Richard Drury

By Indrani De, Lee Clements, & Henry Morrison-Jones

Overview

Infrastructure investment is a key driver of economic growth and an increasingly important asset class for investors as it opens up to private capital. Supported by government programs from Washington to Delhi, it is seen as an important diversifier in investor’s asset allocation plans.

Infrastructure is typically defined as owning, operating, managing and/or maintaining physical assets or networks involved in transportation, energy and telecommunications. Whilst often considered a private markets phenomenon, the listed infrastructure market, such as the FTSE Global Core Infrastructure Index, is an important, liquid way for investors to access the infrastructure market with listed equities and/or bonds with multiple options for regional exposures (e.g. developed markets or emerging markets or global exposure).

Emerging Markets are a particularly interesting area of infrastructure investment, driven by high economic and demographic growth and an existing infrastructure deficit which has held back social development.

Over the last 12 months ending 30 June, 2024, the FTSE Emerging Core Infrastructure Index has outperformed the FTSE Developed Core Infrastructure Index. The key driver of this outperformance has been the Indian infrastructure market, the largest segment of the Emerging index (31% of the index as of 30 June, 2024) and a country where infrastructure development is a key goal of the government and is opening up to private capital.

Infrastructure investment and its new drivers

Infrastructure is the bedrock of economic growth, productivity and social development. The vital importance of strong infrastructure to a country makes it a key area of investment for governments, but an area where private capital is increasingly deployed.

From an investor perspective, infrastructure is often seen by market participants as a portfolio diversification tool, and as a hedge to long-term liabilities (asset-liability management) by offering exposure to potentially stable, inflation-linked returns. It is an asset class which is increasingly seeing growth both in terms of investor demand/capital raising and the need for investment to close the infrastructure gap, both in developed and emerging markets. Infrastructure investment can be in private or public markets, and via equity or debt. This paper concentrates on listed infrastructure equities.

The activities which can be deemed as infrastructure are broad and there is no single definition. However, the “core” infrastructure market is normally defined as owning, operating, managing and/or maintaining physical structures or networks used to process or move goods, services, information, people, energy and/or life essentials. It typically covers Transportation, Energy and Telecommunications. Infrastructure “related” activities are defined as those that involve the utilisation of infrastructure facilities without owning, operating, managing or maintaining them.

Figure 1: Core infrastructure activities

Infrastructure has been core to economies for centuries (e.g. railway building in Victorian England), and has recently again become a key area of government focus. Within developed market economies, the focus is not only on driving economic development, but also on replacing ageing infrastructure, while for emerging market economies, the focus extends to social reasons, such as improving access to healthcare or water supplies. Other key drivers of growth include the energy transition, re-shoring of manufacturing and increasing data infrastructure to accommodate growth in the digital economy and artificial intelligence. All these trends create a need for global infrastructure investment of $97trn by 20401.

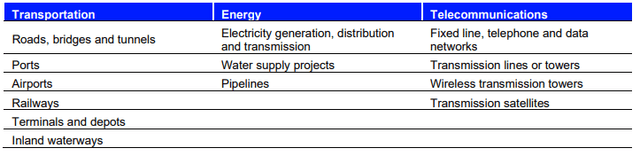

Due to the importance of infrastructure, investment has traditionally been funded by governments; however it is increasingly becoming a key asset class for long-term, private investors as well. Currently, infrastructure investment stands at ~$3trn, or 3% of global GDP1, however private capital is now responsible for ~10%2. Over the last 20 years the private infrastructure market has seen considerable development, both in terms of focus, as it has increasingly encompassed emerging markets, and in terms of new sources of capital from a diverse range of asset owners and sovereign wealth funds. Infrastructure funds are now estimated to be a $1 trillion asset class3.

Figure 2: Growth of private infrastructure investment volumes

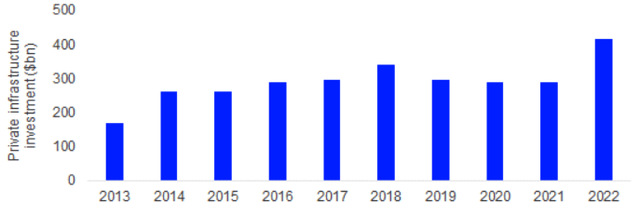

As demand for infrastructure investment grows and with global debt hitting an all-time high of $315trn in Q1 20244, debt laden governments have begun mobilising alternative funding sources for infrastructure projects, including private capital and investors looking to diversify risk into new asset classes. This has helped to create a positive backdrop for the infrastructure market. According to a recent survey of large asset owners, infrastructure was the most popular asset class to increase allocations, significantly ahead of equities or real estate.

Figure 3: Asset classes where large asset owners expect to increase allocation in next 12m

The asset class is traditionally seen as part of the private markets, with funds typically structured as GP/LP. However, with the modernisation of the asset class, investors can now benefit from the characteristics of the infrastructure market without the illiquidity issues through the use of listed (equity) infrastructure products, such as the FTSE Global Core Infrastructure Index Series.

Global Listed (Equity) Infrastructure

The listed infrastructure market exists for investors to benefit from the characteristics and secular trends driving the infrastructure market, whilst avoiding the illiquidity of GP/LP funds by investing in liquid, listed equity securities. The equity listed infrastructure fund market is ~$80-90bn in assets under management5.

FTSE Global Core Infrastructure Index

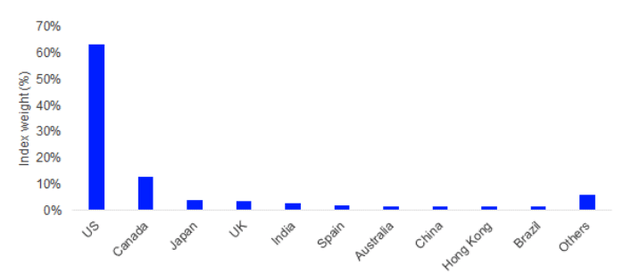

The FTSE Global Core Infrastructure Index is an equity listed infrastructure index covering 269 companies with a market value of $2.5trn across 33 different countries. It is constructed based on the FTSE Global All Cap universe and consists of companies in 12 infrastructure-related ICB subsectors which derive at least 65% of revenues from the infrastructure core activities outlined in the previous section6.

Figure 4: FTSE Global Core Infrastructure weight by country (June 2024)

Source: FTSE Russell/LSEG. Data as of 30 June 2024

Given its status as the world’s predominate equity market and also the initial focus of the private infrastructure investment market, the USA is by far the largest country in the index, followed by Canada, which also has a well-developed private infrastructure market.

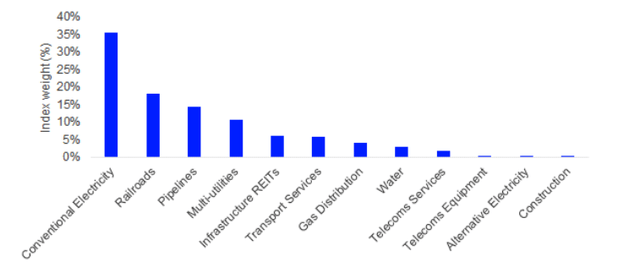

Energy is the largest area of activity, in particular electricity generation and pipelines, with alternative energy, gas distribution and water utilities being smaller but key elements. Transportation is the second largest area, with railroads being particularly large in North America and ports (transport services) being a key segment in emerging markets. Telecommunications is the smallest area of the market, but with the potential growth of digital infrastructure relating to AI it could be an interesting area of growth.

Figure 5: FTSE Global Core Infrastructure weight by ICB subsector (June 2024)

Source: FTSE Russell/LSEG. Data as of 30 June 2024

The nature of the underlying listed equity securities mean that the index can’t fully match the stability of private market infrastructure funds. Being listed securities also means a beta to equity markets and impact from equity market volatility. However, the index still delivers the key characteristics sought by investors of a higher yield and lower volatility than the broader equity market.

Figure 6: Characteristics difference with broader equities (June 2024)

Source: FTSE Russell/LSEG. Data as of 30 June 2024

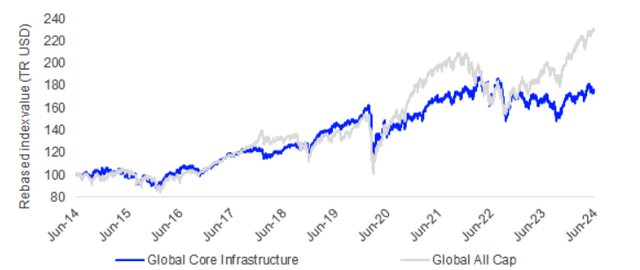

Yet, despite the attractive characteristics of the infrastructure index relative to broader equities in terms of its dividend yield (income stream) and lower realised volatility, it has seen a lower return/risk profile over the last 5 years and has recently underperformed. Looking at a 10-year history, the first 5 years saw performance correlated more closely to the broader equity market, with rolling 12m relative performance typically between ±10% of the equity market. However, since early 2020, the swings in relative performance have been much greater, with the post-covid recovery being slower than the broader market and less extreme negative returns in 2022. Recently the index has underperformed the broader market by ~20%, lacking the technology-driven performance of the broader market.

Figure 7: Performance of FTSE Global Core Infrastructure vs Global All Cap (June 2024)

Source: FTSE Russell/LSEG. Data as of 30 June 2024

Figure 8: 12m Relative Performance of FTSE Global Core Infrastructure vs Global All Cap (June 2024)

Source: FTSE Russell/LSEG. Data as of 30 June 2024

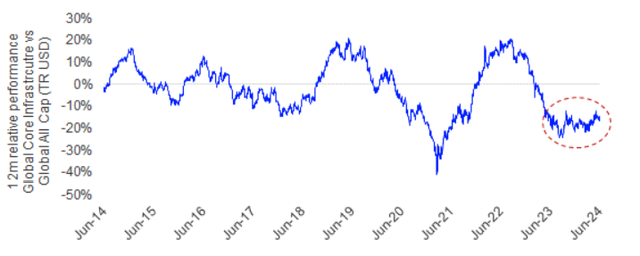

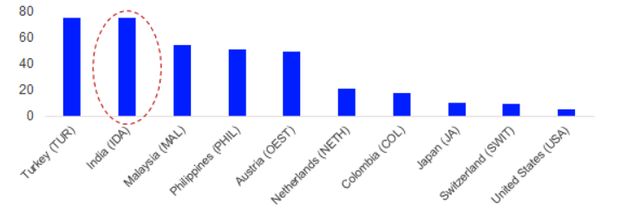

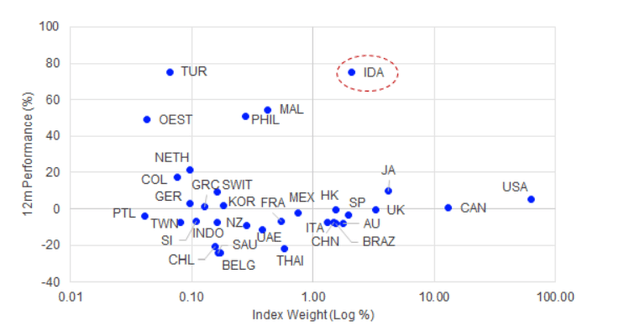

Over the last 12m to 30 June 2024, emerging market countries were some of the best performers in the index. Some of the larger weights in the index, such as USA, Canada and UK saw relatively mediocre performance, whilst China, a key infrastructure market over the last 20 years, underperformed.

Figure 9: FTSE Global Core Infrastructure return by country (top 10) (12m TR USD)

Source: FTSE Russell/LSEG. Data as of 30 June 2024

Figure 10: FTSE Global Core Infrastructure performance vs index weight (June 2024)

Source: FTSE Russell/LSEG. Data as of 30 June 2024

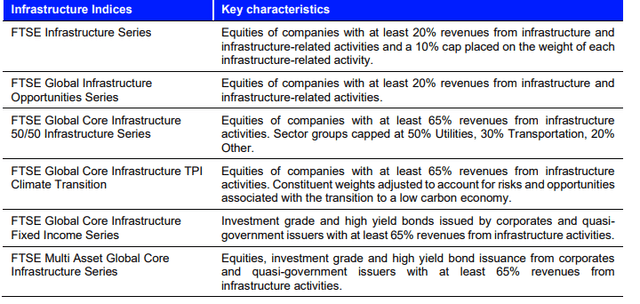

Part of a broader suite of infrastructure indices

In addition to FTSE Global Core Infrastructure investors are also able to address the listed infrastructure market through a suite of different index series with different breadth of infrastructure definition, capping of infrastructure sectors, adjustments for climate transition risks and opportunities, and incorporating infrastructure investment grade and high yield bonds.

Figure 11: Broader range of FTSE Infrastructure Index families

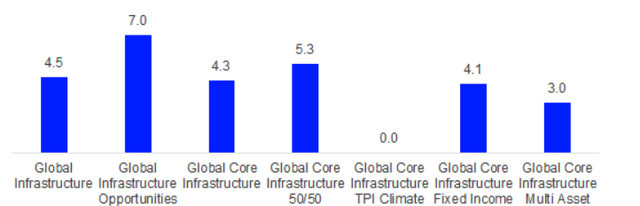

Performance of the key equity infrastructure indices saw a range of 7.0% to 4.3% over the last 12 months ending 30 June 2024, whilst the green, transition-adjusted version underperformed due to an overweight in alternative electricity (which underperformed due to rising costs and overcapacity in the renewable energy market) and an underweight in the pipelines segment (which outperformed due to higher oil prices and a growing US oil production market). The infrastructure fixed income and multi asset performance was lower due to the persistent “higher for longer” yield expectations of the last 12 months, as the market awaited central bank rate cuts.

Figure 12: Performance of different global listed infrastructure indices (12m TR USD, unhedged)

Emerging markets infrastructure

Despite being a smaller part of the global core infrastructure market, the emerging markets are particularly interesting given the large infrastructure gap and prevailing demographic and economic trends in the region being potential tailwinds in the years to come.

Emerging markets growth and infrastructure deficit

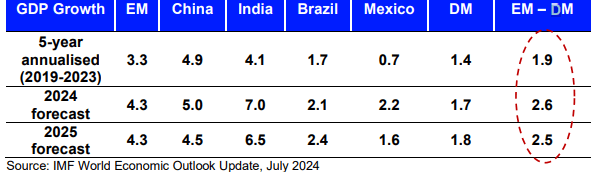

Emerging market GDP growth has outpaced developed markets, helped by structural reforms in countries like India, Brazil and Mexico, and supply chain shifts. Their excess growth relative to developed markets is forecast to widen further.

Figure 13: Forecast and actual GDP growth by region

However, economic growth is held back by an infrastructure deficit across the region. There is an estimated $15 trillion deficit between infrastructure investment needs globally and current trends to 20401, roughly two thirds of which come from emerging markets. Indeed, Asia, predominantly developing Asia, is responsible for approximately half the $97 trillion infrastructure investment needs to 2040. Compared to the developed market emerging infrastructure investment has traditionally been held up by lack of private market participation, weak financial oversight, confusing regulatory environment and inconsistent power supply. Lack of infrastructure holds back both consumption in domestic markets and the ability of countries to participated in global trade as well as holding back social development.

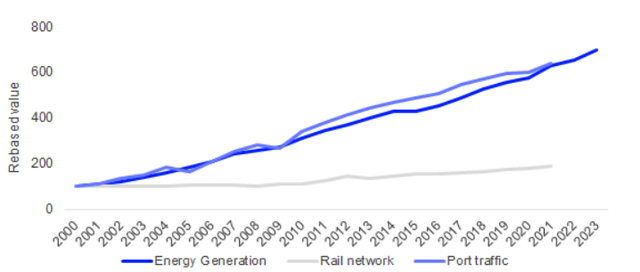

Within emerging markets, China has seen success in infrastructure development, with annual investment greater than $1 trillion. Growth in infrastructure has been one of the driving factors behind Chinese economic growth, particularly post the global financial crisis. This has led to significant growth in Chinese infrastructure, a 6-7-fold increase in power generation and port traffic and doubling in the length of rail network since 2000. However, after more than a decade of remarkable infrastructure growth it has begun to slow through a combination of slower economic growth, weaker demographics and high debt level at both the federal and state level.

Figure 14: Growth in Chinese infrastructure

Source: World Bank; Ember Total electricity generation (TWh), Ember, data to 2023; Rail lines (total route – km), Container port traffic (TEU: 20-foot equivalent units), World Bank development indicators, data to 2021

Whilst Chinese infrastructure has made significant leaps in recent decades, the same cannot be said of other emerging economies. However, this may be changing as other key emerging economies use infrastructure investment as a key element of boosting and broadening economic growth and driving social development. This is helped by economic issues in China giving new opportunities for other emerging economies in the global export market. India is a notable country benefiting from rising economic growth, demographic growth (now the world’s most populous country) and seeing a boom in infrastructure.

India is focusing on developing new infrastructure, alongside self-reliant “Make in India” policies, changing the sectoral mix of the Indian economy and employment, and improving sustainability as part of an ambitious goal to become a developed economy by 2047. The importance of infrastructure growth is backed up by efforts at both the central and state levels in a wide range of sectors such as roads, rail, ports and power generation. The National Infrastructure Pipeline includes funding for projects of more than $1 trillion over 5 years7, the National Master Plan for Multi-Modal Connectivity aims to streamline the planning process and the sovereign wealth National Investment and Infrastructure Fund was set up to manage investments and as a platform for co-investment by global and domestic investors. As part of the difficult process of implementing these plans, India is opening its infrastructure market to private and foreign investors. In addition, it is also trying to overcome key hurdles such as procedural delays, regulatory inconsistency and non-transparent governance which can stand in the way of successful infrastructure development. All of this has the potential to make India a key market for infrastructure investors of the next decade.

FTSE Emerging Core Infrastructure Index and its effectiveness for EM investors

Despite the macroeconomic drivers of infrastructure in the emerging markets, FTSE Emerging Core Infrastructure has underperformed FTSE Developed Core Infrastructure over the last 5 years. However, over the last 12 months ending June 30, 2024 this has begun to change.

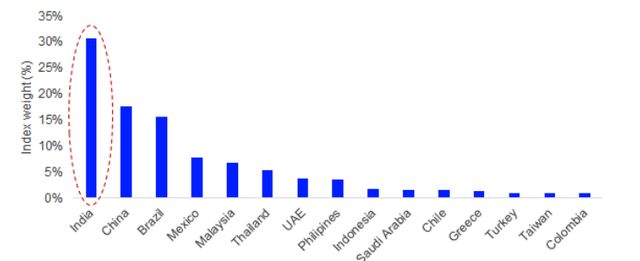

The weighting of the index is distinctly different to the broader equity FTSE Emerging Index, with India being the largest weighting, a lower weighting in China and a much lower weighting in Taiwan. The Americas also have a larger representation, with higher weightings to Brazil and Mexico.

Figure 15: FTSE Emerging Core Infrastructure weight by country (June 2024)

Source: FTSE Russell/LSEG. Data as of 30 June 2024

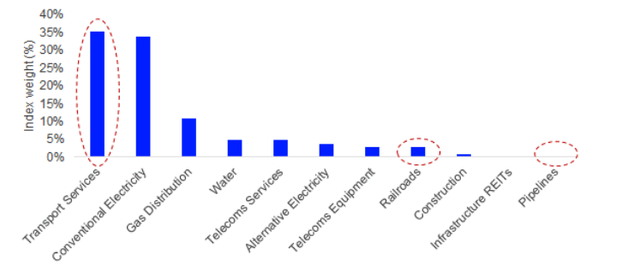

The FTSE EM Core Infrastructure index also has a distinctly different weighting with regards to ICB subsectors compared to the FTSE Developed Core Infrastructure Index. Transport Services, which is predominantly ports, are the largest exposure, reflecting the region’s key position in global trade. Conventional Electricity is a large exposure in both indices, reflecting the importance of access to power in both developed and emerging economies. The Emerging index is also underweight in Railroads and Pipelines compared to the Developed index, reflecting the differences in both the state of development and the ownership models between the two regions. The higher weighting of Gas Distribution also reflects the growing importance of gas in the region, particularly in China, to address both energy demand and urban air pollution issues. The exposures are also distinctly different to the FTSE Emerging (Equity) index, where almost half of the index is in Technology and Banks.

Figure 16: FTSE Emerging Core Infrastructure weight by ICB subsector (June 2024)

Source: FTSE Russell/LSEG. Data as of 30 June 2024

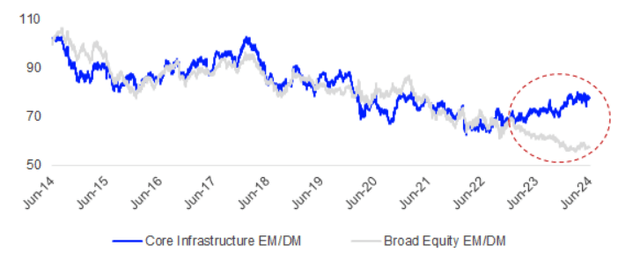

The ratio of the performance between the Emerging and Developed markets has historically tracked closely between listed infrastructure and the broader equity market. Over the last 10 years, EM has underperformed DM in both listed infrastructure and broader equities, except a period of outperformance during 2015-18. However, since the beginning of 2023 the EM/DM relative ratios, in listed infrastructure and broader equities, have diverged. Over the 12m to end-June 2024, the Emerging Core Infrastructure index outperformed Developed Core Infrastructure by 8.1% whilst in the broader equity market Emerging underperformed Developed by 6.5%.

Figure 17: EM/DM performance ratio – core infrastructure vs broader equity market

Source: FTSE Russell/LSEG. Data as of 30 June 2024

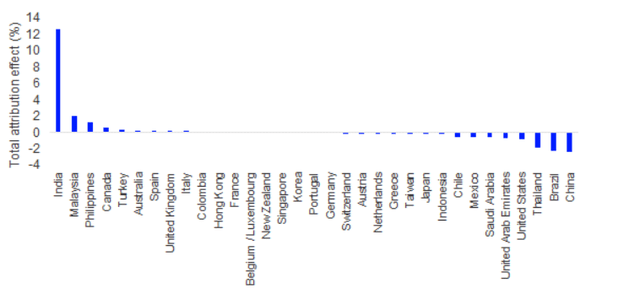

The main driver of the strong performance in Emerging Infrastructure is India. As the largest part of the index, with its very strong performance more than compensating for the weak performance of China, Thailand and Brazil, who are three of the other top 5 countries in the index.

Figure 18: Attribution – FTSE Emerging Core Infrastructure vs Global Core Infrastructure

Brinson attribution of FTSE Emerging Core Infrastructure vs FTSE Global Core Infrastructure, total contribution effect (all from allocation effect as the relative weighting of stocks within a given country is same in both indices if that country is present in both) Source: FTSE Russell/LSEG. 12-month attribution ending 30 June 2024

The performance of the Indian segment of the index was largely driven by the strength of large power generators and port companies, reflecting not only the importance of infrastructure in Indian economic development, but also the key position India is starting to play in the global economy, having previously been eclipsed by China.

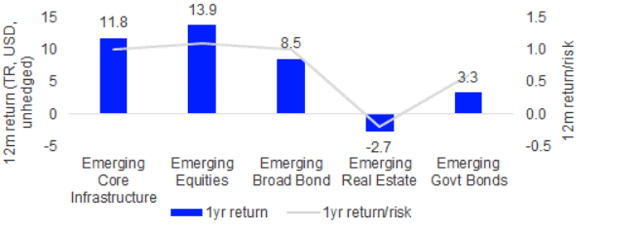

In terms of absolute performance, FTSE Emerging Core Infrastructure has been the second best emerging markets investment over the last 12 months, narrowly behind broader EM equities and ahead of bonds and real estate.

Figure 19: Return and Return/Risk of selected EM Asset Classes (12m TR USD)

Source: FTSE Russell/LSEG. Data as of 30 June 2024 Emerging Core Infrastructure = FTSE Emerging Core Infrastructure Index; Emerging Equities = FTSE Emerging Index; Emerging Broad Bond Index = FTSE Emerging Markets US Dollar Broad Bond Index; Emerging Real Estate = FTSE EPRA Nareit Emerging Index; Emerging Govt Bonds = FTSE Emerging Market Government Bond Index

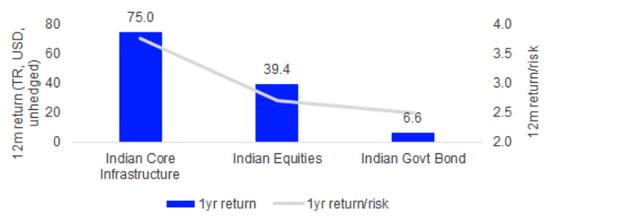

Looking more specifically at India, the Indian element of the Core Infrastructure has also seen the best absolute performance compared to broader Indian equities and bonds, and a much better return/risk ratio.

Figure 20: Return of selected Indian Asset Classes (12m TR USD)

Source: FTSE Russell/LSEG. Data as of 30 June 2024 Indian Core Infrastructure = Indian segment of FTSE Emerging Core Infrastructure Index; Indian Equities = FTSE India RIC Capped Index; Indian Govt Bond = FTSE Indian Government Bond Index

Conclusion

Global infrastructure is a growing asset class, driven by an underlying demand for investment to support GDP growth and the increasing involvement of private investors in the market. With government attitudes towards private investment continuing to turn more favourable, and with a $15 trillion deficit between investment needs globally and current trends to 2040, both of these drivers appear unlikely to fade in the near future. However, a growing dependency on private investment would not be sustainable without similar growth in the demand from investors. Fortunately, infrastructure investment is increasingly sought after by investors – both as an avenue for diversification and as a tool in asset-liability management through offering potentially stable, inflation-linked returns.

As infrastructure investment has increased in popularity, listed infrastructure equities have emerged as a convenient and liquid way for investors to access infrastructure markets. Index products such as the FTSE Global Core Infrastructure index allow investors an easy way to address this listed equity market. There are also a broad range of index families available, with variations in index composition based on the breadth of the infrastructure definition, sector capping, asset class and sustainability. While the nature of the underlying listed equity securities mean that these indices can’t fully match the stability of private market infrastructure funds, listed infrastructure indices can still deliver the key characteristics sought by investors, including higher yield and lower volatility than the broader equity market. Despite these characteristics, listed infrastructure, as represented by the FTSE Global Core Infrastructure index, has largely underperformed broader equities over the last 5 years to June 30, 2024, mainly driven by a lack of exposure to the high-returning technology stocks.

However, within the broader infrastructure market, divergent performance in recent years between subindices presents opportunities for investors to take a more targeted approach to investment in the asset class. At a regional level, Emerging Core Infrastructure, which has underperformed Developed Core Infrastructure for most of the last 10 years, has begun to outperform over the last 12 months ended June 30, 2024. This reflects the potential attractive structural effects which underpin emerging market infrastructure, such as superior economic and demographic growth compared to developed markets, a larger infrastructure deficit and growing government support for infrastructure investment. India has been the largest driver of performance for the Emerging Core Infrastructure index, and is a market with a particular focus on developing new infrastructure. While having been previously eclipsed by China, economic development has meant that India now plays a key role in the global economy – a theme which is likely to continue to support infrastructure investment in the country moving forward.

Source

1 Global Infrastructure Outlook, Global Infrastructure Hub

2 Infrastructure Monitor 2023, Global Infrastructure Hub

3 How infra became a $1trn asset class, Infrastructure Investor

4 IIF Global Debt Monitor, May 2024

5 LSEG Lipper assets in ETFs and mutual funds classified as Equity Theme Infrastructure

6 FTSE Core Infrastructure Indices (lseg.com)

7 When it comes to infrastructure building, is India the next land of opportunity? Norton Rose Fulbright, March 2024

Disclaimer

2024 London Stock Exchange Group plc and its applicable group undertakings (“LSEG”). LSEG includes (1) FTSE International Limited (“FTSE”), (2) Frank Russell Company (“Russell”), (3) FTSE Global Debt Capital Markets Inc. and FTSE Global Debt Capital Markets Limited (together, “FTSE Canada”), (4) FTSE Fixed Income Europe Limited (“FTSE FI Europe”), (5) FTSE Fixed Income LLC (“FTSE FI”), (6) FTSE (Beijing) Consulting Limited (“WOFE”) (7) Refinitiv Benchmark Services (UK) Limited (“RBSL”), (8) Refinitiv Limited (“RL”) and (9) Beyond Ratings S.A.S. (“BR”). All rights reserved. FTSE Russell® is a trading name of FTSE, Russell, FTSE Canada, FTSE FI, FTSE FI Europe, WOFE, RBSL, RL, and BR. “FTSE®”, “Russell®”, “FTSE Russell®”, “FTSE4Good®”, “ICB®”, “Refinitiv” , “Beyond Ratings®” , “WMR™” , “FR™” and all other trademarks and service marks used herein (whether registered or unregistered) are trademarks and/or service marks owned or licensed by the applicable member of LSEG or their respective licensors and are owned, or used under licence, by FTSE, Russell, FTSE Canada, FTSE FI, FTSE FI Europe, WOFE, RBSL, RL or BR. FTSE International Limited is authorised and regulated by the Financial Conduct Authority as a benchmark administrator. Refinitiv Benchmark Services (UK) Limited is authorised and regulated by the Financial Conduct Authority as a benchmark administrator. All information is provided for information purposes only. All information and data contained in this publication is obtained by LSEG, from sources believed by it to be accurate and reliable. Because of the possibility of human and mechanical inaccuracy as well as other factors, however, such information and data is provided “as is” without warranty of any kind. No member of LSEG nor their respective directors, officers, employees, partners or licensors make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to the accuracy, timeliness, completeness, merchantability of any information or LSEG Products, or of results to be obtained from the use of LSEG products, including but not limited to indices, rates, data and analytics, or the fitness or suitability of the LSEG products for any particular purpose to which they might be put. The user of the information assumes the entire risk of any use it may make or permit to be made of the information. No responsibility or liability can be accepted by any member of LSEG nor their respective directors, officers, employees, partners or licensors for (A) any loss or damage in whole or in part caused by, resulting from, or relating to any inaccuracy (negligent or otherwise) or other circumstance involved in procuring, collecting, compiling, interpreting, analysing, editing, transcribing, transmitting, communicating or delivering any such information or data or from use of this document or links to this document or (B) any direct, indirect, special, consequential or incidental damages whatsoever, even if any member of LSEG is advised in advance of the possibility of such damages, resulting from the use of, or inability to use, such information. No member of LSEG nor their respective directors, officers, employees, partners or licensors provide investment advice and nothing in this document should be taken as constituting financial or investment advice. No member of LSEG nor their respective directors, officers, employees, partners or licensors make any representation regarding the advisability of investing in any asset or whether such investment creates any legal or compliance risks for the investor. A decision to invest in any such asset should not be made in reliance on any information herein. Indices and rates cannot be invested in directly. Inclusion of an asset in an index or rate is not a recommendation to buy, sell or hold that asset nor confirmation that any particular investor may lawfully buy, sell or hold the asset or an index or rate containing the asset. The general information contained in this publication should not be acted upon without obtaining specific legal, tax, and investment advice from a licensed professional. Past performance is no guarantee of future results. Charts and graphs are provided for illustrative purposes only. Index and/or rate returns shown may not represent the results of the actual trading of investable assets. Certain returns shown may reflect back-tested performance. All performance presented prior to the index or rate inception date is back-tested performance. Back-tested performance is not actual performance, but is hypothetical. The back-test calculations are based on the same methodology that was in effect when the index or rate was officially launched. However, back-tested data may reflect the application of the index or rate methodology with the benefit of hindsight, and the historic calculations of an index or rate may change from month to month based on revisions to the underlying economic data used in the calculation of the index or rate. This document may contain forward-looking assessments. These are based upon a number of assumptions concerning future conditions that ultimately may prove to be inaccurate. Such forward-looking assessments are subject to risks and uncertainties and may be affected by various factors that may cause actual results to differ materially. No member of LSEG nor their licensors assume any duty to and do not undertake to update forward-looking assessments. No part of this information may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without prior written permission of the applicable member of LSEG. Use and distribution of LSEG data requires a licence from LSEG and/or its licensors.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.