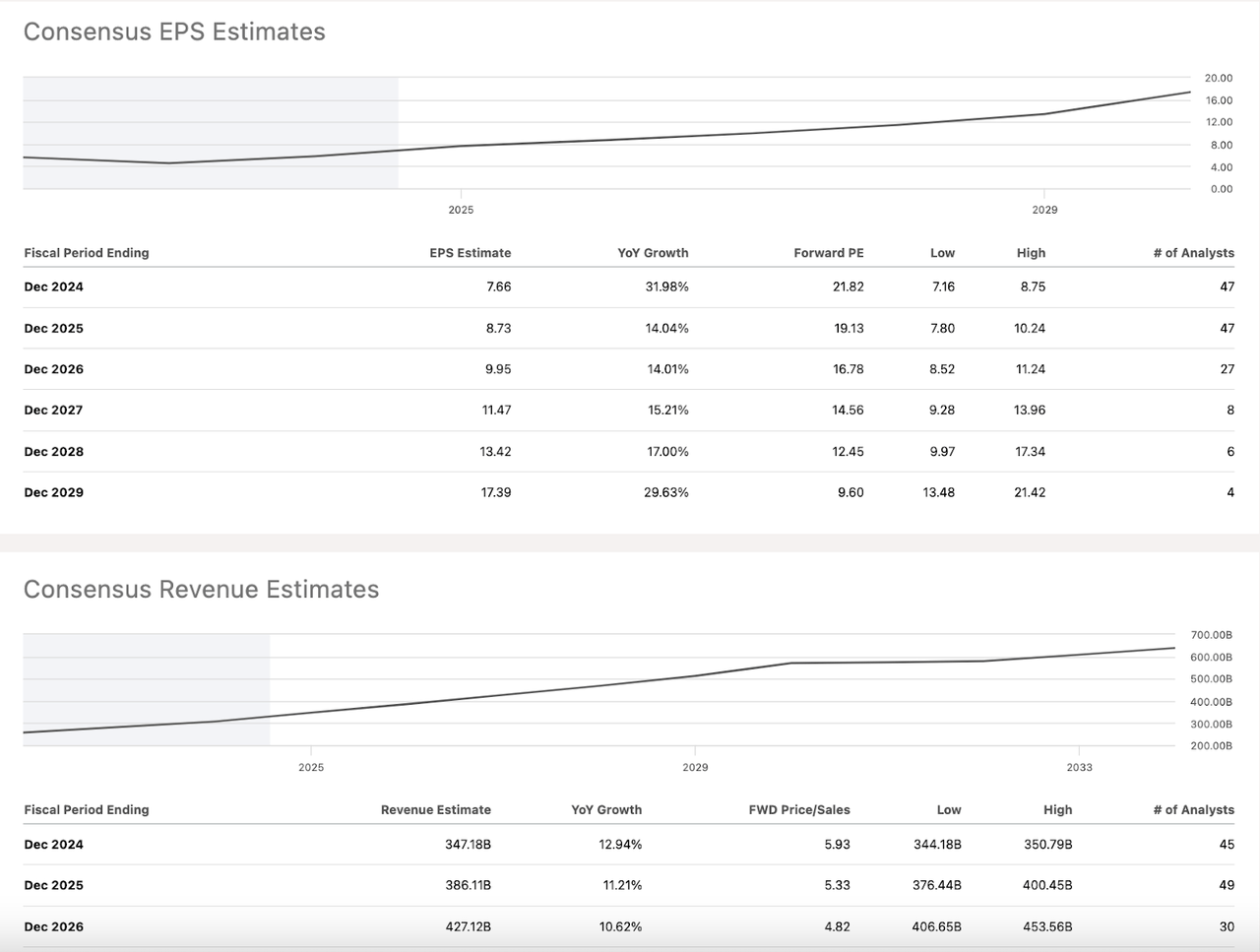

GOOGL EPS and Revenue Estimates (Seeking Alpha)

This is not the case with GOOGL, which is projected to grow revenues at around 11% CAGR over the next three years. So, even if the AI bubble does burst, GOOGL’s estimates should not be heavily affected.

Final Thoughts

In my opinion, GOOGL will do well, no matter what happens. It has some exposure to AI growth and is investing in this technology, so it will do well as AI adoption grows. However, even if this doesn’t happen as fast as people expect, GOOGL has plenty of non-AI revenues that will continue to grow.