Boy Wirat

Regardless of the market sentiment this past week, Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL), the parent company of Google, continues to dominate in 2Q 2024 with top-line growth of 15% YoY revenue growth (ex-forex) and growing diluted EPS over 31% from the year-ago quarter. Despite bears hoping for contraction in most of Alphabet’s businesses, all saw YoY growth, except for Google Networks. The company’s moat continues to expand and appeal to most if not all investors – whether you invest in the stock for its bottom-line growth, large-cap status, buyback program, or the newly issued dividend, Alphabet is hitting in a lot of areas positively for the investor. All that said, there are a few issues internally with respect to silencing certain topics and/or promoting specific topics, but we will try to refrain from that in this discussion.

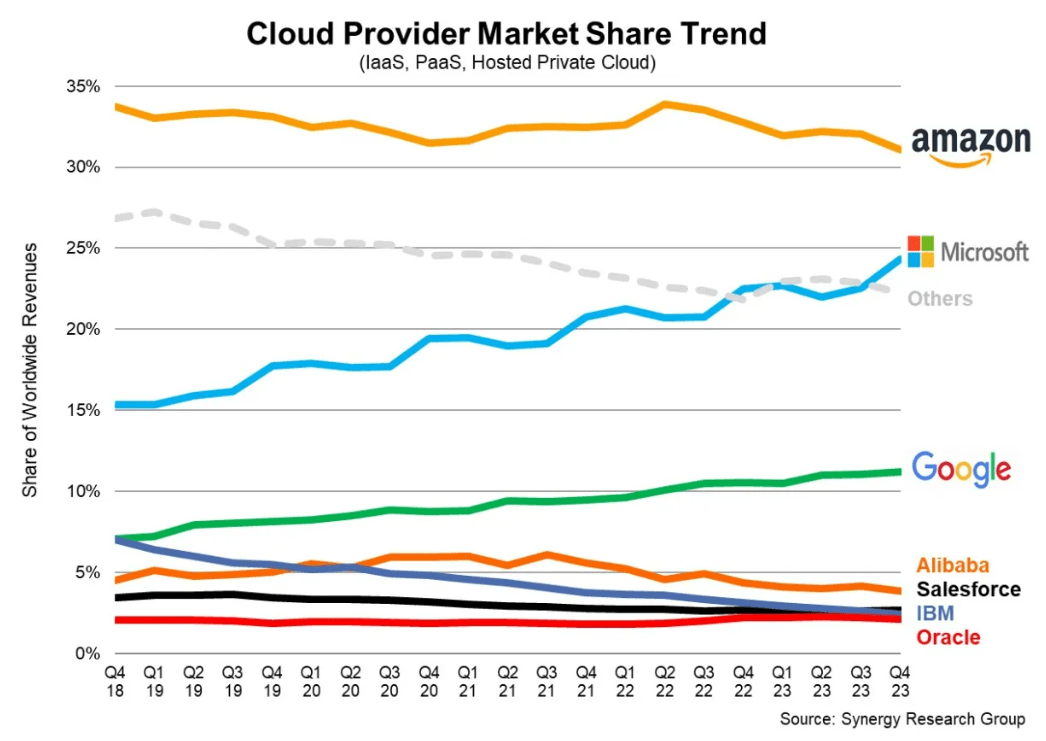

One of the largest reasons I focus on investing in Google is the potential for Google Cloud Platform (GCP) to make a run at the #2 cloud service. In a total addressable market that is ever expanding closer to $1tn+ by 2028, being number three and growing in the space is okay! Coupled with the dominant search and YouTube services growing at a double-digit pace. The company’s businesses are cooking.

Those watching the price action over the past few weeks have seen a retracement in the stock price of 14% from its recent 52-week high of $191.75. In light of the July FOMC meeting and earnings report, the market was deemed for a sell-off – so not a surprise that GOOGL landed back in the mid-$160s to close out the week. This puts the company in a reasonable valuation range between 20-25x price to FY2024 earnings. If I were someone going long, this is the earliest I would initiate a position, however since I have an established position dating back to 2019, I would wait for a further pullback to add for myself, likely at a price to 2024 earnings of 18-20x or $130-$145.

I maintain a fair year-end 2025 valuation for Alphabet to be $185-190/share and rate the stock as a Hold. I am lifting my FY2025 EPS target from $7.50 to $8.20, and lowering my 25x P/E multiple to 22.5x, a PT just shy of $185. A 12% uplift from Friday’s closing price of $165 and just shy of the overextended 52-week high. I envision a period of time when the stock sees over $200/share between now and YE2025, but that does not mean my fair valuation changes and I would view that as slightly overvalued but welcome due to the quality of the company.

Follow-up from my previous Alphabet article

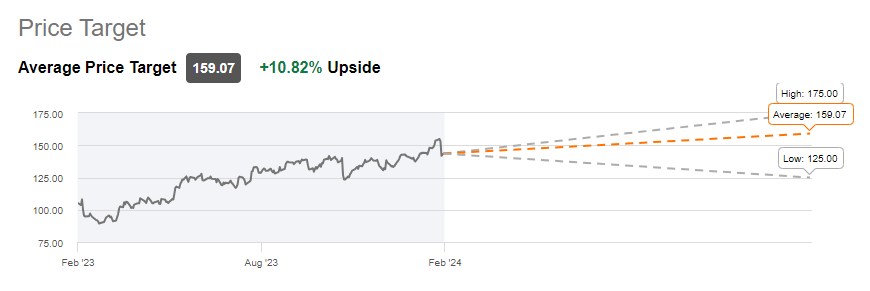

In February 2024, I made my first post about Alphabet specifically discussing FY23 earnings and why I felt it was the most undervalued Mag7 stock. Alphabet had just come off of a massive EPS growth of 27% in FY2023, and GCP had just established profitability. The stock fell 7% and was not warranted with Street price targets of just under $160/share. After a stellar first quarter, analysts re-rated their 12-month price targets to be north of $200, a 28% increase and much more in line with how the stock should be valued with its growth rate and aggressive share repurchase plan. This article is a follow-up to demonstrate how I am still bullish on Alphabet long-term, my price target remains the same at $185/share, but I am re-rating the stock down to a Hold with the recent success the stock price has observed in the first 8 months of the year.

Company Overview

Alphabet is a global technology conglomerate. The largest chunk of the company holds Google, the search engine business the company was built upon. Today, it holds other organizations that span different focuses from Google Workspace, hosting of content creation, venture capital, and autonomous driving. The list of companies underneath Alphabet is long, hence the 26 letters in the alphabet. A few of the larger well-known businesses under Alphabet to note are Android, YouTube, Nest, Fiber, Google Ventures, and Waymo.

List of Alphabet Companies (abc.xyz)

The Cloud Business is starting to Shine

Even with Alphabet’s largest revenue segment, Google Search, growing by almost 14% YoY, Alphabet’s GCP grew just shy of 29% this quarter. The business is keeping up with Amazon’s AWS and Microsoft Azure and continues its solid third position in the cloud market.

With over $10bn in quarterly revenue, Alphabet may be on pace to make $45bn in revenue from Cloud this year alone, and with operating income up almost 200% YoY (from $395m to $1,172m), it would not surprise me to see over $5bn in operating income for FY24.

With global cloud revenue eclipsing $80bn in Q2 and cloud infrastructure services growth re-accelerating closer to 20% YoY, GCP seems poised to take hold of $110-170bn of annual cloud revenue by 2030, destined to take ownership of the 15-20% CAGR cloud market as its portion of the 15-20%+ CAGR market into the 2030s.

If GCP is able to grow its operating margins from 11% in Q2 to what Amazon and Microsoft reported in 2Q (35% and 45%, respectively), then Google Cloud could generate anywhere between $38bn and $76bn in operating income in 2030. With a 25x multiple, that’s nearly a trillion-dollar business on its own, not accounting for other revenues from Search and YouTube.

That is nearly a 10-20x in operating income from Cloud in the next 6 years.

Cloud Market Share (Synergy Resource Group)

The First Dividend: In 1Q 2024, Alphabet’s board of directors approved Alphabet’s first dividend in corporate history to be paid in the 2nd quarter of 2024. While some thought the initiation of a $0.20 quarterly dividend ($0.80 annualized) was small compared to the current stock price, even a 0.5% dividend yield for a company of Alphabet’s size results in $10bn in expected annual payouts to shareholders.

The initiation of a dividend program is wise for Alphabet, as it balances the investor proposition for a wide array of stockholders. While Alphabet’s growth remains intact, they’ve opened up an avenue for dividend growth investors. These new set of investors will be inclined to dip their toe into the stock as dividend growth rates will likely be north of 10% as the corporate payout ratios remain below 20%.

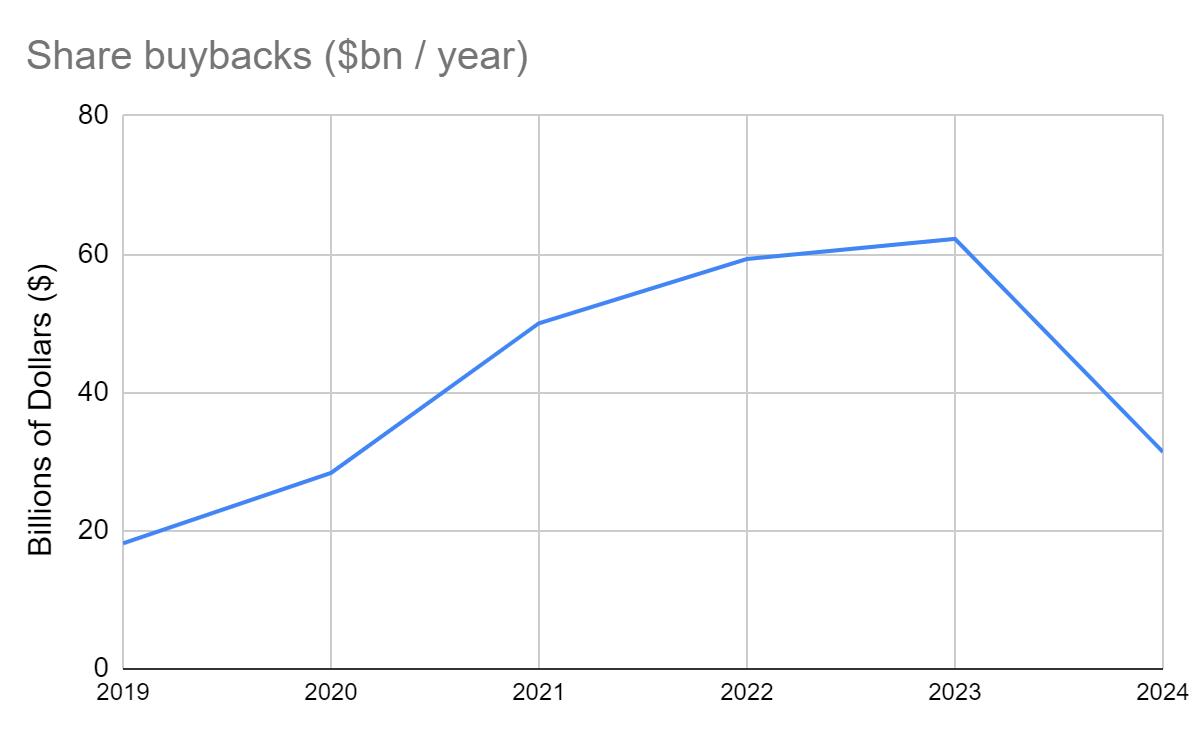

Share repurchases: On top of the newly issued dividend, investors attracted to the share repurchases Alphabet has been dishing out continues. Net repurchases of stock for the first 6 months of 2024 were up 6% compared to the first six months of 2023. Increasing the net purchases of stock to over $31bn in the 1H of 2024 and decreasing the diluted float by over 2% and the basic float by over 2.5%.

Alphabet Share Repurchases Over Time (Alphabet Earnings)

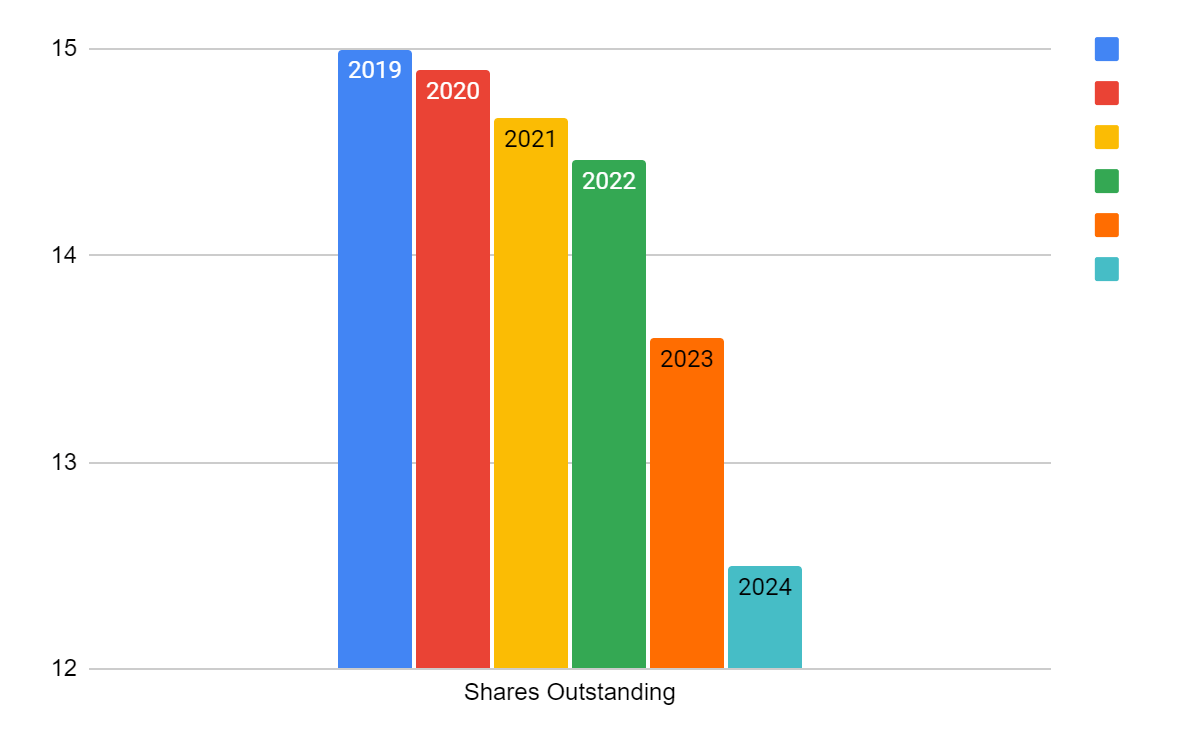

This is the first set of buybacks after the $70bn repurchase program announced by the board in the 1Q2024 earnings call. This is beyond the five years of aggressive share repurchases from 2019 to 2023 of over $200bn – by year-end total repurchases since 2019 will be tracking close to $275bn. Since this time, the float has been reduced from 15bn in shares to 12.5bn in shares, almost 17%, and at a cost basis over this time of $100/share.

Alphabet Shares Outstanding Over Time (Alphabet Earnings)

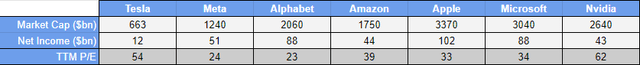

Comparing Against The Rest of the Mag 7

When it comes to how Alphabet stacks up on a price-to-earnings multiple on a trailing twelve-month basis compared to the rest of the Magnificent 7, Alphabet and Meta are the only ones that seem reasonably priced after this recent pullback in the market. That said, I want to note that NVIDIA Corporation (NVDA) is the only one of the Mag7 that has yet to report earnings this season, and thus could reduce its P/E multiple in the coming weeks.

I am a firm believer that premium large-cap companies with moats deserve a 20-25x multiple on next year’s earnings as they will experience cash inflows associated with mass ETF buying, and share buybacks and will also be considered safe havens for capital due to their robust balance sheets and growth trajectories.

Market Cap and Trailing Twelve Months Net Income of Magnificent 7 (Earnings from Respective Companies)

I consider P/Es north of 30x of next year’s earnings to be expensive – however, if the net income growth of the company continues at a 20% growth rate for multiple years, then 30x might be deemed cheap. That said, Apple Inc. (AAPL) and Tesla Inc.’s (TSLA) slowing growth over the trailing twelve months makes me question the premium both of these stocks get on the open market. I am very curious to see how Nvidia’s TTM net income shows up in earnings this week.

However, the continued politics and corporate culture problems running through Alphabet at the moment pose a risk to the brand. Coupling with search from AI chatbots and other LLMs being ever-present going forward… unless Gemini takes a larger market share in the coming quarters, then competitors will put a drag on the future valuation of the stock. And that, with an overheated market as of late, and in light of a worsening economic foundation going into the second half of 2024, the stock growing into $185-$190/share within the 18 months is reasonable.

My 2025 Alphabet Valuation

My initial EPS forecast in February 2024 was $7.50 for FY2025, with 2 additional quarters under its belt, I have adjusted Alphabet’s EPS to be $8.20 in 2025, which is up 42% from 2023 as growth refuses to slow down and the EPS being influenced heavily by share repurchases. This is reasonable, if not conservative, for 2025. 1H 2024 EPS was $3.78 on a diluted basis, therefore 2H 2024 will meet if not exceed 1H EPS, leading to FY24 EPS of $7.50. Adding a conservative 10% YoY EPS growth, allows Alphabet to achieve $8.20 in 2025 quite easily.

At the current price of $165/share, and a FY 2025 EPS forecast of $8.20 EPS, the stock is currently valued at just 20x 2025 earnings. This is conservative, and I can see Alphabet affording a 2025 P/E north of 25x, as Alphabet can always demand a premium. With the bogginess of the macroeconomics at the moment, it’s hard to forecast premiums out into 2025. Although, I can easily see a revision as we go through September and potentially more rate cuts in 2024.

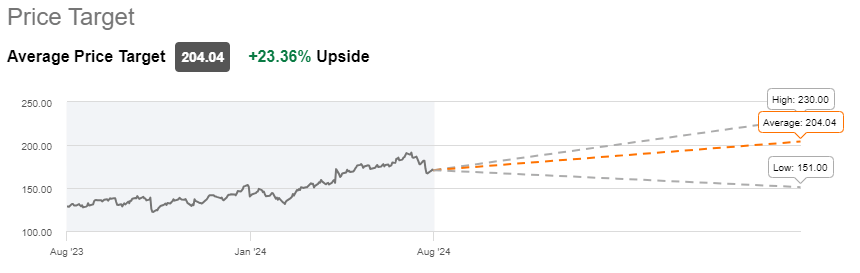

Have other bulls held their price targets?

Street and Seeking Alpha analysts continue to recommend Alphabet as a buy with the average price target increasing from $159 to $204 since February 2024. My $185 price target by year-end 2025 is on the mid- to low-end considering the $151 to $230 Street price range for the coming 12 months. The average Street price of $204.04 represents an upside of 24% on today’s price of $165. My $185 PT is a measly 12% increase on the stock between now and year-end 2025, whereas the bullish Street Analyst predicts an increase of 24-40% in the coming 12 months.

Peer analysts on Seeking Alpha currently rate Alphabet a 4.1 out of 5, with a buy rating on the stock. 8 SA analysts rate the stock a strong buy, 13 others rate the stock a buy, 3 rate it as a hold, and 1 has a strong sell call. The Street analysts rate Alphabet a 4.4 out of 5, nearing a strong buy over the past few weeks. 35 rate the stock a strong buy, 14 rate a buy, 12 are a hold and there are no sellers. Wise move.

The Quant currently rates Alphabet a 3.5 out of 5, bordering between a hold and a buy.

Below, one can see the difference between Street price targets from today:

One-Year Price Target (Seeking Alpha)

When I wrote my first Alphabet article in February. The Street has gotten much more bullish.

Previous One-Year Price Target (Seeking Alpha)

That said, risk has been on since the end of the first quarter, and it has not been until recently, where macroeconomic environment, unemployment, and several other negative pieces of sentiment have started to rise out from the economy. Thus, I would not be surprised if PTs come back down over the next few articles written.

Major Risks

My major risks to Alphabet as an organization remain unchanged since the article I wrote following FY 2023 earnings.

I see the breaking up of the company to avoid monopoly laws and loss of Google Search revenue to competitors or AI chatbots to be the largest risks to Alphabet’s future.

Alphabet break-up: Alphabet continues to face regulatory hurdles and government antitrust lawsuits across the globe, leading the company down a path of splitting up just to maintain normal business operations. Coupling this with recent political bias and corporate culture issues in recent months with Google being fined by the European Union for antitrust and lost several times over the last decade… there seems to be an ongoing discussion of how large can Alphabet get.

The EU claims Google is using its dominance in search to throttle or deprioritize specific results or embellish features that push down rival results. This has also been noted heavily on the popular social media site X, with users posting results of historically inaccurate history results being tamed to meet certain DEI agenda goals when there should be none.

The U.S. Justice Department is also working with the Attorney Generals of California, Colorado, Connecticut, and several other states claiming that Alphabet, more specifically, Google has monopolized digital advertising and is in violation of Sections 1 and 2 of the Sherman Act.

Alphabet’s Google search has been dominant over the decades as it is a quality product with a simple user interface and great algorithm. It has beaten out dozens of competitors over the years, like AskJeeves, Yahoo, Bing, and many other search engines to arrive at the top. The continued politics and culture clash going on within Alphabet to the point where the search algorithms and throttling of specific results are happening and are beyond my area of expertise. All I know is companies have been taken down by the government for less, and I would not be surprised if they find a way to break down Alphabet’s search business.

Generative AI: Alphabet’s Gemini hype has died down and chatbot products like ChatGPT, Bing, and DuckAssist all are changing how search is being done on the internet. Bears of Alphabet assume these chatbots will impact Google Search and search engine optimization (SEO) while these chatbot AI products will reduce all things on the internet to a single link or single hyperlink. All this would result in revenue loss from traditional search products like Google Search which is currently 57% of the Alphabet group’s revenue stream. That could be a reality, but I view Alphabet mitigating this with time and ingenuity – Alphabet was here before during the 2008 takeover of YouTube when they were spending billions of dollars on servers without revenue monetization. Now YouTube is a growing revenue stream that everyone thought was a waste of capital.

Compared to other companies, originally Meta Platforms, Inc.’s (META) Instagram did not have ads. YouTube did not have ads. Facebook did not have ads. However, here we are in 2024, with these being the largest advertisers on the planet. If there is attention to a product and a screen, as a chatbot like ChatGPT, Gemini, or another, will have… then there will be a preferred search flow or advertisements – both will drive revenue.

How we use Gemini in everyday life will evolve as we understand how the algorithm and how it fits into our lives. A simple chat prompt could infer that you are trying to buy a product, and the chatbot could return results specific to upsell that product, no different than how Google Search works today. After providing a response to your specific question, Alphabet’s Gemini could interact with the answer and follow up with a question, asking in return if you want it to add a product to your wish list or shopping list.

Or if you ask about picking up beer at the store, it immediately starts referring to AB InBev products.

There are new ways to monetize these chatbots, I just do not believe Big Tech has fully understood their best way to do it yet.

Conclusion

Alphabet remains a solid long-term investment for those looking five years to a decade out. The company continues to demonstrate strong financial performance across Search, and YouTube and now leveraging positive operating income from its growth driver Google Cloud. Coupling this financial performance with continued share repurchases and initiation of a dividend demonstrates Alphabet’s commitment to a wide shareholder base.

Internal corporate culture, political bias, antitrust concerns in the EU, and the rise of AI chatbots provide sufficient headwinds to concern any Alphabet bull and definitely fuel the bears. My confidence lies in Alphabet to innovate and adapt to mitigate AI chatbot competition, the other risks and uncertainties remain unmitigated for the time being… Street analysts are bullish on the stock, with a PT exceeding $200 in the coming 12 months. While I hold a conservative value target of $185 by year-end 2025. The market and economic environment have worsened over the past few weeks as we progress closer to rate cuts in September, and so the market seems to be slightly less risky than in previous quarters. All that said, investors seeking a large cap stock with a tech focus and a strong moat should consider Alphabet when compared to the other Mag7 stocks.

As the price has been on a jog and recent 52-week highs above $190, I have adjusted my rating on the stock to a hold while maintaining the $185 price target by year-end 2025. I would contemplate increasing my shares in the stock by 10-15% if a buying opportunity presented itself between $130 and $145.